Life Estate Deed Form Illinois With Example

Description

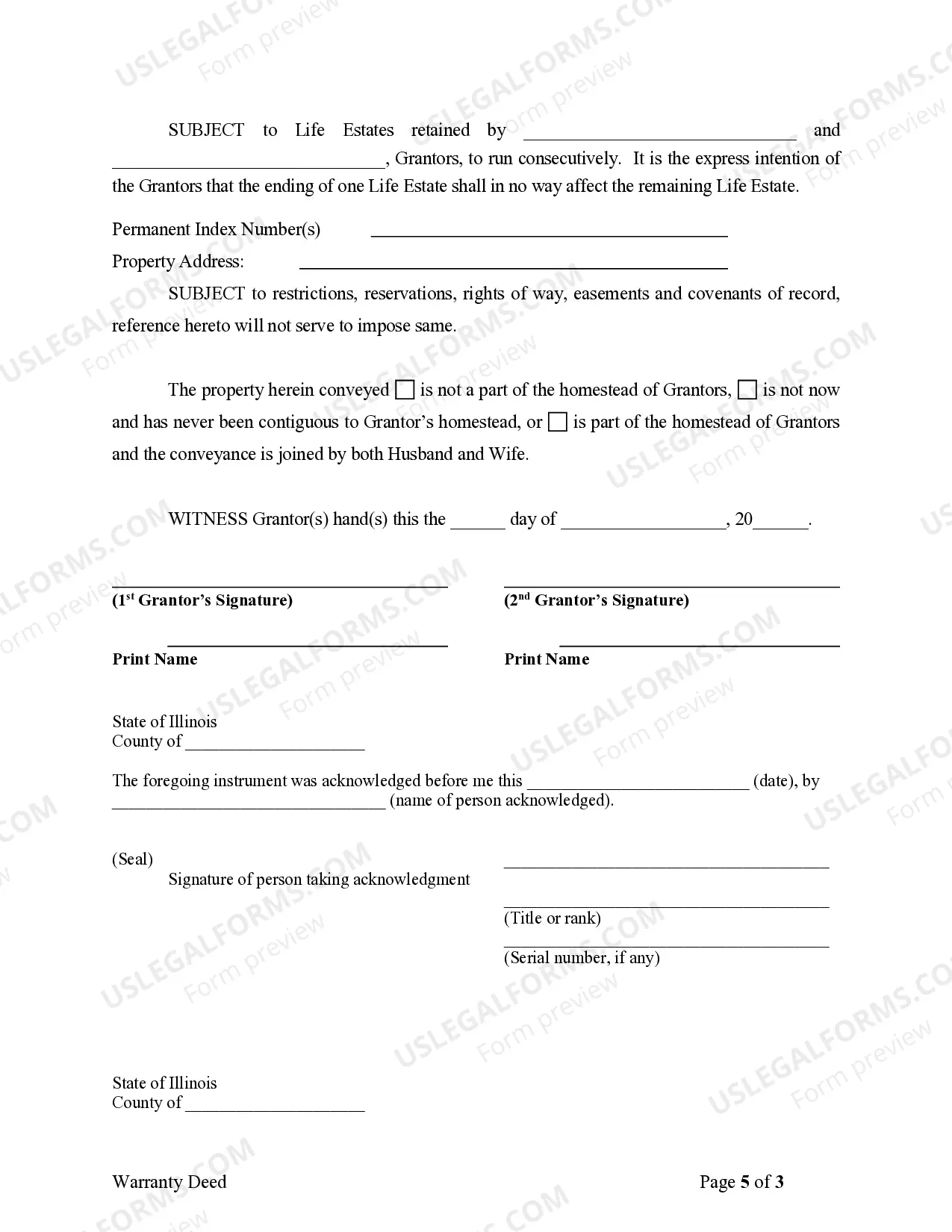

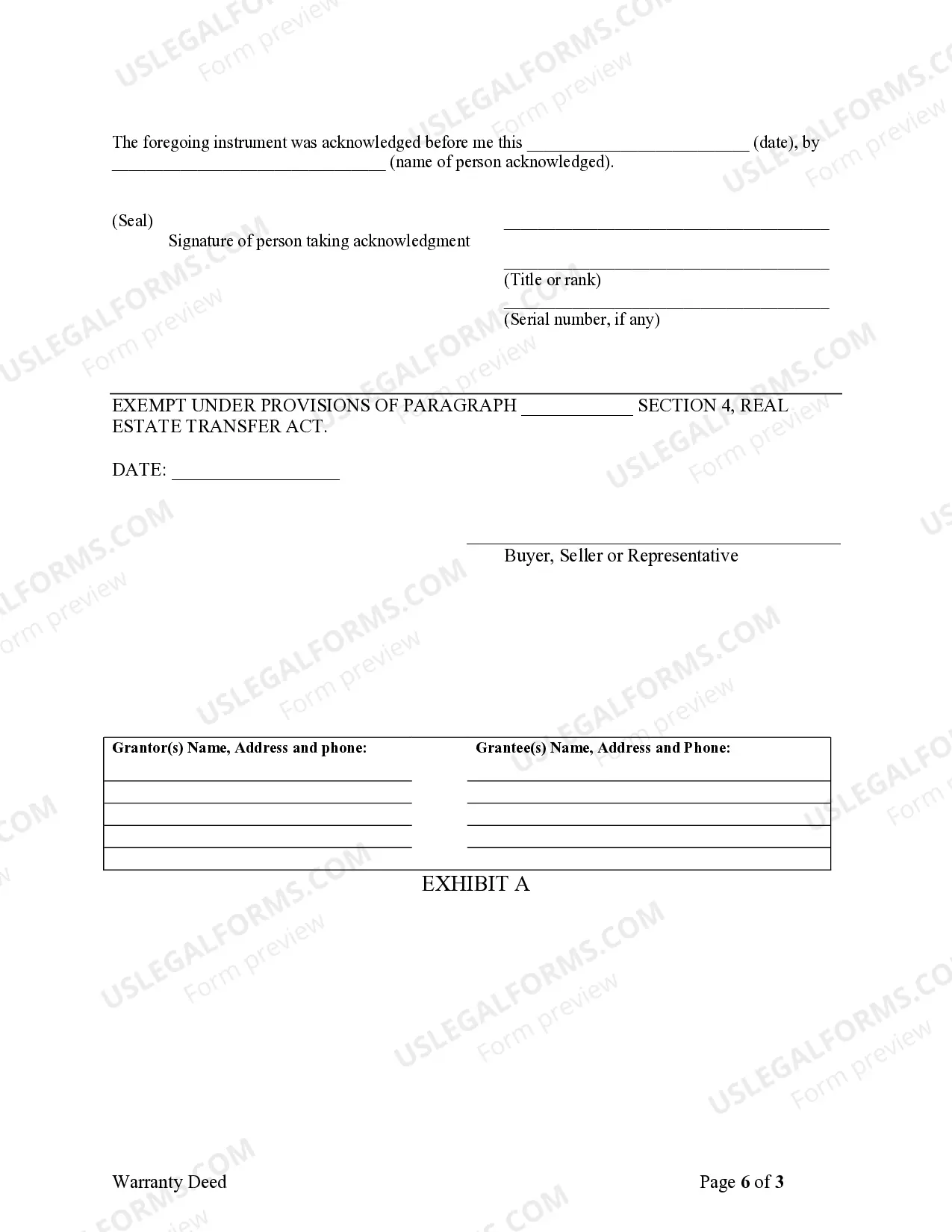

How to fill out Illinois Warranty Deed To Child Reserving A Life Estate In The Parents?

It’s no secret that you can’t become a legal professional overnight, nor can you learn how to quickly draft Life Estate Deed Form Illinois With Example without the need of a specialized set of skills. Putting together legal documents is a long venture requiring a specific training and skills. So why not leave the preparation of the Life Estate Deed Form Illinois With Example to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our website and get the document you need in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether Life Estate Deed Form Illinois With Example is what you’re searching for.

- Start your search again if you need any other template.

- Register for a free account and choose a subscription option to buy the template.

