Illinois Warranty Deed to Child Reserving a Life Estate in the Parents

Understanding this form

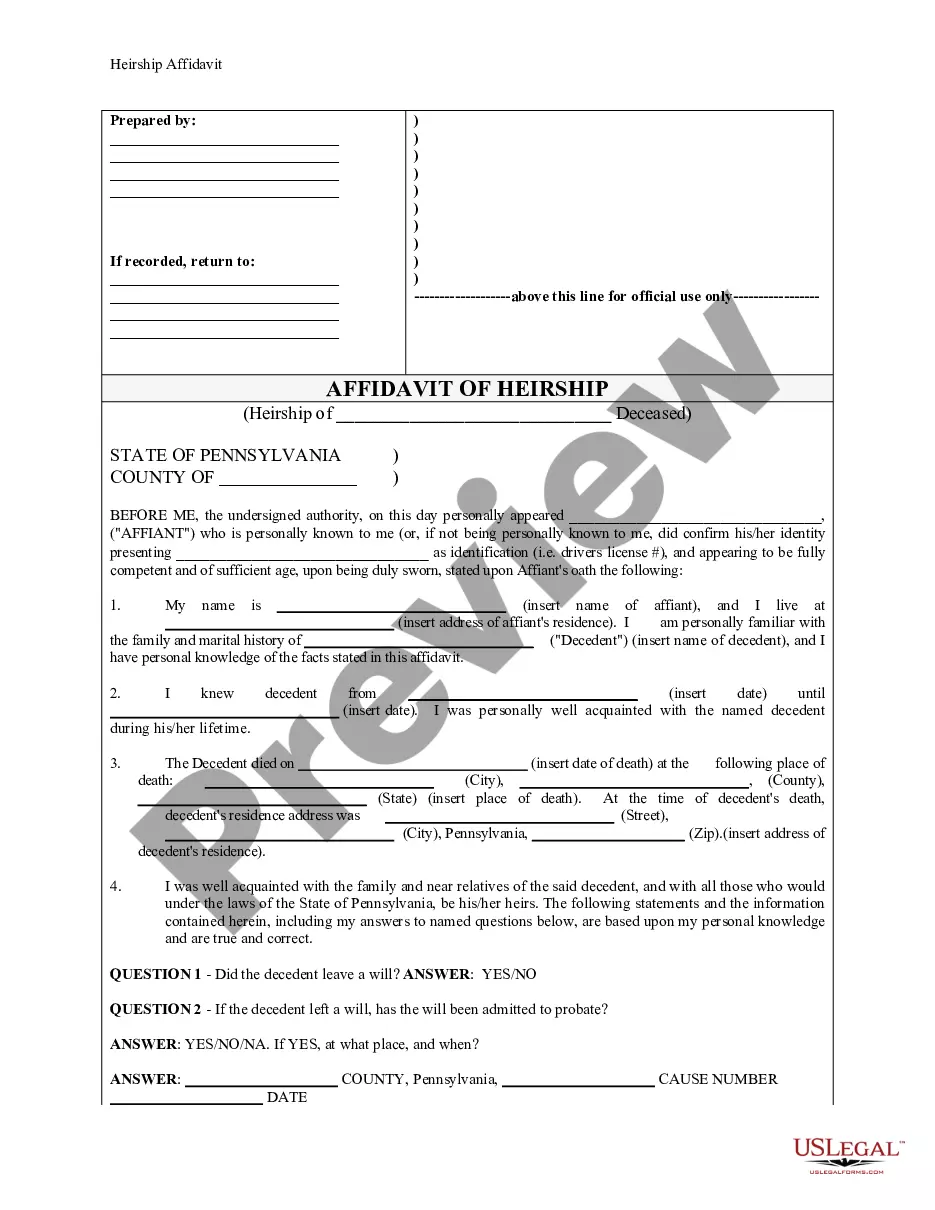

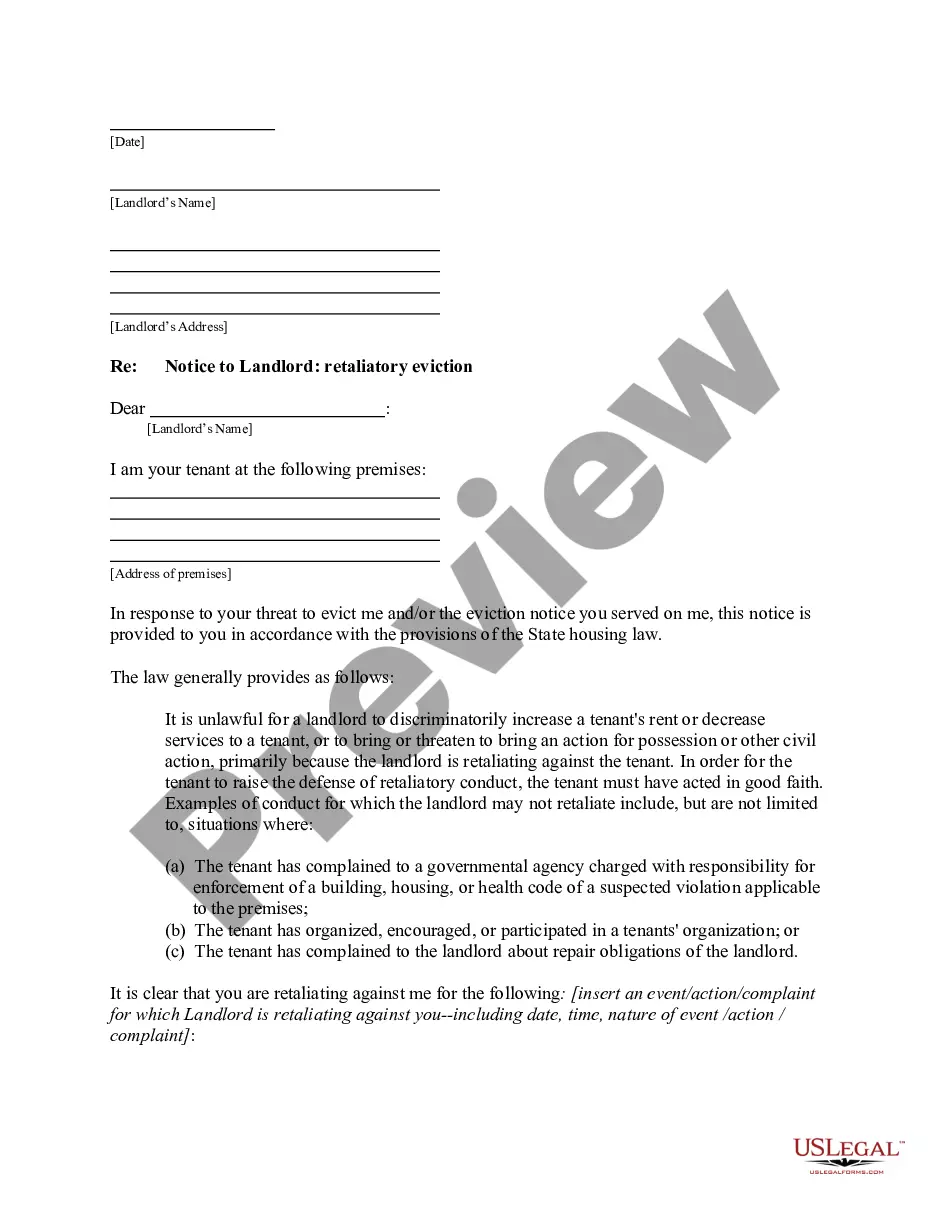

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that allows parents to transfer their property to their child while retaining the right to live in the property for the rest of their lives. This form is particularly useful for parents who wish to ensure that their child inherits the property without going through probate, while still enjoying the benefits of living in the home. Unlike a simple gift deed, this warranty deed includes a reservation of a life estate, providing an added layer of security for the parents.

