Hawaii Special Limited Withholding Rules

Description

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- If you are already a user, log into your account and click the Download button for the form template you require. Ensure your subscription is active; if it isn’t, renew according to your payment plan.

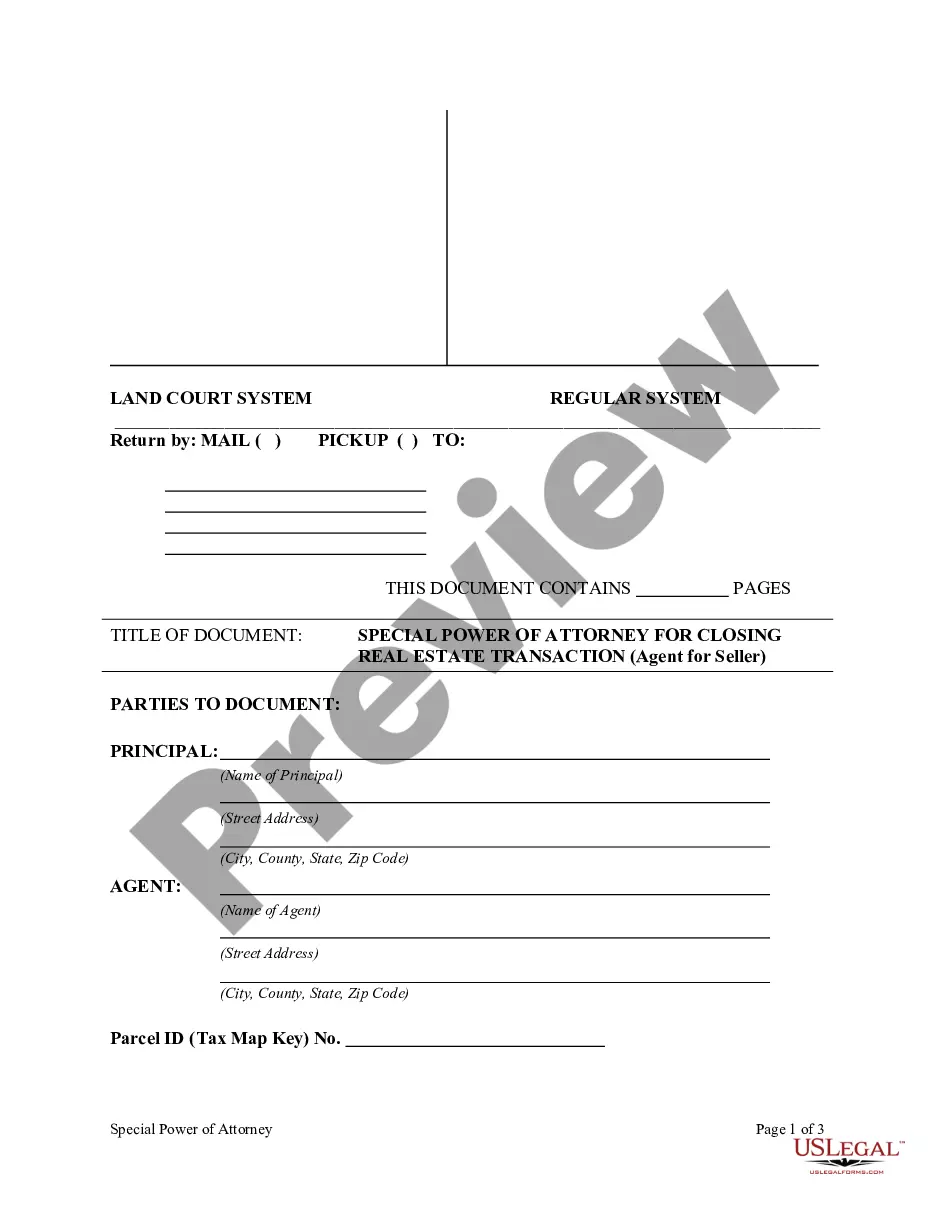

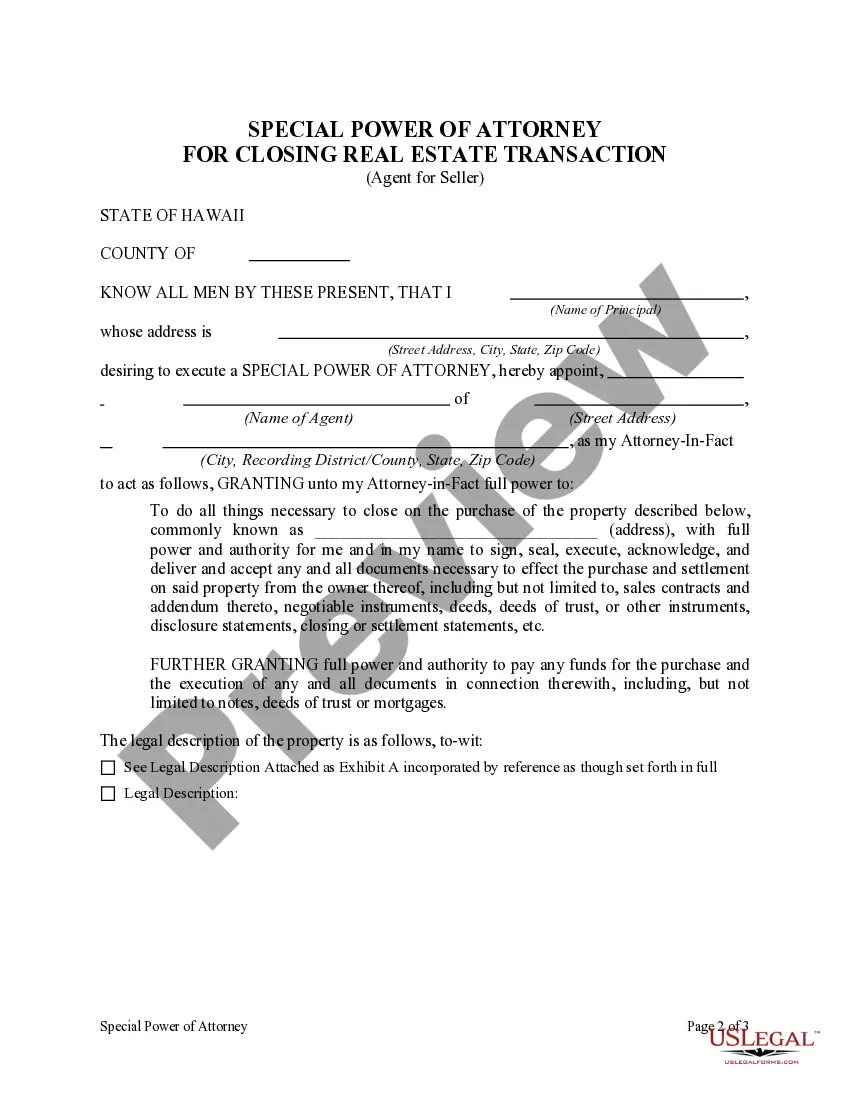

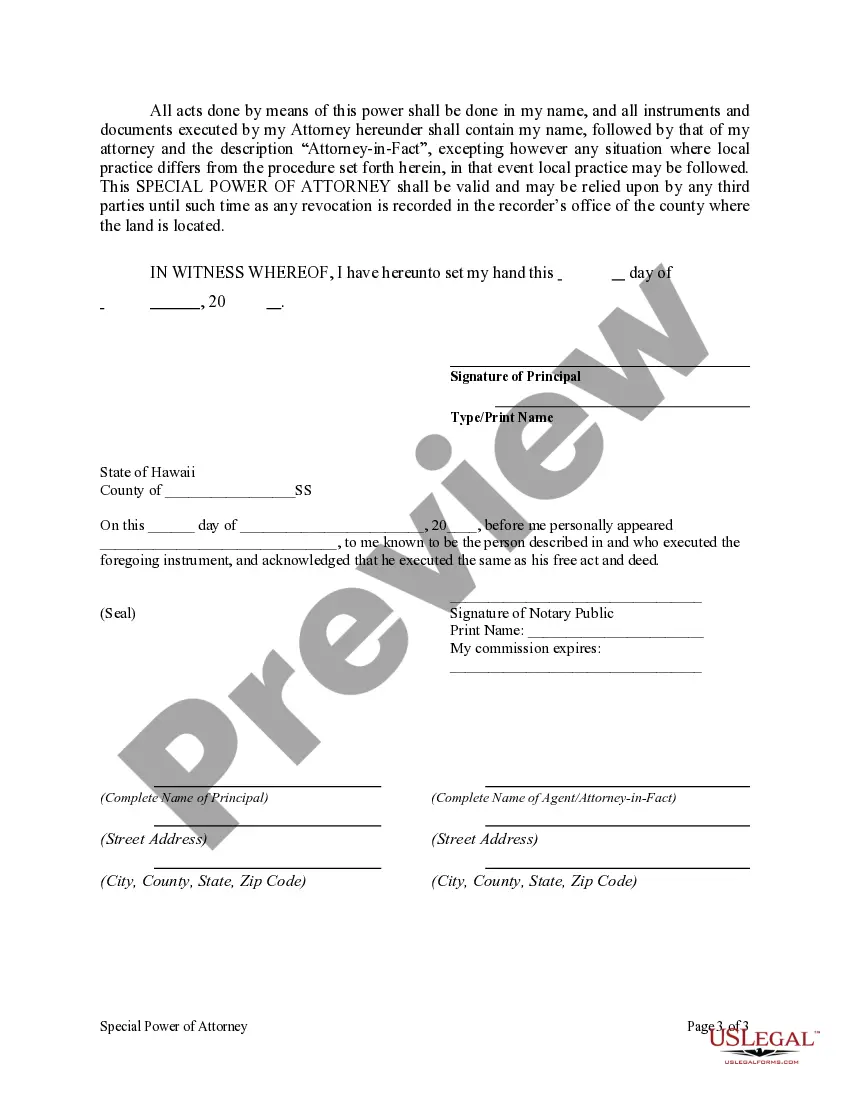

- For first-time users, start by checking the Preview mode and description of the forms available. Ensure that you've selected the document that aligns with your specific needs.

- If necessary, refine your search using the Search tab to locate the ideal template. Once identified, continue to the next step.

- Proceed to purchase the selected document. Click on the Buy Now button and select your preferred subscription plan, registering an account for full access to the library.

- Finalize your transaction by providing your payment details, either through credit card or PayPal.

- Download your completed form directly to your device for continuous accessibility via the My Forms section of your profile.

With an extensive library of over 85,000 customizable forms, US Legal Forms empowers users to quickly create legally sound documents, ensuring compliance with the relevant regulations.

Experience the difference for yourself; start your journey with US Legal Forms today and simplify your legal document needs!

Form popularity

FAQ

To obtain a General Excise (GE) license in Hawaii, you need to apply through the Hawaii Department of Taxation. You may fill out Form BB-1, available on their website, and ensure you provide all necessary details about your business activities. Following the Hawaii special limited withholding rules when operating your business will help you stay compliant with tax regulations and requirements.

