Hawaii Special Limited Withholding Certificate

Description

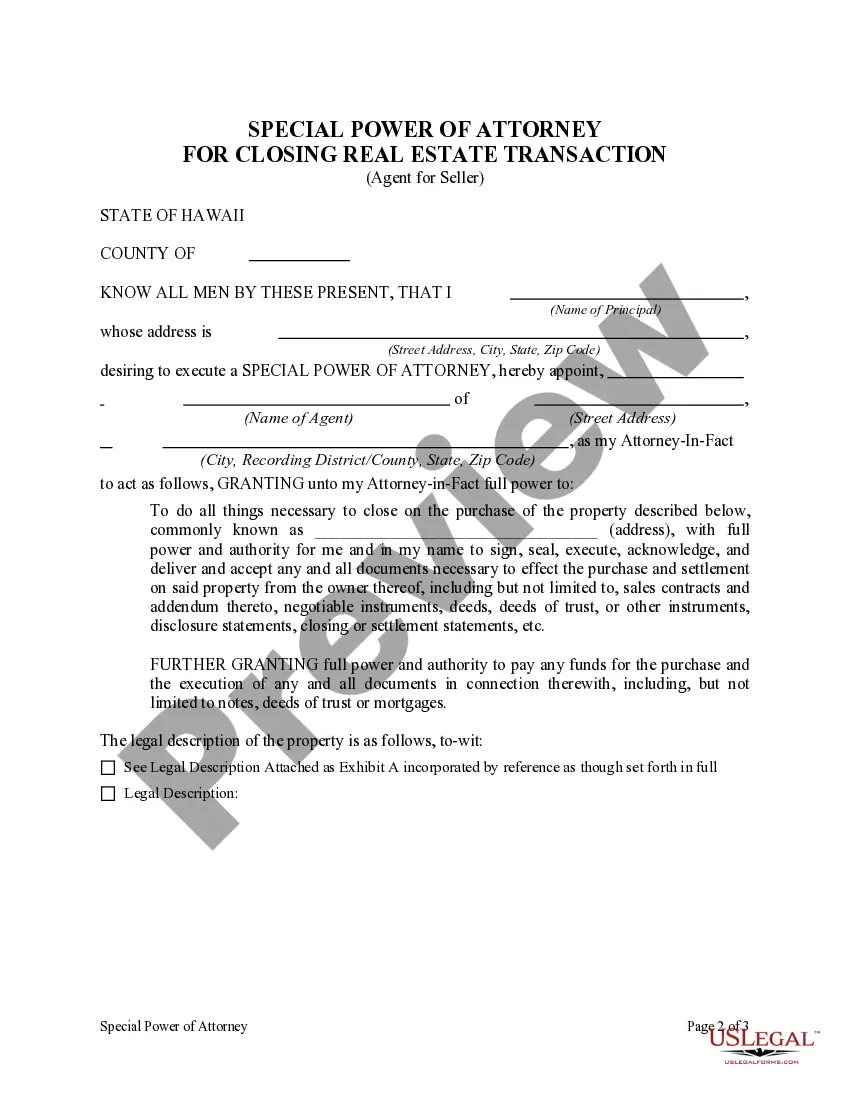

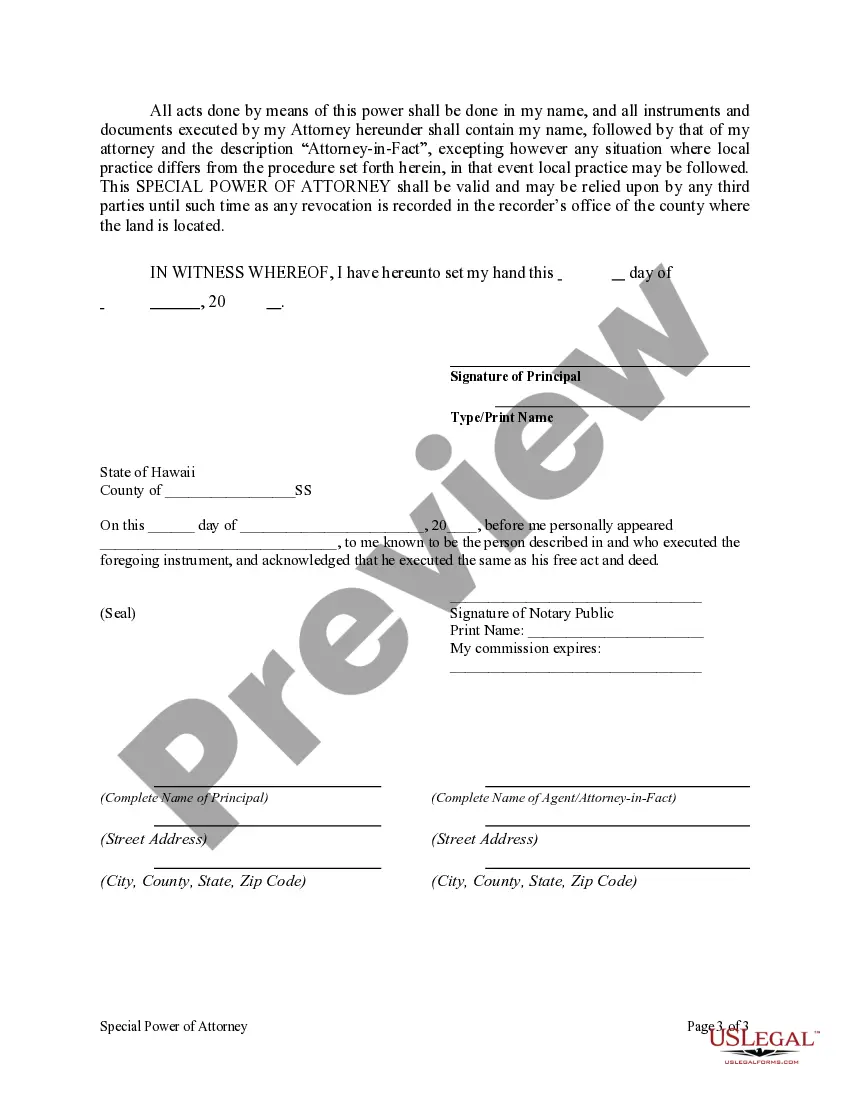

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- Log in to your account on US Legal Forms. If you're a returning user, ensure your subscription is active, or renew it based on your payment plan.

- Preview the form options. Look for the Hawaii special limited withholding certificate and ensure it aligns with your jurisdiction requirements.

- If necessary, utilize the Search feature to find other relevant templates that suit your needs.

- Select the certificate and proceed to purchase by clicking the Buy Now button. Choose your desired subscription plan and create an account if you haven't already.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- Download your certificate. Save it to your device and access it anytime through the My Forms section in your profile.

In conclusion, US Legal Forms empowers you to easily obtain essential legal documents like the Hawaii special limited withholding certificate. With over 85,000 fillable forms and expert assistance at your disposal, you’ll ensure your documents are both accurate and compliant.

Start your journey today by visiting US Legal Forms and take advantage of the extensive resources available to you!

Form popularity

FAQ

You can obtain a copy of your Hawaii General Excise (GE) tax license through the Hawaii Department of Taxation's online portal or by contacting their office directly. Ensure you have your business details ready to expedite the process. If you need assistance, platforms like USLegalForms can help you navigate obtaining the Hawaii special limited withholding certificate and other tax documents you may need.

To set up tax withholding, start by collecting the necessary information from your employees regarding their tax preferences. Use the appropriate withholding forms and submit them to the Hawaii Department of Taxation. Properly completing the Hawaii special limited withholding certificate is vital to ensure your withholdings align with state requirements.

Filling out your withholding form requires you to write your personal information accurately. You’ll need to provide details about your income and any exemptions you are claiming. The Hawaii special limited withholding certificate can assist in determining the correct withholding amounts based on your specific situation.

