Life Estate Deed Form Illinois For Powers

Description

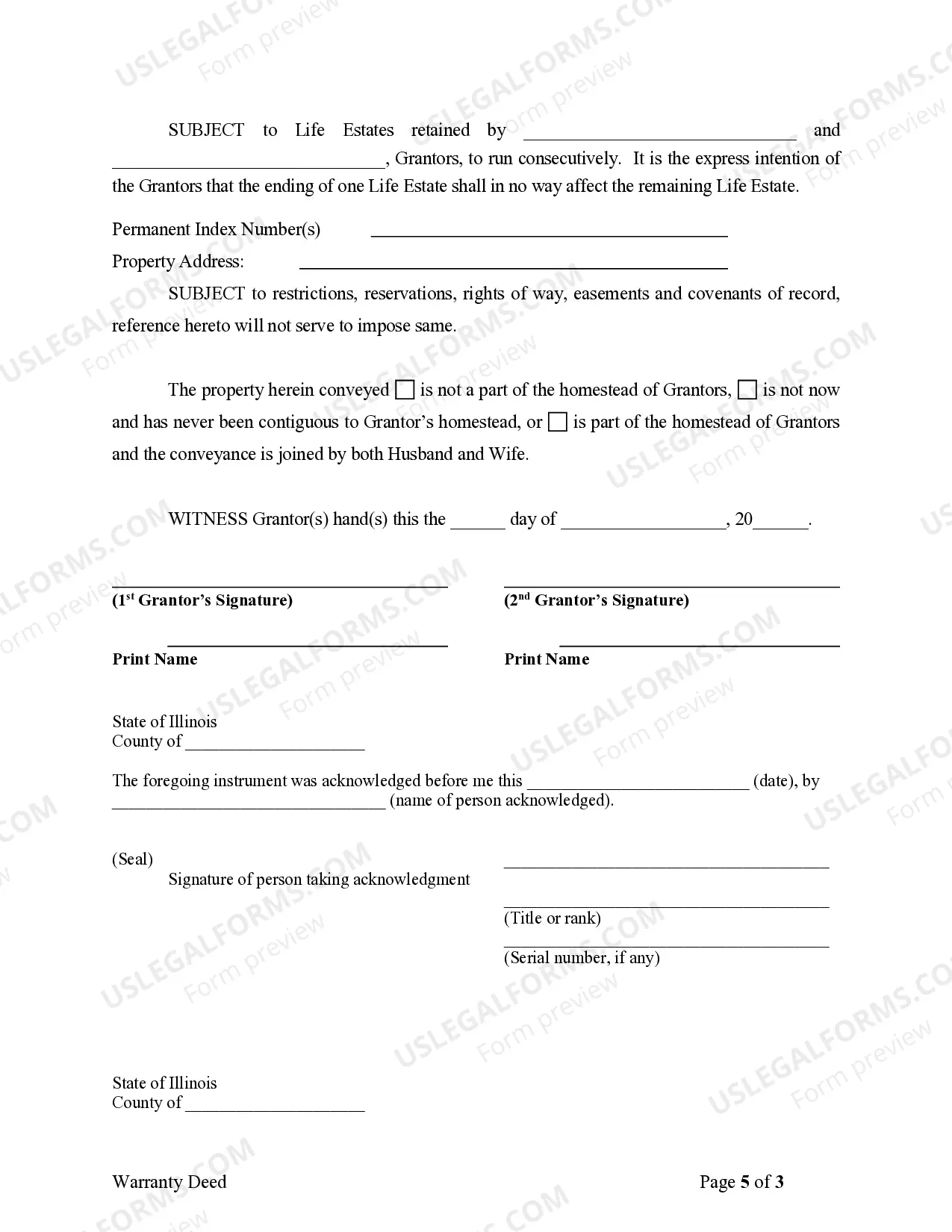

How to fill out Illinois Warranty Deed To Child Reserving A Life Estate In The Parents?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly draft Life Estate Deed Form Illinois For Powers without having a specialized background. Putting together legal documents is a time-consuming process requiring a particular education and skills. So why not leave the creation of the Life Estate Deed Form Illinois For Powers to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court paperwork to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and get the document you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Life Estate Deed Form Illinois For Powers is what you’re searching for.

- Begin your search again if you need a different template.

- Set up a free account and select a subscription plan to buy the template.

