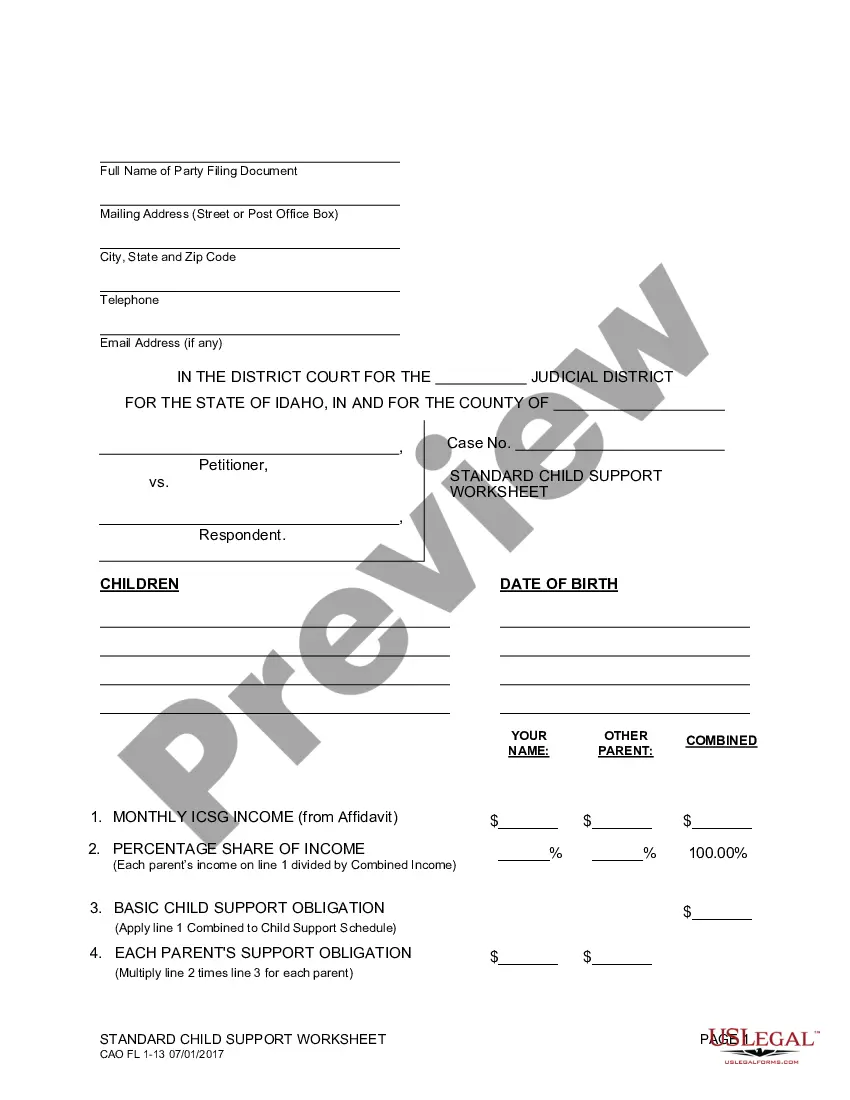

This is a Child Support Worksheet to be used by those parents whom share custody of their child or children. It is used in conjunction with the financial information supplied in the Child Support Affidavit in order to arrive at a correct amount of child support to be paid by the non-custodial parent.

Idaho Child Support Income Guidelines

Description

How to fill out Idaho Child Support Worksheet For Shared Custody?

Whether for business purposes or for personal matters, everybody has to manage legal situations sooner or later in their life. Completing legal papers demands careful attention, beginning from selecting the proper form sample. For instance, when you select a wrong edition of a Idaho Child Support Income Guidelines, it will be rejected once you send it. It is therefore essential to have a reliable source of legal papers like US Legal Forms.

If you need to obtain a Idaho Child Support Income Guidelines sample, stick to these easy steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s information to make sure it fits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong document, go back to the search function to find the Idaho Child Support Income Guidelines sample you require.

- Download the template if it meets your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved templates in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Select your transaction method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Idaho Child Support Income Guidelines.

- After it is downloaded, you are able to fill out the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time looking for the right sample across the internet. Make use of the library’s easy navigation to get the proper form for any situation.

Form popularity

FAQ

Idaho family courts use a formula that considers both parents' incomes and the needs of the child to arrive at a monthly child support amount. The parenting time percentage adjustment only figures into joint physical custody cases.

Support obligations should be determined without regard to the gender of either parent. Rarely should a parent's child support obligation be set at zero; therefore, there is a rebuttable presumption that each parent should contribute at least $50 per month per child.

If the order is at least three years old or a significant and sustained change has occurred, you can request a review by calling 800-356-9868. An order can only be changed by the court and fees may be charged.

Child support obligations in Idaho are calculated using the Income Shares Model. The idea is to estimate the amount of support that the children would have received if the marriage hadn't failed. This support amount is then divided between the parents in proportion to their respective incomes.

Unless the decree of adoption provides otherwise, the effects of terminating parental rights on the parent is that the parent is relieved of all parental duties toward, and all responsibilities for the child, including support and no longer has any right over it.