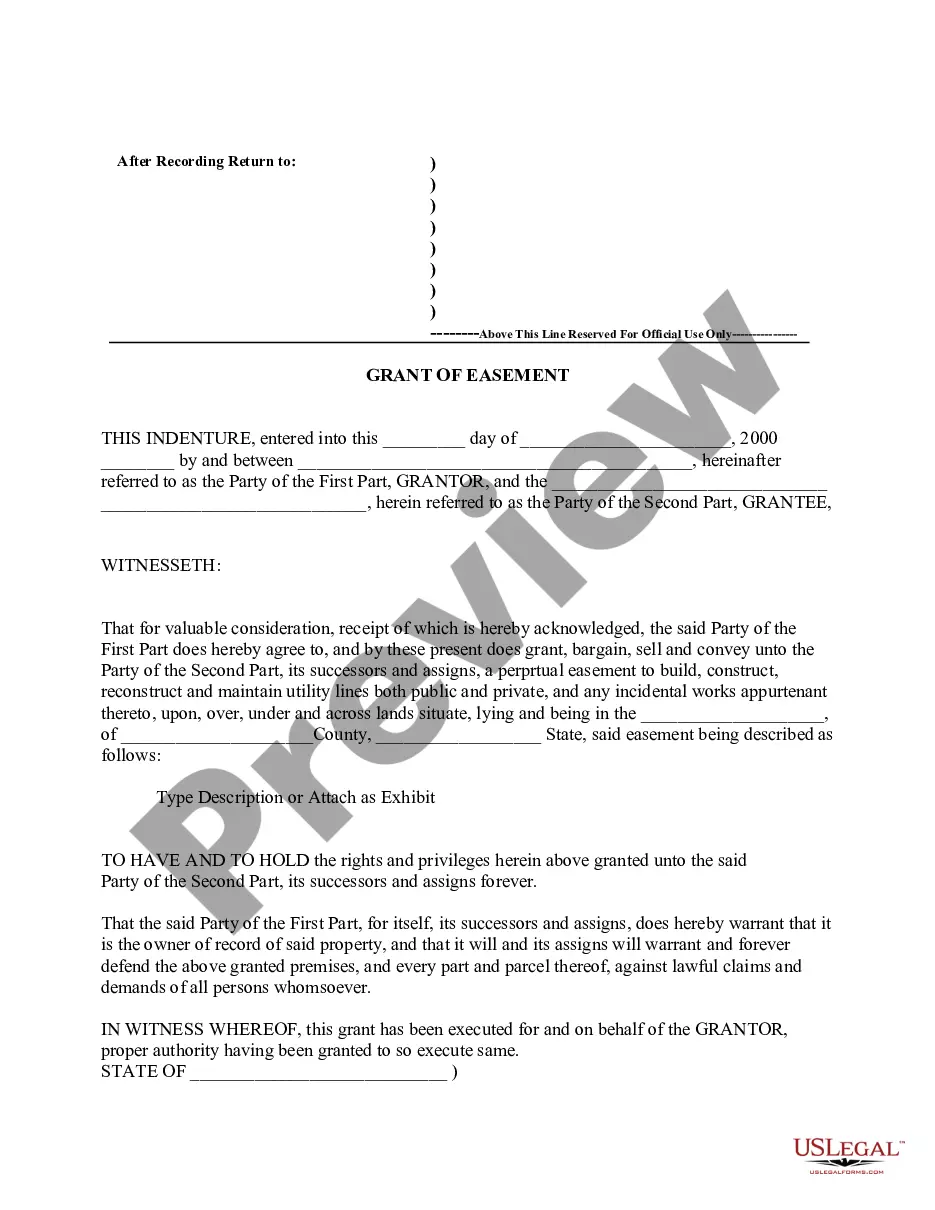

Easement for Utilities: An Easement for Utilities allows a Grantor the right to grant to a Grantee the ability to use his/her land to acquire utlities. However, the form clearly states that the land is still the Grantor's and will be left to his/her heirs. This form is available in both Word and Rich Text formats.

An easement gives one party the right to go onto another party's property. That property may be owned by a private person, a business entity, or a group of owners. Utilities often get easements that allow them to run pipes or phone lines beneath private property. Easements may be obtained for access to another property, called "access and egress", use of spring water, entry to make repairs on a fence or slide area, drive cattle across and other uses. The easement is a real property interest, but separate from the legal title of the owner of the underlying land.