Life Estate Deed Form Illinois With Address

Description

How to fill out Illinois Warranty Deed To Child Reserving A Life Estate In The Parents?

Drafting legal paperwork from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of creating Life Estate Deed Form Illinois With Address or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of more than 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates diligently prepared for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Life Estate Deed Form Illinois With Address. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and navigate the library. But before jumping directly to downloading Life Estate Deed Form Illinois With Address, follow these recommendations:

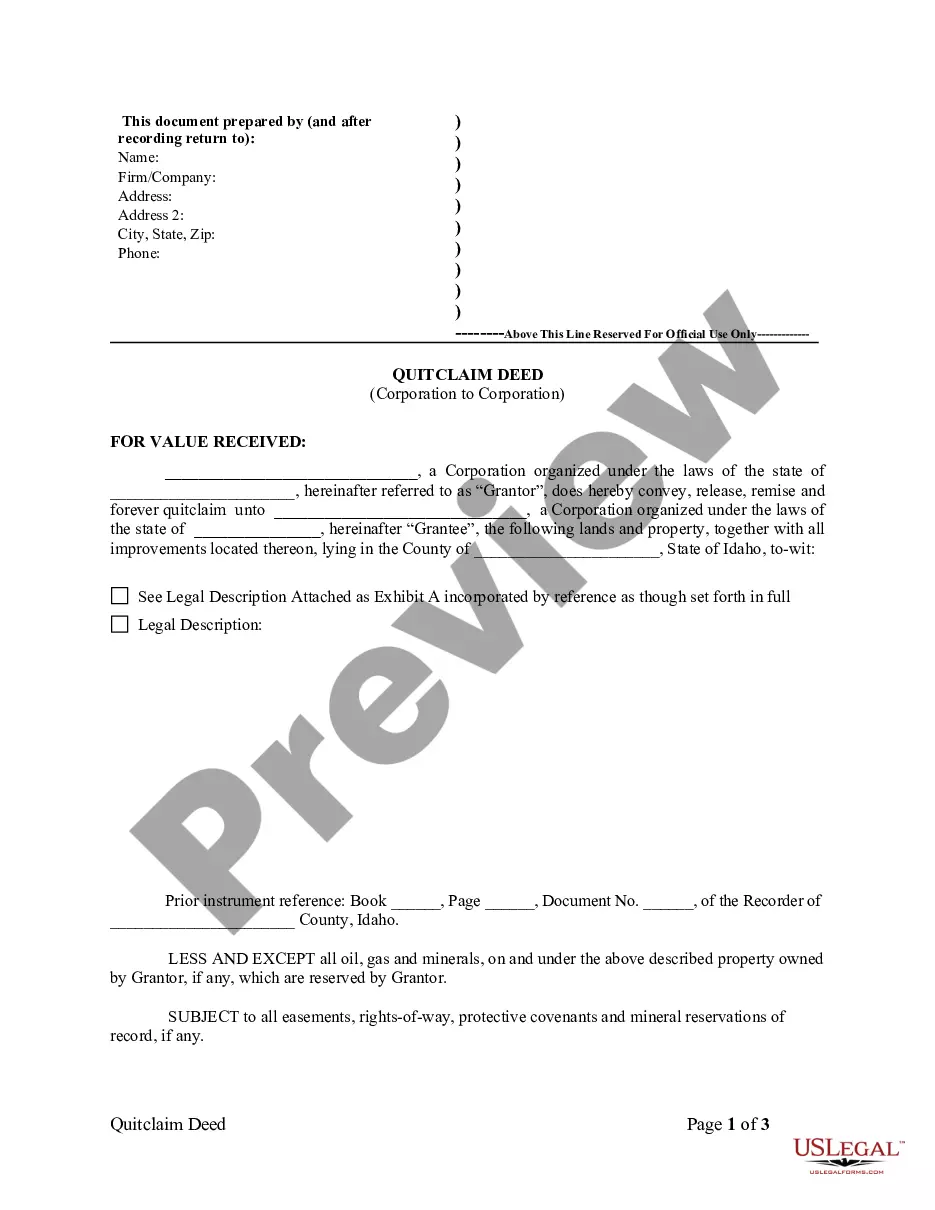

- Review the document preview and descriptions to make sure you are on the the form you are searching for.

