Auto Promissory Note Without Interest

Description

How to fill out Illinois Promissory Note In Connection With Sale Of Vehicle Or Automobile?

There's no longer any justification to squander hours searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in a single location and simplified their availability.

Our platform provides over 85,000 templates for any business and personal legal situations categorized by state and area of usage.

Using the Search field above to look for a different template if the current one does not suit your needs.

- All forms are meticulously drafted and validated for legitimacy, allowing you to feel confident in obtaining an up-to-date Auto Promissory Note Without Interest.

- If you are acquainted with our platform and already possess an account, you must confirm that your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You may also revisit all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you have never utilized our platform before, the process will require some additional steps to finalize.

- Here’s how new users can find the Auto Promissory Note Without Interest in our catalog.

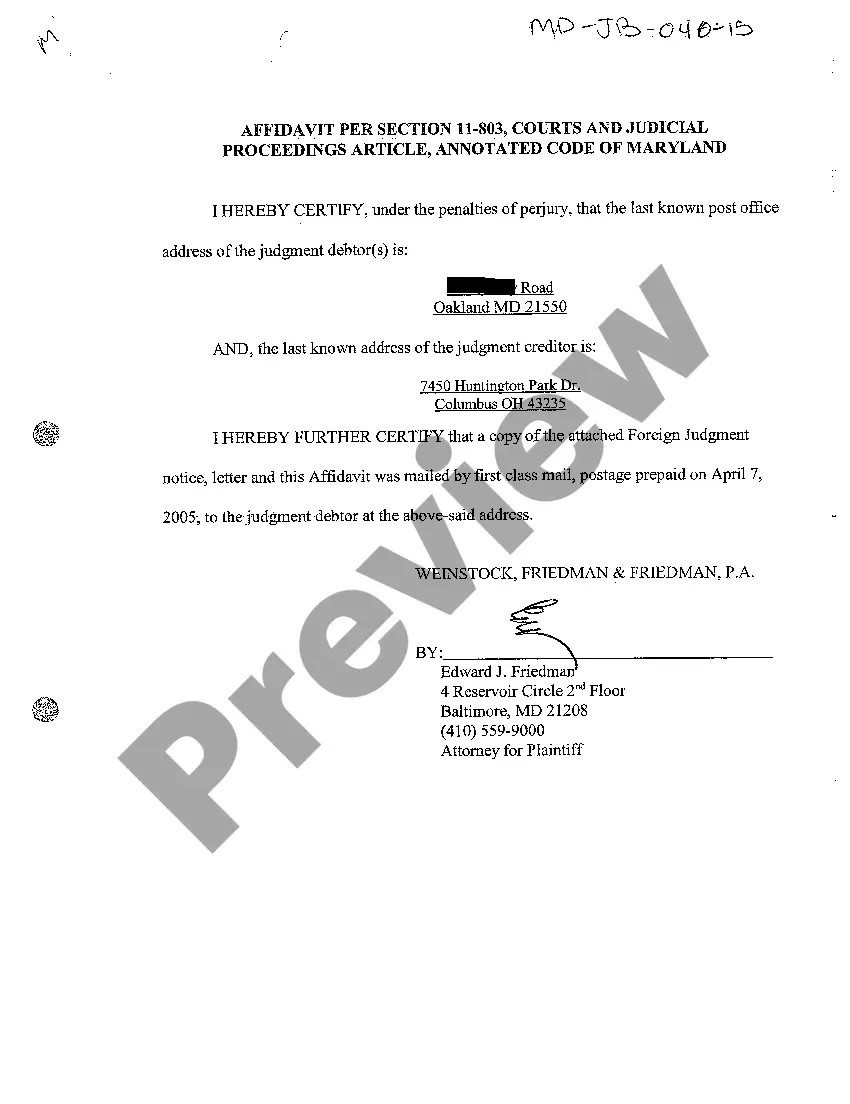

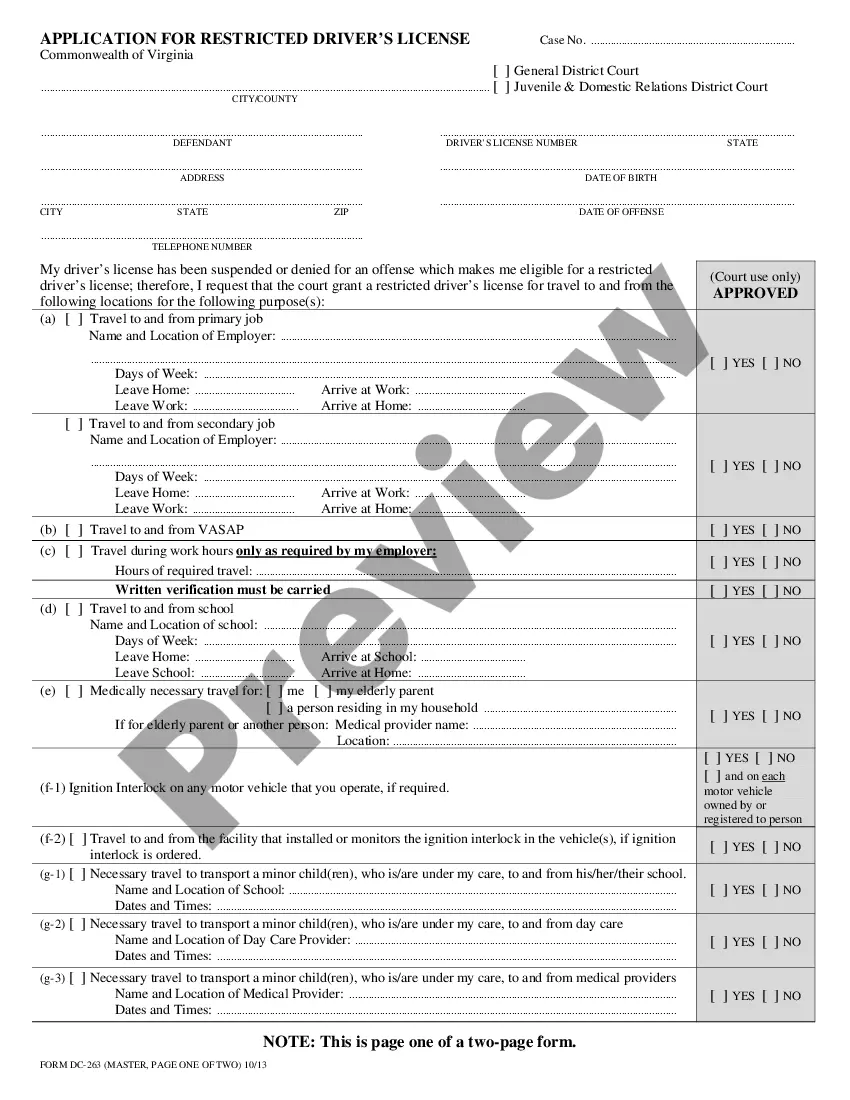

- Carefully review the page content to ensure it contains the example you need.

- To assist with this, make use of the form description and preview options if available.

Form popularity

FAQ

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

Principal and interest are payable in lawful money of the United States of America. Maker may prepay this Note in full or in part at any time without a prepayment charge. DEFAULT/ACCELERATION.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.