Hawaii Assignment Trust For Nature

Description

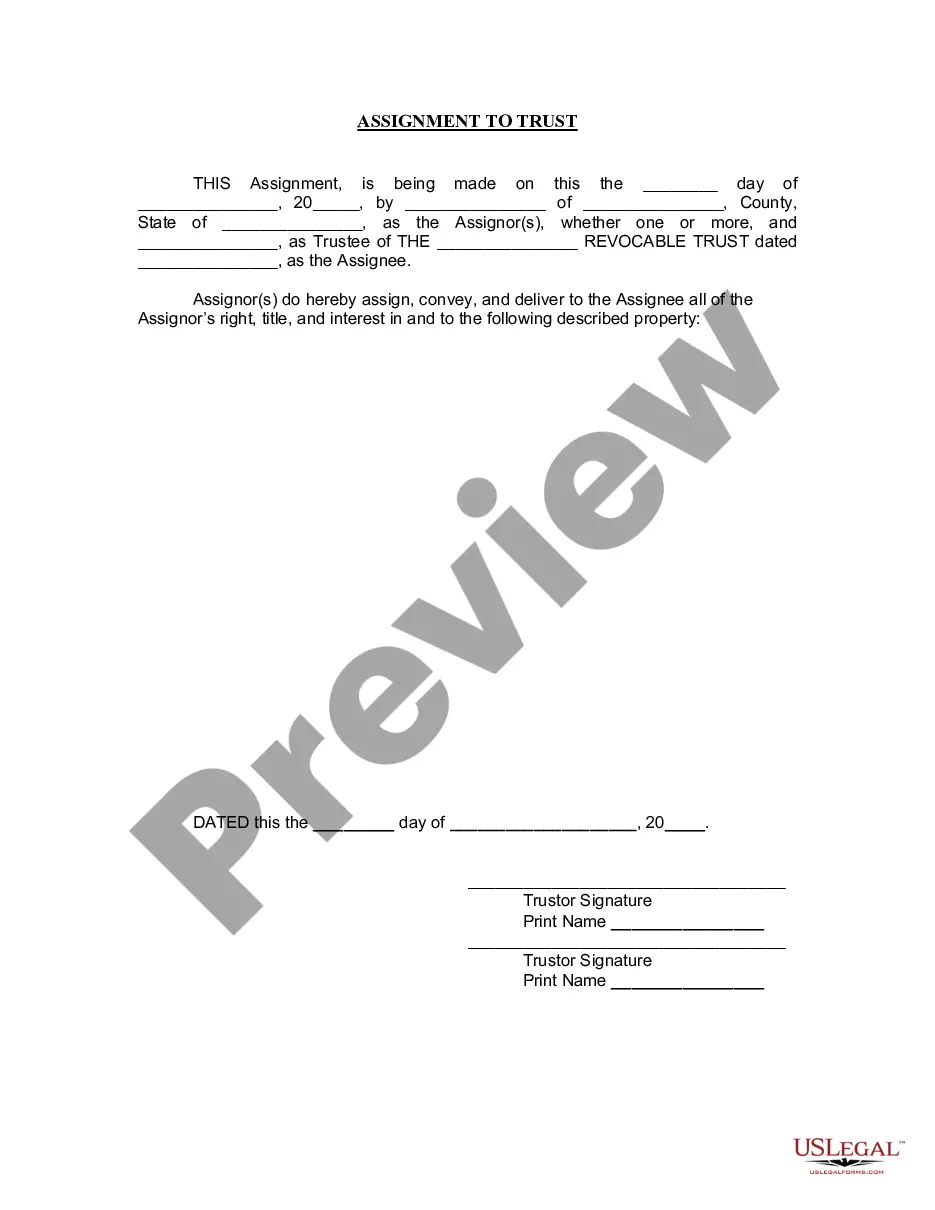

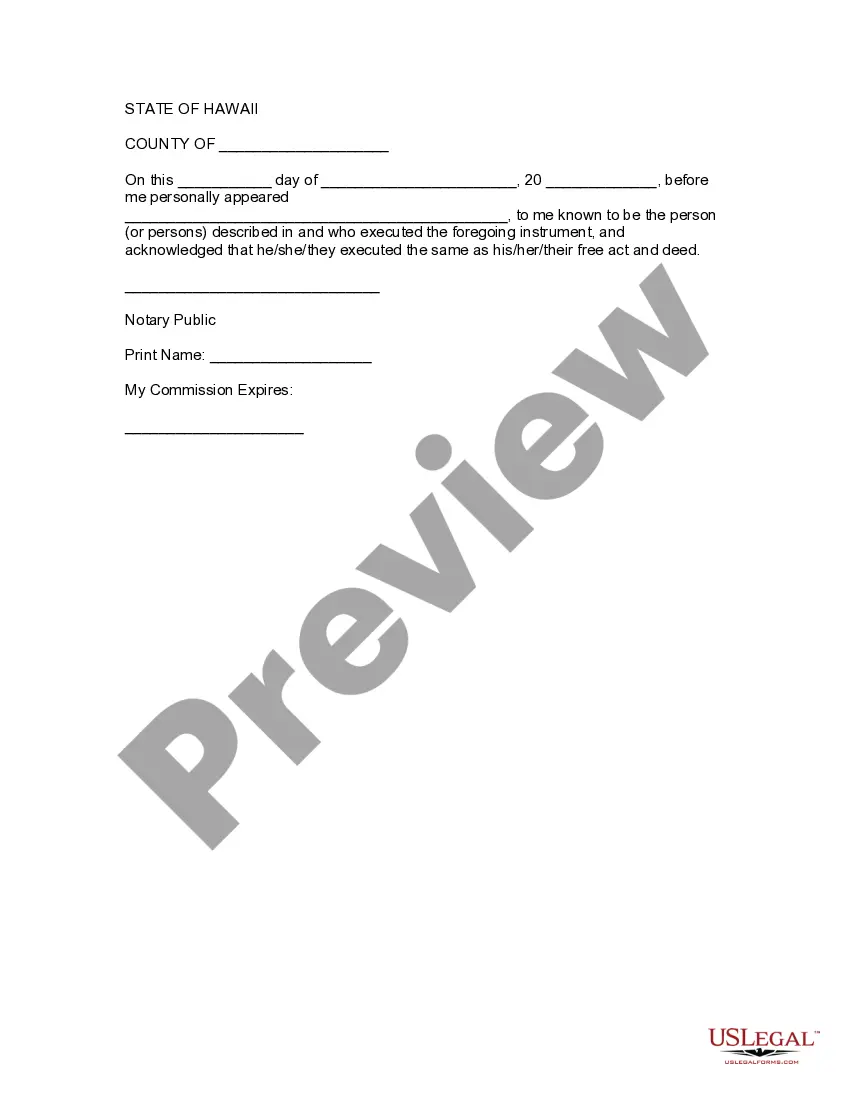

How to fill out Hawaii Assignment To Living Trust?

- Log in to your US Legal Forms account if you are a returning user. Verify that your subscription is active; renew it if necessary.

- For first-time users, start by checking the Preview mode to ensure you select the appropriate Hawaii assignment trust for nature form that meets local requirements.

- If the form doesn't meet your needs, use the Search tab to look for additional templates that may better suit your requirements.

- Once you find the correct document, click the Buy Now button. Choose a subscription plan and create an account for full access to the resources.

- Proceed with payment using your credit card or PayPal to finalize your subscription.

- After purchase, download your completed form to your device. You can access it anytime via the My Forms menu in your profile.

In conclusion, using US Legal Forms grants you access to a vast library and expert support, streamlining your legal document preparation. Take the first step in safeguarding your interests with legal clarity.

Start exploring your options today!

Form popularity

FAQ

Several states do not tax trust income, including states like Wyoming, South Dakota, and Alaska. While Hawaii does impose taxes on trust income, a Hawaii assignment trust for nature might present unique benefits and strategies for managing income effectively. For those looking to minimize tax burdens, understanding the differences across states can be advantageous.

In Hawaii, the frequency of filing GE taxes depends on your business revenue. Generally, businesses with higher revenue need to file more frequently, either monthly or quarterly. Staying on top of these deadlines is crucial, and using resources like US Legal Forms can help you keep track of filing requirements seamlessly.

Filing General Excise (GE) taxes late in Hawaii can result in penalties and interest charges. The penalties typically increase with the length of the delay. To avoid such penalties, it’s crucial to file on time, and utilizing tools like US Legal Forms can streamline the filing process, ensuring compliance with the law.

