Timber Agreements Vebal In The State Of Iowa Withholding

Definition and meaning

A timber agreement is a contract that outlines the terms and conditions under which a seller permits a purchaser to harvest timber from their land. In Iowa, verbal agreements can be legally binding but may lack the protections afforded by written contracts. It is crucial for both parties to understand the implications and enforceability of such agreements, especially regarding ownership rights and obligations in timber harvesting.

How to complete a form

When preparing a timber agreement, it is essential to include key information to ensure clarity and legal validity. Users should follow these steps:

- Identify the seller and purchaser, providing names and contact information.

- Describe the property where the timber is located, including land boundaries.

- Specify the types of timber to be harvested and the agreed-upon price.

- Outline the rights and responsibilities for both parties during the timber removal process.

- Include the start and end dates for the agreement.

- Ensure that any verbal elements are documented to avoid disputes.

Who should use this form

This form is suitable for landowners who wish to sell timber and for individuals or companies interested in purchasing timber rights. It is particularly relevant in scenarios involving:

- Landowners in Iowa seeking to monetize timber resources.

- Loggers or timber companies looking to harvest trees for commercial use.

- Individuals engaged in estate planning who wish to manage timber assets.

Legal use and context

In Iowa, timber agreements can be established verbally or in writing. However, a written contract is recommended for clarity and legal protection. Verbal agreements may pose challenges in enforcement and proof of terms. Understanding Iowa state laws regarding timber rights and property ownership is vital for both sellers and buyers to avoid legal disputes.

State-specific requirements

In Iowa, timber agreements must comply with state regulations. Key considerations include:

- Harvesting practices should adhere to environmentally sustainable guidelines.

- Notification requirements to local authorities or land management services, if applicable.

- Compliance with tax obligations related to timber sales.

Users are encouraged to consult legal professionals to ensure compliance with all state regulations and obtain the necessary forms.

Benefits of using this form online

Using an online form for timber agreements provides numerous advantages, such as:

- Access to templates designed by licensed attorneys, ensuring legality and reliability.

- Convenience of completing the form from anywhere at any time.

- Immediate download options for easy record-keeping.

- Guidance in filling out the form through user-friendly interfaces.

Common mistakes to avoid when using this form

When completing a timber agreement, users should be aware of potential pitfalls:

- Failing to clearly define the property boundaries and timber types.

- Neglecting to specify responsibilities for damages during logging operations.

- Overlooking the importance of including start and end dates for the agreement.

- Relying solely on verbal agreements without documentation.

How to fill out Iowa Timber Sale Contract?

