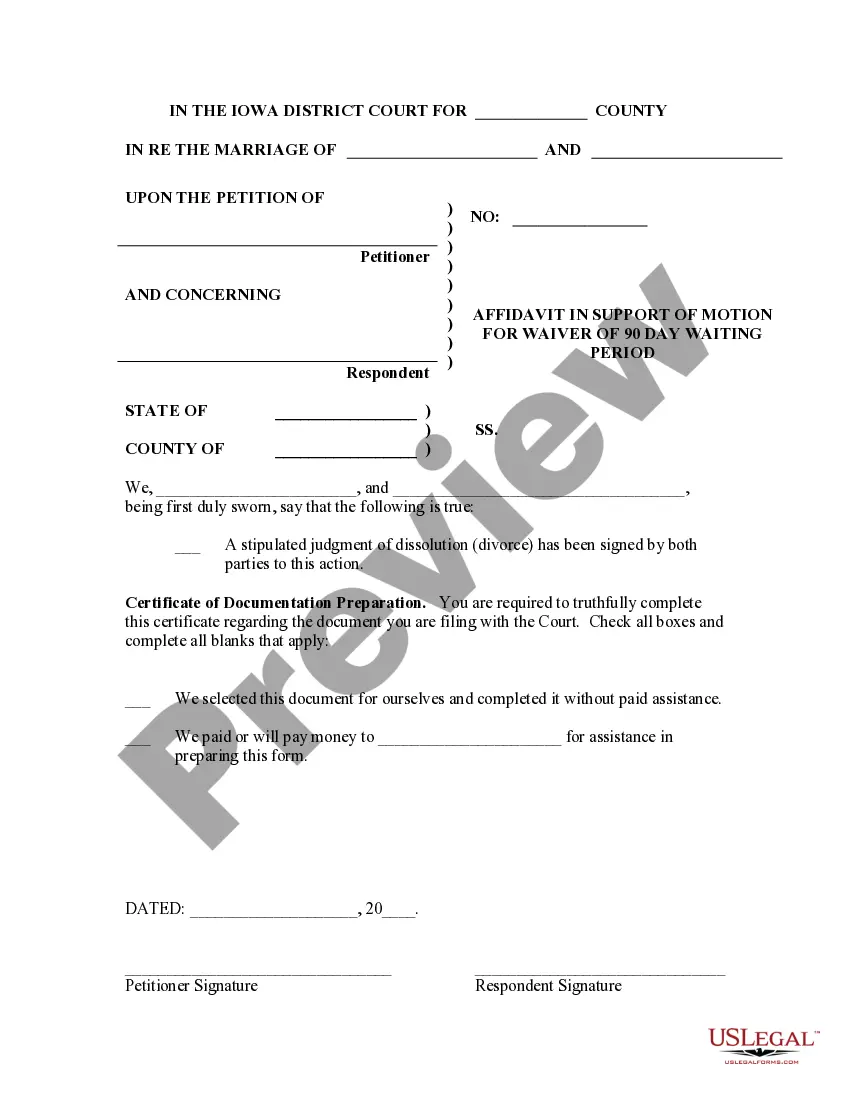

This a motion to waive the 90 day waiting period to grant a divorce.

222 Marriage Rule With Social Security

Description

How to fill out Iowa Motion For Waiver Of 90 Day Waiting Period?

Utilizing legal documents that adhere to federal and state guidelines is crucial, and the internet provides a variety of options to select from.

However, what’s the purpose of wasting time browsing for the appropriate 222 Marriage Rule With Social Security template online when the US Legal Forms digital repository has such documents gathered in a single location.

US Legal Forms is the largest online legal resource with over 85,000 editable templates created by lawyers for all business and personal needs.

Review the template using the Preview feature or through the text description to ensure it suits your needs.

- They are simple to navigate with all materials categorized by state and intended use.

- Our experts keep abreast of legislative changes, ensuring that your form is always current and compliant when obtaining a 222 Marriage Rule With Social Security from our site.

- Acquiring a 222 Marriage Rule With Social Security is straightforward and swift for both existing and new users.

- If you’re already registered with a valid membership, Log In to download the document template you need in your chosen format.

- If you’re new to our platform, follow these steps.

Form popularity

FAQ

Public records in Maryland belong to the State. Public records sometimes end up in private hands for a variety of reasons, not all of which are sinister. Conscientious members of the public often preserve records from places where they have been illegally discarded or inadvertently misplaced.

Maryland Judiciary Case Search (?Case Search?) is the primary way that the public may search for records of court cases.

When proof is made by affidavit that a defendant has acted to evade service, the court may order that service be made by mailing a copy of the summons, complaint, and all other papers filed with it to the defendant at the defendant's last known residence and delivering a copy of each to a person of suitable age and ...

Criminal Background Check - contact the Maryland Department of Public Safety and Correctional Services at 1-888-795-0011 or online at dpscs.maryland.gov.

Criminal Background Check - contact the Maryland Department of Public Safety and Correctional Services at 1-888-795-0011 or online at dpscs.maryland.gov.

Someone Owes Me Money File a civil case to get your money or property back. The court that hears the case will depend on the amount involved. ... File a civil case in rent court. ... File criminal charges. ... Once a court rules in your favor, you will have a judgment stating that the other person owes you money.

With a few exceptions, anyone may view the records in person at the clerk's office. Provide the clerk with the case number for the court record you wish to view. If you do not have the case number, the clerk may be able to locate the file with the names of the persons involved.

D ? Public Records ? D Death Certificates. Death Records ? Baltimore City Death Index. Deeds ? Land Records. Demographics ? Maryland State Data Center (SDC) DOC ? DPSCS Public Information Act. Divorce Records / Divorce Decrees ? Divorce Verification (Division of Vital Records) Driver License Lookup ? Real Id Information.