Iowa Small Estate Threshold

Description

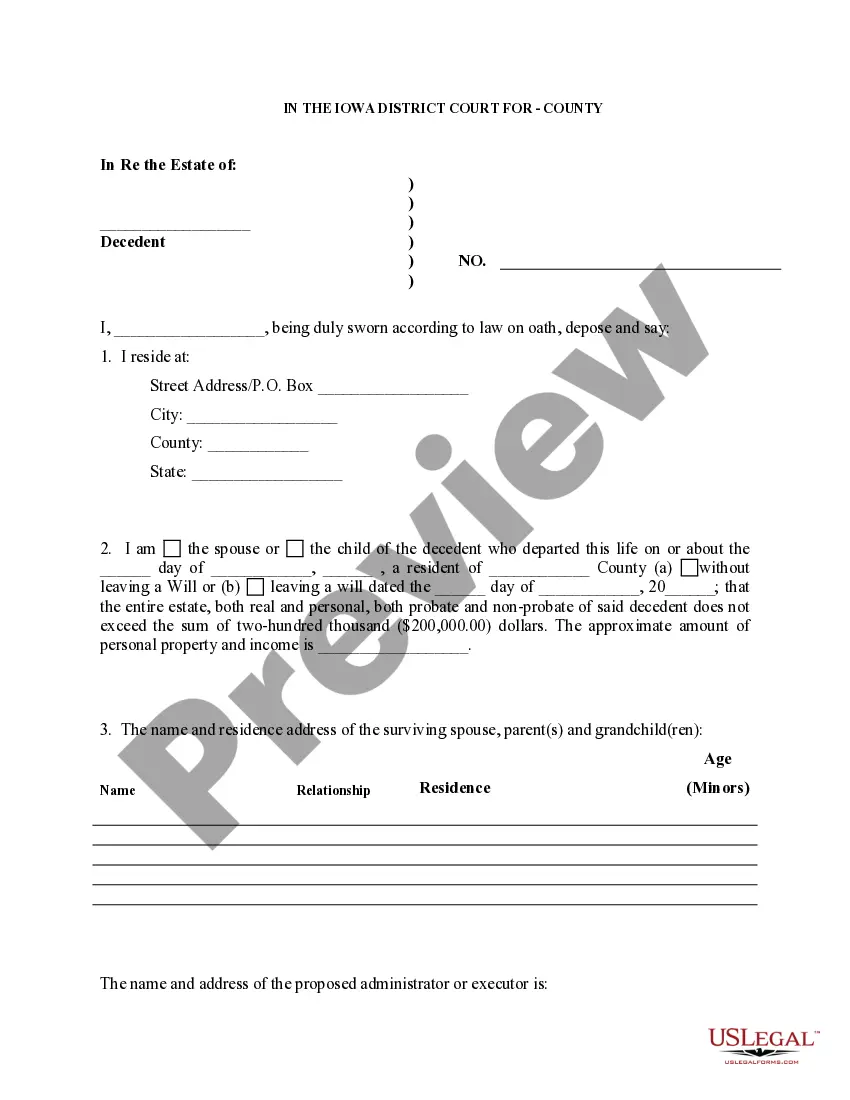

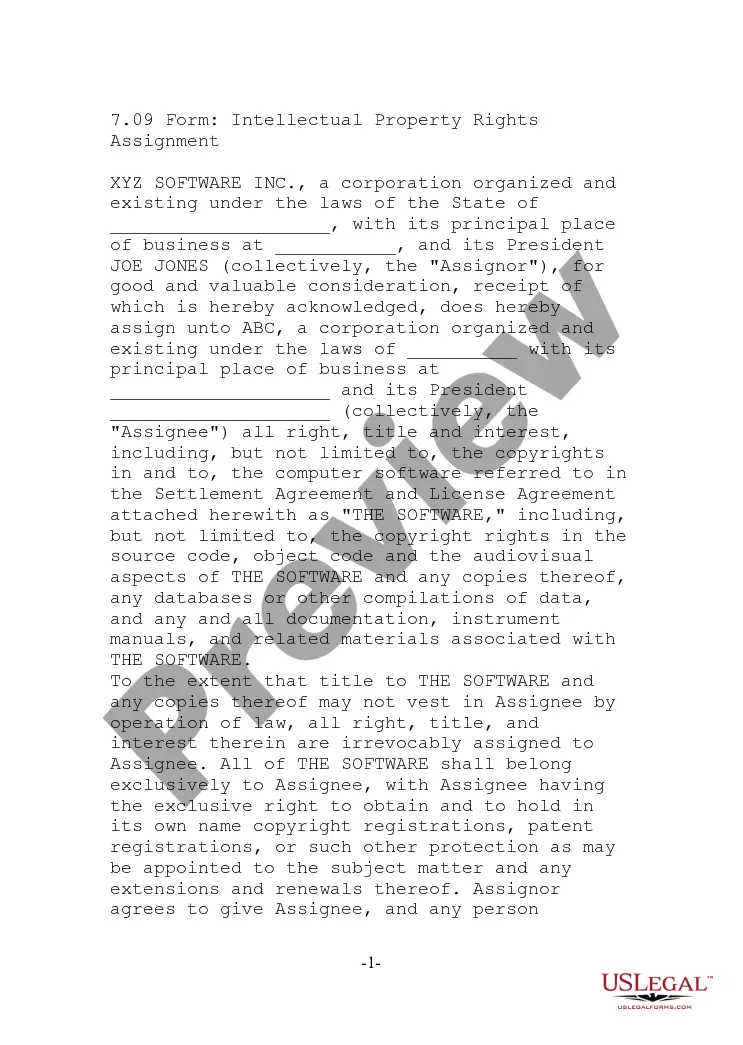

How to fill out Iowa Small Estate Affidavit For Estates Not More Than $200,000?

Managing legal documents can be overwhelming, even for the most seasoned professionals.

When seeking an Iowa Small Estate Threshold and lacking the time to find the correct and updated version, the process can be challenging.

US Legal Forms addresses all your needs, from personal to business documentation, all in one location.

Utilize sophisticated tools to complete and manage your Iowa Small Estate Threshold.

Here are the steps to follow after accessing the form you require: Verify that this is the correct form by previewing it and reading its description. Ensure that the sample is accepted in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the format you need, and Download, complete, eSign, print, and deliver your documents. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Transform your daily document management into an easy and user-friendly process today.

- Access a resource library of articles, guides, and materials pertinent to your situation and requirements.

- Save time and effort in searching for the documents you need, and utilize US Legal Forms’ advanced search and Preview feature to locate the Iowa Small Estate Threshold and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check your My documents tab to view the documents you've previously downloaded and manage your folders as needed.

- If it's your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- A comprehensive online form library can be a game-changer for anyone wishing to handle these situations effectively.

- US Legal Forms is a leading provider in online legal documents, with more than 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

If the estate is less than $250,000, it may qualify as a small estate in Iowa, depending on the type of assets involved. In this case, you can potentially avoid probate, making asset distribution more straightforward. The Iowa small estate threshold provides a clear path to simplify the process for smaller estates. Consider using platforms like US Legal Forms to access the necessary documents and guidance for small estate procedures.

In Iowa, an estate must exceed the small estate threshold to enter probate. If the total value of the estate surpasses $100,000 in personal property or $25,000 in real property, it will require probate proceedings. This process can be complex and time-consuming, making it essential to know the Iowa small estate threshold. Utilizing resources like US Legal Forms can help you navigate these requirements effectively.