To register for the Hawaii General Excise Tax (GET), visit the Department of Taxation’s site to fill out the application form. This process will give you the necessary license to conduct business in Hawaii. Additionally, having the Hawaii special limited withholding certificate can simplify your tax reporting.

Filing employer withholding tax in Hawaii starts by gathering your employees' tax information. You can file online using the Hawaii tax portal or submit the required forms by mail. Remember, it's essential to properly complete the Hawaii special limited withholding certificate to ensure compliance.

To obtain a Hawaii tax ID number, visit the Hawaii Department of Taxation website. You can complete the online application for a tax identification number. This number is necessary for filing the Hawaii special limited withholding certificate and managing your tax obligations efficiently.

To fill out your W-4 correctly, provide your full name, address, and Social Security number on the form. After that, follow the instructions to determine the number of withholding allowances that apply to your situation. It's crucial to ensure accuracy to avoid over- or under-withholding taxes, especially in consideration of the Hawaii special limited withholding certificate if it applies to you.

To fill out a withholding allowance form, start by entering your personal details. Next, indicate how many allowances you claim based on your financial situation. Be sure to review your selections to optimize your tax withholdings, especially if the Hawaii special limited withholding certificate comes into play, offering potential tax benefits.

Filling out form HW-4 involves providing your personal information, including your name, address, and Social Security number. Additionally, follow the instructions to select your allowances carefully. Consider the implications of your selections, particularly in relation to the Hawaii special limited withholding certificate, as it can significantly affect your tax liability.

To register for Hawaii withholding tax, you can apply online through the Hawaii Department of Taxation's website. The process usually requires your employer details and information about your business structure. For more guidance, including how the Hawaii special limited withholding certificate may apply to you, consider checking resources available on platforms like uslegalforms.