Hawaii Limited Sales For 202

Description

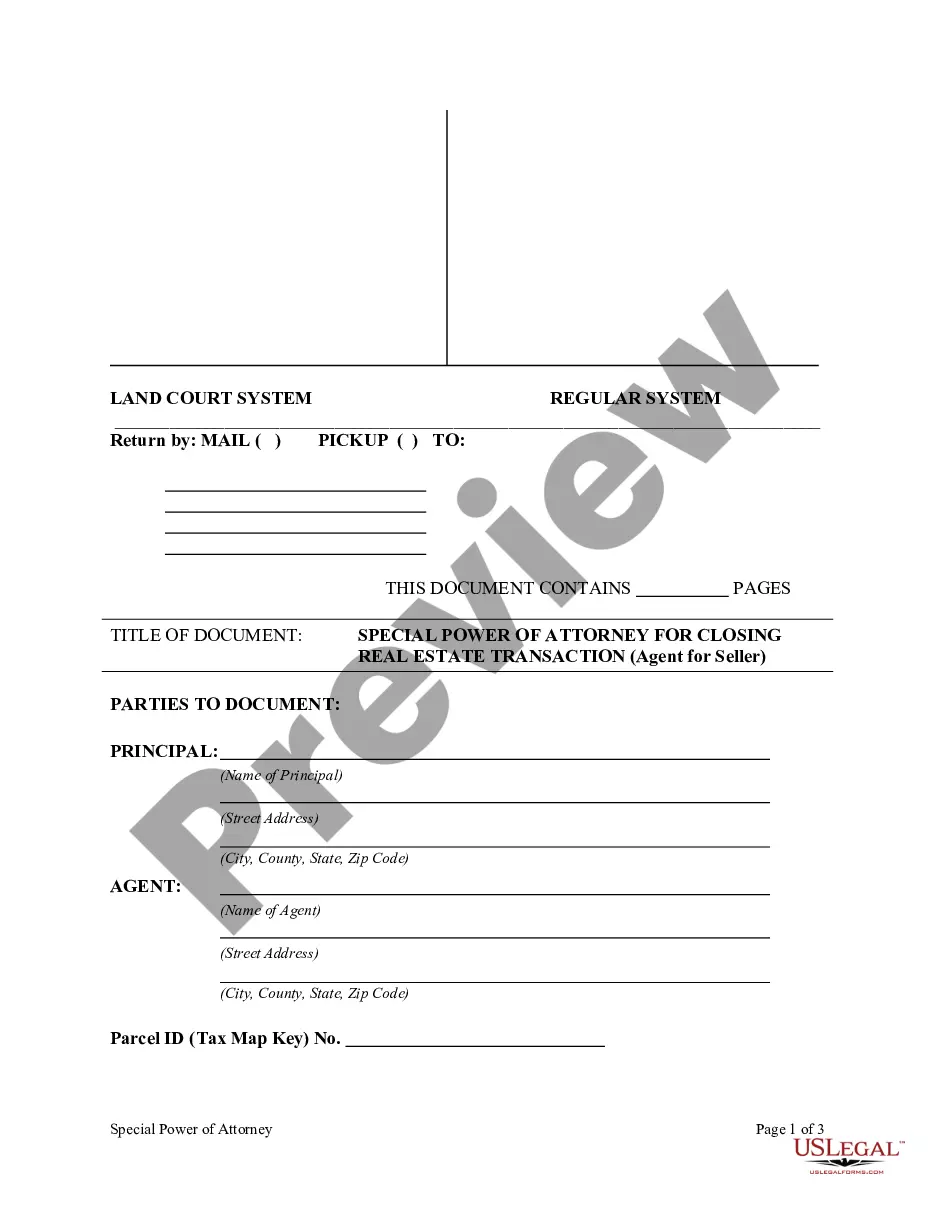

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- Access your account on US Legal Forms by clicking here to download your necessary form template. Ensure your subscription is active; renew if needed.

- Preview the form and its description to confirm it meets your legal requirements. Make adjustments based on your jurisdiction as necessary.

- If the initial form doesn’t suit your needs, utilize the Search bar at the top to find an appropriate template that meets your criteria.

- Proceed to purchase the selected document by clicking the 'Buy Now' button. Select your desired subscription plan as you create an account to access the extensive library.

- Complete your transaction by entering your payment details, using either a credit card or PayPal to finalize your subscription.

- Download your finalized form to your device. It will be stored in your profile's My Forms section for future access.

By following these steps, you can effortlessly create legally sound documents tailored to your specific needs.

Get started today with US Legal Forms and discover the advantages of a comprehensive database at your fingertips. Don’t wait; empower yourself with the right legal tools now!

