Idaho Dissolve Llc Withdrawal

Description

Form popularity

FAQ

To shut down a business account, you should contact your bank or financial institution directly. They will provide guidance on the necessary steps to close your account. Ensure you settle all outstanding transactions and inform all relevant parties. If you're closing an LLC under an Idaho dissolve LLC withdrawal, address this in your business account closure to maintain proper records.

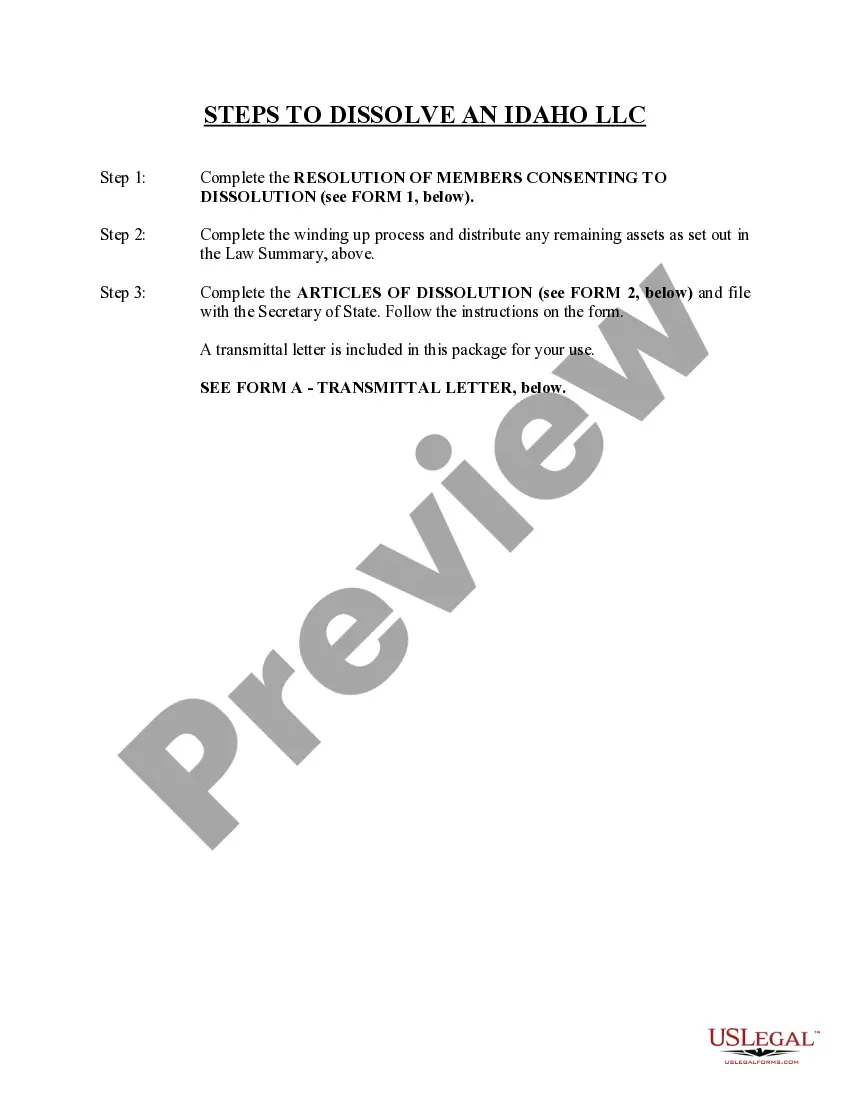

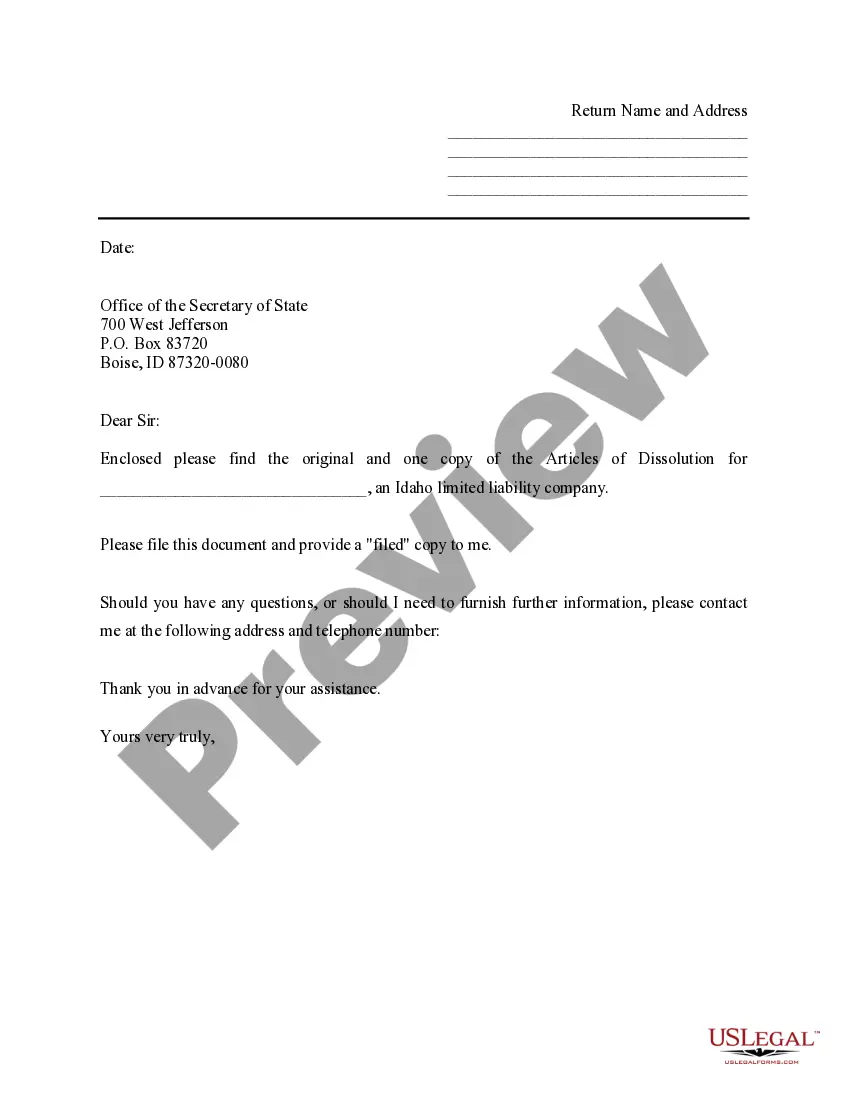

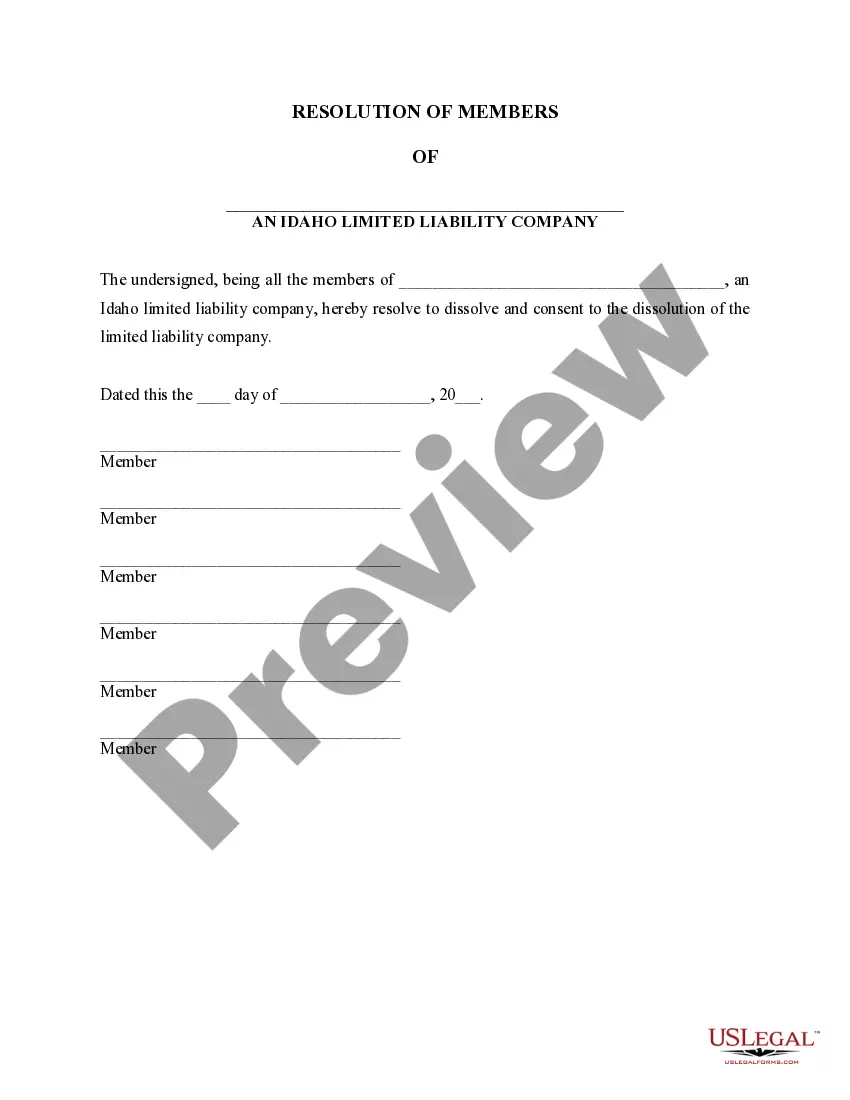

To terminate a business in Idaho, you must follow specific steps. Firstly, file the appropriate paperwork with the Idaho Secretary of State's office, which includes your Articles of Dissolution. Additionally, settle all financial obligations and notify stakeholders about the termination. This process is crucial when considering an Idaho dissolve LLC withdrawal, as it ensures a legal and orderly closure.

Shutting down a business involves several steps. You need to settle all debts, cancel licenses and permits, and inform your employees. If you have an LLC, take the necessary steps for an Idaho dissolve LLC withdrawal to ensure you close it legally and avoid future liabilities.

