Chicago Title Quit Claim Deed Form Illinois

Description

How to fill out Illinois Quitclaim Deed From Individual To LLC?

Finding a reliable source for the most up-to-date and pertinent legal templates is half the challenge of dealing with bureaucracy.

Selecting the appropriate legal documents demands accuracy and careful consideration, which is why it is crucial to obtain samples of Chicago Title Quit Claim Deed Form Illinois exclusively from reputable providers, such as US Legal Forms. An incorrect template can squander your time and prolong your current situation. With US Legal Forms, you have minimal concerns.

Once you have the form on your device, you can modify it using the editor or print it and fill it out manually. Remove the hassle that comes with your legal paperwork. Discover the extensive US Legal Forms collection where you can locate legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the library navigation or search bar to locate your template.

- Examine the form’s details to verify if it aligns with the requirements of your state and region.

- Access the form preview, if available, to confirm that the template is the one you are seeking.

- Continue your search and identify the correct document if the Chicago Title Quit Claim Deed Form Illinois does not meet your needs.

- When you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Select the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Chicago Title Quit Claim Deed Form Illinois.

Form popularity

FAQ

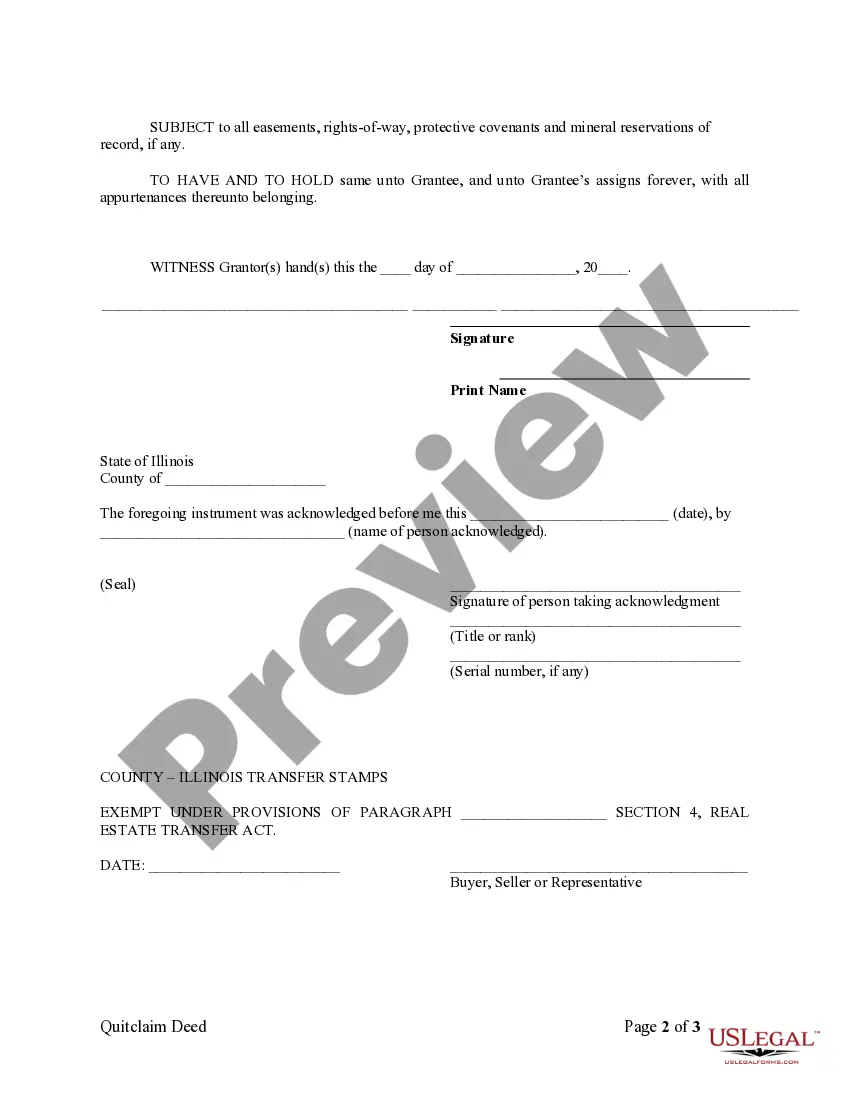

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

If you're preparing the quitclaim deed yourself, make sure to enter the property description just as it appears on an older deed of the property. If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

How do you file a quit claim deed in Illinois? To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees.

Form PTAX-203, Illinois Real Estate Transfer Declaration, is completed by the buyer and seller and filed at the county in which the property is located. Form PTAX-203-A, Illinois Real Estate Transfer Declaration Supplemental Form A, is used for non-residential property with a sale price over $1 million.