Example Of A Notarized Lease Agreement

Description

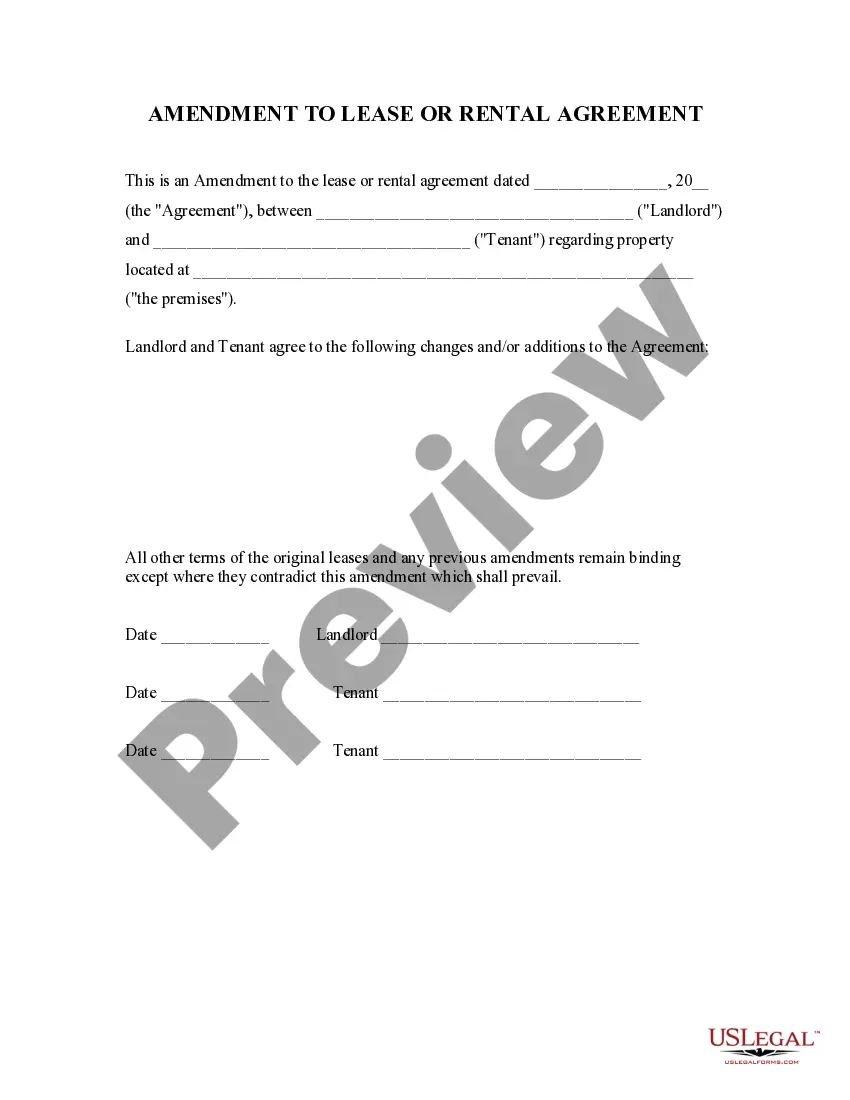

How to fill out Illinois Amendment To Lease Or Rental Agreement?

Handling legal documents and tasks can be a lengthy addition to your whole day.