Form popularity

FAQ

In Hawaii, notarization of a bill of sale is generally not required, but doing so can provide added security and validity. A notarized document can help prevent disputes by proving the identities of both parties involved. Even though it might not be mandatory, taking this extra step can safeguard your transaction in cases involving Hawaii limited sales for 202. Always consult with local regulations to ensure you meet any specific requirements.

Yes, in Hawaii, collecting sales tax is essential for certain transactions, including Hawaii limited sales for 202. As a seller, you are responsible for understanding the applicable tax laws for your transactions. Ensure that you register for a General Excise Tax (GET) license if you plan on making regular sales. This way, you will comply with local regulations and avoid potential penalties.

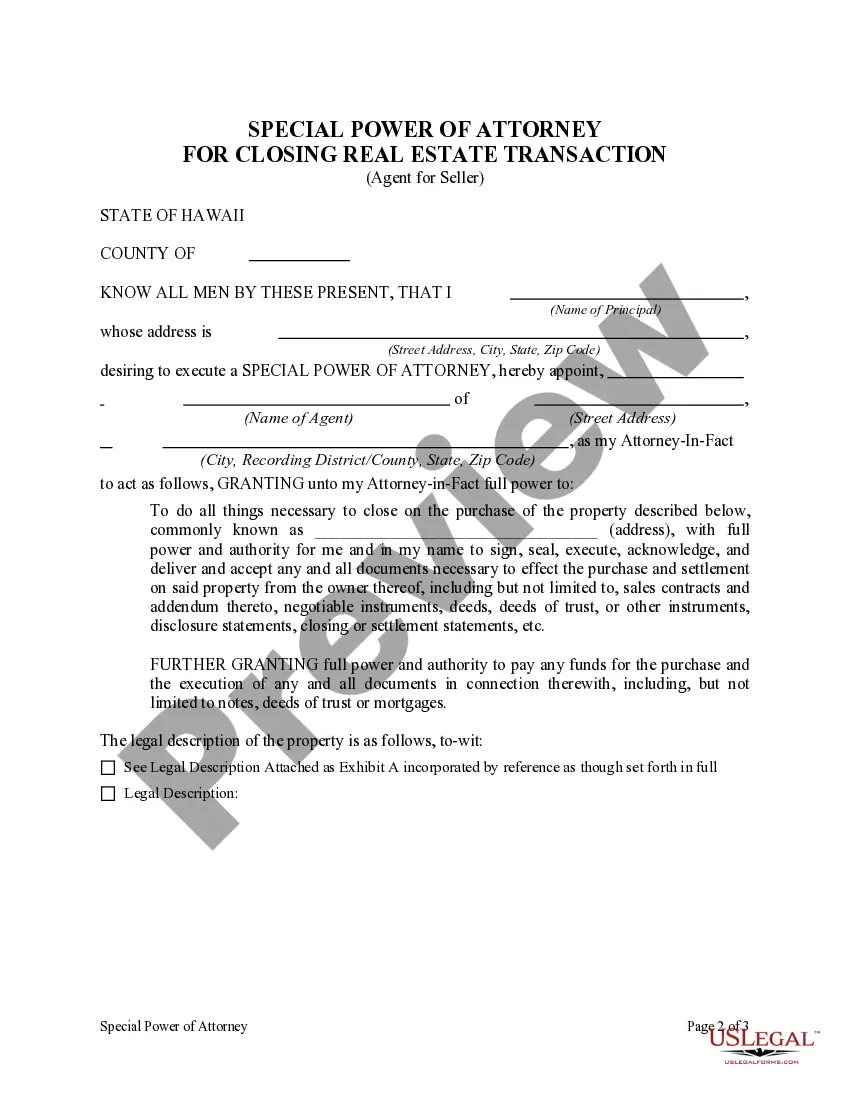

Filling out a Hawaii bill of sale involves several straightforward steps. Start by clearly identifying the seller and buyer, including their names and addresses. Then, describe the item being sold, including its condition and any identifying details. Finally, both parties should date and sign the document to finalize the agreement. Using a reliable platform like uslegalforms can simplify this process for Hawaii limited sales for 202.

