Iowa Corporation Withholding Tax

Description

How to fill out Iowa Business Incorporation Package To Incorporate Corporation?

Legal document management may be frustrating, even for experienced professionals. When you are looking for a Iowa Corporation Withholding Tax and do not get the a chance to devote looking for the correct and updated version, the procedures could be demanding. A strong web form catalogue could be a gamechanger for anyone who wants to take care of these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you may have, from individual to business documents, in one spot.

- Utilize advanced tools to accomplish and manage your Iowa Corporation Withholding Tax

- Access a useful resource base of articles, guides and handbooks and resources highly relevant to your situation and needs

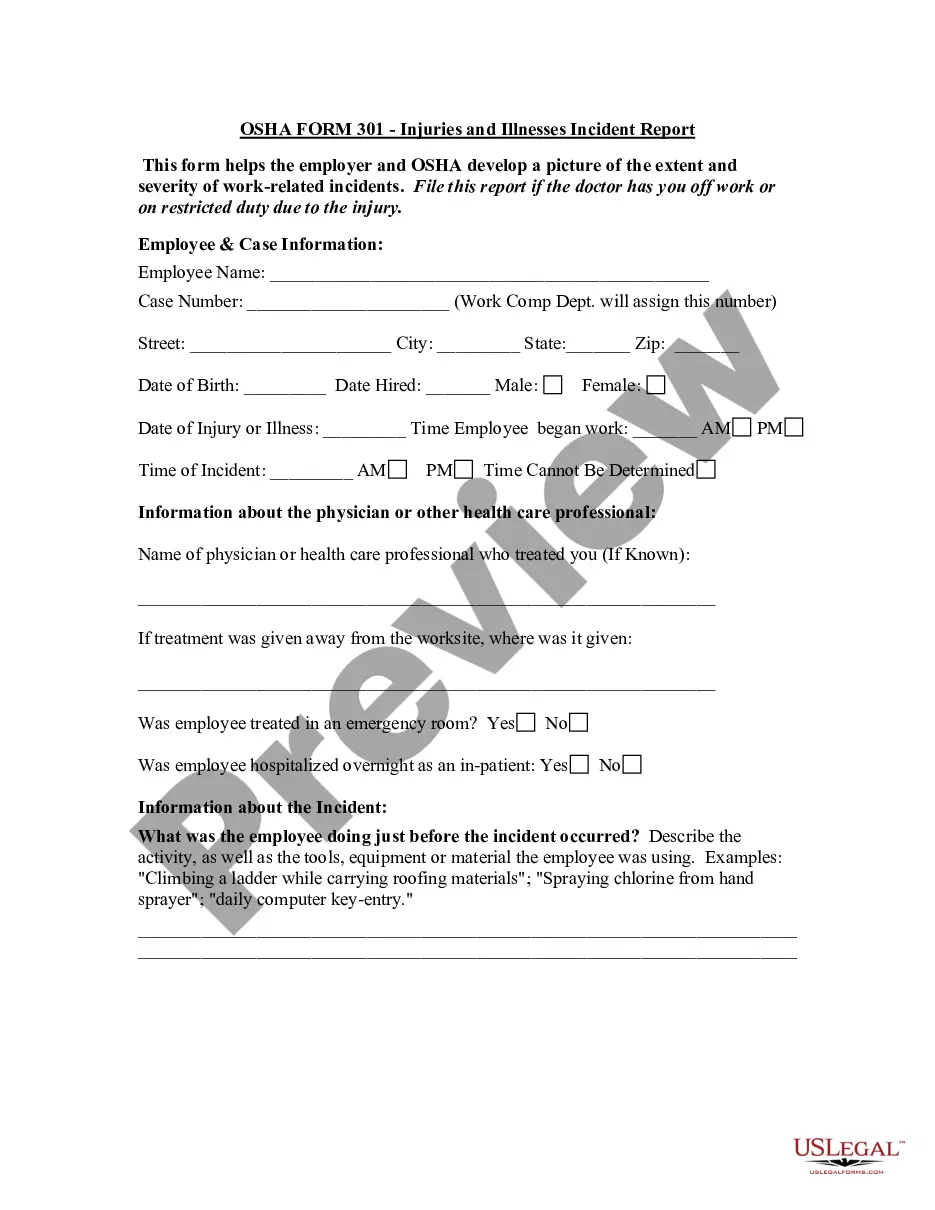

Save time and effort looking for the documents you will need, and make use of US Legal Forms’ advanced search and Preview feature to get Iowa Corporation Withholding Tax and get it. In case you have a subscription, log in for your US Legal Forms account, search for the form, and get it. Review your My Forms tab to see the documents you previously downloaded and also to manage your folders as you see fit.

Should it be your first time with US Legal Forms, make a free account and have unlimited use of all benefits of the library. Listed below are the steps to consider after accessing the form you want:

- Verify it is the correct form by previewing it and looking at its information.

- Be sure that the sample is acknowledged in your state or county.

- Select Buy Now when you are all set.

- Select a monthly subscription plan.

- Find the format you want, and Download, complete, sign, print and send out your document.

Take advantage of the US Legal Forms web catalogue, supported with 25 years of expertise and trustworthiness. Change your day-to-day document management in to a easy and intuitive process today.

Form popularity

FAQ

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Beginning in tax year 2023, there will be four tax brackets ranging from 4.4% to 6.0%. In subsequent years, the top rate will be reduced on an annual basis until a 3.9% flat tax rate is achieved in tax year 2026.

Your federal income tax withholdings are based on your income and filing status. For 2022, the federal income tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Regardless of your situation, you'll need to complete a W-4 and submit it to your employer.

IA W-4 Employee's Withholding Certificate and Centralized Employee Registry 44-019 | Iowa Department Of Revenue.

If federal income tax is withheld on a flat rate basis, Iowa income tax is required to be withheld at the rate of 6 percent. However, if the supplemental wage payment is included with the regular wage payment, the two are combined and the withholding tables or formulas are used.