Hawaii Informal Probate Information Sheet For Teachers

Description

Form popularity

FAQ

Rule 42 of the Hawaii Rules of Civil Procedure addresses the consolidation of actions. This rule allows a court to combine multiple cases that share common questions of law or fact, making the legal process more efficient. By simplifying proceedings, this rule can save time and resources for everyone involved. For specific applications, refer to the Hawaii informal probate information sheet for teachers, which may help clarify how these civil procedures can impact probate cases.

To avoid probate in Hawaii, consider establishing a living trust. This allows your assets to transfer directly to your beneficiaries without going through probate court, which can be time-consuming and costly. Additionally, you can name beneficiaries on accounts such as life insurance or retirement plans. For detailed guidance, look for the Hawaii informal probate information sheet for teachers, which provides essential insights on the probate process.

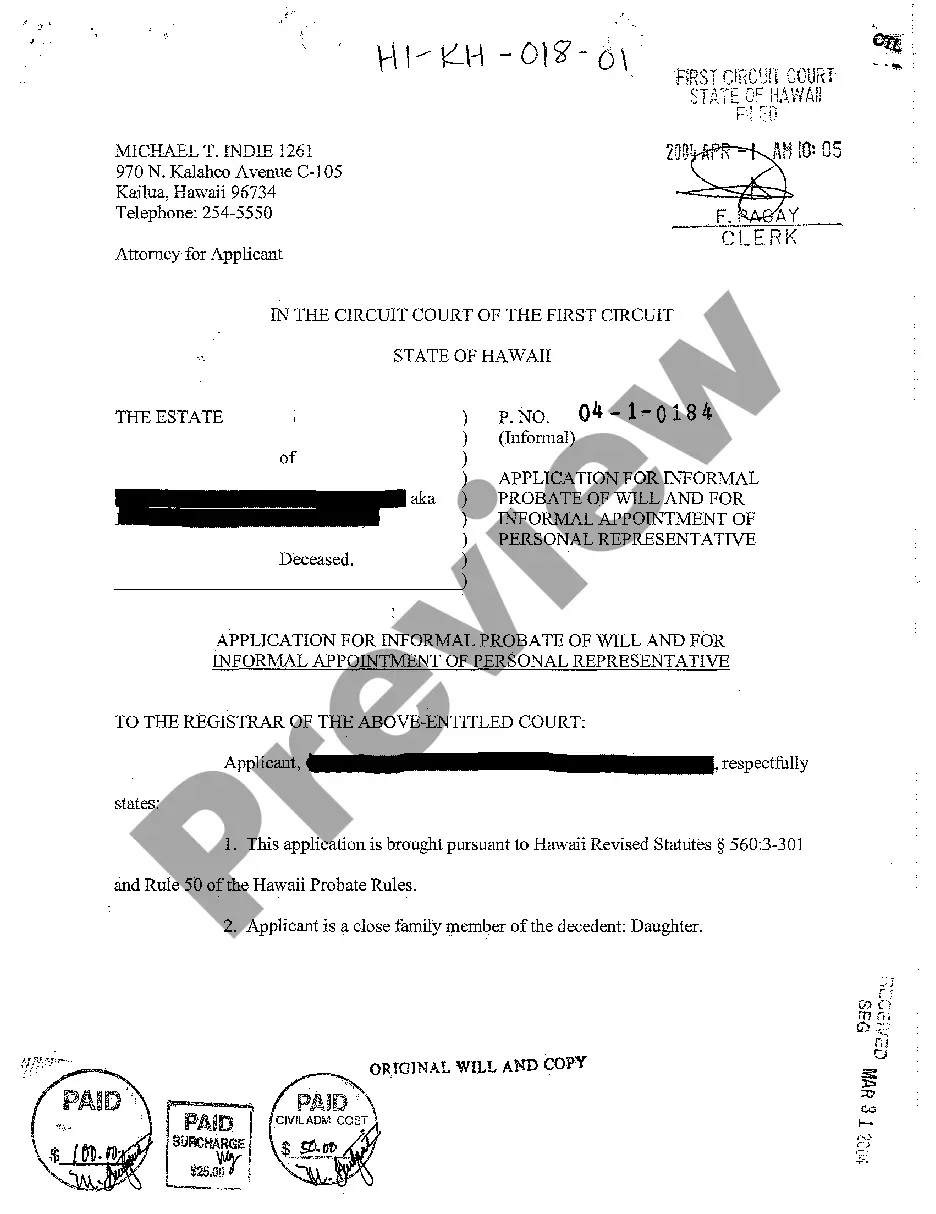

To find probate records in Hawaii, you can start by visiting the official website of the Hawaii State Judiciary. They provide access to various court records, including those related to informal probate. You may also consider using a Hawaii informal probate information sheet for teachers to help navigate the information more easily. Additionally, USLegalForms offers resources and templates that can assist you in understanding and obtaining the pertinent documents.