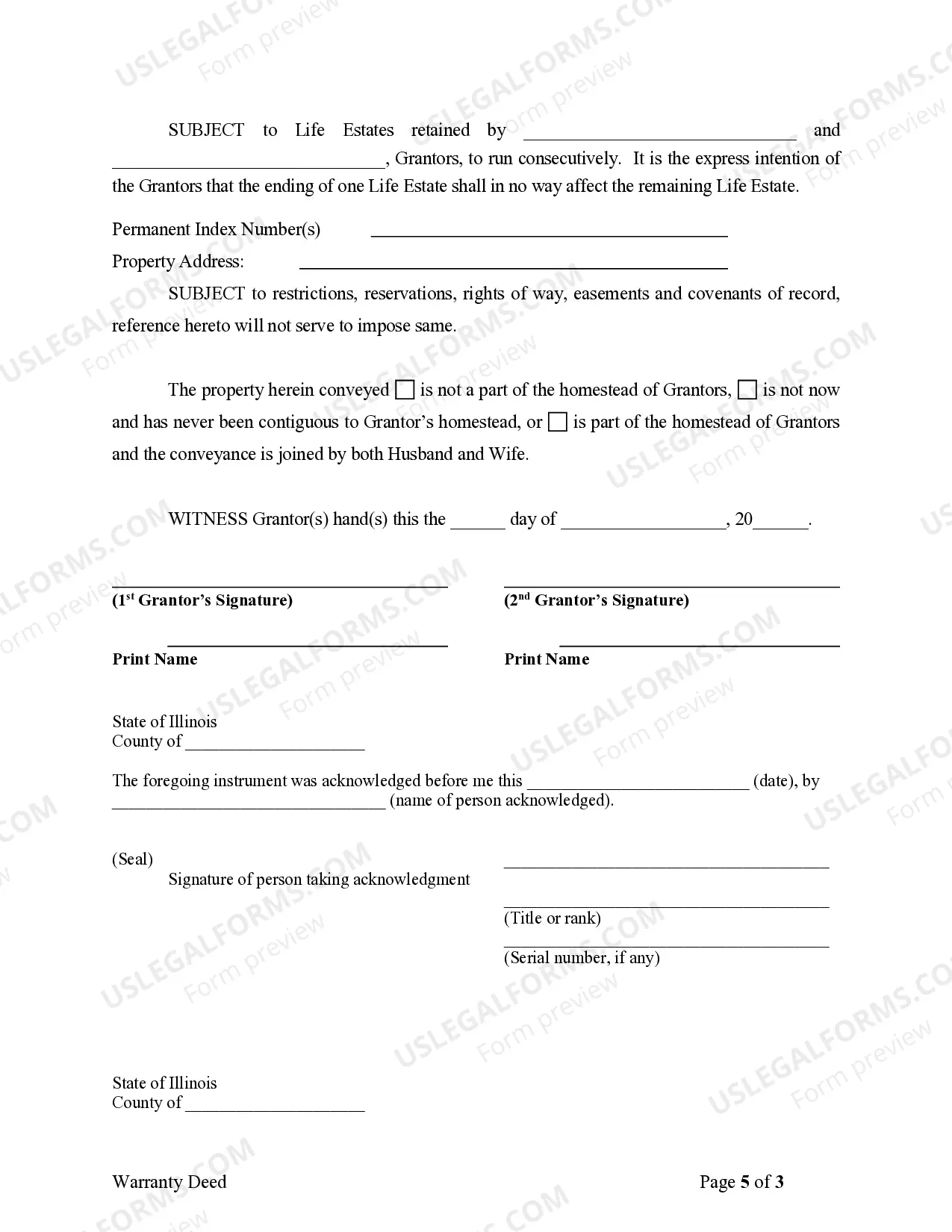

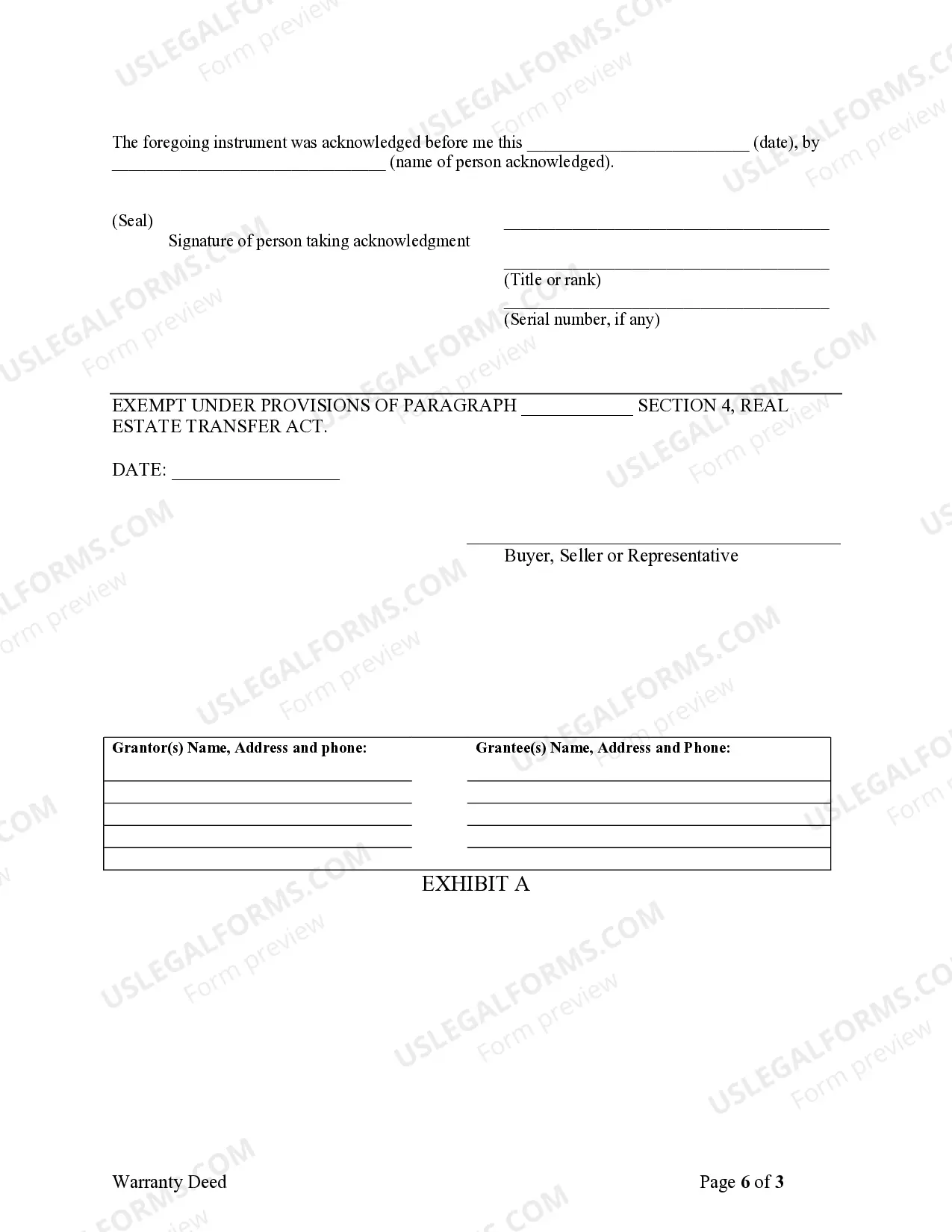

Form components explained

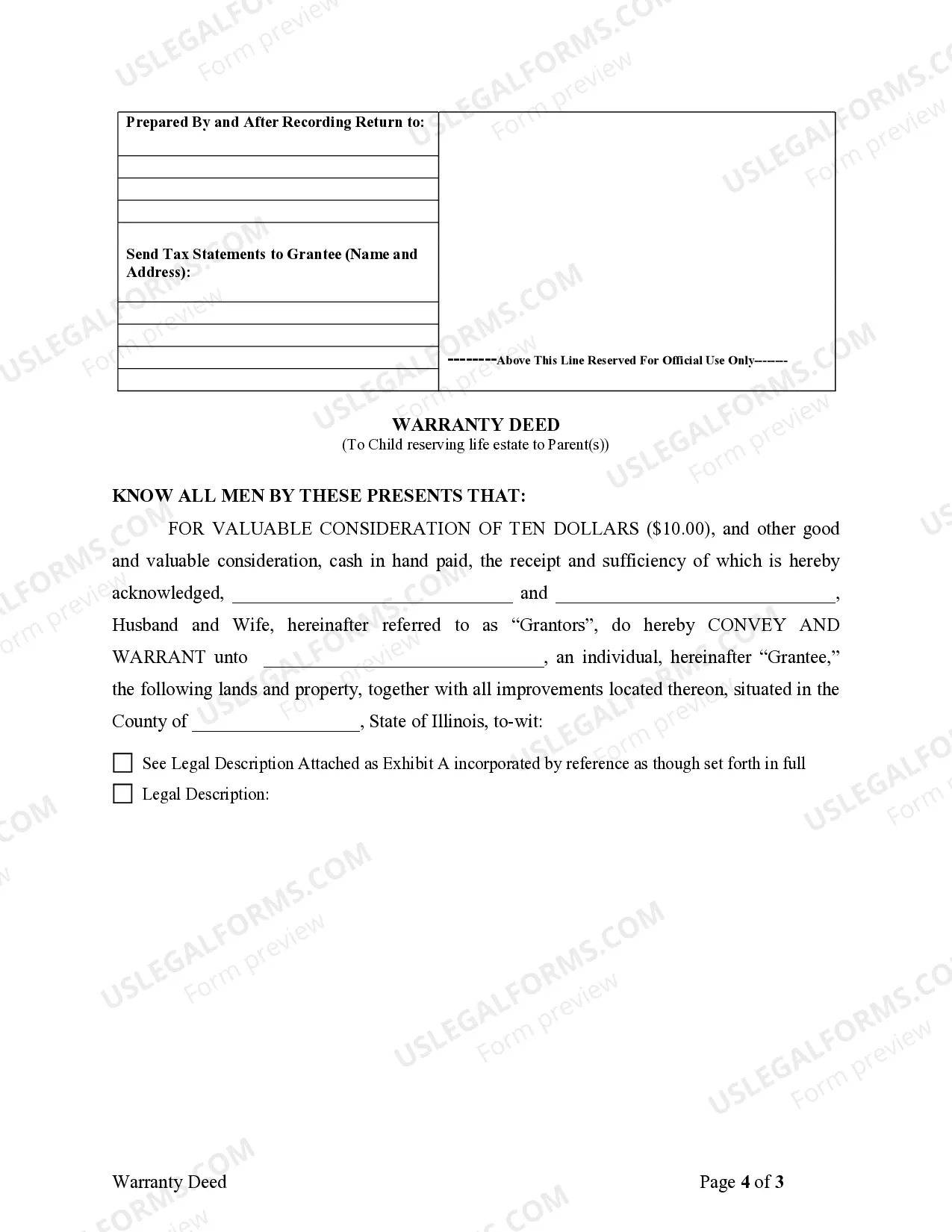

- Grantor Information: Names and details of the parents transferring the property.

- Grantee Information: Details of the child receiving the property.

- Property Description: A thorough legal description of the property being transferred.

- Life Estate Clause: An explicit statement reserving the life estate to the grantors.

- Signatures: Required signatures of both parents to validate the deed.

When this form is needed

This warranty deed is appropriate in situations where parents wish to ensure their child receives a specific property while still maintaining a right to live there. It is commonly used in estate planning to facilitate property transfer and avoid probate, ensuring that the child has clear ownership once the parents' life estate ends. Families considering this arrangement should evaluate their property assets and discuss their wishes with an attorney.

Who needs this form

This form is suitable for:

- Parents who wish to transfer real estate to their child while retaining living rights.

- Individuals involved in estate planning who want to avoid probate.

- Property owners looking for a legally recognized method to ensure their child's inheritance.

How to prepare this document

- Identify the grantors: Enter the names of the parents transferring the property.

- Specify the grantee: Enter the name of the child receiving the property.

- Enter the property details: Provide a detailed legal description of the property being conveyed.

- Include the life estate clause: Clearly state that the grantors are reserving a life estate.

- Sign and date the document: Ensure all grantors sign the deed on the designated lines.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to complete the Real Estate Transfer Declaration required in Illinois.

- Not providing a complete legal description of the property.

- Omitting signatures from both parents, which can invalidate the deed.

Advantages of online completion

- Convenience: Download the form anytime from the comfort of your home.

- Editability: Easily fill out the form digitally before printing.

- Reliability: Forms are drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

The Illinois TOD deed form form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.