- Pick Buy now. Once the payment is complete, you can get the Life Estate Deed Form Illinois With Example, fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your paperwork-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

An Illinois quit claim deed can be used to give property to your family or loved ones during your lifetime. Lifetime gifts come with a few significant drawbacks: When you give away real estate, you lose control and financial benefits of ownership. There's no way to change your mind.

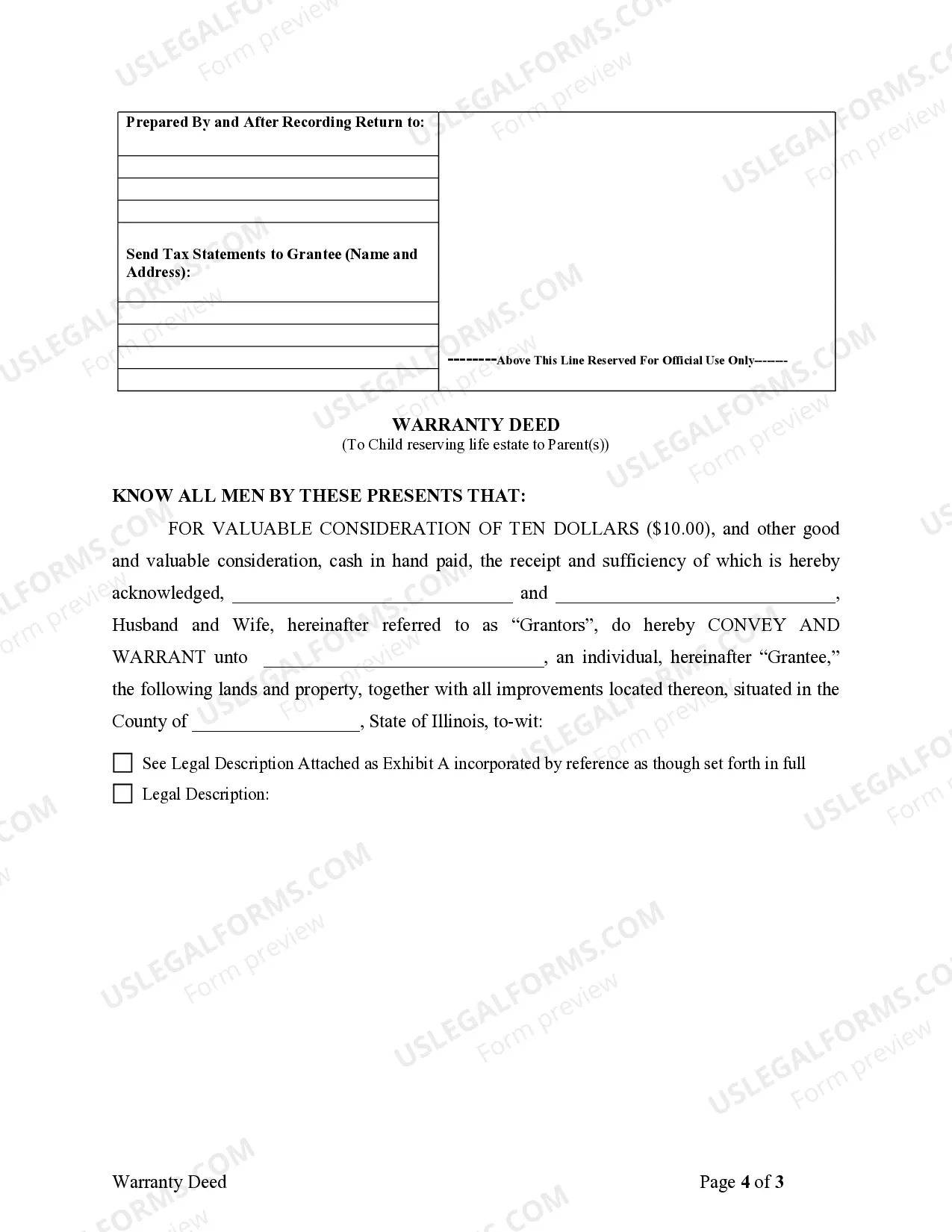

A life estate is the continued possession of property during one's life while at the same time transferring it to another party or parties. Thus, the party living in the house or possessing the property has a tenancy for an uncertain time, but they cannot sell it.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.