Your withholding allowance should reflect your financial situation. Generally, the more allowances you claim, the less tax is withheld from your paycheck. Consider factors like your filing status and number of dependents. Reviewing the Hawaii special limited withholding rules can clarify how to determine the optimal number of allowances for your needs.

When filling out Hawaii HW-4, start by providing your personal information, including your name and Social Security number. Next, indicate the number of allowances you are claiming and any additional amount you wish to withhold. Following the Hawaii special limited withholding rules will guide you in completing this form correctly, setting you up for more accurate tax handling.

Allowances and dependents are related but not the same. Allowances affect your tax withholding amount, while dependents refer to individuals you support financially such as children or elderly parents. The Hawaii special limited withholding rules can help you appropriately claim your allowances based on your dependents. It’s crucial to distinguish between them for accurate tax reporting.

To register for Hawaii withholding tax, you'll need to complete Form HW-1, which is available on the Hawaii Department of Taxation website. Provide your business details and estimated payroll information, ensuring you meet all requirements. Following the Hawaii special limited withholding rules will ensure your registration is accurate and timely.

When determining the amount for extra withholding, consider your overall tax situation. The Hawaii special limited withholding rules allow you to adjust your withholding based on expected tax liabilities. Review your previous year's tax return and consult with a tax professional if needed. This ensures you are neither over-withholding nor under-withholding.

