Dissolution Dissolve Corporation With The Government

Description

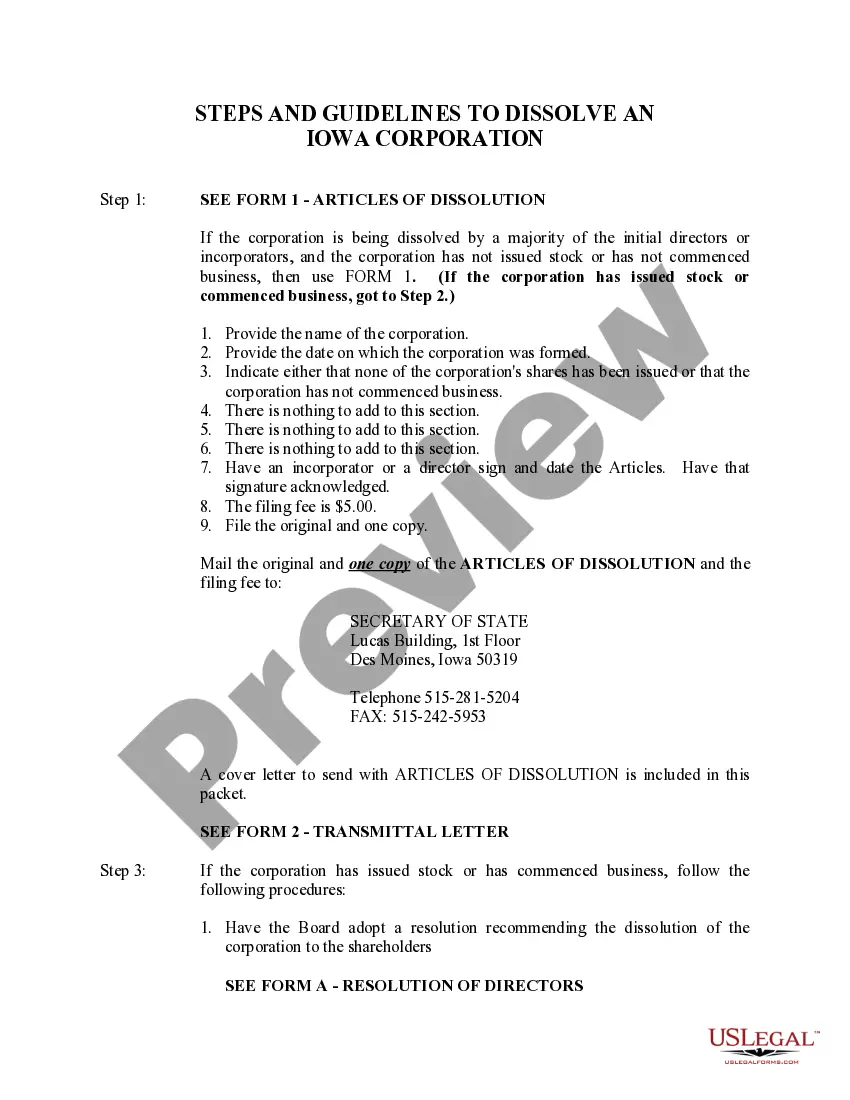

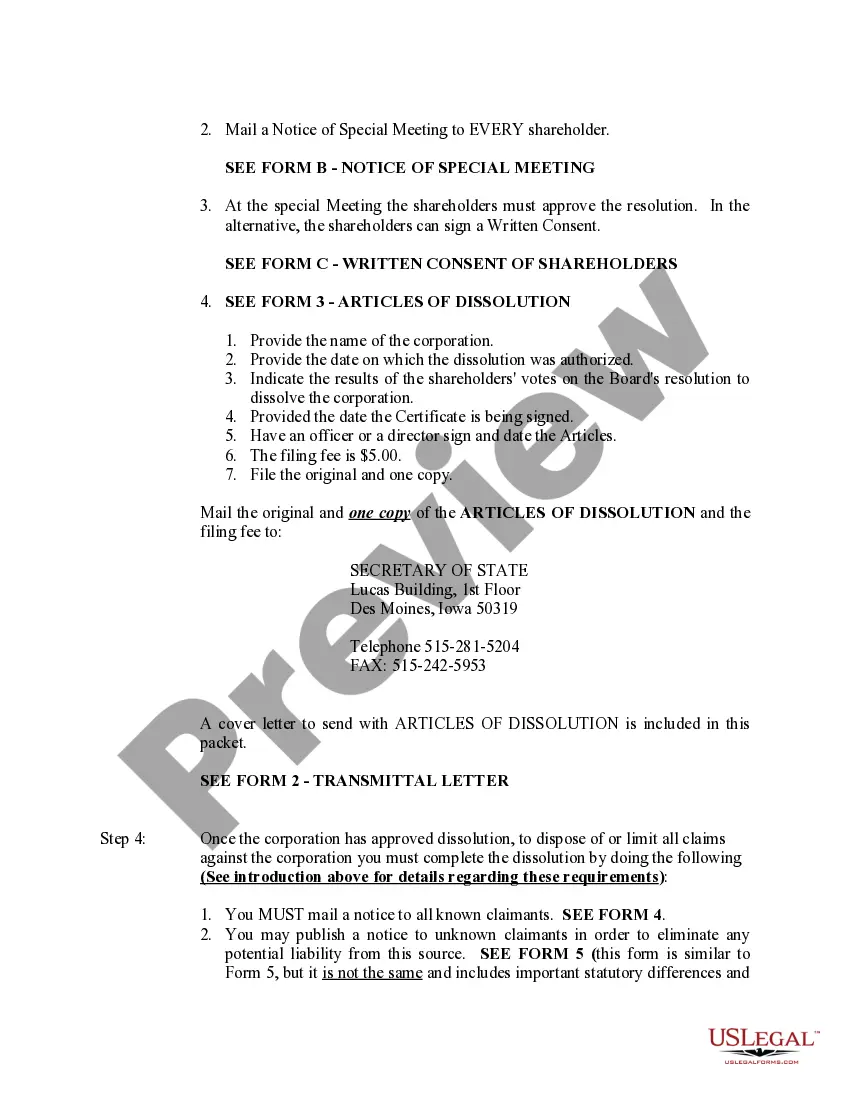

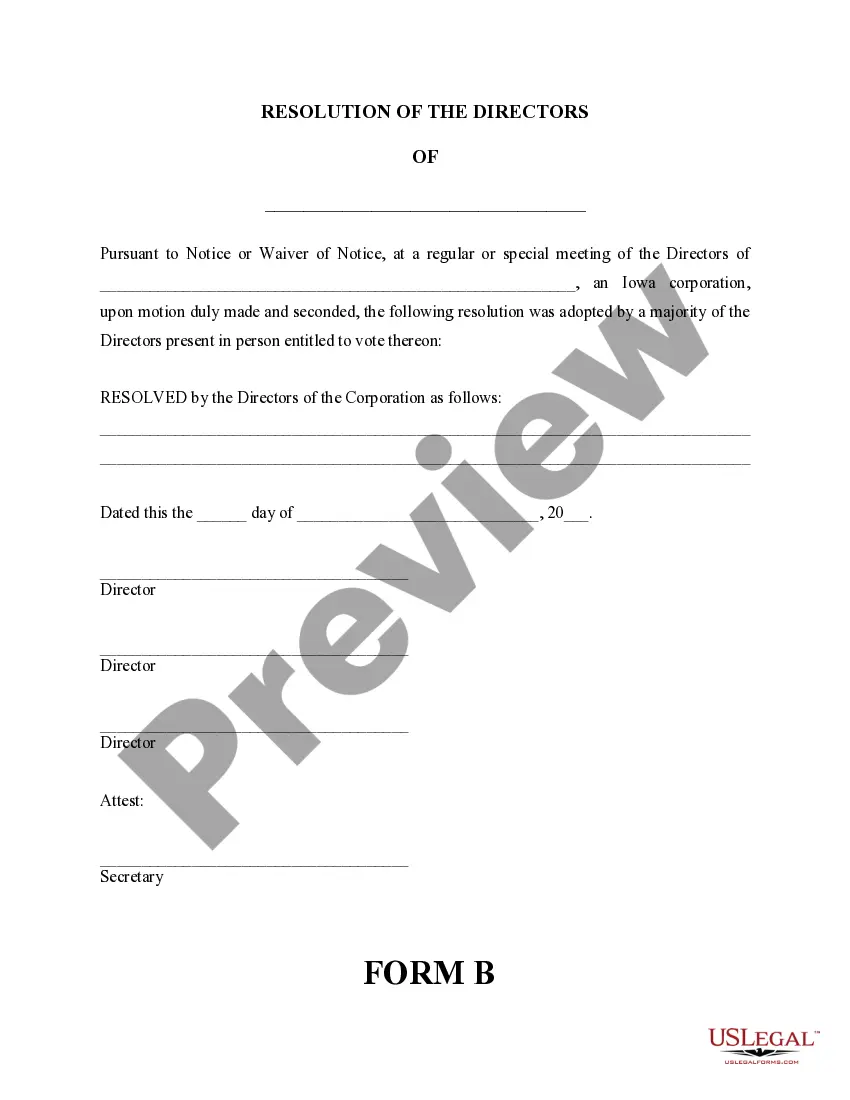

How to fill out Iowa Dissolution Package To Dissolve Corporation?

- Log into your US Legal Forms account. If you're a returning user, ensure your subscription is active. If not, renew it accordingly.

- Preview the desired template focusing on the description to confirm it matches your needs and complies with local jurisdiction.

- If you need a different template, use the Search tab at the top to find the appropriate one.

- Click the Buy Now button after selecting the correct document, and choose a subscription plan that suits you.

- Complete your purchase by entering your credit card information or opting for PayPal to process your subscription.

- Download your finalized form onto your device. You can access it anytime via the 'My Forms' section of your profile.

By following these steps, you will ensure that your documents are accurate and ready for submission to the government. Remember, US Legal Forms not only offers a robust collection of templates but also connects you with premium experts for assistance.

Ready to get started? Visit US Legal Forms now and streamline your process to dissolve your corporation with confidence!

Form popularity

FAQ

Form 8978 is used to report any changes associated with the allocation of the credit for an S Corporation’s tax years. This form is important for accurate recordkeeping as you proceed with the dissolution of your corporation with the government. Properly completing Form 8978 ensures compliance and clarity regarding tax implications. Resources like US Legal Forms can assist you in navigating this process effectively.

