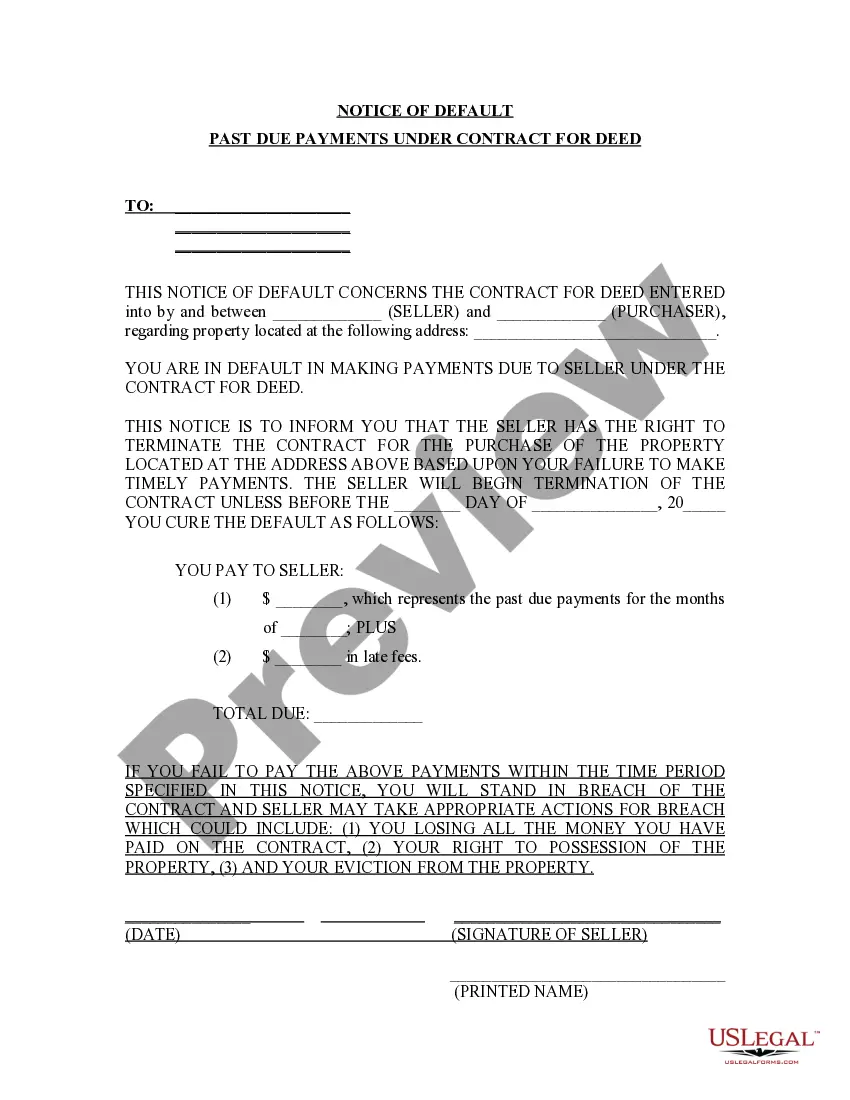

New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out New Hampshire Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Use US Legal Forms to obtain a printable New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library online and provides reasonably priced and accurate templates for consumers and attorneys, and SMBs. The templates are grouped into state-based categories and some of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to easily find and download New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed:

- Check to ensure that you have the proper template in relation to the state it’s needed in.

- Review the document by looking through the description and using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including New Hampshire Notice of Default for Past Due Payments in connection with Contract for Deed. Above three million users have already used our platform successfully. Select your subscription plan and obtain high-quality forms in just a few clicks.

Form popularity

FAQ

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

If a buyer backs out of a transaction without invoking her rights under a contingency, the seller could sue her to force the sale to move forward or for damages. To avoid this risk, most contracts contain a clause that allows the seller to keep the buyer's deposit if the buyer backs out.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Should I record the contract? The seller must record the contract or a memorandum of the contract within 10 days of the date of sale. They must do this at the county recorder of deeds where the property is located.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Contact the other party and ask whether they are willing to negotiate the cancellation of the contract. Offer the other party an incentive to cancel the contract for deed.