- Make sure the form you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Life Estate Deed Form Illinois With Address.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us now and turn form completion into something easy and streamlined!

Form popularity

FAQ

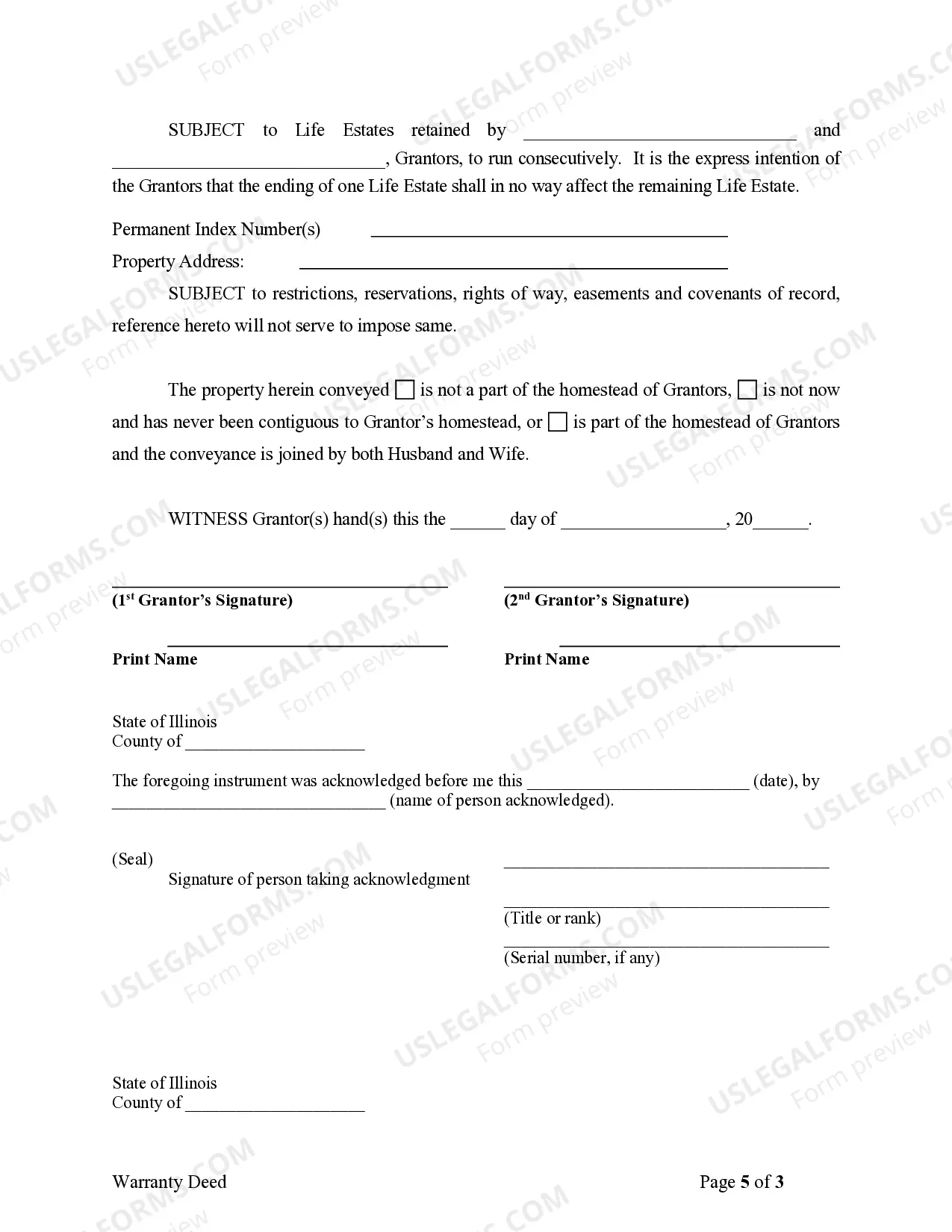