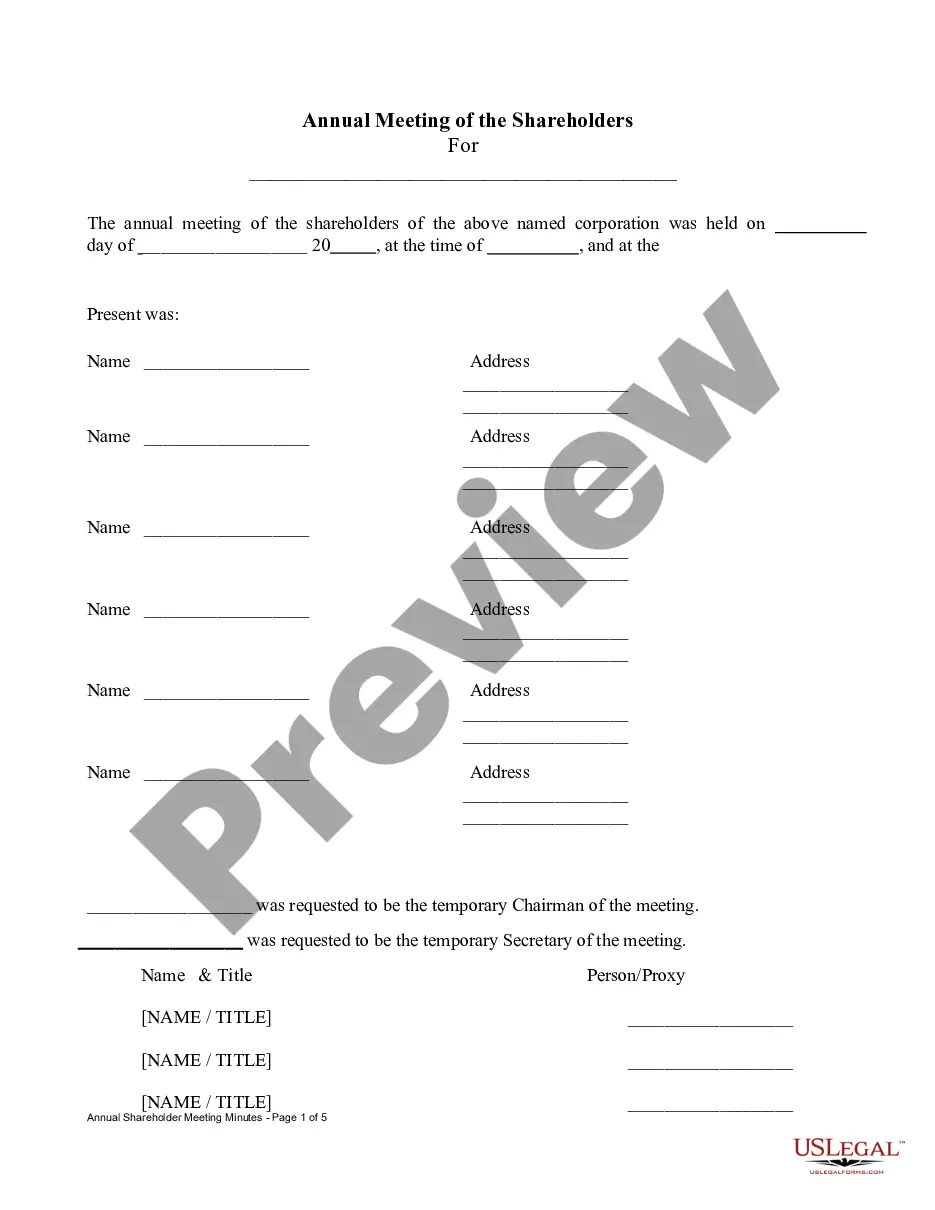

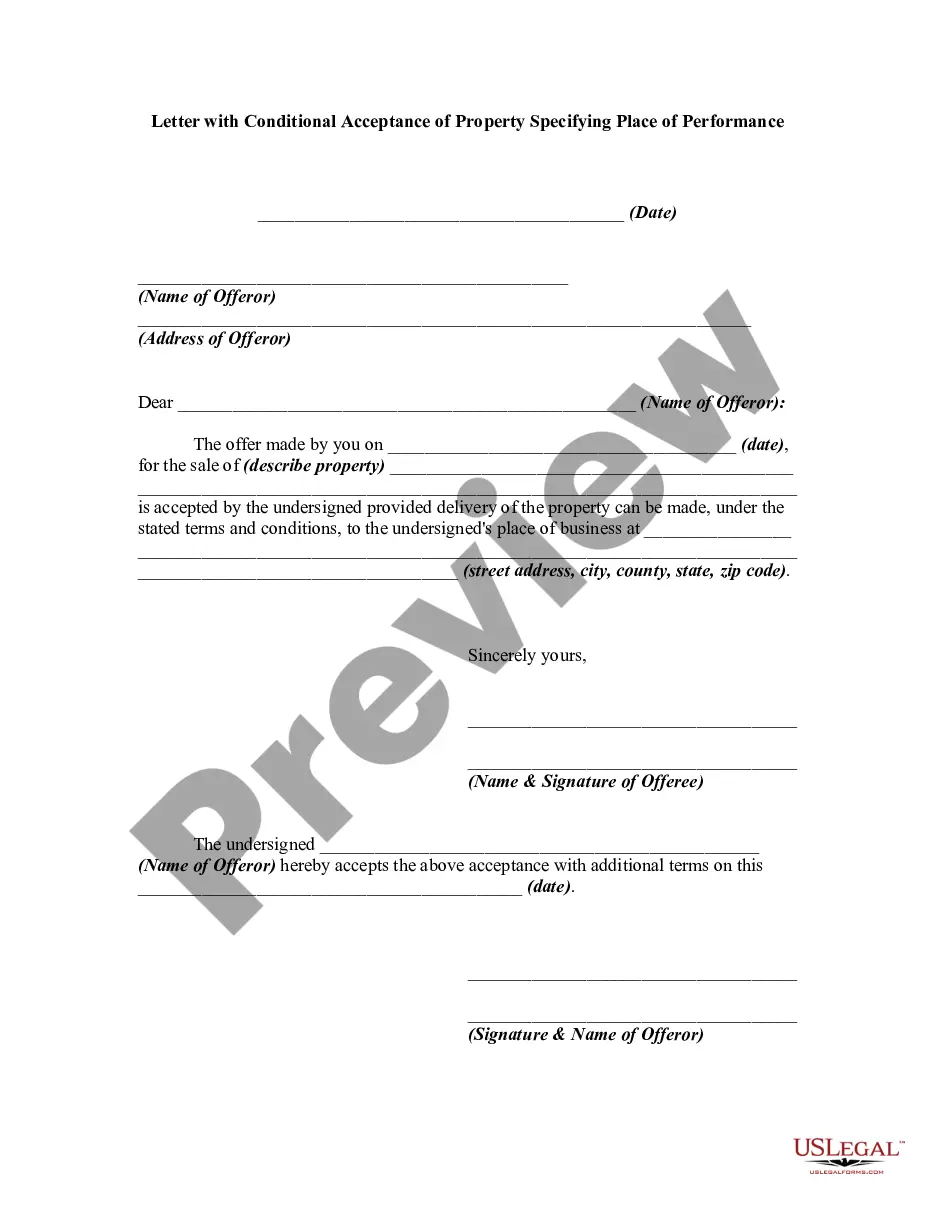

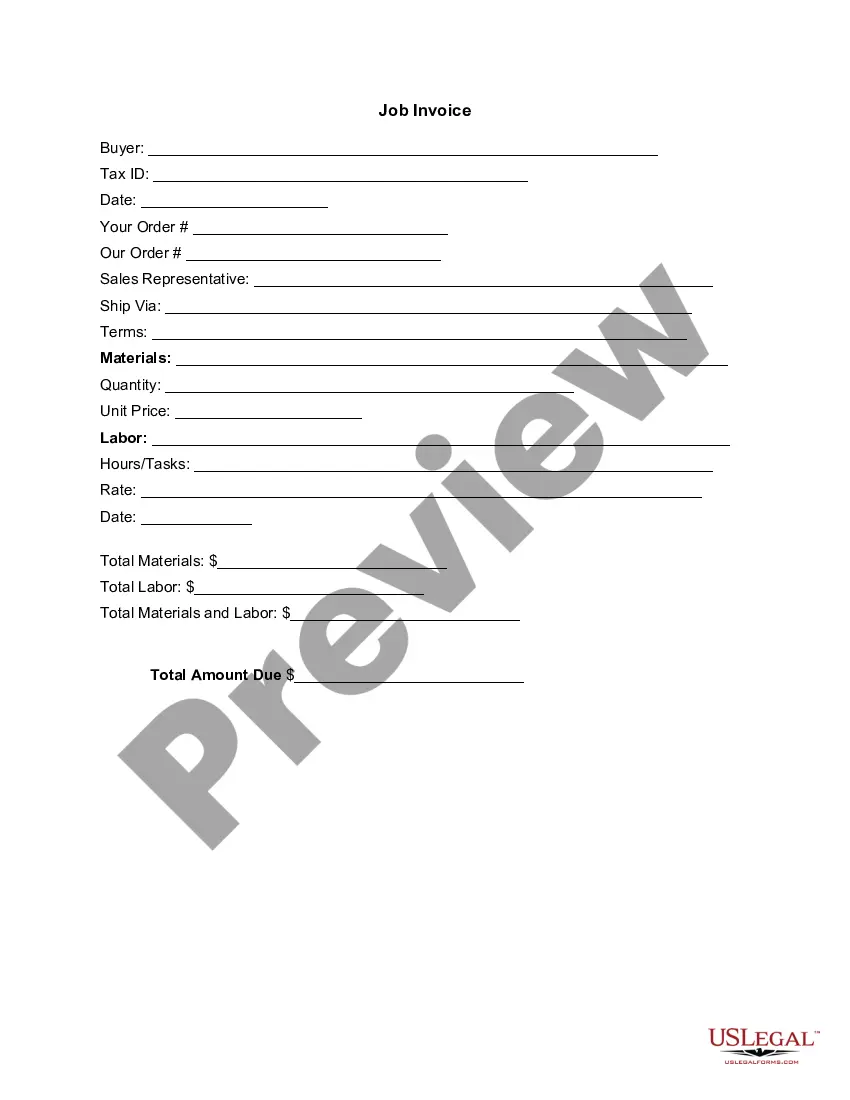

What is the most reliable service to obtain the Timber Agreements Vebal In The State Of Iowa Withholding and other recent editions of legal documents? US Legal Forms is the answer!

It represents the largest collection of legal paperwork for any purpose. Each template is expertly created and verified for compliance with federal and local regulations. They are categorized by area and state of application, making it effortless to find what you need.

US Legal Forms is an excellent option for anyone needing to handle legal documentation. Premium users can benefit even more as they can complete and approve previously saved documents electronically at any time using the built-in PDF editing tool. Check it out today!

- Experienced visitors of the platform just need to Log In to the system, verify if their subscription is active, and click the Download button next to the Timber Agreements Vebal In The State Of Iowa Withholding to acquire it.

- Once saved, the template is accessible for future reference within the My documents section of your account.

- If you haven't registered with us yet, here are the steps you need to follow to create an account.

- Form compliance verification. Prior to obtaining any template, ensure it aligns with your use case requirements and adheres to your state or county's guidelines. Review the form description and utilize the Preview if available.

Form popularity

FAQ

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Iowa income tax is generally required to be withheld in cases where federal income tax is withheld. In situations where no federal income tax is withheld, the receiver of the payment may choose to have Iowa withholding taken out. Withholding on nonwage income may be made at a rate of 5 percent.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W-4 at any time if the number of your allowances increases.