Yes, Hawaii generally taxes trust income, but the specifics depend on the type of trust and its structure. A Hawaii assignment trust for nature can potentially provide a framework to manage or minimize tax liability effectively. By aligning trusts with Hawaii's tax laws, you can enjoy certain benefits that might reduce your overall tax burden.

Some types of trusts are exempt from taxes, including charitable trusts and certain irrevocable trusts. A Hawaii assignment trust for nature, if properly set up, may also qualify for tax exemptions. It’s essential to consult with a legal professional to understand the specific requirements for maintaining tax-exempt status.

In Hawaii, certain types of income are not taxed, including social security benefits, certain types of pensions, and income from certain trusts. Specifically, a Hawaii assignment trust for nature can be structured to avoid certain taxes on specified income. Emphasizing proper trust management and adherence to local regulations can maximize these tax benefits.

The Land Reform Act in Hawaii was designed to address the concentration of land ownership and improve access to land for residents, especially Native Hawaiians. It sought to create more equitable opportunities for land use while preserving cultural integrity. Solutions like the Hawaii assignment trust for nature are essential to complement such reforms, ensuring long-term protection and sustainable use of land.

The Hawaii Land Use Commission consists of seven members appointed by the governor. These individuals serve to oversee land use policies and make decisions that affect the sustainable development of land across the state. Their work often intersects with initiatives like the Hawaii assignment trust for nature, emphasizing responsible land management.

Conservation land in Hawaii refers to parcels designated for the protection of ecosystems, wildlife habitats, and cultural sites. These lands are crucial for maintaining Hawaii's unique biodiversity and addressing environmental challenges. The Hawaii assignment trust for nature plays a vital role in securing and managing these conservation areas for future generations.

The Legacy Land Commission in Hawaii was established to oversee the funds provided by the state for conservation purposes. It evaluates applications for grants and provides financial support to protect important natural and cultural resources. This support is critical in initiatives like the Hawaii assignment trust for nature, which prizes land preservation.