Quitclaim Deed Illinois Withholding

Description

How to fill out Illinois Quitclaim Deed From Individual To LLC?

Regardless of whether it's for professional reasons or personal matters, everyone must confront legal issues at some point in their lives. Filling out legal paperwork requires meticulous care, beginning with the selection of the correct form example. For example, if you choose an incorrect version of a Quitclaim Deed Illinois Withholding, it will be denied upon submission. Thus, it's crucial to obtain a trustworthy source of legal documents like US Legal Forms.

If you need to obtain a Quitclaim Deed Illinois Withholding template, follow these straightforward steps: Find the form you require by using the search bar or browsing the catalog. Review the description of the form to confirm its suitability for your situation, state, and county. Click on the form’s preview to inspect it. If it is the wrong document, return to the search feature to find the Quitclaim Deed Illinois Withholding template you want. Download the file when it meets your specifications. If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents. If you do not have an account yet, you can acquire the form by clicking Buy now. Choose the relevant pricing option. Complete the profile registration form. Choose your payment method: you can use a credit card or PayPal account. Choose the document format you prefer and download the Quitclaim Deed Illinois Withholding. Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Choose the relevant pricing option. Complete the profile registration form. Choose your payment method: you can use a credit card or PayPal account. Choose the document format you prefer and download the Quitclaim Deed Illinois Withholding. Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand. With a substantial US Legal Forms catalog at hand, you do not have to spend time searching for the right template across the internet. Take advantage of the library’s easy navigation to get the appropriate form for any occasion.

- Regardless of whether it's for professional reasons or personal matters, everyone must confront legal issues at some point in their lives.

- Filling out legal paperwork requires meticulous care, beginning with the selection of the correct form example.

- For example, if you choose an incorrect version of a Quitclaim Deed Illinois Withholding, it will be denied upon submission.

- Thus, it's crucial to obtain a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain a Quitclaim Deed Illinois Withholding template, follow these straightforward steps.

- Find the form you require by using the search bar or browsing the catalog.

- Review the description of the form to confirm its suitability for your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to find the Quitclaim Deed Illinois Withholding template you want.

- Download the file when it meets your specifications.

- If you already possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

Form popularity

FAQ

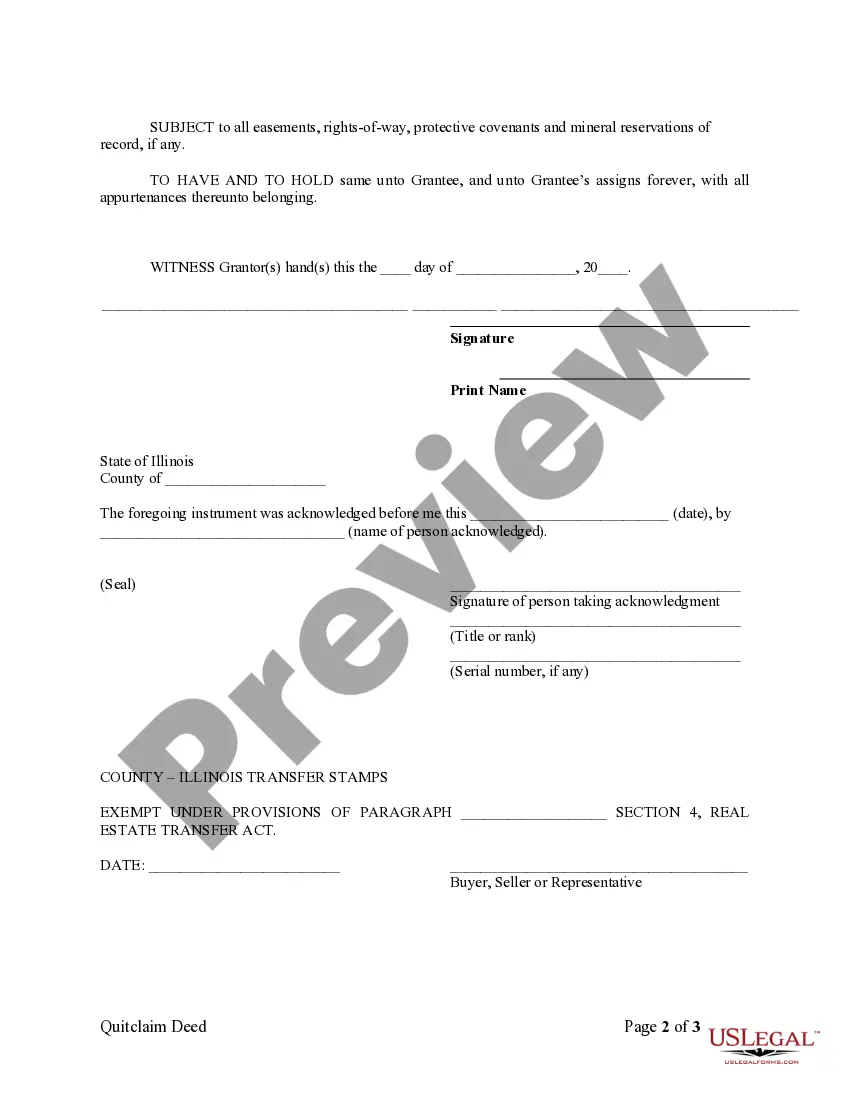

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

How do you file a quit claim deed in Illinois? To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees.

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

If you're preparing the quitclaim deed yourself, make sure to enter the property description just as it appears on an older deed of the property. If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.