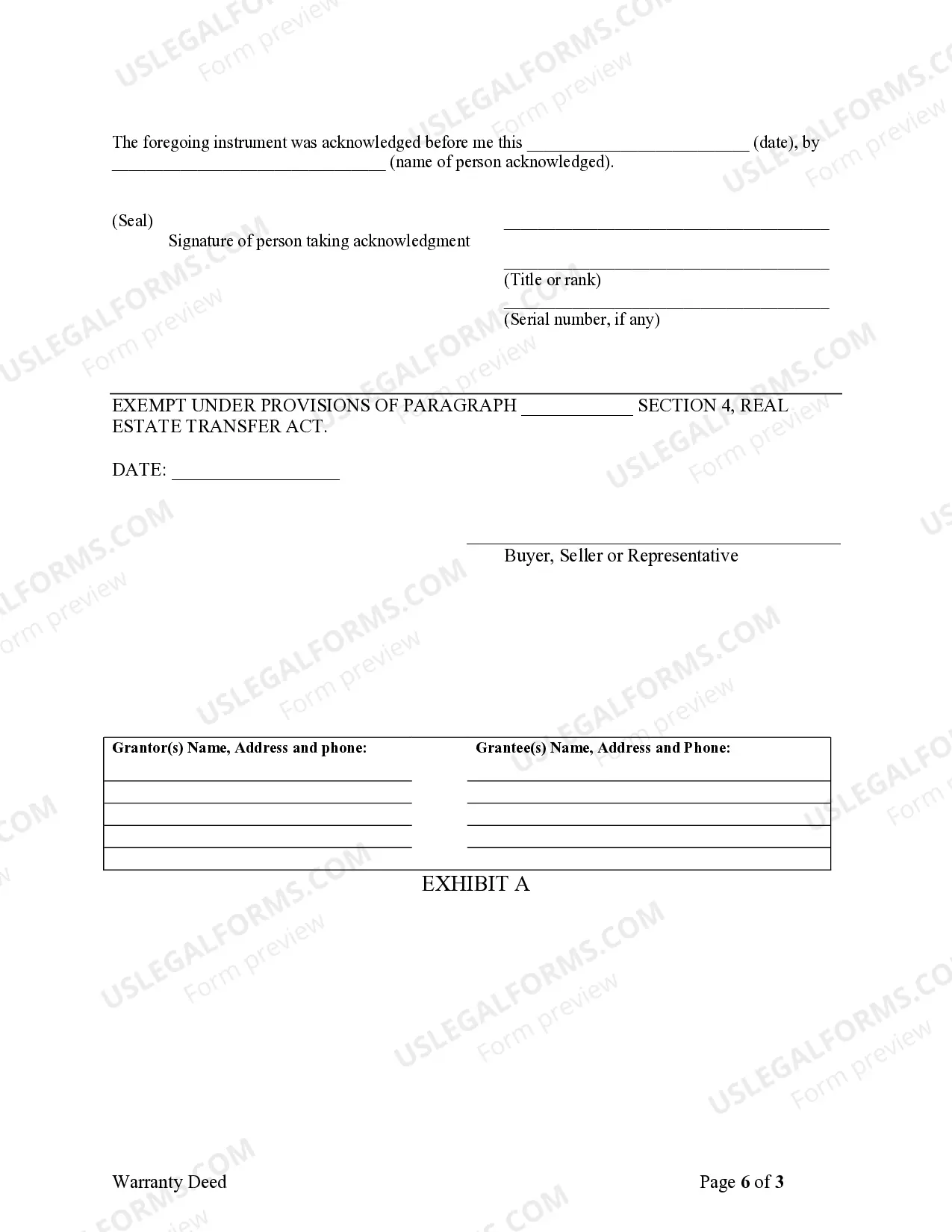

Recording of Deeds A deed must contain the names of the parties typed or printed to the side or below the signatures. This includes grantors as well as any witnesses and persons taking the acknowledgements. 765 ILCS 5/35c, 765 ILCS 5/9, 5/10.

