Quitclaim Deed Illinois With Right Of Survivorship

Description

How to fill out Illinois Quitclaim Deed From Individual To LLC?

Whether for business purposes or for individual matters, everyone has to manage legal situations sooner or later in their life. Filling out legal paperwork needs careful attention, beginning from selecting the correct form sample. For instance, when you pick a wrong version of the Quitclaim Deed Illinois With Right Of Survivorship, it will be rejected once you submit it. It is therefore essential to have a reliable source of legal documents like US Legal Forms.

If you need to get a Quitclaim Deed Illinois With Right Of Survivorship sample, stick to these easy steps:

- Find the template you need using the search field or catalog navigation.

- Check out the form’s information to make sure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to locate the Quitclaim Deed Illinois With Right Of Survivorship sample you need.

- Get the template when it matches your requirements.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Finish the account registration form.

- Select your payment method: use a bank card or PayPal account.

- Pick the file format you want and download the Quitclaim Deed Illinois With Right Of Survivorship.

- Once it is saved, you can fill out the form by using editing software or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time seeking for the right template across the web. Take advantage of the library’s straightforward navigation to find the correct template for any situation.

Form popularity

FAQ

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

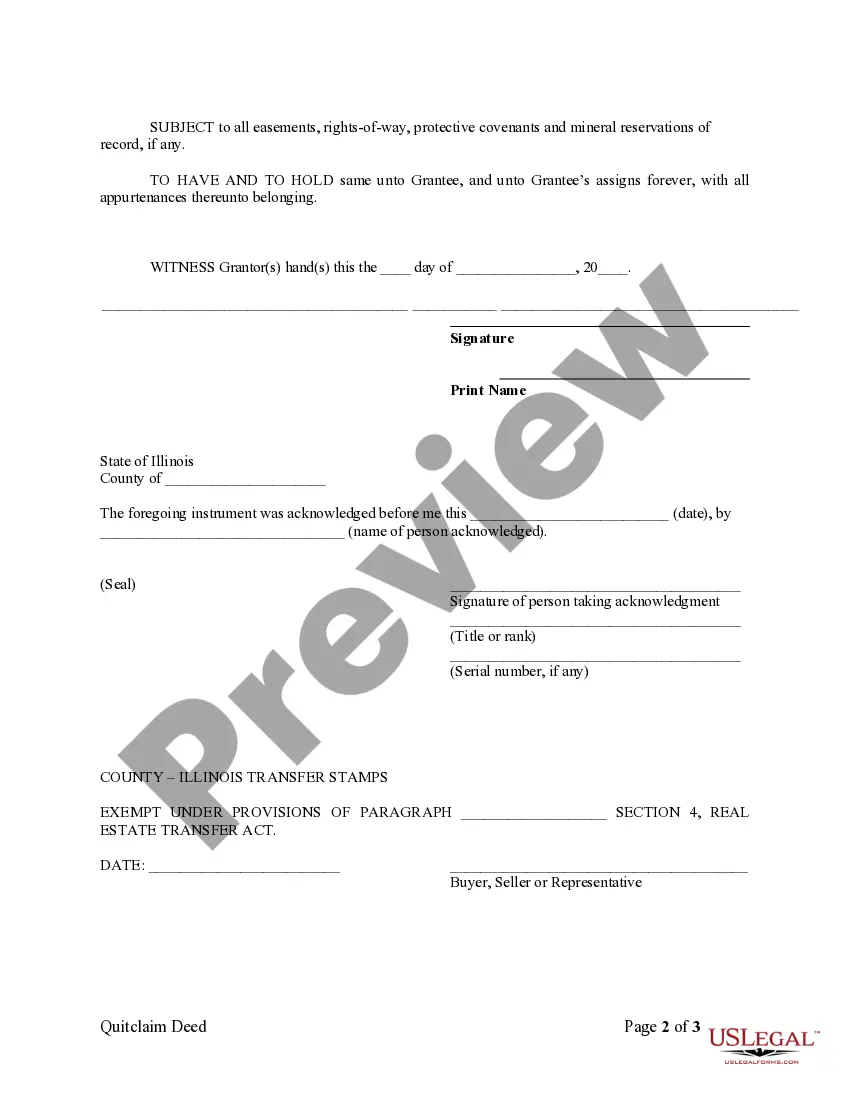

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

A Quit Claim Deed is required to clearly identify the grantor and grantee, the address of the property being transferred, a legal description of the property, the manner in which the grantee is taking title, a notarized signature of the grantor, and the name and address of the party that has prepared the deed.

Prior to signing a quitclaim, you will want to make sure that you and your spouse have a fully executed Marital Settlement Agreement (MSA) that has been signed by both parties. Once a quit claim deed is signed, then the party transferring their rights will have no claim to the home.

If you're preparing the quitclaim deed yourself, make sure to enter the property description just as it appears on an older deed of the property. If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed.