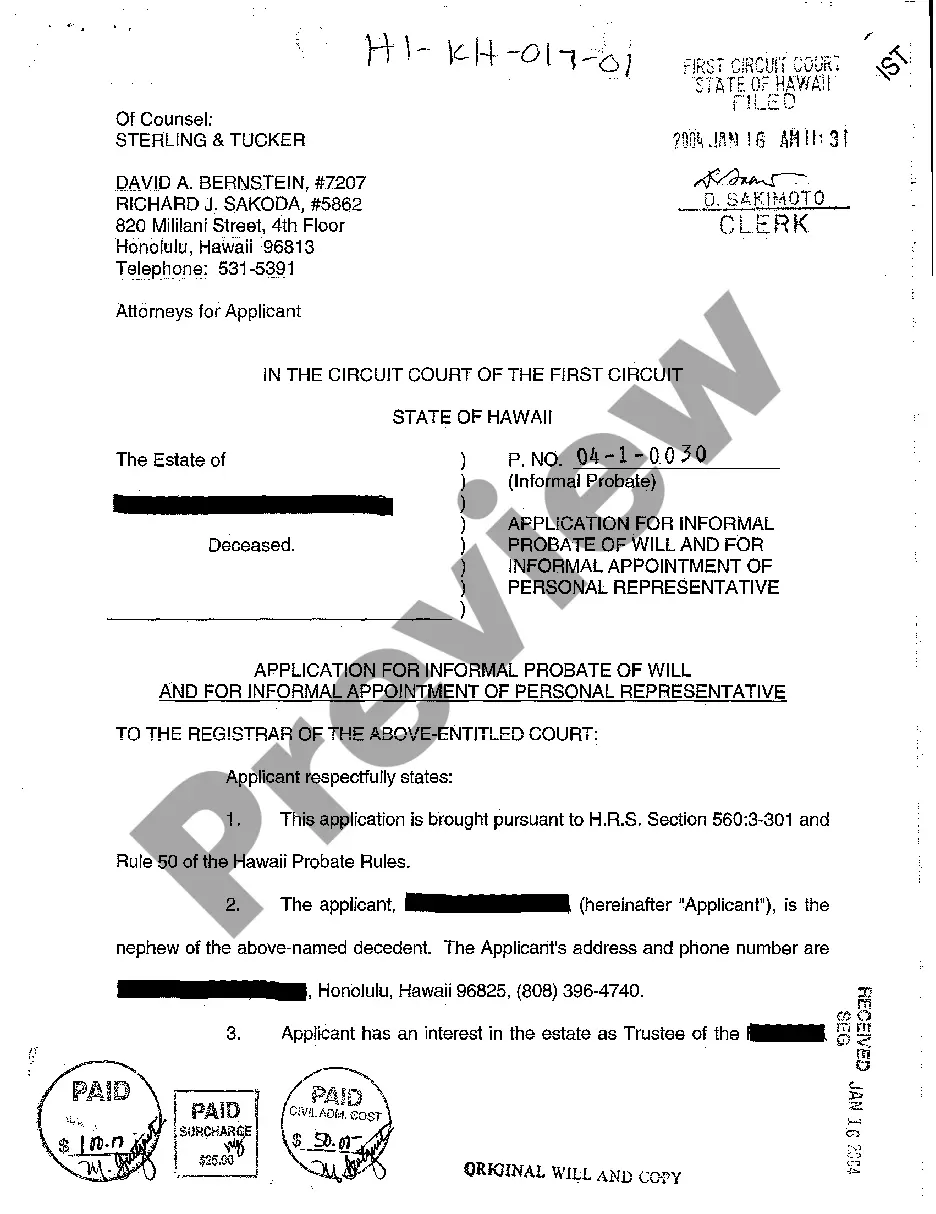

Hawaii Probate Testate Sample Case 2 With Answer

Description

Form popularity

FAQ

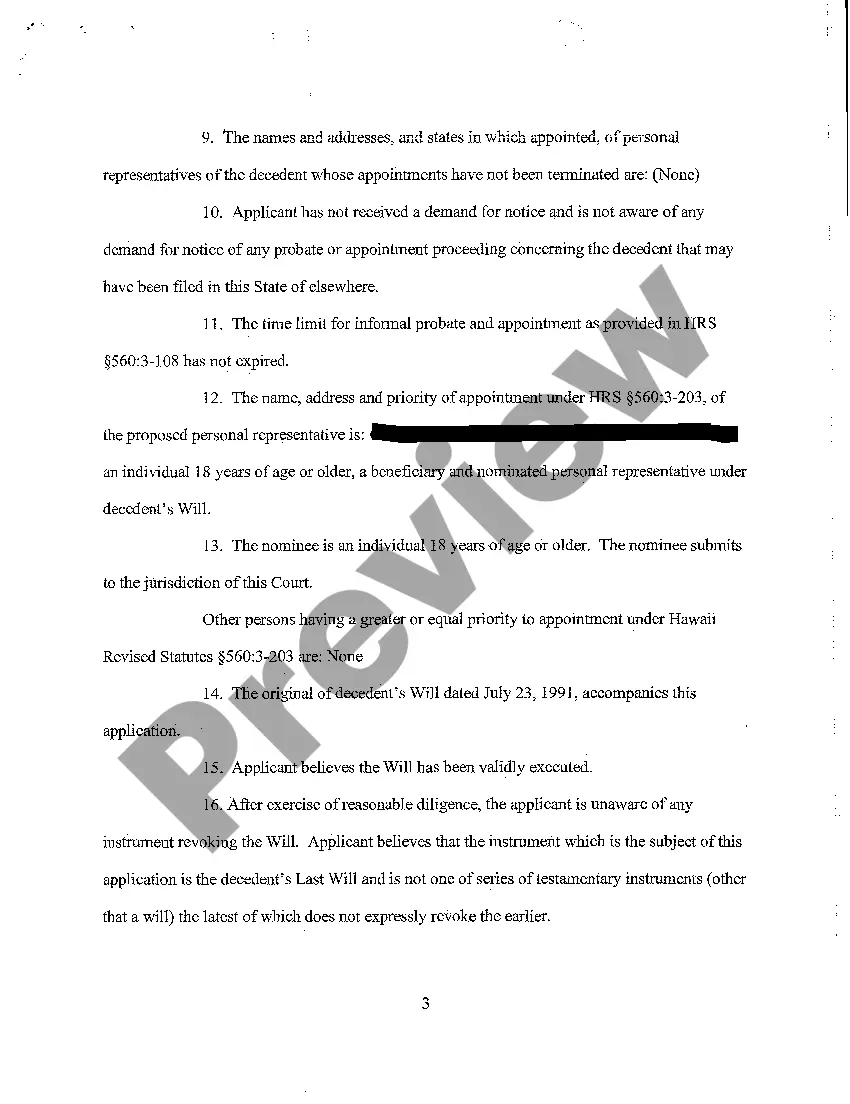

Rule 50 in Hawaii probate pertains to the use of forms and the procedure for petitions to the court. It establishes guidelines to ensure that the probate process remains efficient and organized. Familiarizing yourself with this rule can be beneficial, especially when handling a case like the Hawaii probate testate sample case 2 with answer. This knowledge can help streamline your navigation through the legal requirements.

In Hawaii, you typically have up to three years from the date of death to file for probate. However, it’s advisable to start the process sooner to avoid complications or disputes among heirs. Early action can also help expedite the distribution of the estate. Referencing the Hawaii probate testate sample case 2 with answer can clarify timelines and procedures, ensuring you are prepared.

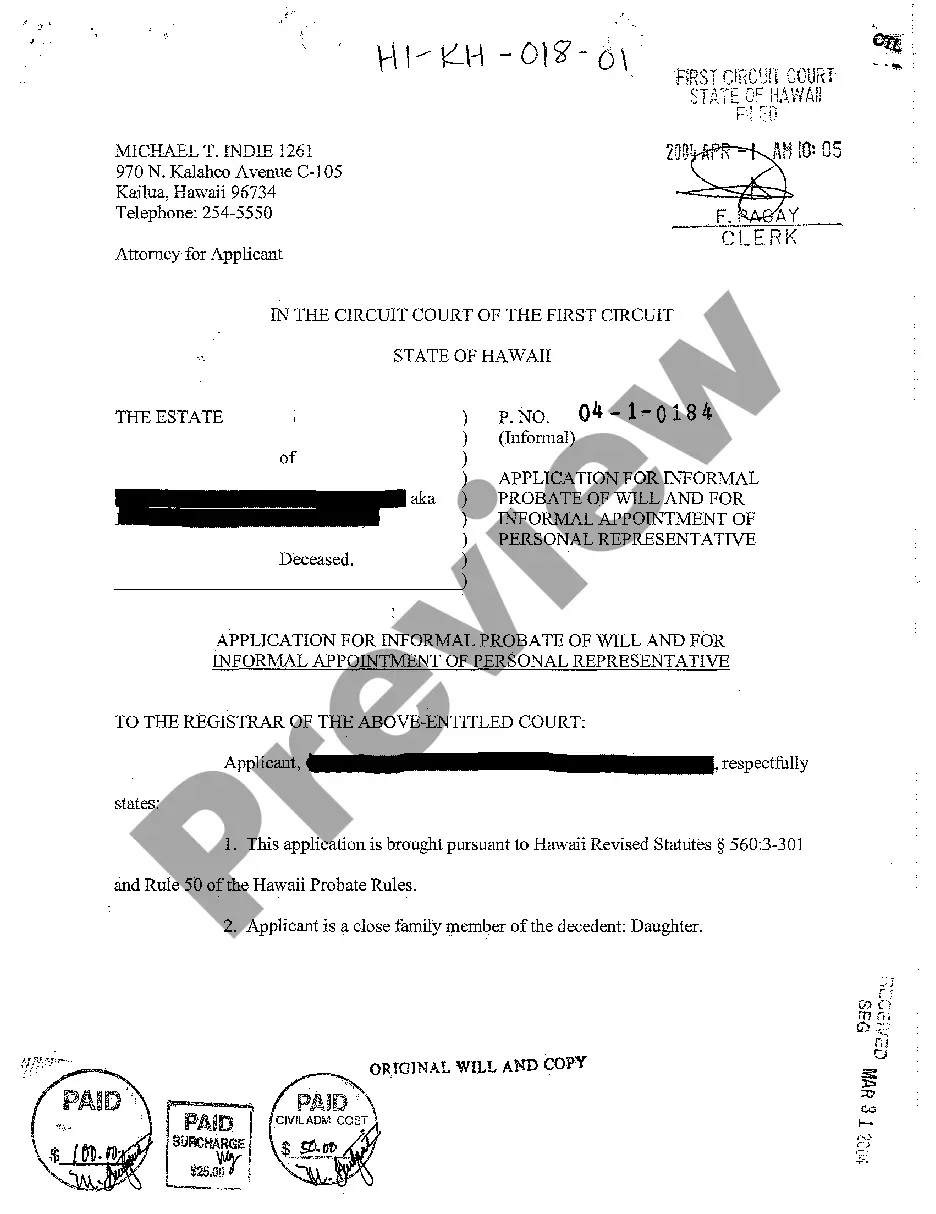

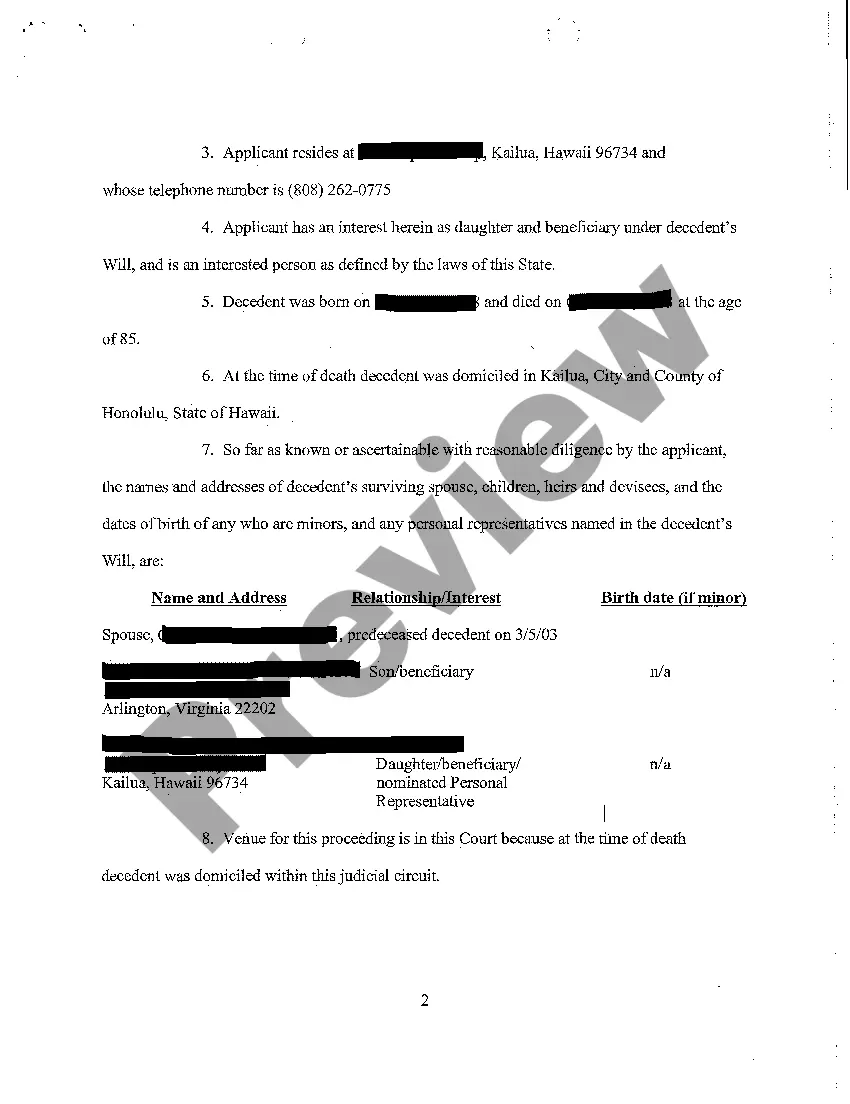

To file probate in Hawaii, you must first gather the necessary documents, including the deceased's will and a death certificate. You will then need to submit these documents to the Probate Court in the county where the deceased lived. It’s essential to follow the specific requirements to ensure a smooth process. Utilizing the Hawaii probate testate sample case 2 with answer can provide you with a practical example to help navigate this process.

The best way to avoid probate court is through proactive estate planning, such as creating a revocable living trust or designating payable-on-death accounts. These strategies can simplify the transfer of assets and eliminate the need for court involvement. Investigating Hawaii probate testate sample case 2 with answer may highlight effective methods for avoiding probate.

Rule 73 governs the process of distributing an estate in Hawaii probate and outlines the necessary steps to ensure lawful and equitable distribution of assets. It provides a framework for the appropriate handling of estate matters. To delve deeper, looking into Hawaii probate testate sample case 2 with answer is beneficial.

To avoid probate after death, strategic planning, such as creating joint ownership of assets or naming beneficiaries on accounts, is essential. Additionally, life insurance policies and retirement accounts can also bypass probate when properly set up. Resources like Hawaii probate testate sample case 2 with answer can help in navigating these routes.

Rule 44 involves the handling of small estates in Hawaii probate, providing a streamlined process for estates under a certain value. This rule enables quicker resolution and distribution without extensive legal procedures. For a comprehensive understanding, consider Hawaii probate testate sample case 2 with answer.

Rule 42 deals with the procedures for filing claims against an estate in Hawaii probate. It outlines the timelines and acceptable formats for submitting claims, which helps ensure that all creditors receive fair consideration. Familiarizing yourself with Hawaii probate testate sample case 2 with answer could clarify this rule further.

To avoid probate in Hawaii, individuals can utilize methods such as establishing a living trust or holding property jointly with rights of survivorship. These strategies allow for a smoother transfer of assets without the need for court intervention. Engaging with resources about Hawaii probate testate sample case 2 with answer can help you explore these options effectively.

Probate in Hawaii is triggered when an individual passes away owning assets solely in their name. This ensures that the deceased's estate is properly managed and distributed according to state laws. Estate administrators or executors typically oversee this process. Referring to Hawaii probate testate sample case 2 with answer can provide further insights.