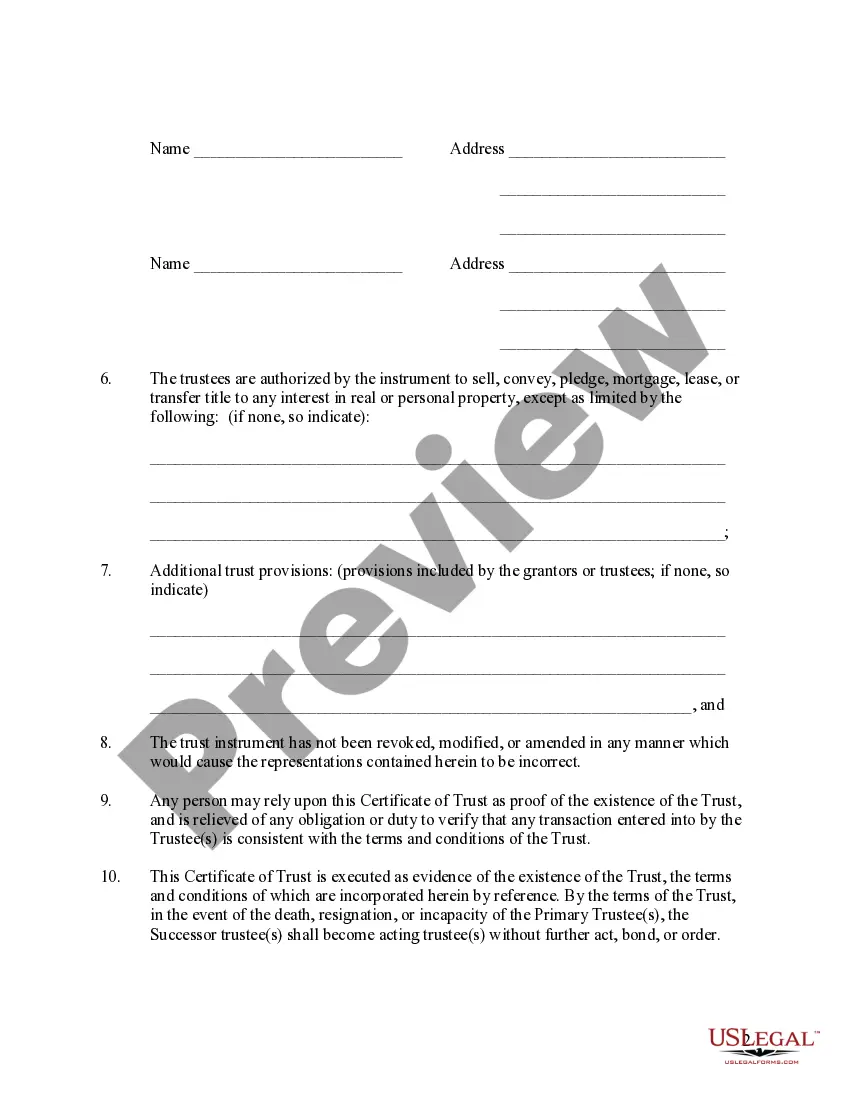

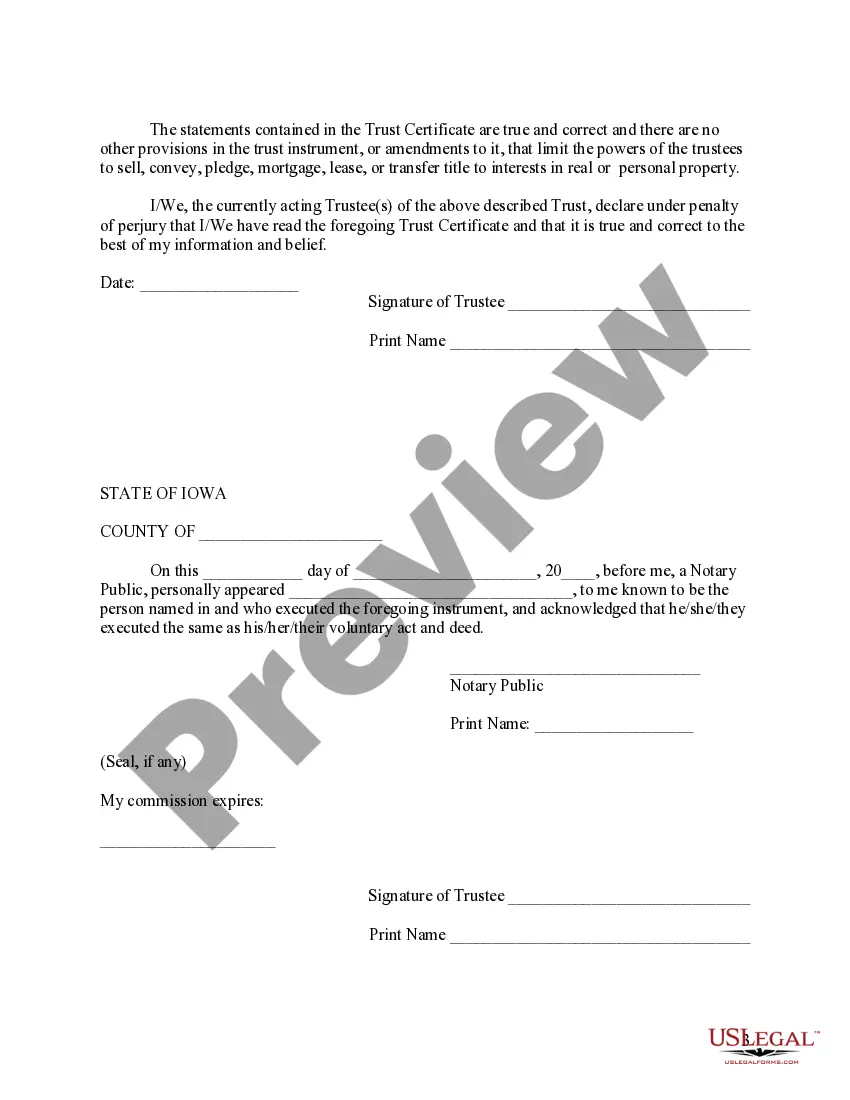

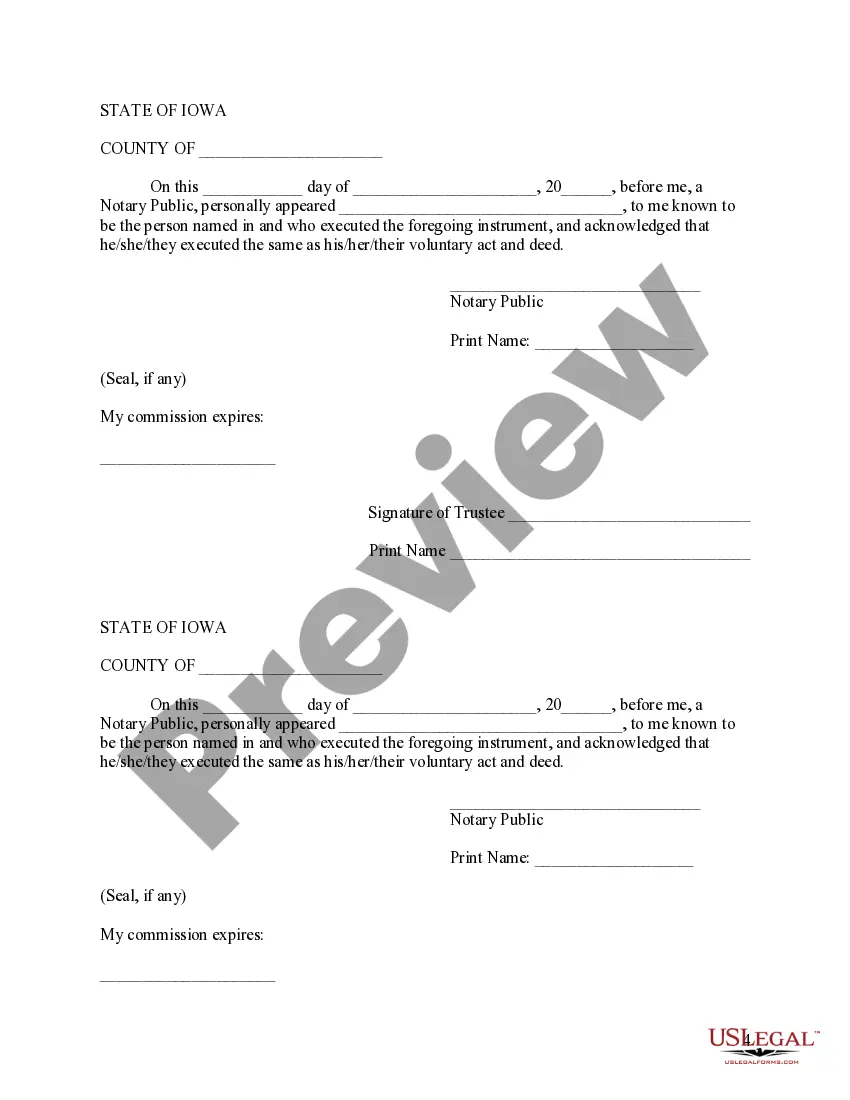

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The individual trustee may present a certification of trust to

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Iowa Special Needs Trust Form

Description

Form popularity

FAQ

To set up a special needs trust in Iowa, begin by selecting a reliable trustee who will manage the trust. Next, complete the Iowa special needs trust form, including details about the beneficiary and the trust’s intended purpose. It's advisable to consult with a qualified attorney to ensure compliance with state laws and to make the process smoother. Taking these steps helps secure the financial future of loved ones with special needs.

There are various trusts available for individuals with disabilities, including special needs trusts, discretionary trusts, and supplemental needs trusts. Each trust serves specific functions, such as preserving eligibility for government benefits while providing financial support. By understanding the distinctions, you can better decide which option suits your situation. Utilizing the Iowa special needs trust form can help establish the right framework for financial security.

The three main categories of special needs include physical disabilities, developmental disabilities, and emotional or mental health conditions. Physical disabilities may affect mobility, while developmental disabilities can impact learning and social skills. Emotional or mental health conditions involve various psychological issues that require support. Understanding these categories can help you determine the appropriate options, including the need for an Iowa special needs trust form.

