Small Estate Affidavit For Ia

Description

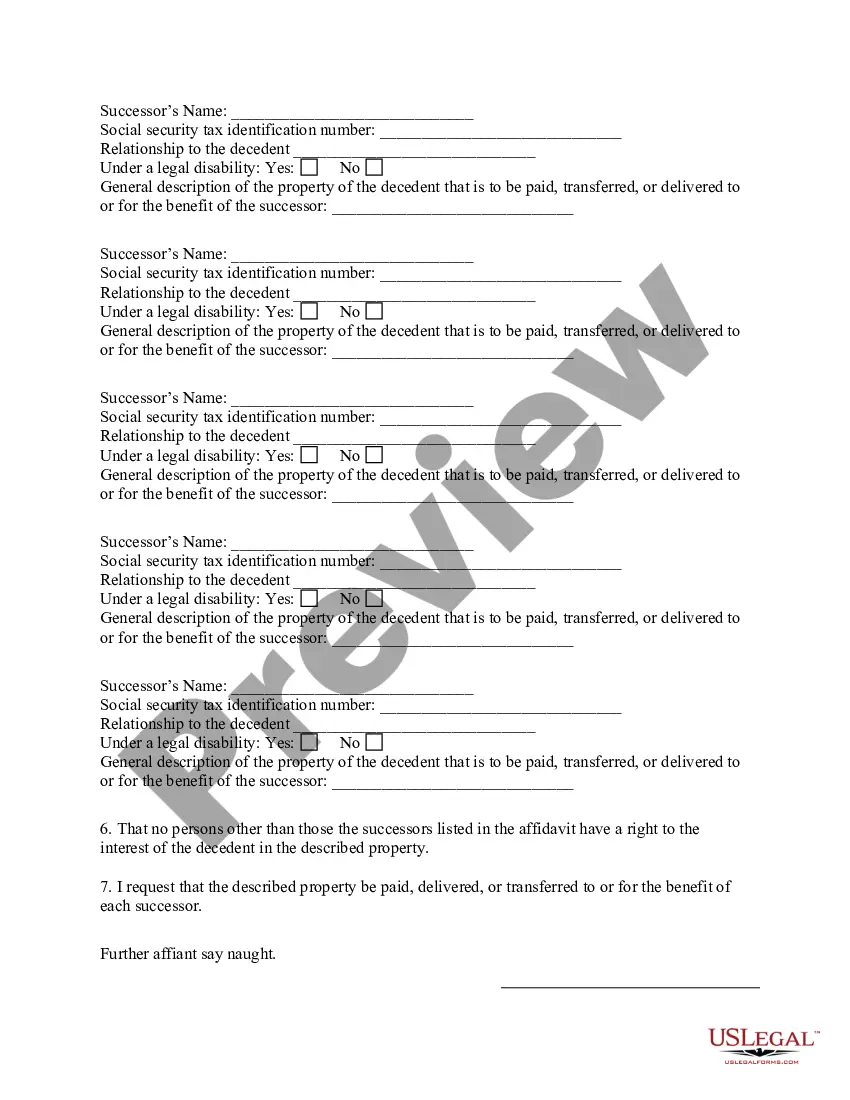

How to fill out Iowa Small Estate Affidavit For Personal Property Estates Not More Than $50,000?

Regardless of whether it’s related to commercial activities or personal matters, everyone inevitably faces legal issues at some point in their lives.

Completing legal paperwork necessitates meticulous care, starting with choosing the appropriate form template.

Select the file format you desire and download the Small Estate Affidavit For Ia. Once downloaded, you can complete the form using editing software, or print it and fill it out by hand. With an extensive catalog of US Legal Forms available, you no longer need to waste time searching online for the correct sample. Use the library's user-friendly navigation to find the right form for any scenario.

- For instance, selecting an incorrect version of the Small Estate Affidavit For Ia will result in its rejection once you submit it.

- Therefore, it is crucial to find a reliable source of legal documents such as US Legal Forms.

- If you need to obtain a Small Estate Affidavit For Ia template, follow these simple steps.

- Utilize the search bar or browse the catalog to find the sample you require.

- Review the form's description to confirm it aligns with your situation, state, and area.

- Click on the form’s preview to inspect it.

- If it is not the correct document, return to the search function to find the Small Estate Affidavit For Ia template you need.

