Hawaii Lessor For Rent

Description

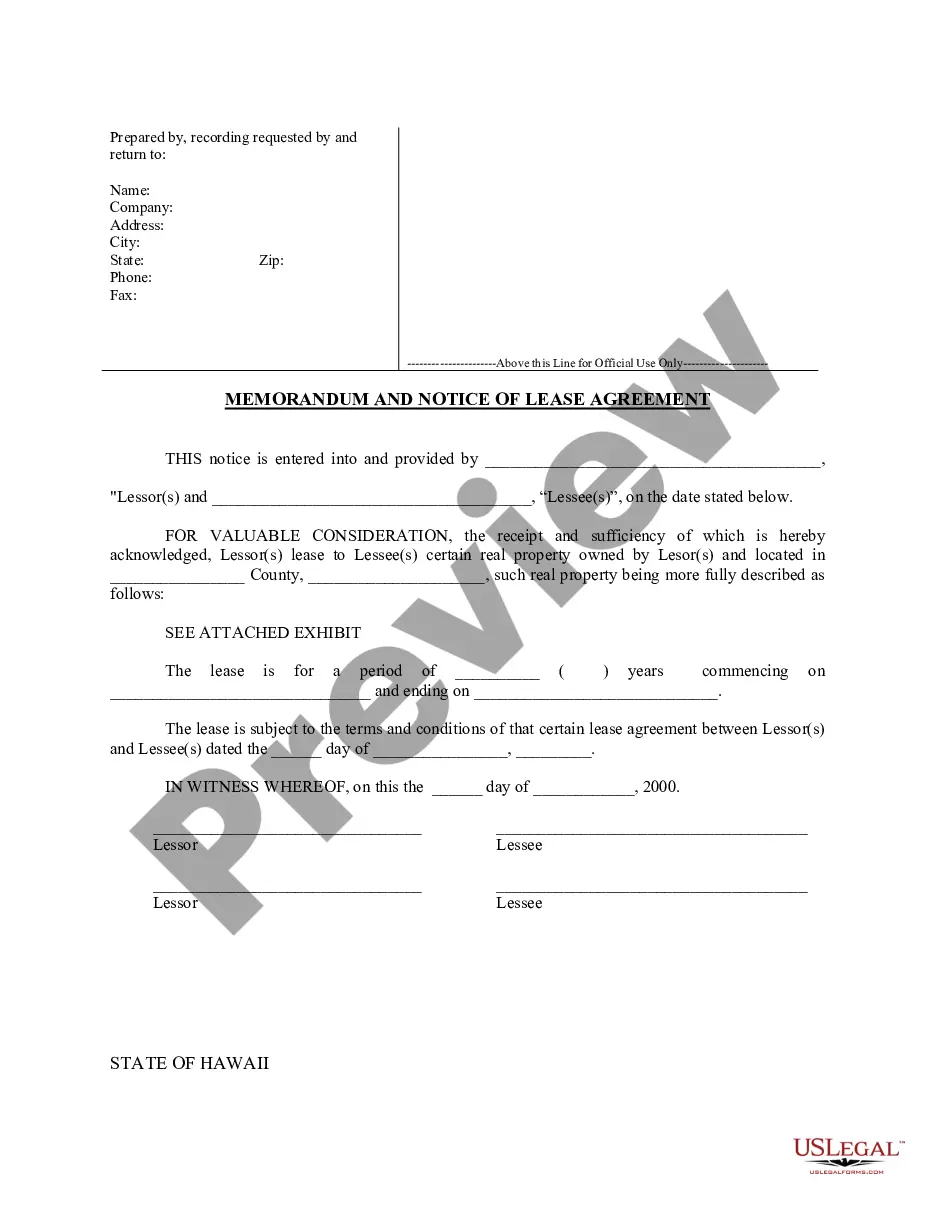

How to fill out Hawaii Notice Of Lease For Recording?

- Log into your US Legal Forms account. If you're new, create an account to get started.

- Preview the available forms. Carefully read the descriptions to select one that aligns with your requirements and complies with local laws.

- Use the search feature if needed. If the initial document doesn't meet your needs, locate another suitable template easily.

- Proceed with your purchase. Click the Buy Now button and select a subscription plan that works for you. You'll need to register to access the full library.

- Make your payment. Enter your credit card info or opt to pay through PayPal to finalize your subscription.

- Download the necessary template. Save it on your device, ensuring you can access it any time via the My Forms section of your profile.

US Legal Forms offers unparalleled benefits, including a comprehensive library of over 85,000 legal forms more extensive than most competitors. This means you have access to a greater variety of documents at lower costs, including expert assistance for ensuring your forms are correctly filled out and legally binding.

Concluding your journey to securing a Hawaii lessor for rent is easy with US Legal Forms. Start today, and take advantage of the seamless access to essential legal documents!

Form popularity

FAQ

To report as a landlord in Hawaii, you need to register with the state and file the appropriate forms for rental income. Use IRS Form 1040, Schedule E to report your income, and familiarize yourself with Hawaii’s tax regulations for landlords. Resources like US Legal Forms can assist you in navigating these requirements smoothly.

If you do not receive a 1099 form, you can still report rental income as a Hawaii lessor for rent by including the total amount earned on your tax return. Maintain your own records of payments received and expenses incurred. This practice keeps your income accurate and in compliance with IRS regulations.

Documenting rental income involves keeping detailed records of all transactions. Save copies of leases, payment receipts, and correspondence with tenants. Utilizing tools from US Legal Forms can streamline this process and ensure that your documentation meets legal requirements.

As a Hawaii lessor for rent, you typically report rental income using IRS Form 1040, Schedule E. This form allows you to detail your rental income and any allowable expenses. Ensuring accurate reporting can prevent issues with the IRS and enhance your financial records.

To show proof of rental income as a Hawaii lessor for rent, you can provide documents like bank statements reflecting monthly deposits or copies of leases. Additionally, receipts from tenants can support your claim. Using platforms like US Legal Forms can help you generate the necessary paperwork efficiently.

You do not need a specific license to be a landlord in Hawaii; however, it’s essential to comply with local laws and rental regulations. This includes understanding tenant rights, fair housing laws, and health and safety codes. Our platform can guide you through the necessary steps and provide resources for those navigating the responsibilities of being a Hawaii lessor for rent.

In Hawaii, there is no statewide limit on how much a landlord can raise rent, but landlords are required to provide written notice of any increase. Typically, landlords should provide at least 45 days' notice for increases of 10% or less. For increases higher than 10%, a 60-day notice is necessary. If you're a Hawaii lessor for rent, staying informed on these regulations can help you maintain a positive landlord-tenant relationship.

Most landlords require that your income be at least two to three times the monthly rent amount. This standard helps ensure tenants can comfortably afford their rent payments. When applying with a Hawaii lessor for rent, being clear about your financial situation can enhance your chances of approval.

To fill out a landlord application, begin by providing your complete personal details, including full name, address, and contact information. Follow this by listing your employment history and references who can vouch for your reliability. If you are seeking a property through a Hawaii lessor for rent, be prepared to provide consent for background and credit checks.

Red flags on a rental application can include missing information, inconsistent employment history, or previous evictions. Additionally, a low credit score may also raise concerns for landlords. When applying to a Hawaii lessor for rent, it is beneficial to present a strong application to alleviate any potential doubts.