Dissolution Dissolve Corporation For 3 Years

Description

How to fill out Iowa Dissolution Package To Dissolve Corporation?

- Log into your US Legal Forms account to access your previously downloaded templates. Ensure your subscription is current; if not, renew it according to your plan.

- If you're new to US Legal Forms, start by browsing the extensive library. Check the Preview mode of the forms available and confirm that the document aligns with your jurisdiction's requirements.

- If you find discrepancies, use the Search feature to locate a suitable template that meets your specifications.

- Once you've identified the right document, click on the 'Buy Now' button and select your preferred subscription plan. You will need to create an account for future access.

- Complete your purchase by providing your payment details, either through credit card or PayPal.

- Download the finalized form to your device and navigate to the 'My Forms' section in your account anytime for future access.

Completing the dissolution process is made easy with US Legal Forms, ensuring that you have the right documents at your fingertips.

Don't hesitate to utilize US Legal Forms to assist you in executing legal documents accurately. Start your journey to corporate dissolution today!

Form popularity

FAQ

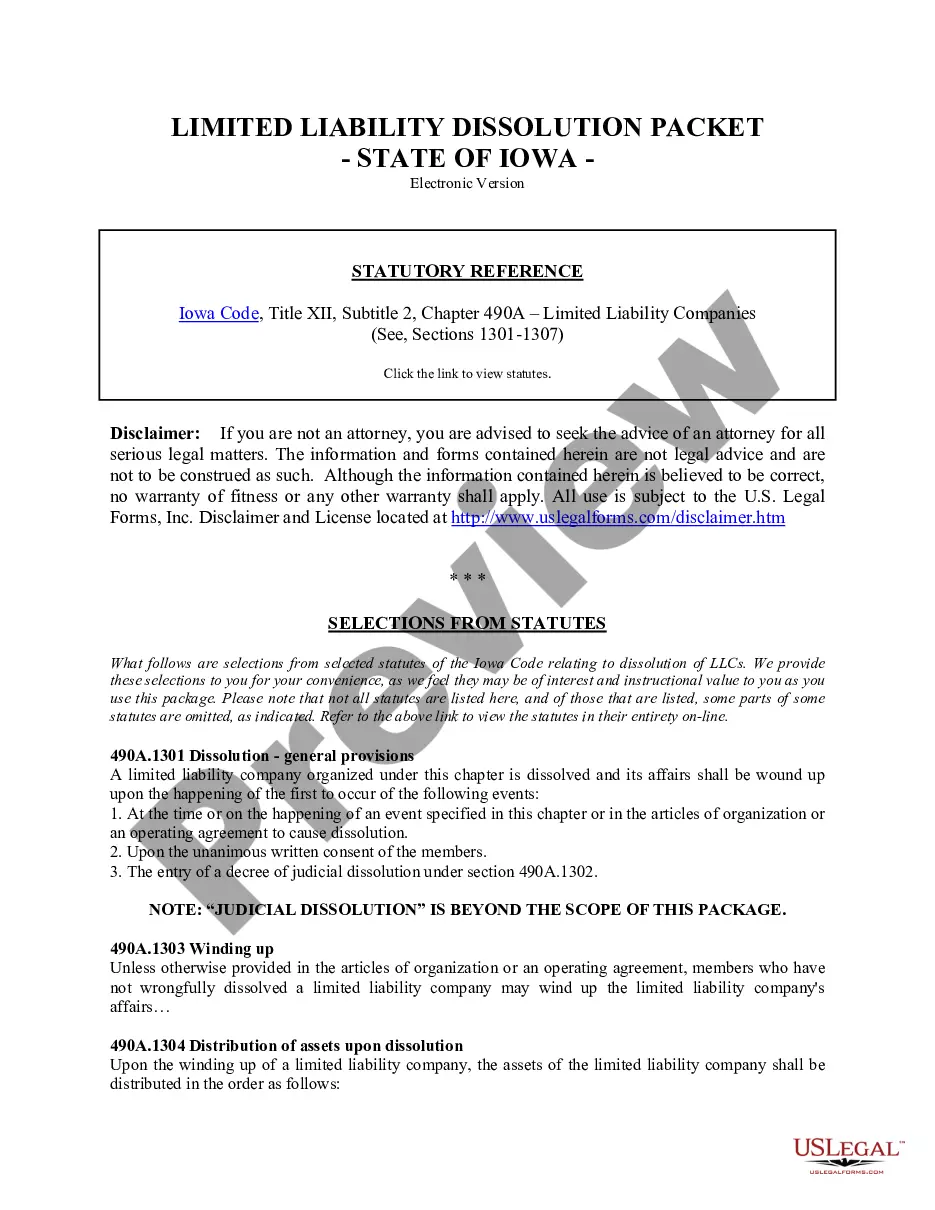

To complete its dissolution, a corporation must follow state-mandated procedures, which typically involve filing articles of dissolution and settling all debts. It’s important to inform stakeholders and ensure compliance with all legal requirements. Utilizing resources like uslegalforms can simplify this process, guiding you to smoothly dissolve corporation for 3 years while avoiding potential pitfalls.

Completing articles of dissolution requires you to fill out specific forms detailing your corporation's operations and reason for dissolution. You will need to provide necessary information, including company name and address, and submit these to the appropriate state agency. It's important to ensure these documents are accurate to avoid delays, especially if you aim to dissolve corporation for 3 years efficiently.