- Pick Buy now. As soon as the transaction is through, you can download the Life Estate Deed Form Illinois For Powers, fill it out, print it, and send or send it by post to the designated people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

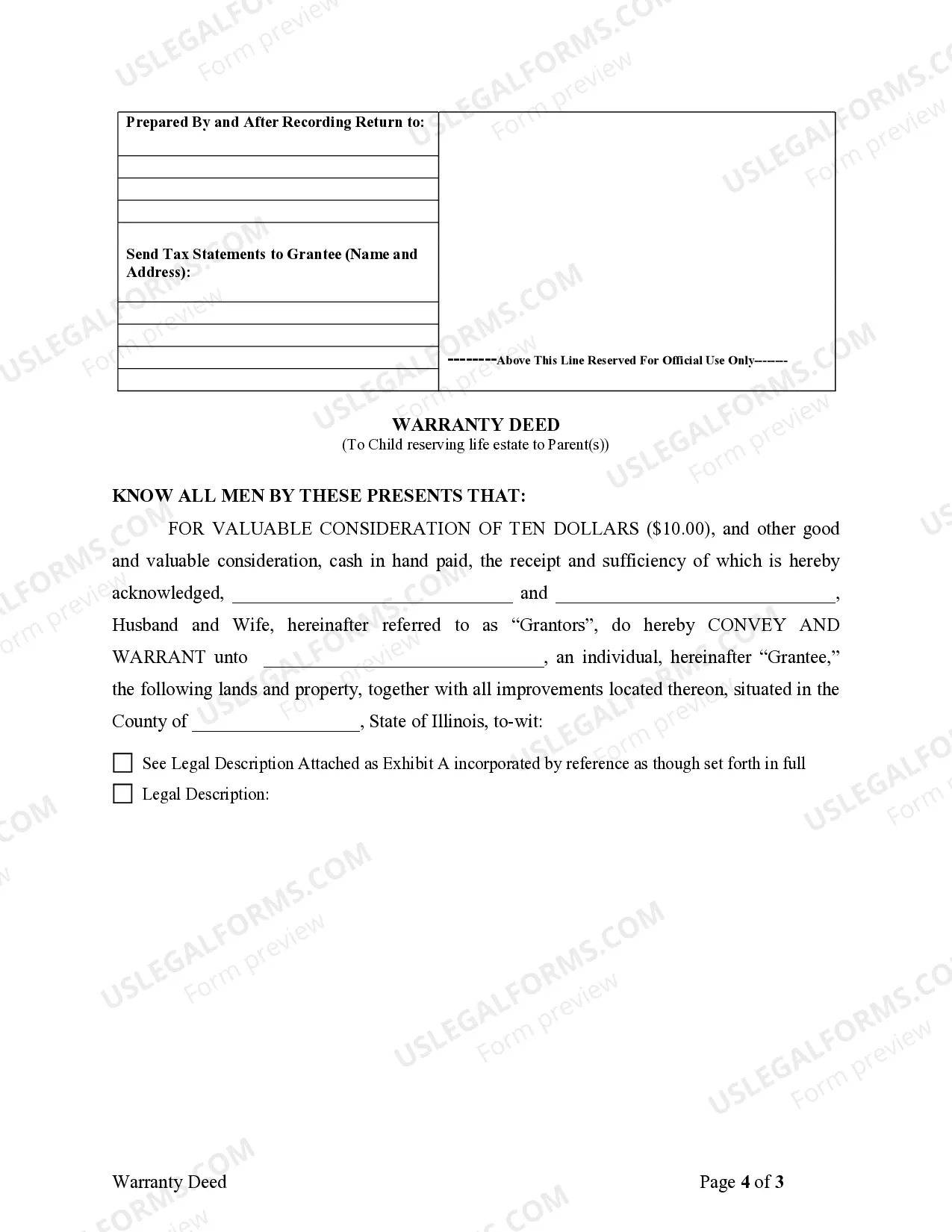

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed. Illinois requirements for quitclaim deeds | .com ? articles ? illinois-requirem... .com ? articles ? illinois-requirem...

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

In Illinois, establishing a TOD provision often involves filling out a form provided by the financial institution that holds your assets. For real estate, a TOD deed must be filled out and recorded with the county recorder's office. Transfer on Death in Illinois: How it Works and What You Need to Know getsnug.com ? post ? transfer-on-death-in-ill... getsnug.com ? post ? transfer-on-death-in-ill...

The life estate lasts as long as the life of the grantee. When the life tenant or the person whose life measures the life estate dies, the property passes to the remainderman. Life Estates - Attorneys' Title Guaranty Fund, Inc. atgf.com ? until-death-do-us-part-life-estates atgf.com ? until-death-do-us-part-life-estates

The transfer of ownership of real estate is a complex process. In fact, the Illinois Supreme Court has recognized that the preparation of a deed is considered the practice of law. This means that non-attorneys are barred from preparing deeds on behalf of anyone other than themselves. Don't Prepare a Deed on Your Own tedbondjrpc.com ? estate-planning ? dont-pr... tedbondjrpc.com ? estate-planning ? dont-pr...