Iowa Trust Account Rules

Description

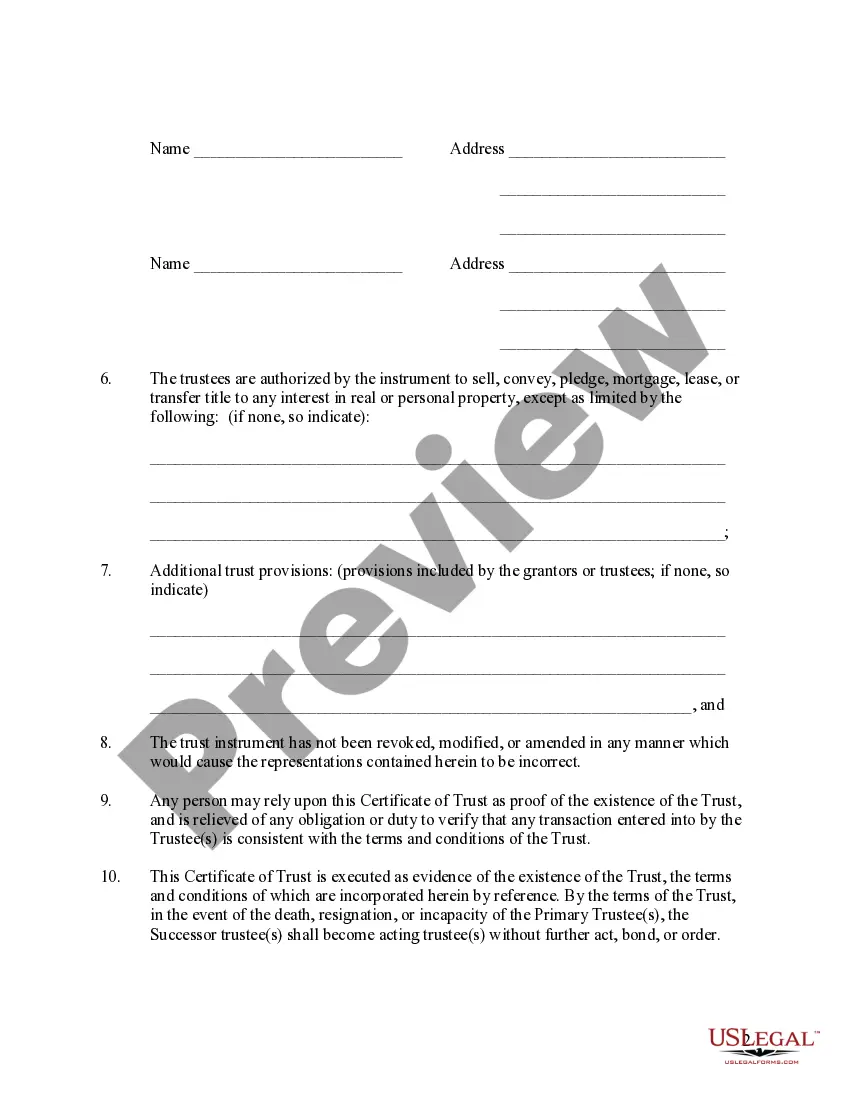

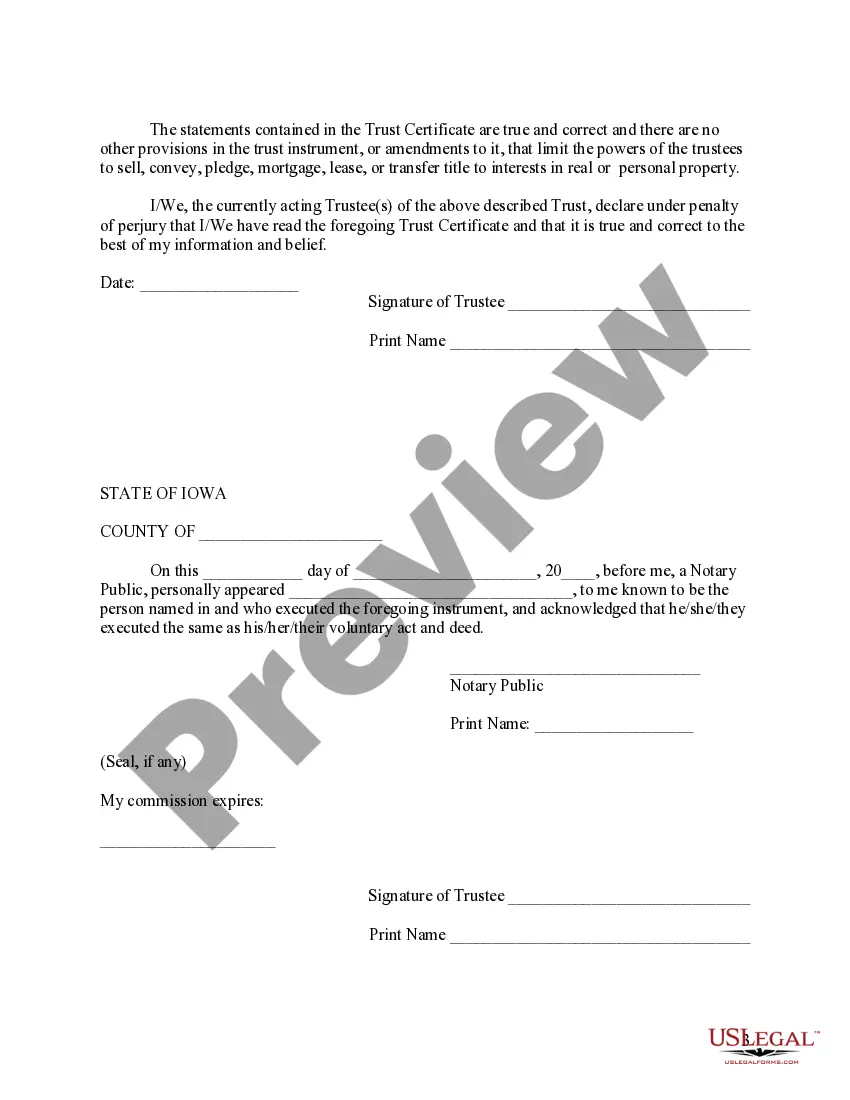

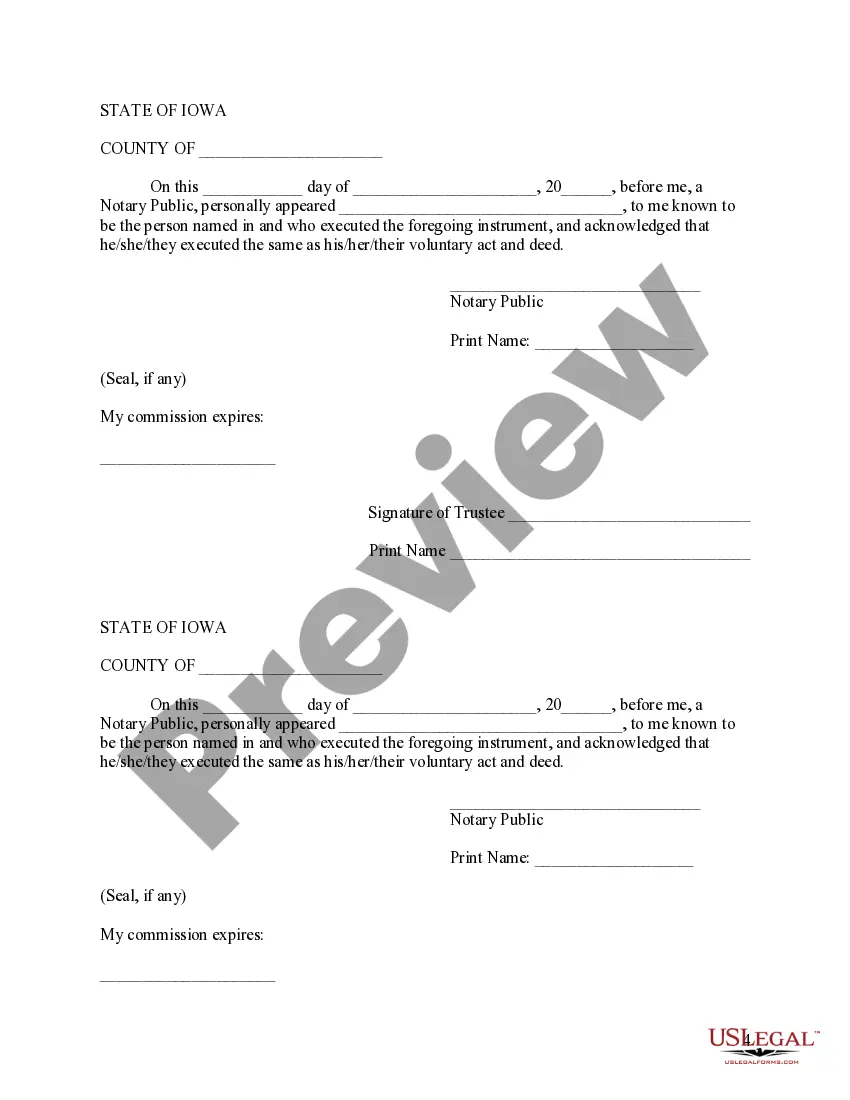

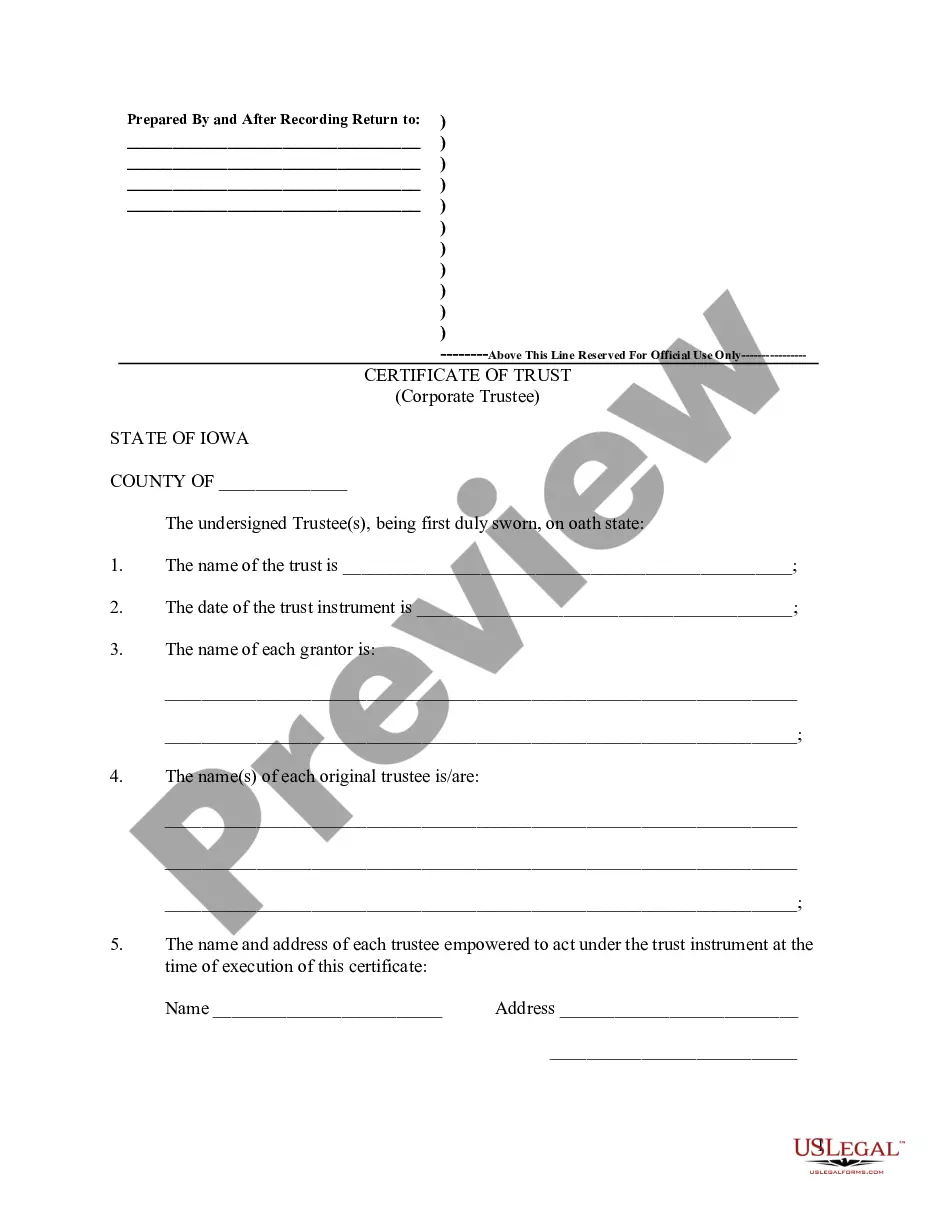

How to fill out Iowa Certificate Of Trust By Individual?

The Iowa Trust Account Guidelines you observe on this page is a versatile formal template crafted by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners with over 85,000 validated, state-specific documents for any business and personal event. It’s the quickest, easiest, and most dependable method to acquire the papers you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you desire for your Iowa Trust Account Guidelines (PDF, Word, RTF) and download the sample to your device.

- Search for the document you require and examine it.

- Browse through the sample you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you have found the template you require.

- Subscribe and Log In.

- Select the pricing option that fits you and sign up for an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

To open a Trust checking account, you will need documentation proving the identity of the Trust. This may include the original Trust Agreement and IRS form SS-4, which grants the Trust a tax ID number.

The process to close a trust account is similar to the one to set it up. You must produce identification to verify your identity and provide proof that the trust's contents have been distributed. Follow the closure process as defined by the bank.

How to Create a Living Trust in Iowa Pick the type of trust you'll make. Are you single? ... Take inventory of your property. ... Pick a trustee. ... Draw up the trust, either by yourself using an online program or with the help of a lawyer. Sign the trust in front of a notary. Fund the trust.

Creating a living trust in Iowa occurs when you create a trust document and sign it in front of a notary public.

Most banks can finalize the change in ownership to the Trust and keep the same account numbers. However, some banks may require new account numbers for your Trust.