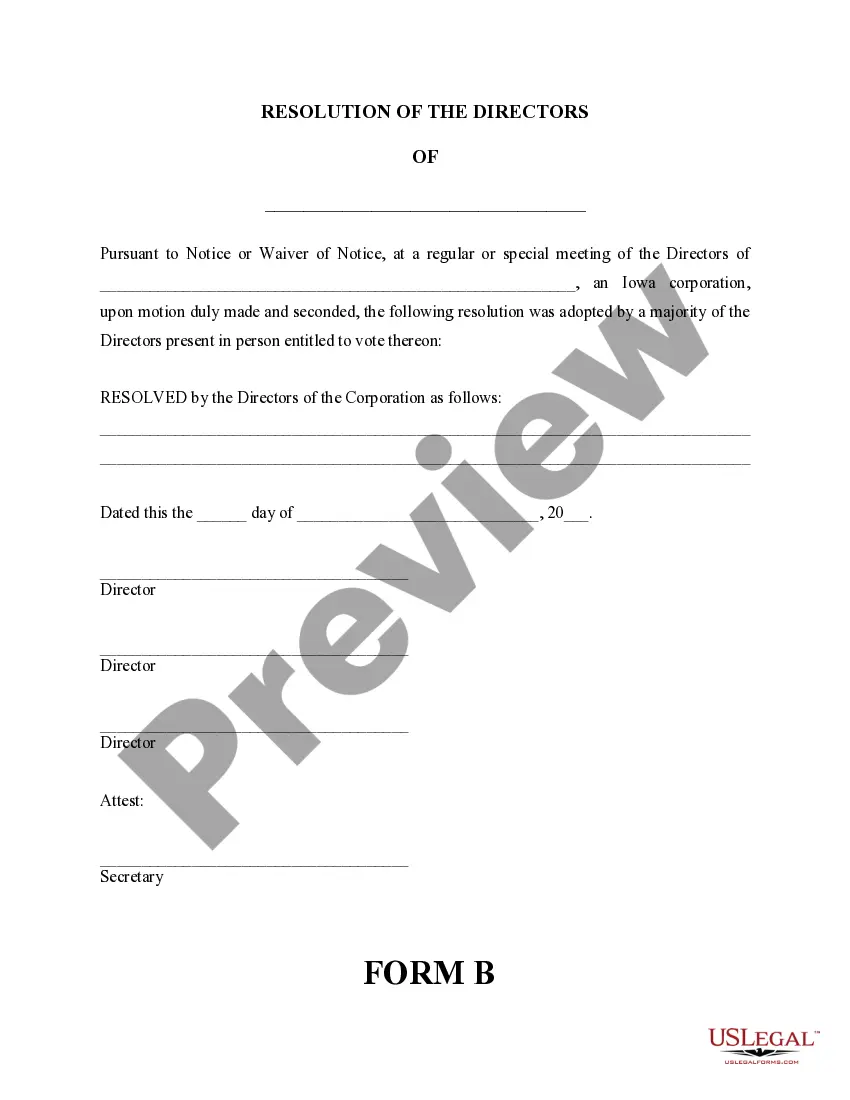

The process of dissolution involves multiple steps, starting with a board resolution and then filing the necessary forms with the state. It generally includes settling debts, notifying creditors, and distributing remaining assets to shareholders. This ensures that all legal and financial obligations are met before the company is officially dissolved. Properly managing this process is essential for those looking to dissolve corporation for 3 years.

Dissolving a company is not the same as merely closing its doors. When you dissolve a corporation, you are officially ending its legal existence, which involves following specific procedures. Closing might involve simply ceasing operations without completing the necessary legal steps. Understanding this difference is crucial, especially when considering a dissolution dissolve corporation for 3 years.

The two modes of dissolution are voluntary dissolution and involuntary dissolution. Voluntary dissolution is initiated by the corporation’s management or shareholders, often in response to business strategy changes or financial issues. Involuntary dissolution occurs when a court or government agency mandates closure due to legal violations or failure to comply with regulations. Understanding these modes helps streamline the process of dissolution to dissolve corporation for 3 years.

There are several reasons why a corporation might opt for dissolution, with two common ones being financial difficulties and changes in business strategy. Sometimes, a corporation may face insurmountable debts that make operation unfeasible. Alternatively, owners may decide to dissolve the corporation to pivot towards more profitable opportunities. Recognizing these reasons can facilitate a smoother dissolution to dissolve corporation for 3 years.

Yes, if you are dissolving an S Corporation, you must file Form 966 with the IRS. This form notifies the IRS of your intention to dissolve the corporation and provides important information about the dissolution process. It is an essential step to ensure that you meet all legal requirements and can successfully complete the dissolution to dissolve corporation for 3 years. Consider using US Legal Forms for guidance on this form.

Dissolving a corporation can be accomplished through several methods, including a board resolution, shareholder agreement, or court order. The most common method is a board resolution, where directors formally decide to close the business. For complex situations, parties may need to resort to judicial dissolution, which involves legal proceedings. Each method requires careful consideration to effectively manage the dissolution to dissolve corporation for 3 years.

The two types of dissolution are voluntary dissolution and judicial dissolution. Voluntary dissolution is initiated by the corporation's board of directors and shareholders when they decide to close the business. Judicial dissolution happens through a court order, typically due to issues like failure to comply with state laws or internal disputes among shareholders. These definitions are critical when considering ways to dissolve corporation for 3 years.

To dissolve a corporation with the IRS, you must first ensure that all tax obligations are settled. This includes filing any required tax returns and paying outstanding taxes. After that, you should file IRS Form 966 to formally notify the IRS about the dissolution. This process is essential for a successful dissolution to dissolve corporation for 3 years and avoid future tax complications.