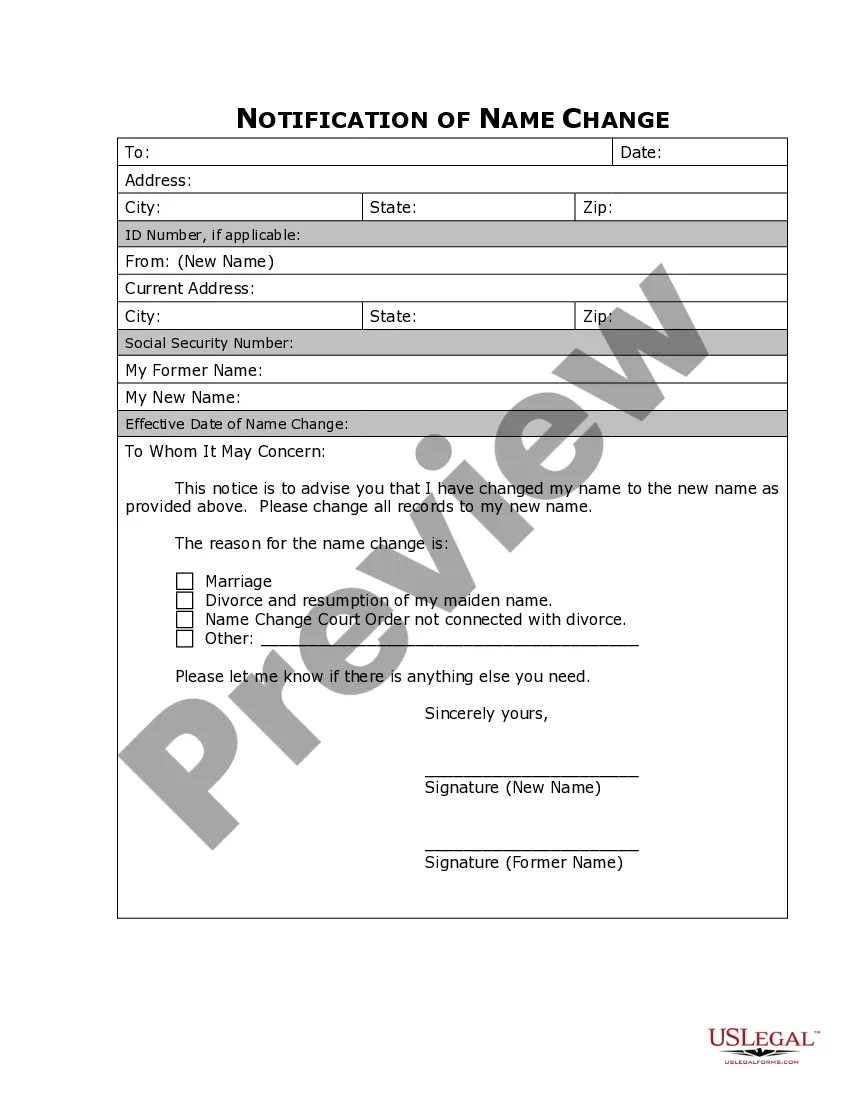

Sample Of A Notarized Lease Agreement and forms like it generally necessitate you to search for them and comprehend how to fill them out correctly.

Therefore, whether you are managing financial, legal, or personal issues, possessing a thorough and effective online directory of forms readily available will greatly assist.

US Legal Forms is the premier online resource for legal templates, boasting over 85,000 state-specific forms and various resources to help you complete your documents with ease.

Simply Log In to your account, locate Sample Of A Notarized Lease Agreement, and download it immediately from the My documents section. You can also access previously saved forms.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms provides you with state- and county-specific forms available anytime for download.

- Protect your document management processes with a top-tier service that allows you to prepare any form within minutes without any extra or hidden costs.

Form popularity

FAQ

To take legal action to collect a debt, the creditor (the person or company owed money) files a lawsuit against the debtor (the person who owes the money). Once a debt collection lawsuit is filed with the court, the creditor must give the debtor notice of the lawsuit (service).

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

In general, if you have a contractual debt in Oregon that you have not repaid, the creditor has six years to pursue you with legal action before the Oregon statute of limitations expires. This applies to medical, credit card, mortgage, and auto loan debt. There is no statute of limitations on a state tax debt.

In Oregon, debt collectors must register with the Oregon Department of Consumer and Business Services and comply with state and federal fair debt collection laws.

Oregon has a law called the Unlawful Debt Collection Practices Act. It controls how a creditor may try to collect a debt, whether by letter or phone call. Unlawful debt collection practices include the use of obscene or abusive language.

Collection agencies can collect interest and late charges on the debt that is owed if there is a written agreement (contract) that allows this. If there is no contract, they can collect interest of up to 9 percent each year on the amount of the unpaid bill.

In general, under the Debt Collection Rule, a debt collector must not engage in conduct in connection with the collection of a debt if the natural consequence of that conduct is to harass, oppress, or abuse any person. 12 CFR § 1006.14(a).

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.