There are three primary types of special needs trusts: first-party, third-party, and pooled trusts. A first-party trust holds assets belonging to the individual with special needs, while a third-party trust is funded by someone else, typically family or friends. Pooled trusts, on the other hand, combine the funds of many individuals for investment purposes, providing professional management. Each type of trust serves a unique purpose and may require the Iowa special needs trust form.

Setting up a special needs trust involves several key steps. First, choose a trustee who will manage the trust assets and ensure compliance with regulations. Next, you’ll need to complete the Iowa special needs trust form, outlining the assets and specifying how they will be used for the beneficiary's benefit. It may also be beneficial to consult with a legal professional to navigate any complexities in the process.

While a special needs trust can provide significant benefits, there are some downsides to consider. For example, the complexity of setting it up may require legal assistance, which can incur costs. Additionally, if not properly managed, there might be restrictions on the beneficiary's eligibility for certain government benefits. Therefore, it’s crucial to carefully evaluate the situation and ensure that the Iowa special needs trust form meets your unique needs.

A Miller's trust, often referred to as an Income Trust, is a legal arrangement used in Iowa to assist individuals in qualifying for Medicaid. Essentially, it allows excess income to be redirected, ensuring the person can access benefits while still managing some assets. It's wise to consult with professionals when setting up this type of trust to align it with an Iowa special needs trust form for added security.

The main purpose of a Miller trust is to help individuals qualify for Medicaid when their income exceeds the state's limits. By setting aside excess income in an Iowa special needs trust form, you can manage resources while still receiving necessary assistance. This option provides financial freedom without sacrificing access to essential health care services.

The best trust for a disabled person often depends on their unique situation and needs. An Iowa special needs trust form can be ideal for many, as it allows for the management of funds while preserving eligibility for public benefits. Working with a knowledgeable attorney is vital to ensure that the selected trust meets individual requirements and protects the beneficiary's future.

In Iowa, a Miller trust allows individuals over the Medicaid income limit to qualify for benefits. By using an Iowa special needs trust form, you can transfer excess income into the trust, which helps manage funds needed for medical care. As a result, it protects individuals while maintaining access to essential support services.