Workers Comp Laws In Idaho

Description

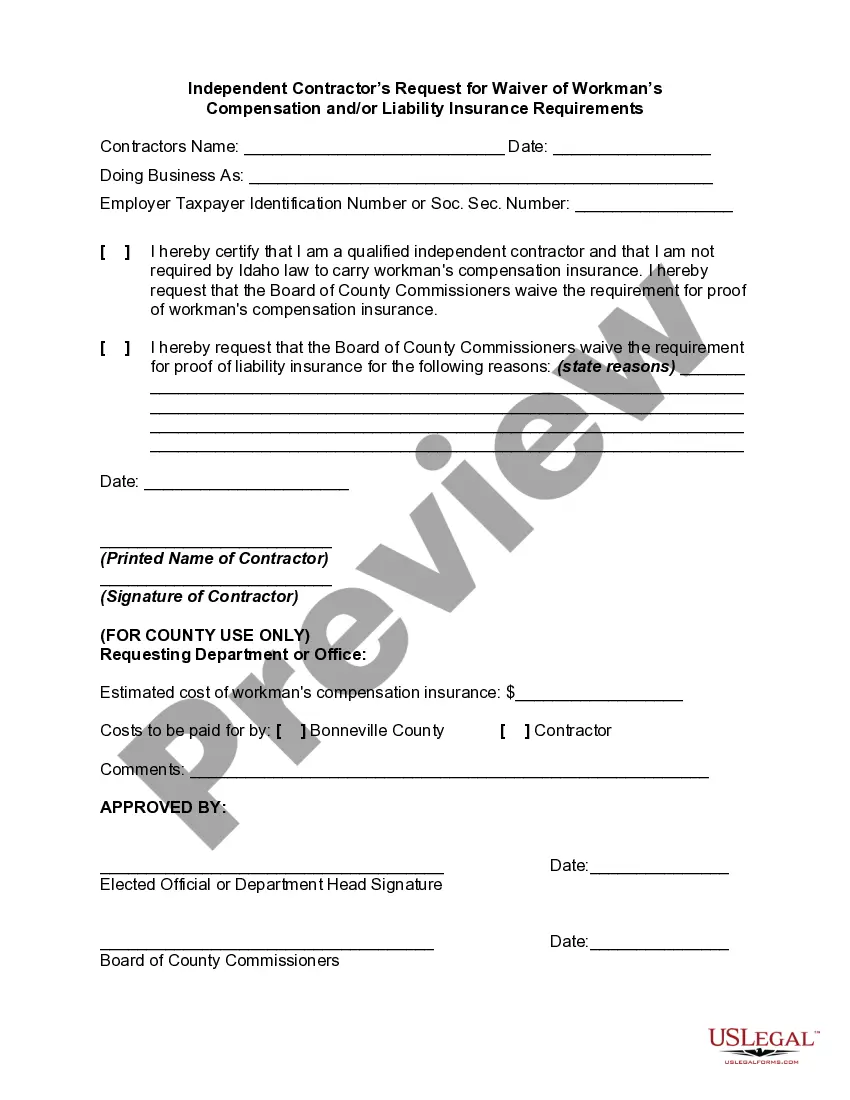

How to fill out Idaho Independent Contractor's Request For Waiver Of Workman's Compensation And/or Liability Insurance Requirements?

