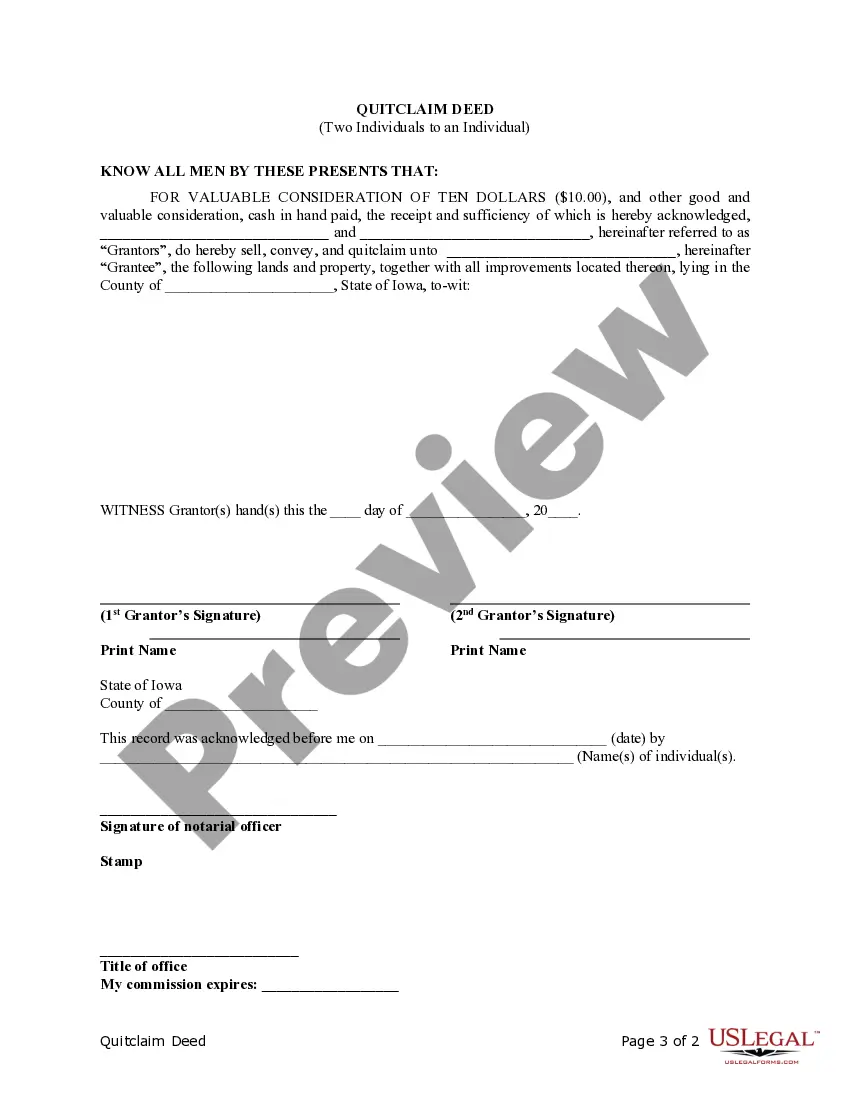

This form is a Quitclaim Deed where the Grantors are two Individuals and the Grantee is an Individual. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Iowa Quitclaim Deed With A Mortgage

