Limited Liability Company For Dummies

Description

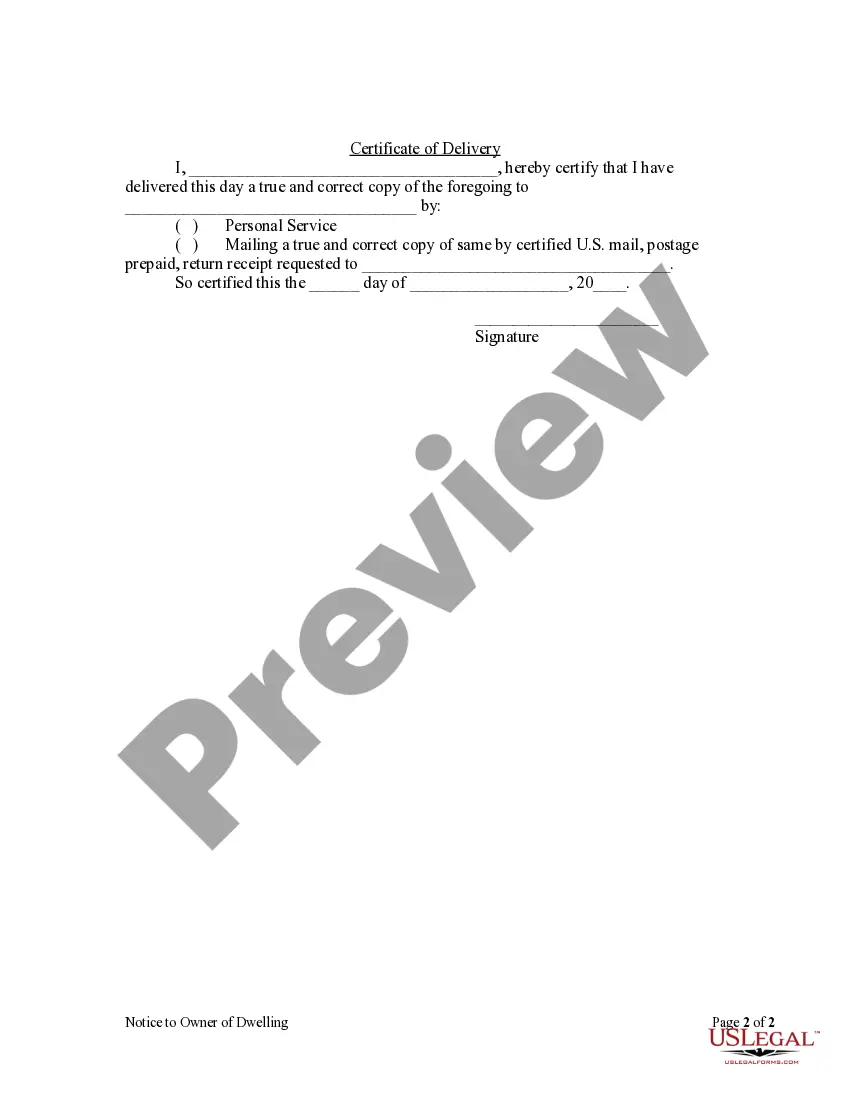

How to fill out Iowa Notice To Owner Of Dwelling By Corporation Or LLC?

- Visit the US Legal Forms website and check the Preview mode for the desired form. Make sure it matches your local jurisdiction's requirements.

- If you encounter inconsistencies, use the Search feature to find a more suitable document that fits your needs.

- Once you find the correct form, click on the Buy Now button. Choose a subscription plan that best fits your requirements, and register for an account.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download your selected form to your device. You can always return to the My Forms section in your account for easy access in the future.

By leveraging US Legal Forms, you gain access to over 85,000 editable legal forms along with premium expert support. This ensures your documents are accurate and legally compliant, making the process smoother and more efficient.

Don't hesitate—start your journey towards forming your LLC with confidence today. Explore the resources available at US Legal Forms now!

Form popularity

FAQ

If you want to know what is the easiest LLC to start, look for a state with user-friendly regulations and low filing fees. For dummies, states like Florida or Colorado offer clear guidelines and quick processing times. Additionally, uslegalforms provides a step-by-step approach, making it even simpler to set up your limited liability company. This combination of factors ensures a smooth start to your business journey.

The easiest LLC to create generally involves minimal paperwork and straightforward regulations. For dummies looking at a limited liability company, many states have streamlined the formation process, allowing you to register online without much hassle. Using platforms like uslegalforms can also simplify the paperwork significantly. Choosing the right state and using the right tools can make the process a breeze.

Limited liability, in simple terms, means that the owners of an LLC are not personally responsible for the business debts. In a limited liability company for dummies style, imagine it as a protective shield around your personal assets. If the business incurs debts or faces lawsuits, creditors generally cannot claim your personal property. This feature makes LLCs a safer option for many entrepreneurs.

While a limited liability company (LLC) offers personal asset protection, there are some downsides. For dummies, it's important to know that LLCs can have varying fees and regulations depending on the state. Additionally, you may face limited fundraising opportunities compared to corporations. These factors, while manageable, can impact your business decisions.

Typically, you do file LLC and personal taxes together if your LLC is a single-member entity. In this case, the income and expenses of the LLC are reported on your personal tax return. However, multi-member LLCs file a separate return and issue K-1s to members. Understanding how this works can help you manage your limited liability company for dummies effectively.

The best way to file taxes as an LLC is to keep clear and organized records of your income and expenses throughout the year. Using accounting software can help simplify this process significantly. Moreover, consulting resources from platforms like US Legal Forms can help clarify tax obligations and deadlines, ensuring your limited liability company for dummies meets all requirements efficiently.

An LLC files taxes by reporting its profits or losses on the owners' individual tax returns. For single-member LLCs, this is done on Schedule C, while multi-member LLCs use Form 1065. Using US Legal Forms can provide resources and templates that guide you through the process of filing taxes, making it easier to understand how your limited liability company for dummies fits into your overall tax picture.

The best way to file for an LLC involves a few straightforward steps. First, decide on your LLC name and ensure it complies with your state’s rules. Then, prepare your Articles of Organization and find a reliable resource like US Legal Forms to streamline your filing process. This ensures you set up your limited liability company for dummies accurately and efficiently.

LLCs are generally treated as pass-through entities for tax purposes. This means that the profits and losses of the limited liability company for dummies pass through to the owners, who report them on their personal tax returns. Depending on the number of members and the elections made, LLCs can also choose to be taxed as corporations. Understanding these principles helps in planning the tax strategy effectively.

Yes, you can file your LLC by yourself. You will need to gather the necessary documents, such as your Articles of Organization, and submit them to your state's business filing agency. If you're unsure about the process, using a tool like US Legal Forms can simplify your filing and ensure accuracy. This approach is perfect for those who want to handle their limited liability company for dummies.