No, it is not illegal for employers to withhold federal taxes; in fact, it is required by law. Employers must withhold the appropriate amount of federal income tax along with Social Security and Medicare taxes based on the information employees provide on their W-4 forms. Understanding Hawaii's special limited withholding rules allows you to see how state requirements align with federal laws. If you need help navigating these issues, US Legal Forms offers helpful resources.

Yes, it is illegal for an employer to withhold an employee's W-2. Employees have the right to receive their W-2 forms by January 31 each year, which detail their earnings and taxes withheld. Being aware of Hawaii's special limited withholding rules can help you understand your rights and how tax paperwork should be managed. If you encounter issues, using US Legal Forms can provide guidance on your rights and next steps.

Yes, you can complete Form W-4V online, making it a convenient option for providing your withholding preference to your employer. This form is specifically for those who want to have an amount withheld from certain government payments. Familiarizing yourself with Hawaii's special limited withholding rules ensures that you correctly indicate your desired withholding amounts. Additionally, the US Legal Forms platform offers resources to simplify the process and ensure compliance.

In Hawaii, the frequency of filing General Excise (GE) tax returns depends on your business's gross income. Businesses with a higher gross income are generally required to file monthly, while those with lower incomes can file quarterly or annually. Staying compliant with Hawaii's special limited withholding rules is crucial to avoid penalties. To keep track of your filing obligations, you might find tools through US Legal Forms helpful.