Description

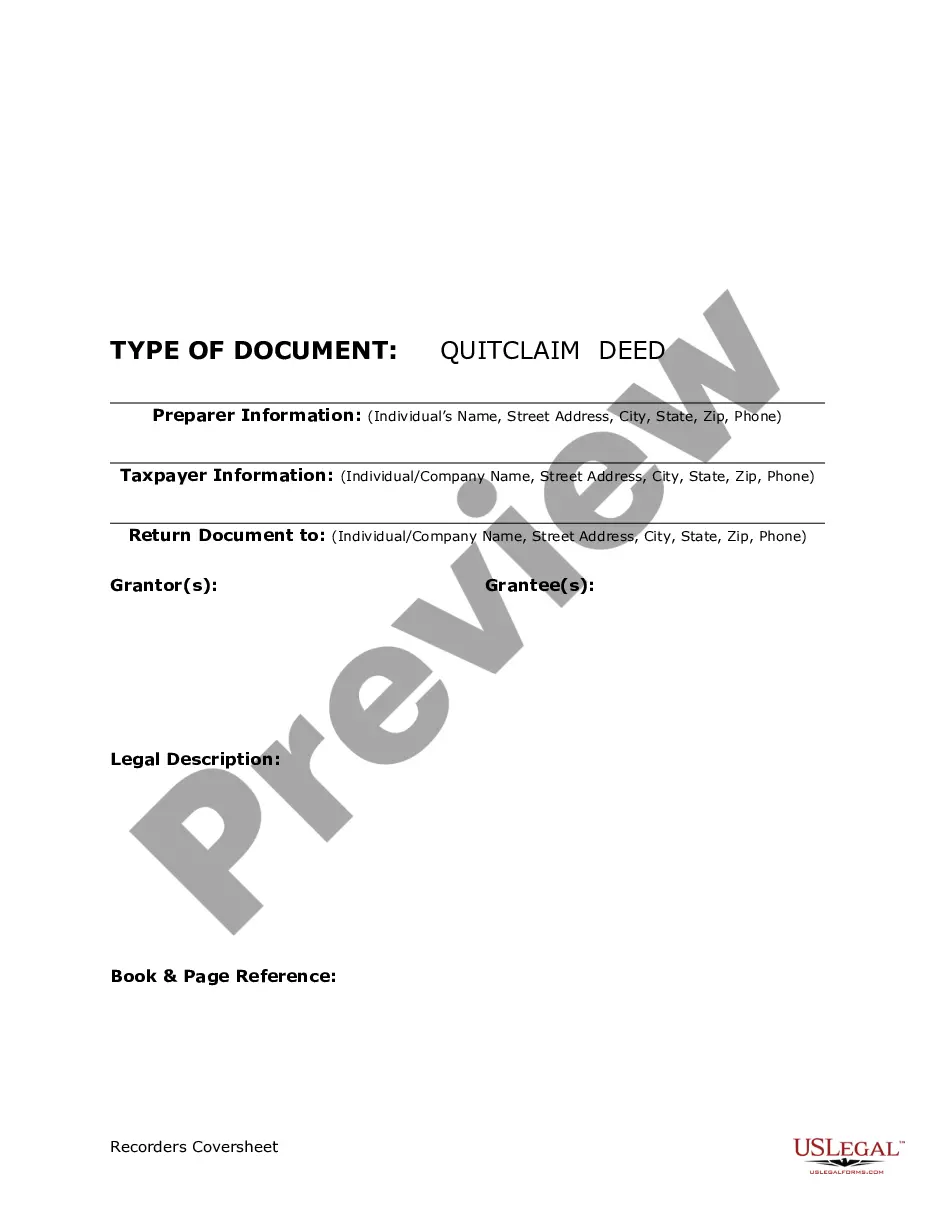

How to fill out Iowa Quitclaim Deed From Two Individuals To One Individual?

There’s no longer a necessity to spend countless hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has consolidated all of them in a single location and made them easier to access.

Our site provides over 85,000 templates for any business and personal legal needs, organized by state and area of application. All forms are expertly drafted and validated for correctness, allowing you to feel assured about acquiring an updated Iowa Quitclaim Deed With A Mortgage.

Choose your desired subscription plan and create an account or Log In. Pay for your subscription using a credit card or PayPal to proceed. Select the file format for your Iowa Quitclaim Deed With A Mortgage and download it to your device. Print your form to fill it out manually or upload the sample if you prefer completing it in an online editor. Preparing formal documentation in accordance with federal and state regulations is quick and straightforward with our library. Experience US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Click Log In to your account, select the document, and press Download.

- You can also revisit all saved documents whenever necessary by navigating to the My documents section in your profile.

- If you have never interacted with our platform previously, the process will require a few additional steps.

- Here’s how new users can locate the Iowa Quitclaim Deed With A Mortgage in our catalog.

- Review the page content thoroughly to confirm it includes the sample you need.

- To assist with this, utilize the form description and preview options if available.

- Use the search bar above to browse for another sample if the current one does not meet your requirements.

- Click Buy Now next to the template title once you find the correct one.

Form popularity

FAQ

The Iowa quitclaim deed with a mortgage is often regarded as one of the best options for transferring property between individuals who trust each other. It allows for quick and effective documentation of the transfer. When using this deed, it’s important to understand existing mortgages, so you can make informed decisions regarding the property ownership.

For transferring ownership, the Iowa quitclaim deed with a mortgage is often the preferred choice. This deed facilitates a swift and uncomplicated transfer of property. It is particularly useful when the relationship is strong, such as between family members or friends, as it does not involve rigorous title checks.

To transfer property to a family member, consider using the Iowa quitclaim deed with a mortgage. This deed simplifies the transfer process, enabling you to convey your ownership interest easily. It’s essential, however, to ensure that both parties understand any existing mortgage obligations associated with the property before finalizing the transfer.

The Iowa quitclaim deed with a mortgage is frequently used during divorce proceedings. This type of deed allows one spouse to transfer their interest in a property to the other spouse quickly and without the need for lengthy negotiations. It is particularly useful when there is a mortgage involved, as it can help clarify the ownership and responsibilities of payment moving forward.

Individuals who need to transfer property without a sale often benefit the most from a quitclaim deed. It offers a simple and quick way to move ownership while bypassing lengthy legal processes. This transfer method is particularly useful in family situations or when re-evaluating property ownership in light of an existing Iowa quitclaim deed with a mortgage.

Securing a mortgage after a quitclaim deed can be complex but is possible. Lenders will evaluate your financial situation and the deed's implications on ownership. Often, they will require a refinancing of the mortgage to adjust the terms under the new ownership arrangement, especially in an Iowa quitclaim deed with a mortgage.

In Iowa, a quitclaim deed must be signed by the grantor and typically requires notarization. It should also be properly recorded with the county recorder to be effective against third parties. Familiarity with Iowa's specific rules helps ensure the deed's proper usage, especially when linked to a mortgage.

The primary disadvantage of a quitclaim deed is the lack of warranties regarding the property's title. This means you assume the risk of existing liens or debts. Additionally, using a quitclaim deed does not eliminate any mortgage obligations tied to the property, especially when dealing with an Iowa quitclaim deed with a mortgage.

A quitclaim deed transfers ownership but does not remove someone from a mortgage. The responsibility for the mortgage remains with all named borrowers regardless of ownership changes. To fully remove someone from the mortgage, you typically need a refinance or a consent from the lender.

A quitclaim deed is not suitable when there are disputes regarding property ownership or when the property has significant debts. It also should not be used in transactions requiring a formal title search or when transferring property as part of a sale. Understanding these limitations is crucial when considering an Iowa quitclaim deed with a mortgage.