Com Liability Illinois Withdrawal

Description

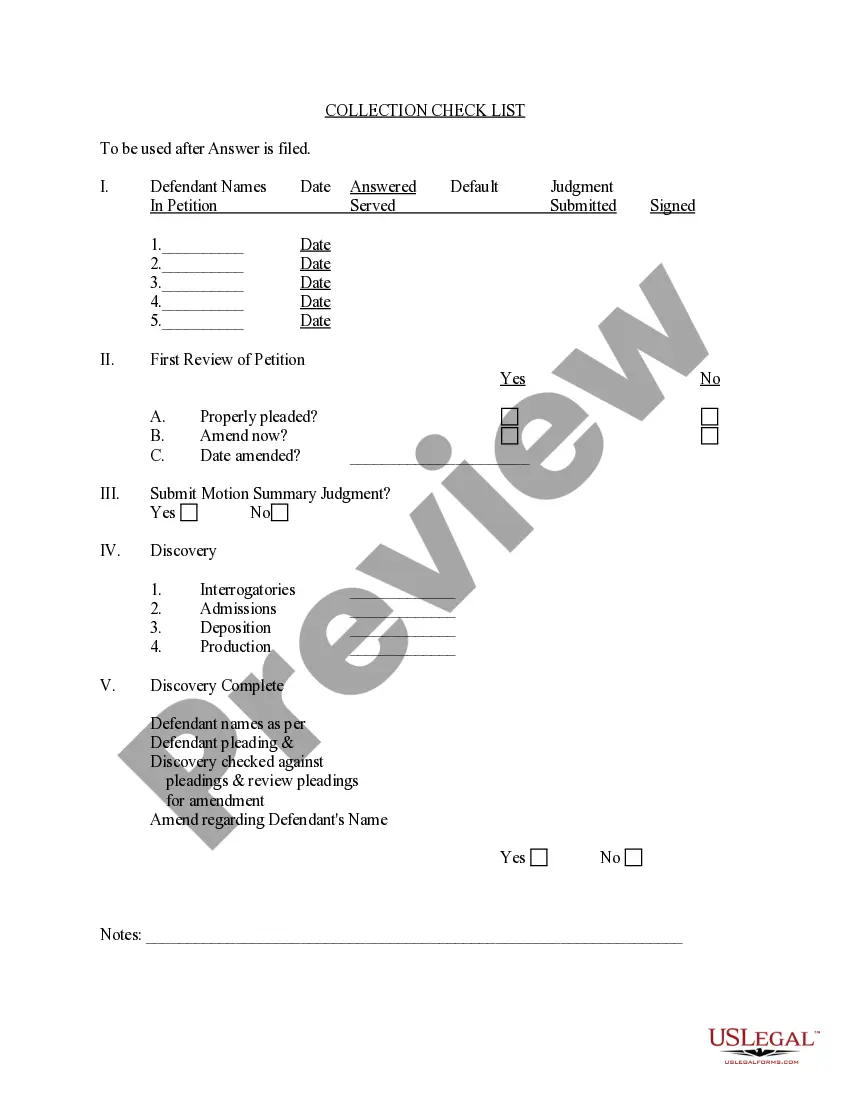

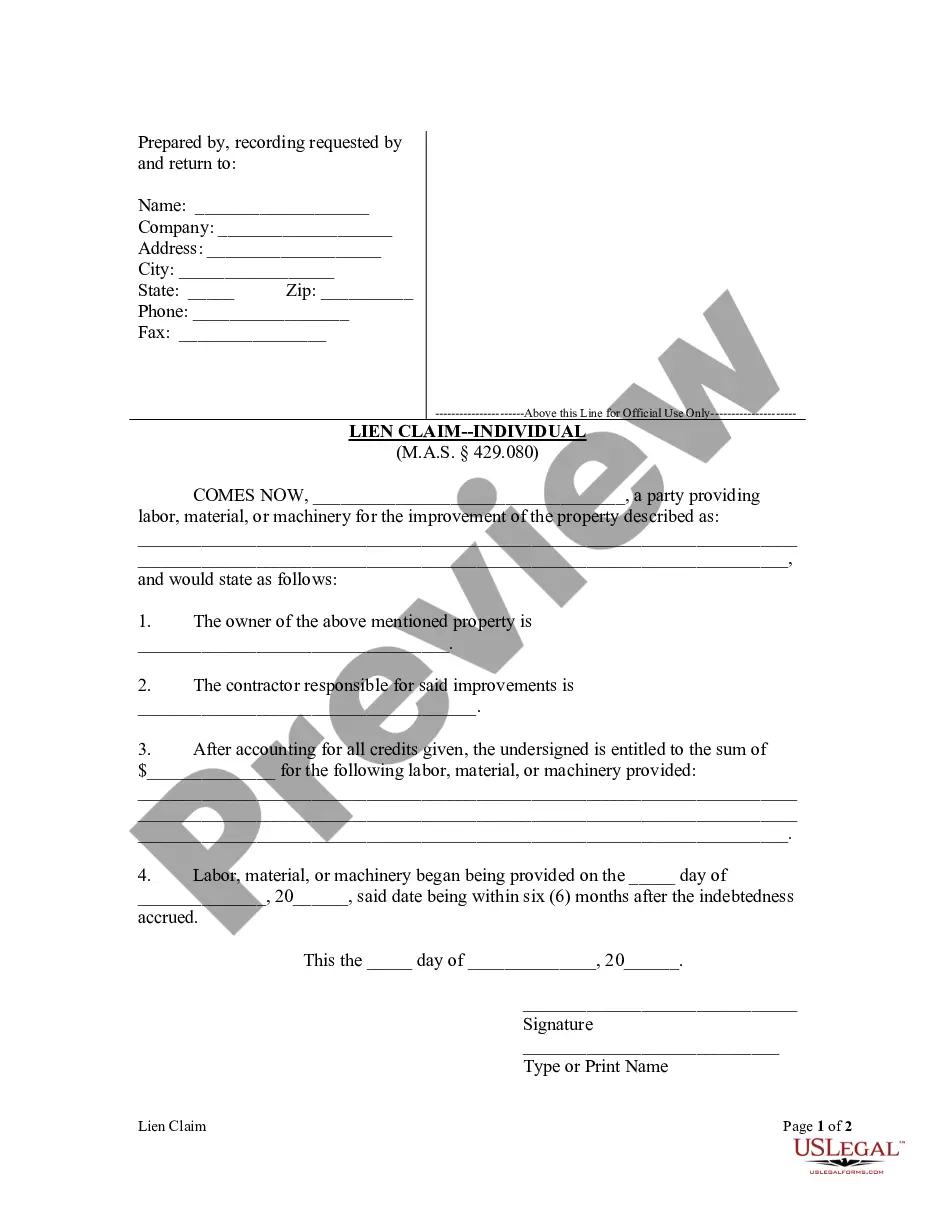

How to fill out Illinois Professional Limited Liability Company PLLC Formation Package.?

Whether for commercial reasons or personal affairs, everyone must confront legal circumstances at some stage in their life.

Completing legal paperwork requires meticulous attention, starting from choosing the correct form template.

With an extensive US Legal Forms catalog available, you don’t need to waste time searching for the proper template across the web. Utilize the library’s straightforward navigation to locate the right template for any situation.

- Obtain the template you need by utilizing the search field or catalog browsing.

- Review the form’s details to ensure it is suitable for your case, state, and locality.

- Click on the form’s preview to inspect it.

- If it is the incorrect form, return to the search function to find the Com Liability Illinois Withdrawal sample you need.

- Download the document if it satisfies your needs.

- If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can retrieve the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can utilize a credit card or PayPal.

- Choose the file format you desire and download the Com Liability Illinois Withdrawal.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

To close your Illinois LLC, you need to file the Articles of Termination with the Illinois Secretary of State. Additionally, make sure to settle any outstanding debts and obligations to ensure a smooth Com liability Illinois withdrawal. It is advisable to notify your members and creditors about your decision to dissolve the business. Lastly, consider using platforms like US Legal Forms to access the necessary documents and streamline your closure process.

Closing a Business in Illinois: Everything You Need to Know File final tax returns and terminate your EIN. File the required dissolution documents. Settle any remaining tax liabilities and other debts. Sell any remaining inventory, property, and other assets.

What is the process of transferring LLC ownership in Illinois? Review the LLC Operating Agreement. The first step in transferring LLC ownership is to review your LLC's operating agreement. ... Prepare a Membership Interest Transfer Agreement. ... Obtain Approval from All LLC Members. ... File the Required Documents.

To cancel your foreign LLC in Illinois, you must complete and submit in duplicate the LLC-45.40, Application for Withdrawal form by mail or in person to the Illinois Secretary of State, with the filing fee. Include a duplicate copy also.

How to Dissolve an Illinois LLC. To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.