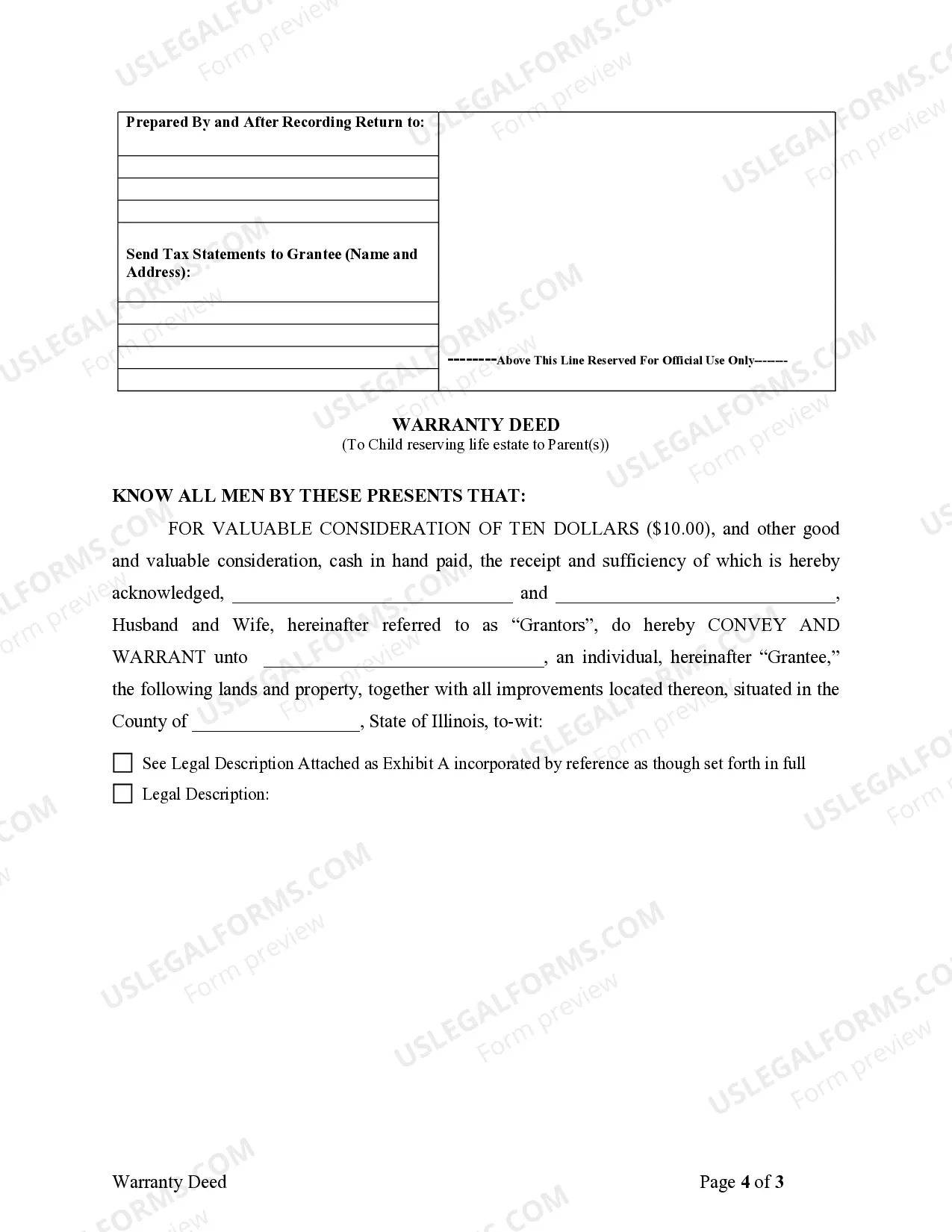

How to Create an Illinois Warranty Deed Form The names and address of the current owner and new owner; An accurate legal description of the real estate; A statement of consideration; and. Addresses for return of the recorded deed and for future tax statements (often the same address).

How to Create an Illinois Warranty Deed Form The names and address of the current owner and new owner; An accurate legal description of the real estate; A statement of consideration; and. Addresses for return of the recorded deed and for future tax statements (often the same address).

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

You and two witnesses must sign the TOD instrument while in the presence of a notary public, and then record (file) the document with the county recorder of deeds before your death.