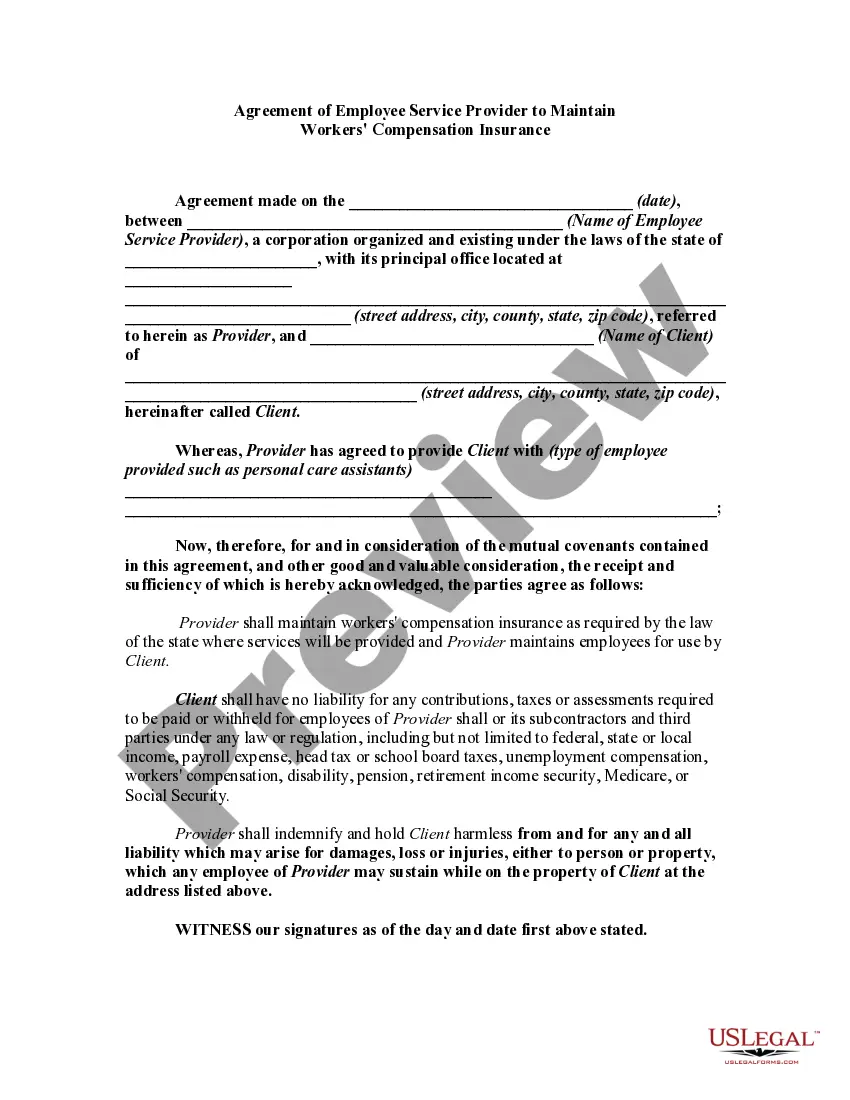

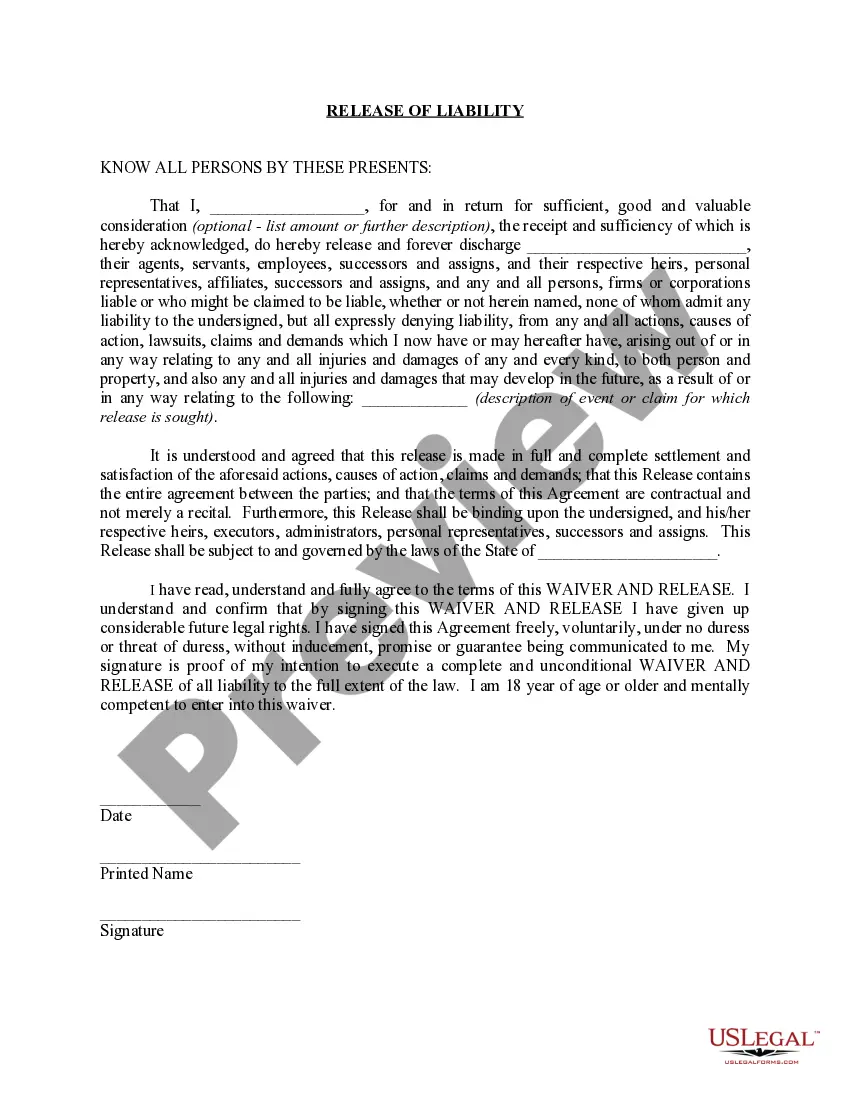

The Workers Compensation Regulations In Idaho displayed on this page is a reusable legal blueprint created by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with over 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, simplest, and most reliable method to acquire the documentation you require, as the service ensures bank-level data security and anti-malware safeguards.

Choose the format you desire for your Workers Compensation Regulations In Idaho (PDF, DOCX, RTF) and save the document on your device. Complete and sign the paperwork. Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to swiftly and accurately fill out and sign your form with a valid signature. Download your documents again as needed. Utilize the same form once more anytime required. Access the My documents section in your profile to redownload any previously saved documents. Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and review it.

- Examine the file you searched for and preview it or review the form details to confirm it meets your requirements. If it doesn’t, utilize the search bar to find the suitable one. Click Buy Now once you have located the template you need.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

In Idaho, workers' comp rates depend on your business' payroll and the type of work your employees do. As a business owner, you're required to pay the entire cost of your workers' compensation coverage. You can't put any of that cost onto your employees at any time.

If you've reported your injury and filed your claim successfully, there is no statute of limitations on Idaho medical benefits. The exception to this rule is when your claim is closed with a lump sum settlement.

Idaho Rates for Select Work Comp Class Codes Class Code & DescriptionLow RateHigh Rate5022 Masonry Construction$9.58$15.815102 Door & Window Installers$8.54$13.665183 Plumbing Contractors$4.31$6.905190 Electrical Wiring-Electrician$3.60$5.7665 more rows

Basic Idaho workers comp benefits start at 67% of your weekly wage, but with minimums and maximums based on 90% of the average Idaho state wage. If that sounds a little complicated, that's because it is. Your workers compensation attorney can help you figure out your total benefits.

Exemptions from workers' compensation requirements in Idaho include: Sole proprietors and independent contractors. Family members employed by a sole proprietor and living in the same household. Some family members of sole proprietors who don't live in the same household may file for an exemption.