Yes, you can run a business from your home in Idaho. However, you must check local zoning laws to ensure compliance. Additionally, depending on the type of business, you may need to obtain specific permits or licenses. If you later decide to pursue an Idaho dissolve LLC withdrawal, ensure you follow the necessary procedures to properly close your business.

Deciding whether to dissolve your LLC or keep it inactive depends on your future plans. Dissolving will eliminate the ongoing costs and liabilities associated with maintaining the LLC. However, if you foresee future use of the business entity, keeping it inactive might be a better choice for flexibility. Assess your situation carefully, and USLegalForms can provide the support you need in making the right decision regarding your Idaho dissolve LLC withdrawal.

To reinstate an LLC in Idaho, you need to file a reinstatement application along with any required fees. It's also crucial to bring your business up to date with all tax obligations and settle any penalties. Be mindful that there may be deadlines for filing reinstatement, so act promptly. Services like USLegalForms can assist in navigating this process smoothly.

To officially close an LLC, you must follow your state’s procedure for dissolution, which typically includes filing formal paperwork with the state agency. Additionally, notify all creditors, settle any outstanding debts, and distribute remaining assets among members. Properly closing your LLC prevents future liabilities. You might find using USLegalForms helpful in ensuring you complete all steps correctly.

To dissolve an LLC in South Dakota, you start by filing Articles of Dissolution with the Secretary of State. It's essential to ensure that all debts are settled, and final tax returns are filed. Once you file the dissolution documents, your LLC will officially cease to exist. For a smooth process, consider using a service like USLegalForms to guide you through the necessary steps.

Idaho Code 30-25-702 outlines the procedures for dissolving an LLC in Idaho. This code specifies the necessary steps, documentation, and approvals required to legally terminate your business. Understanding this code is crucial if you wish to successfully proceed with an Idaho dissolve LLC withdrawal. Consulting resources from US Legal Forms can provide clarity on this legislation.

Establishing an LLC in Idaho can take as little as 1-2 business days with an expedited service, or it might take longer if filed by mail. The overall timeline depends on the filing method and state processing speeds. Remember, if you ever need to navigate the complexities of an Idaho dissolve LLC withdrawal in the future, thorough planning now can help ease that process. US Legal Forms can assist in both formation and dissolution.