Hawaii Llc Formation

Description

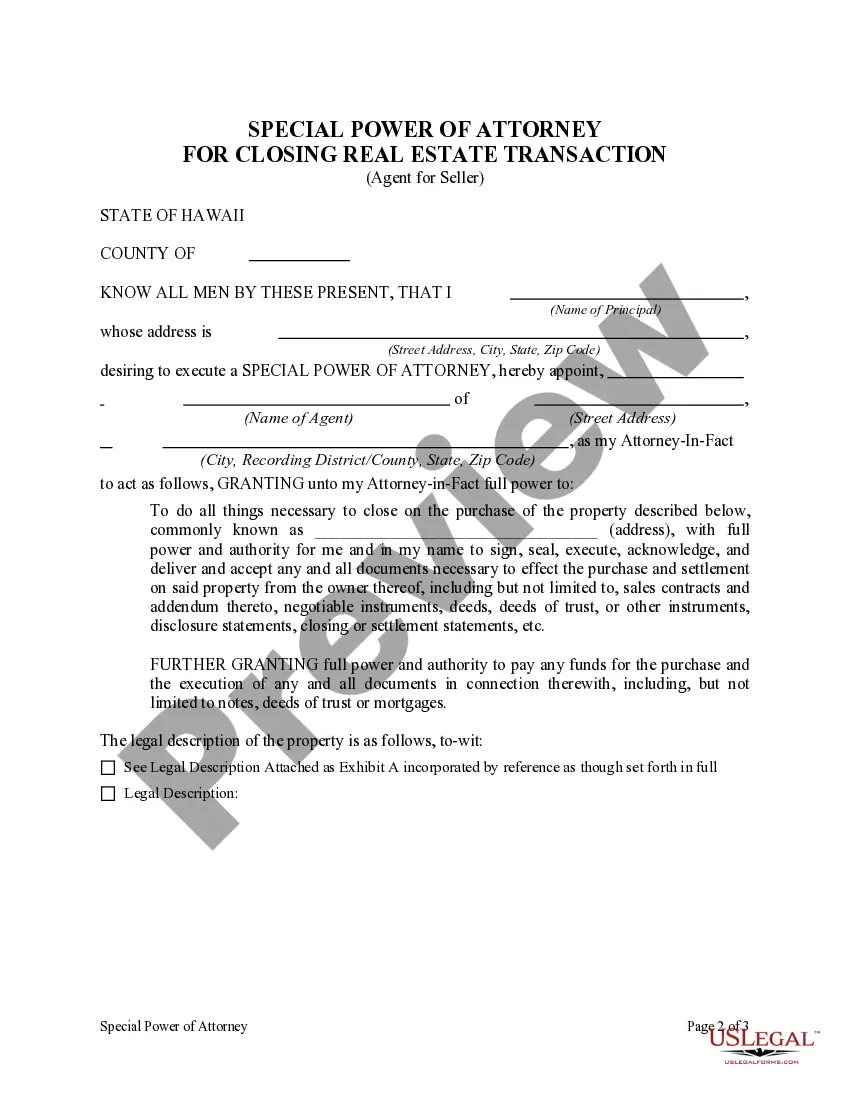

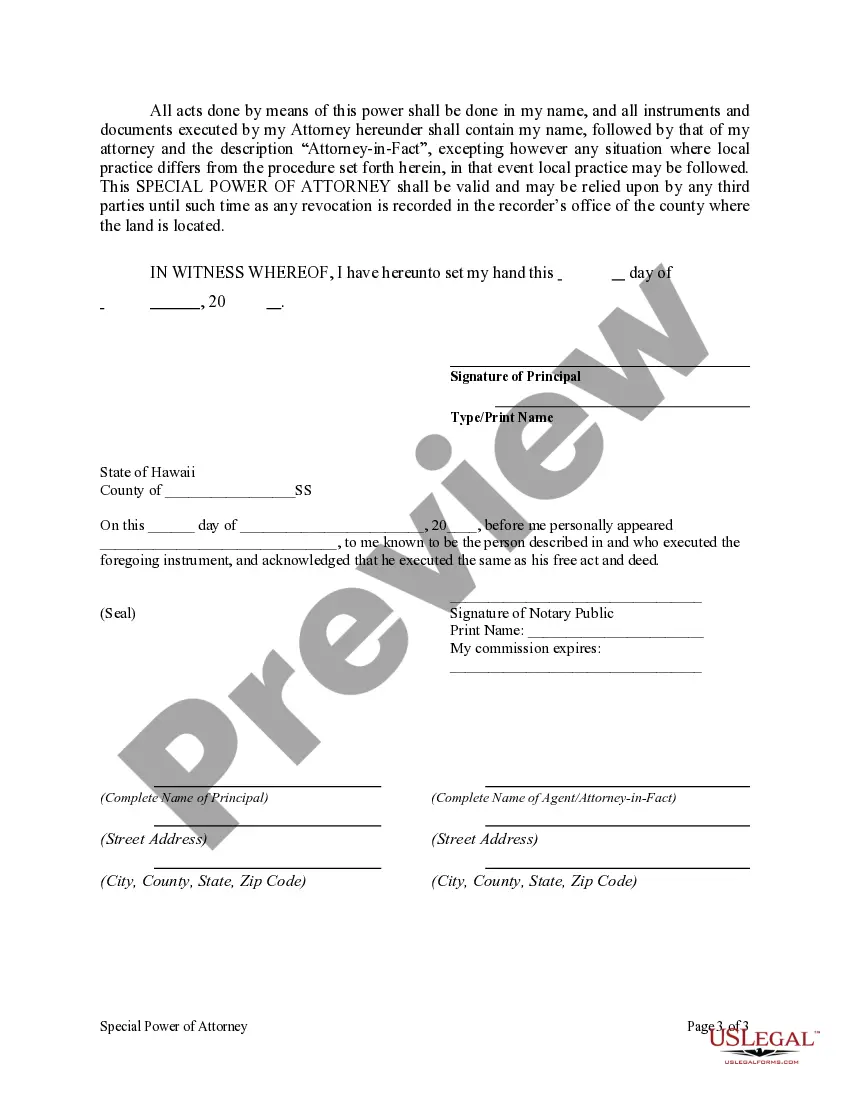

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- If you're a returning user, log in to access your account. Ensure your subscription is active for unlimited downloads.

- For first-time users, begin by browsing the extensive library. Check the Preview mode and description of each form to ensure it aligns with your local requirements.

- If the initial form isn’t suitable, use the Search function to find the appropriate template for your specific needs.

- Once you've selected the correct document, click on the Buy Now button. Choose a subscription plan that fits your requirements. You'll need to create an account for full access.

- Complete your purchase using your credit card or PayPal account to finalize your subscription.

- After your transaction is confirmed, you can immediately download your form. It will also be available anytime in the My Forms section of your profile.

By utilizing US Legal Forms, you can efficiently navigate the paperwork needed for Hawaii LLC formation while ensuring that your documents are accurate and legally compliant.

Take the first step towards establishing your LLC today by visiting US Legal Forms!

Form popularity

FAQ

To expedite your Hawaii LLC formation, consider filing online and opting for expedited service. This can significantly reduce your wait time. Additionally, using pre-verified templates and resources from US Legal Forms can help you quickly prepare the necessary paperwork. By following the right steps, you can have your LLC established in no time.

The Hawaii LLC formation process typically takes about 1 to 2 weeks once you submit your application. However, if you choose expedited processing, you can often receive approval in just a few days. It's important to ensure that all your documents are complete to avoid delays. Using a platform like US Legal Forms can help you streamline this process.

Yes, an LLC can operate without an operating agreement, as it is not a requirement in Hawaii. However, functioning without one may lead to potential conflicts among members and may not provide clear guidelines for the business. Having an operating agreement can enhance your Hawaii LLC formation by providing a structured framework for management and decision-making. Using a platform like US Legal Forms can help you easily create one that suits your business.