Rule 73 in Hawaii probate pertains to the procedures for informal probate administration. This rule simplifies the process, allowing for efficiency without a formal court hearing in many cases. For teachers, the Hawaii informal probate information sheet for teachers provides key insights into the implications of Rule 73. Understanding this rule can help you navigate probate more effectively.

In Hawaii, you generally have to file probate within three years of the date of death. However, it is wise to start the probate process sooner to avoid complications or delays. Utilizing the Hawaii informal probate information sheet for teachers can help you keep track of deadlines and ensure you meet all legal requirements. Remember, timely filing can facilitate a smoother probate experience.

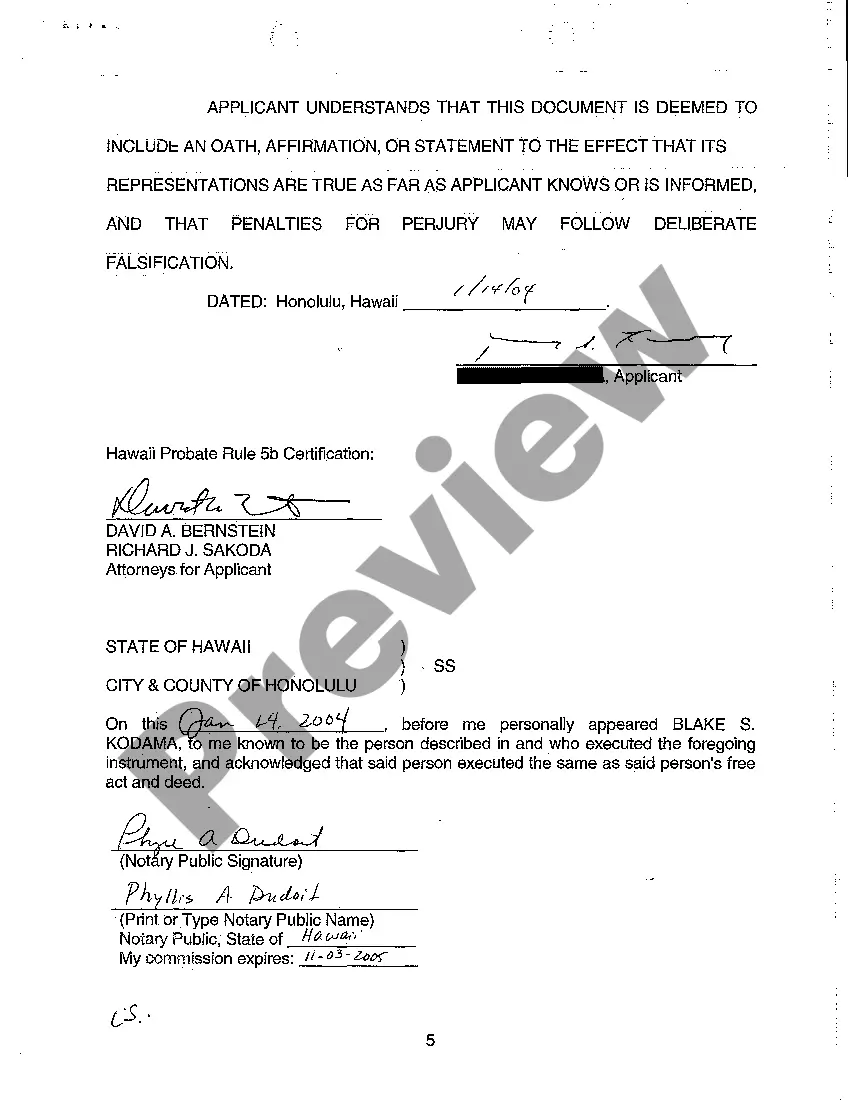

To file probate in Hawaii, you must first gather the necessary documents, including the deceased's will, if available. You then submit these documents to the probate court in the county where the deceased resided. The Hawaii informal probate information sheet for teachers can guide you through the process of filing and ensuring you have all required paperwork. It is recommended to consult with a legal professional for assistance.

Rule 50 in Hawaii probate involves the formal requirements for distributing an estate's assets. This rule offers guidelines that personal representatives must follow to ensure fair distribution among heirs. For a clear understanding, the Hawaii informal probate information sheet for teachers explains how to navigate these regulations with ease.

To avoid probate in Hawaii after death, individuals can establish living trusts, designate beneficiaries for accounts, and ensure property ownership is joint. These strategies allow assets to pass directly to heirs without going through probate. The Hawaii informal probate information sheet for teachers provides detailed steps on setting up these alternatives effectively.

The shortest time probate can take in Hawaii is around four to six months, primarily when there are no disputes and all necessary documents are filed promptly. However, this duration can extend if complications arise. For those seeking efficiency, utilizing resources like the Hawaii informal probate information sheet for teachers can offer practical tips.

The overall probate process in Hawaii varies widely depending on factors such as estate complexity and whether disputes arise. Typically, it takes longer if the estate includes significant assets or potential challenges from heirs. Consulting the Hawaii informal probate information sheet for teachers can provide insights on expected durations and procedures.