Limited Lliability

Description

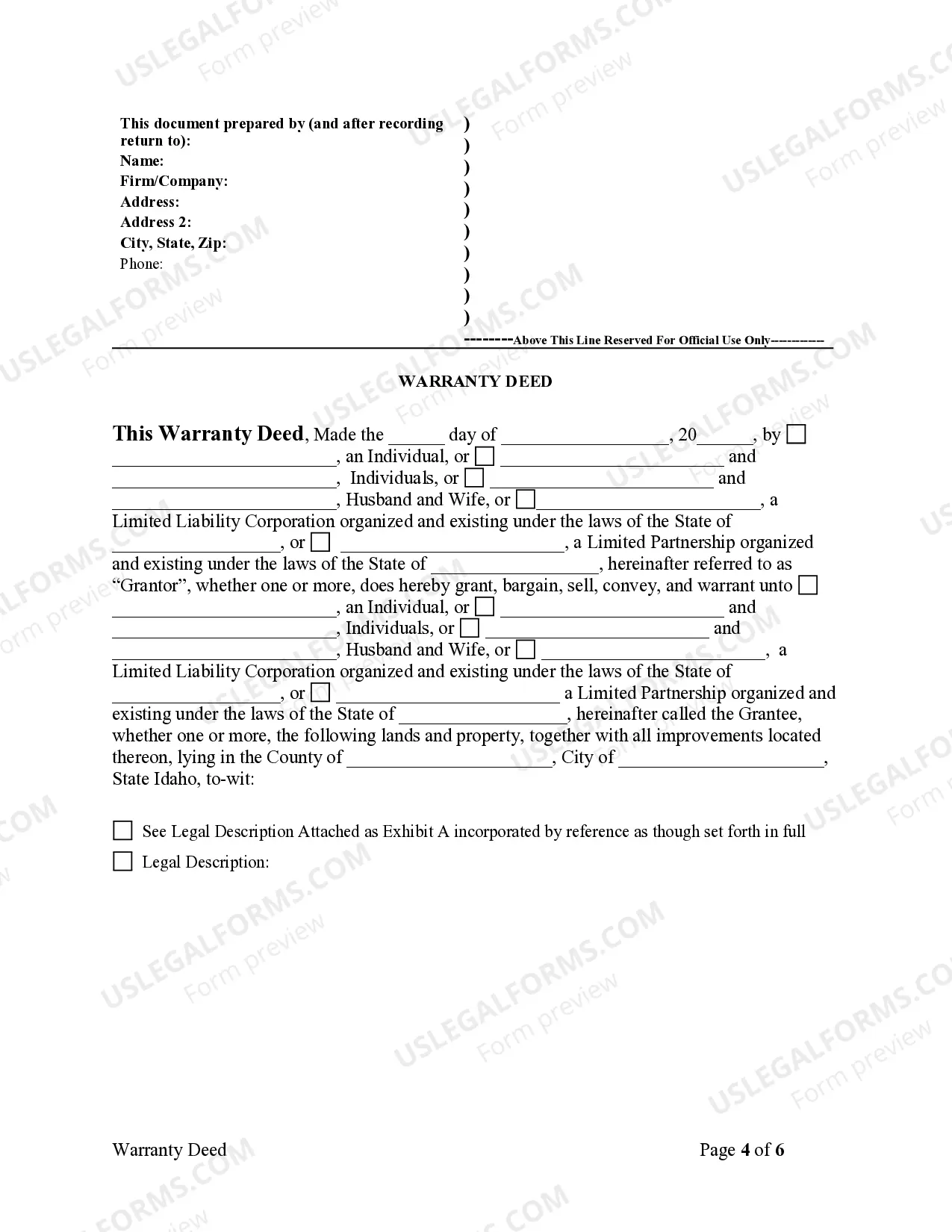

How to fill out Idaho Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- If you're a returning user, log in to your account and locate the desired legal form template. Ensure your subscription remains active; if it has expired, simply renew it as per your chosen payment plan.

- For first-time users, begin by exploring the preview mode and reading the form description. Confirm that you select the proper document that aligns with your requirements and complies with local jurisdiction regulations.

- Should you need different templates, use the search function to locate additional options. If you find an alternative that is a better fit, proceed to the next stage.

- To purchase your form, click the Buy Now button and select your preferred subscription plan. Remember to register for an account to access the extensive library.

- Complete your order by entering your payment details through credit card or PayPal, finalizing the subscription.

- Next, download your form and save it to your device. You can access it anytime through the My Forms section in your account.

With US Legal Forms, you gain access to a vast collection of over 85,000 easy-to-fill templates, ensuring that your legal documents are both accurate and personalized.

Empower yourself with reliable legal resources today. Start your journey with US Legal Forms and ensure your documents meet all legal requirements.

Form popularity

FAQ

You can establish a Limited Liability Company without an active business, although this may not be beneficial. Forming an LLC serves to protect personal assets and may provide tax advantages, even before business income begins. If you're considering future entrepreneurial plans, forming an LLC now can lay a solid foundation. For clarity on this process, you may want to explore the resources available through US Legal Forms.

Starting a Limited Liability Company comes with various costs. Generally, you will face filing fees, which can vary by state, along with potential costs for business licenses and permits. Additional expenses might include legal fees if you choose professional assistance. An understanding of these start-up costs is essential for effective financial planning when forming your LLC.

While a Limited Liability Company (LLC) offers protection from personal liability, it does have downsides. One notable concern is the potential for self-employment taxes, which can impact your overall earnings. Furthermore, in some cases, LLCs may face stricter regulatory complexities compared to sole proprietorships. It's crucial to evaluate these factors carefully before forming an LLC.

An LLC must file taxes if it earns any income, even if the amount is low. The Internal Revenue Service requires reporting income regardless of the total generated. For single-member limited liability companies, this means filing as part of your personal return once you've earned profit.

If your LLC has only one member, you can indeed file your LLC and personal taxes together. You would include your LLC’s income on Schedule C of your Form 1040. This process highlights the benefits of the limited liability structure, allowing for simpler tax filing.

Yes, in most cases, you will file taxes separately from your LLC if it has multiple members. Each member will report their share of profits or losses on their individual tax returns. However, if your LLC is a single-member formation, this process becomes much easier, as you file as part of your personal taxes.

member LLC simplifies tax filing significantly. The IRS considers it a disregarded entity, so you report its income on Schedule C, attached to your Form 1040. This approach allows you to enjoy the benefits of limited liability while keeping your tax process straightforward.

Whether you should file taxes together depends on your business structure. If you have a single-member limited liability company, you can report business income on your personal tax return, making filing together more straightforward. However, if your LLC has multiple members, you will need to file separately, as the LLC will file its own tax return.

A limited liability company typically files Form 1065 if it has multiple members, as this form reports partnership income. If your LLC is a single-member entity, you will report its income on Schedule C of your personal tax return using Form 1040. The limited liability structure allows for pass-through taxation, meaning profits are taxed at your individual income level.

LLC should be written in uppercase letters, indicating that it stands for 'Limited Liability Company.' It is essential to include the abbreviation 'LLC' at the end of your business name whenever it appears in official documents and marketing materials. Adhering to this standard showcases professionalism and compliance with naming regulations. For more guidance, consider exploring resources on the US Legal Forms platform.