Yes, you can write your own operating agreement for your LLC. This document is flexible and should reflect your specific business needs and operations. Crafting your own agreement allows you to tailor it according to your vision during the Hawaii LLC formation process. While you can draft it yourself, consulting a resource like US Legal Forms can provide templates and guidance to ensure you cover all necessary points.

Not all states require an operating agreement for LLCs; however, having one is highly beneficial for outlining the ownership and management structure. In Hawaii, while it is not mandated, an operating agreement can help clarify your LLC's operations. By creating an operating agreement, you can strengthen your Hawaii LLC formation process, making it smoother and more effective. It also provides protection against disputes among members.

While Hawaii does not legally require an LLC to have an operating agreement, it is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC, providing clarity for all members. This document is beneficial in case of disputes or changes in ownership, making it an important aspect of your Hawaii LLC formation process. You can easily draft one using templates available through platforms like US Legal Forms.

Yes, when you form an LLC in Hawaii, you must designate a registered agent. This person or entity acts as your official point of contact for legal documents and government notices. Choosing a reliable registered agent ensures the smooth handling of important communications, which is essential for your Hawaii LLC formation. You can select an individual resident or a business entity authorized to conduct business in Hawaii.

Yes, Hawaii does allow the formation of single member LLCs. This option provides all the same benefits as multi-member LLCs, such as limited liability protection and easier tax management. If you are considering this structure, uslegalforms can assist you in ensuring that your single member Hawaii LLC formation meets all legal requirements.

While LLCs provide many benefits, they also come with certain downsides. One consideration is the ongoing compliance requirements and fees that come with maintaining your LLC in Hawaii. Additionally, some businesses may face higher taxes depending on their structure, so it is important to weigh these factors before deciding on Hawaii LLC formation.

Starting your LLC in Hawaii offers various advantages, including limited liability protection and tax flexibility. Additionally, Hawaii allows for pass-through taxation, helping you avoid double taxation on your business income. With uslegalforms, you can easily navigate the unique requirements and regulations that come with Hawaii LLC formation.