- Download the file if it meets your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you don’t have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: either use a credit card or PayPal account.

Form popularity

FAQ

Probate. In Iowa, a small estate is categorized based on the assets owned by the deceased at the time of death. To be considered a small estate, the sum of the assets must equal $200,000 or less.

Small Estate Affidavit Requirements for Indiana Indiana law says that a small estate affidavit must: Provide the name, address, Social Security number and date of the decedent's death. State that the value of the assets in the estate is less than $100,000.

Some limits and drawbacks of small estate affidavits in Indiana include: Estates must be valued under $100,000. All qualifying heirs and beneficiaries must be contacted and consent to the use of the affidavit. Real estate cannot be transferred without court agreement.

How Long Do You Have to File Probate After Death? While there is no specific timeline, a person with possession of the will must file it after learning of the person's death. By filing the will promptly, you can begin the probate process as soon as possible.

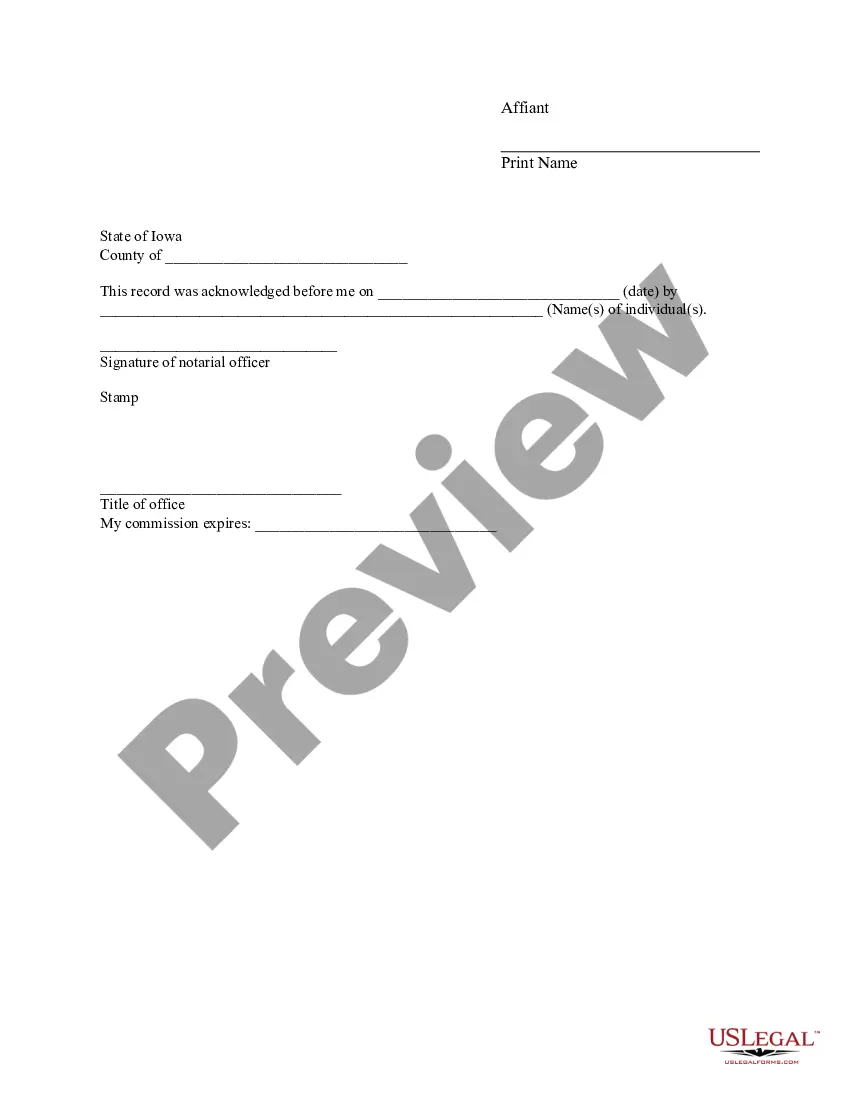

Since the affidavit does not need to be filed with the court, there are no filing or court fees. The only cost is likely to be paying to have signatures notarized. However, a notary's services typically cost $20 or less. Illinois lays out the requirements of a small estate affidavit on its legislative website.