Federal Form 2553 is the document you file to elect S Corporation status for your business. This form allows your corporation to pass corporate income, losses, deductions, and credits through to your shareholders. Understanding its purpose is crucial for a smooth process when you plan to dissolve your corporation with the government. You can find additional guidance on this form through US Legal Forms.

Yes, filing Form 966 is typically required to dissolve your S Corporation with the government. This form notifies the IRS of your intent to dissolve the corporation. It's essential to submit this form along with your final tax return to ensure compliance. You can use resources like US Legal Forms to access the necessary templates for this process.

Before dissolving your LLC, you should review any ongoing financial obligations and ensure all debts are settled. Notify your creditors and gather all necessary documents, including tax returns and business licenses. Taking these preliminary steps ensures a smoother dissolution process and helps you adequately dissolve your corporation with the government.

To write a notice of dissolution, start by clearly stating the name of your business, the official date of dissolution, and the reason for closing. It's important to communicate any information regarding the dissolution of your corporation effectively. Once you draft the notice, distribute it to all relevant parties to ensure formal communication about your business closure.

To write an article of dissolution, you need to include specific information such as the name of the corporation, the reason for dissolution, and the effective date of dissolution. Include statements regarding the distribution of assets, if applicable. Once you have drafted the article of dissolution, you must file it with the appropriate state agency to effectively dissolve your corporation with the government.

While Form 966 is not strictly required for every type of business dissolution, it is highly recommended if you want to notify the IRS about dissolving your corporation. This form serves as an official communication to the IRS, simplifying the dissolution process. By using Form 966, you help ensure that you properly dissolve your corporation with the government and reduce future tax liabilities.

To notify the IRS of your business dissolution, you must file your final tax return and indicate that it is your last return due to the dissolution. Additionally, review any state-specific requirements that might also be necessary. Taking this step helps to formally dissolve your corporation with the government and prevents potential misunderstandings about your tax situation.

Yes, you need to notify the IRS if you dissolve your LLC. This is crucial to ensure accurate record-keeping and to avoid any potential tax issues down the line. By informing the IRS of your dissolution, you protect yourself and your business reputation, enabling a smooth transition as you dissolve your corporation with the government.

Yes, when dissolving an LLC, it is generally advisable to fill out IRS Form 966. This form notifies the IRS of your intent to dissolve the corporation and helps clarify that you are closing the business with the government. Completing this form aids in preventing any confusion regarding your tax obligations during the dissolution process.