Iowa Life Estate Form With 2 Points

Description

How to fill out Iowa Warranty Deed To Child Reserving A Life Estate In The Parents?

- Log in to your account if you are a returning user, ensuring your subscription is active. Download the form by clicking the Download button.

- If you are new to the service, begin by reviewing the form's preview and description to confirm it fits your needs and complies with local regulations.

- In case the desired form is not suitable, utilize the Search tab to find an alternative template that meets your criteria.

- Select the Buy Now button on the form page and choose a suitable subscription plan before registering for an account.

- Complete your purchase by entering your credit card information or using PayPal for a seamless payment experience.

- Once your transaction is successful, download the form directly to your device and find it anytime under the My Forms menu in your profile.

By using US Legal Forms, you access one of the most robust collections of legal documents. This service allows users to create precise and legally binding documents effortlessly.

Start your experience today and simplify your legal paperwork with US Legal Forms for a stress-free document creation process!

Form popularity

FAQ

Calculating a life estate involves assessing the age of the life tenant and using actuarial tables to determine the portion of the estate value allocated to them. The remainder of the estate goes to the remainderman. Using the Iowa life estate form can help clarify these calculations and ensure accurate documentation of each party's rights.

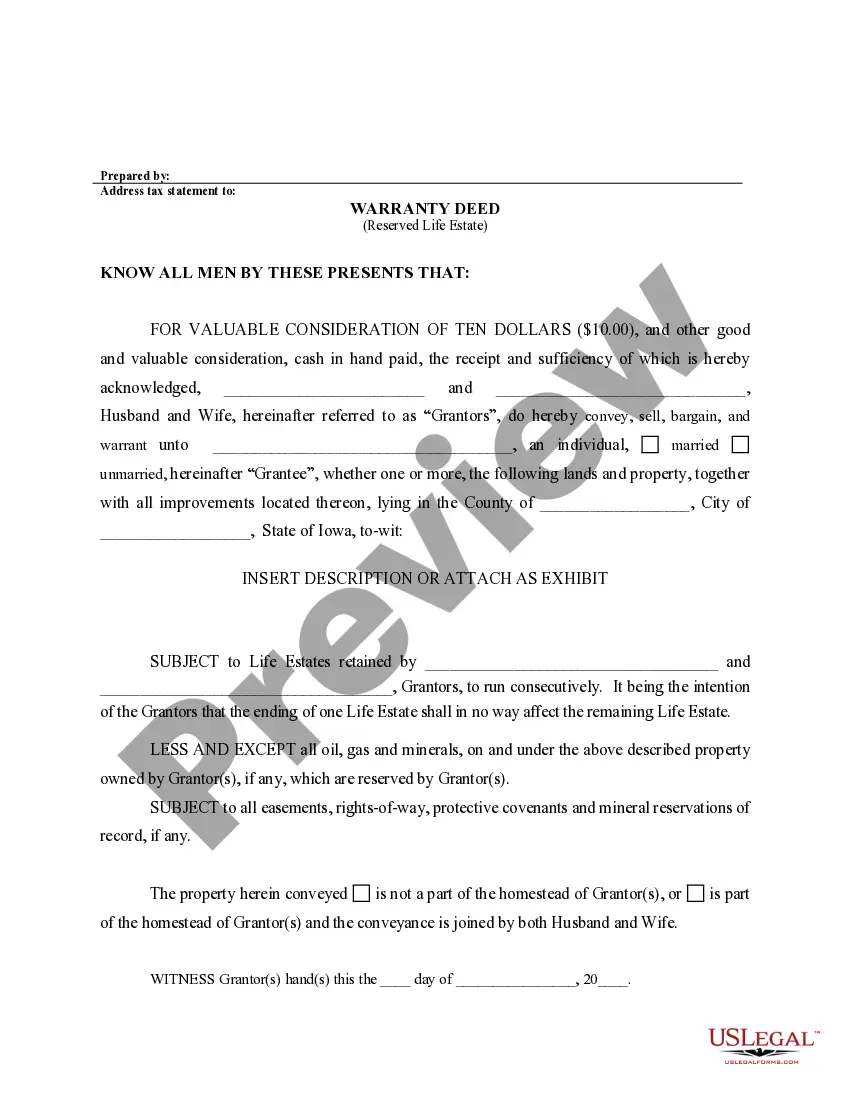

A common example of a life estate occurs when a parent transfers property ownership to a child but retains the right to live in the home for their lifetime. This arrangement allows the parent to maintain residence while ensuring property passes to the child after their death. Creating an Iowa life estate form can help in documenting such arrangements effectively.

To calculate a life estate, determine the life tenant's age and use a life estate table to find the present value of the life interest. Subtracting that value from the total property value gives you the remainderman's interest. An Iowa life estate form can assist in clearly defining these interests and ensuring accurate calculation.

In Iowa, an estate typically needs to be valued at over $50,000 for probate unless it qualifies for small estate procedures. If the estate is below this threshold, alternatives may expedite asset transfer. Utilizing the Iowa life estate form can help outline property ownership, simplifying or avoiding probate.

To calculate the value of an estate, sum all assets, including real estate, bank accounts, and personal property, and subtract any debts or liabilities. Consulting a financial expert can provide more accurate assessments. Incorporating an Iowa life estate form allows for clarity about asset division during this process.

A life estate may become invalid if it lacks clear terms or involves illegal activity. Additionally, if the grantor does not have the legal capacity to create the estate, it can be challenged. Properly using an Iowa life estate form when drafting the estate can help prevent these issues.

To navigate around a life estate, you may consider options like establishing a revocable trust or creating a new property deed. These methods can provide alternatives to transferring property without the limitations of a life estate. Utilizing an Iowa life estate form may help clarify your intentions if you choose that path.

A life estate clause typically includes language that outlines the rights of the life tenant and the remainderman. For instance, a typical clause might state that 'Upon my death, the property shall transfer to my children for their lifetime, after which it will pass to my grandchildren.' By using an Iowa life estate form, individuals can clearly define these rights and ensure smooth transitions of property ownership. This form assists in preventing disputes and provides clarity on property management during and after the life tenant's lifetime.

A life estate can be revoked under certain conditions, such as mutual agreement between the life tenant and remainder beneficiaries. Additionally, if the life tenant becomes incapacitated or commits waste to the property, a court may allow for revocation. Understanding the circumstances that could lead to revocation is vital to maintaining control over your estate. A comprehensive Iowa life estate form can help clarify these terms.

While life estates offer benefits, they also have drawbacks. For example, the life tenant cannot sell or mortgage the property without the consent of remainder beneficiaries, which can limit financial flexibility. Additionally, a life estate does not protect the property from creditors during the life tenant's lifespan. Therefore, it's important to weigh these factors when considering an Iowa life estate form.