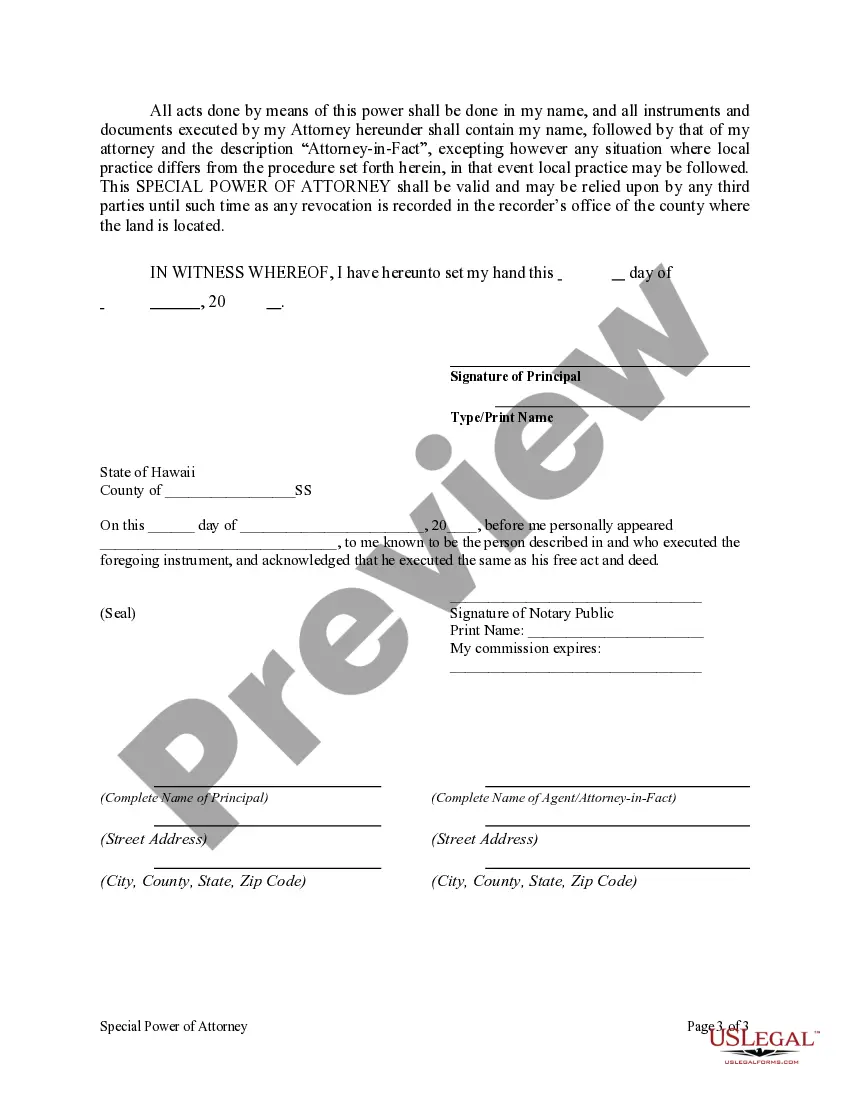

In Hawaii, both parties typically need to be present for a title transfer to be valid. This is especially important to ensure that all necessary signatures are obtained on the relevant documents. By being present, both parties can also ask questions and clarify any concerns regarding the Hawaii limited sales for 202. If one party cannot attend, consider using a power of attorney to authorize someone to act on their behalf.

To close your Hawaii sales tax account, you need to complete the necessary forms and submit them to the Hawaii Department of Taxation. This typically requires reporting your final sales, along with indicating that you wish to close your account. For those managing Hawaii limited sales for 202, the US Legal Forms platform can provide the proper forms and guidance, making the process straightforward.

The exclusion on the sale of a home allows you to exclude a portion of the profit from your taxable income when selling your primary residence. In Hawaii, this aligns with the federal exclusion, permitting you to exclude gains up to $250,000 for individuals or $500,000 for married couples. Understanding this exclusion is essential for anyone involved in Hawaii limited sales for 202.

To file the Hawaii G-49, also known as the General Excise Tax Return, you should start by gathering your sales records for the reporting period. Complete the G-49 form accurately, detailing your gross income and any deductions. Filing can be done online or by mailing the paper form, making it convenient for those conducting Hawaii limited sales for 202.

The estate exclusion in Hawaii pertains to the amount that can be passed on to heirs without incurring estate taxes. As of 2023, Hawaii allows an exclusion amount up to $5.49 million, meaning that estates valued below this threshold are exempt from state estate taxes. For those involved in Hawaii limited sales for 202, understanding the estate exclusion can aid in effective estate planning.

In Hawaii, the exclusion for selling a house generally refers to the capital gains tax exclusion. Under federal law, if you meet certain requirements, you can exclude up to $250,000 of capital gains on the sale of your primary residence, or $500,000 for married couples. This can significantly benefit those engaging in Hawaii limited sales for 202, reducing taxable income and increasing profits from the sale.

A salary of $100,000 is typically considered good in Hawaii, as it allows for a comfortable lifestyle by covering housing, groceries, and other necessities. However, keep in mind that high living costs may mean this salary does not go as far as in other states. Understanding your budget and taking advantage of local resources, including uslegalforms, can enhance your financial stability while navigating Hawaii limited sales for 202.