The Iowa small estate threshold is the maximum value an estate can have to avoid the lengthy probate process. As of 2023, this threshold is set at $100,000 for personal property and $25,000 for real property. If your estate falls below these limits, you may be able to use a simpler process to distribute assets. Understanding this threshold can save time and reduce legal costs.

To file a small estate affidavit in Iowa, you first need to determine if the estate meets the Iowa small estate threshold. If it does, you should gather the necessary documents, including the decedent's death certificate and a list of assets. Next, complete the small estate affidavit form, ensuring that all information is accurate and complete. Finally, file the affidavit with the appropriate county court, and be prepared to provide any additional information if requested.

Filling out a small estate affidavit in Iowa is a straightforward process. First, ensure that the estate meets the Iowa small estate threshold, which allows for simplified handling of the decedent's assets. Next, gather necessary information such as the deceased's name, date of death, and a list of assets. Finally, complete the affidavit form accurately, sign it, and file it with the appropriate court to initiate the small estate process.

The value of the entire assets of the estate of Decedent, not including homestead and exempt property, does not exceed the limit of $50,000 set by the State of Iowa. 8. The value of the entire assets of the estate of Decedent, not including homestead and exempt property, exceeds the known liabilities.

Under Iowa statute, where as estate is valued at no more than $100,000, an interested party may issue a small estate affidavit to collect any debts owed to the decedent. Iowa Requirements: Iowa requirements are set forth in the statutes below.

IOWA CODE § 635.1. Where there is no will, a petition for small estate administration may be made by a surviving spouse, heirs of the decedent, creditors of the decedent, or any other persons showing good grounds therefor; if there is a will, such a petition may be filed by any interested person.

How to Write (1) Iowa Small Estate Distributee As Declarant. ... (2) Distributee Name. ... (3) Iowa Decedent Name. ... (4) Date Of Iowa Decedent Death. ... (5) County Of Iowa Decedent Death. ... (6) Distributee As Iowa Affiant. ... (7) Address Of Distributee/Iowa Affiant. ... (8) Description Of Iowa Decedent Asset.

Probate. In Iowa, a small estate is categorized based on the assets owned by the deceased at the time of death. To be considered a small estate, the sum of the assets must equal $200,000 or less.