Limited Business

Description

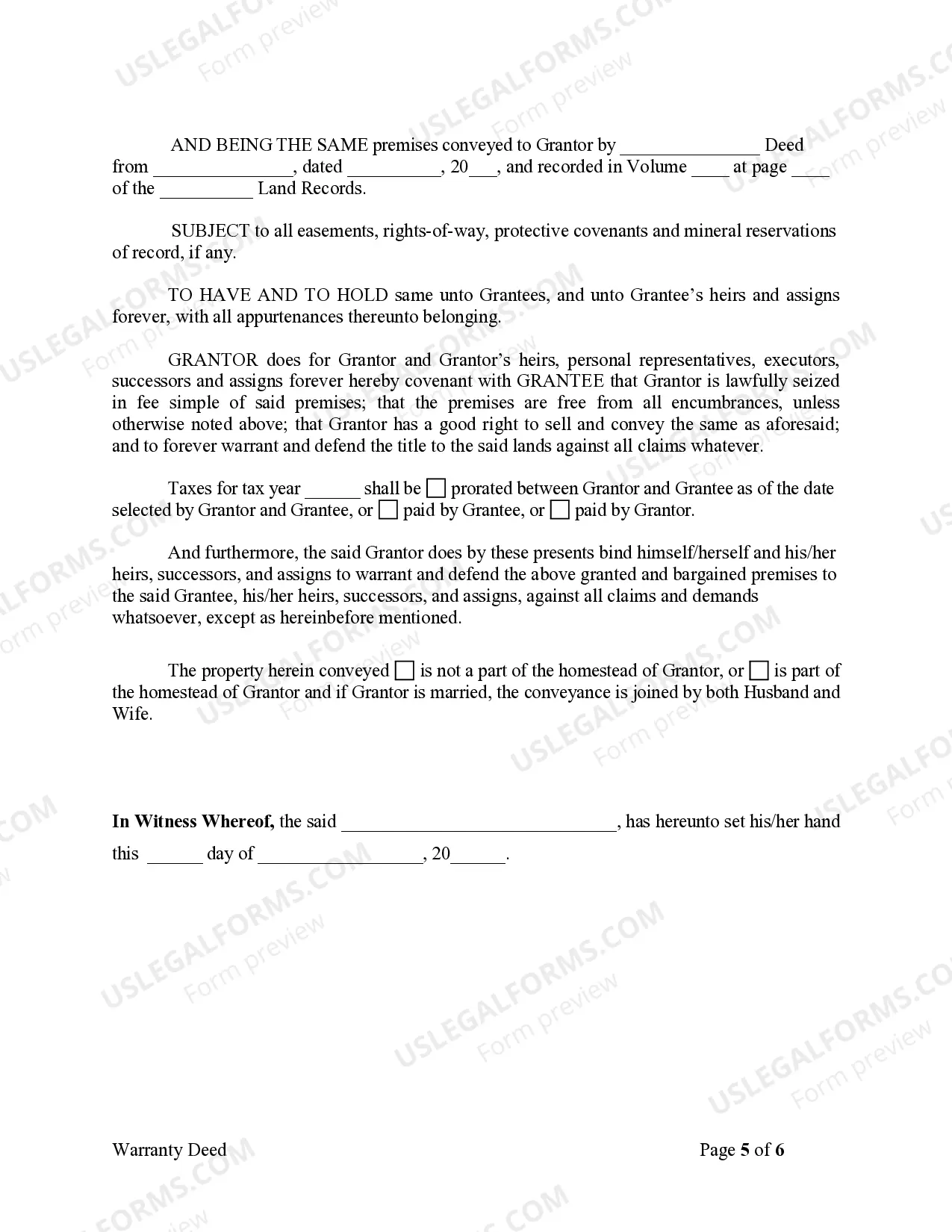

How to fill out Idaho Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- Start by checking the Preview mode and form description to ensure you've selected the right document for your limited business needs.

- If the form doesn’t meet your requirements, use the Search tab to find an alternative template that matches your criteria.

- Once you've identified the appropriate document, click on the Buy Now button to choose your preferred subscription plan.

- Register for an account to proceed with the payment and gain access to US Legal Forms library resources.

- Enter your payment information, either through credit card or PayPal, and finalize your purchase.

- Download the form to your device and find it later under the My Forms section in your profile for easy access.

In conclusion, US Legal Forms provides a seamless experience for acquiring legal documentation for your limited business. Whether you are a first-time user or returning, the platform simplifies the process while ensuring safety and compliance.

Start benefiting from the extensive library today and ensure that your legal forms are always precise and up-to-date.

Form popularity

FAQ

An example of a limited business is a Limited Liability Company (LLC) or a Corporation (Inc). These structures allow for personal asset protection while enabling the business to grow under a formal company framework. Many popular small businesses and startups choose this model for its flexibility and security. The limited business format also appeals to investors and partners who seek a low-risk environment.

Businesses use 'limited' in their names to inform clients and partners that they enjoy limited liability status. This not only enhances credibility but also assures stakeholders that their personal assets are not at risk if the business encounters financial difficulties. Additionally, this status may provide various tax benefits and facilitate easier fundraising efforts. It's a clear indicator of professionalism and responsibility in the business world.

When a business has 'limited' in its name, it signifies that it is a limited liability company or corporation. This indicates that the liabilities of the business do not extend to its owners or shareholders. Therefore, their personal finances are safeguarded in cases of business failure. It reflects a formal structure that many prefer when starting a limited business due to the protections it offers.

In a business context, 'limited' stands for the restriction of the owners' liabilities. It indicates that the company is incorporated and legally recognized, providing a legal separation between the business and its owners. The term suggests that if the business incurs debt or legal issues, the owners are shielded from losing personal assets. This is one of the key advantages of establishing a limited business.

A limited company is a type of business structure where the owners' liability is limited to their investment in the company. This means that personal assets are protected from business debts. In essence, if the business faces financial trouble, the owners are not personally responsible beyond their contributions. Choosing to operate as a limited business can provide significant financial security and peace of mind.

You become a limited company by formally registering your business as such with the appropriate state or federal authorities. This includes submitting necessary documents, such as articles of incorporation, and paying applicable fees. Being a limited company means that your personal assets are generally protected from business debts and liabilities, making it an appealing choice for many entrepreneurs when establishing a limited business.

To determine if you are a limited company, you should check your business registration documents. If they indicate that your business is organized as a company limited by shares or guarantee, you have a limited company. Additionally, your business name may include 'Limited' or its abbreviation, 'Ltd.' If you are uncertain, seeking guidance from uslegalforms can provide clarity regarding your limited business status.

A limited company qualifies as a business structure that limits the liability of its members. Generally, these companies must be registered with the appropriate authorities and comply with specific regulations. They typically involve shares and a distinct separation between personal and business assets. Knowing whether your entity qualifies as a limited company is essential for protecting your limited business investments.

Yes, you can use 'limited' instead of 'LLC' in your business name if your company qualifies as a limited company. However, this choice may depend on the state regulations governing business formations. It’s important to check the rules in your area to ensure compliance. Remember, using appropriate terminology for your limited business helps convey the right information to customers and partners.

A limited company and a Limited Liability Company (LLC) share similarities, but they are not identical. A limited company is usually a broader term, often referring to companies limited by shares or by guarantee, depending on their structure. An LLC specifically refers to a business structure that limits the owners' liability, offering flexibility in management and tax treatment. Understanding these distinctions is crucial when considering your limited business options.