Hawaii Child Support Calculator For Virginia

Description

How to fill out Hawaii Child Support Guidelines Worksheet For Joint Custody / Extensive Visitation?

Using legal templates that meet the federal and state regulations is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Hawaii Child Support Calculator For Virginia sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are easy to browse with all documents organized by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your paperwork is up to date and compliant when getting a Hawaii Child Support Calculator For Virginia from our website.

Getting a Hawaii Child Support Calculator For Virginia is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the instructions below:

- Analyze the template using the Preview option or through the text description to ensure it meets your needs.

- Look for another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Hawaii Child Support Calculator For Virginia and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Gross income ?shall mean all income from all sources, and shall include, but not be limited to, income from salaries, wages, commissions, royalties, bonuses, dividends, severance pay, pensions, interest, trust income, annuities, capital gains, social security benefits, worker's compensation benefits, disability ...

To calculate child support in Virginia the DCSE uses the Income Shares Model. The Income Shares Model estimates the amount of money that would have been available to the child if the parents had not divorced or separated. This estimated amount is then divided proportionately between the parents based on their income.

To find your individual support obligation, first multiply the total shared support obligation by the other parent's time percentage. If the other parent pays for work-related child care or the children's health insurance premiums, add the monthly cost to your result.

If the combined family income is $35,000 or greater per month, it falls outside the table and support is based on a percentage of income from 2.6% for one child to 5% for six children. Items that are added to the support obligation include the cost of health insurance and any work-related childcare expenses.

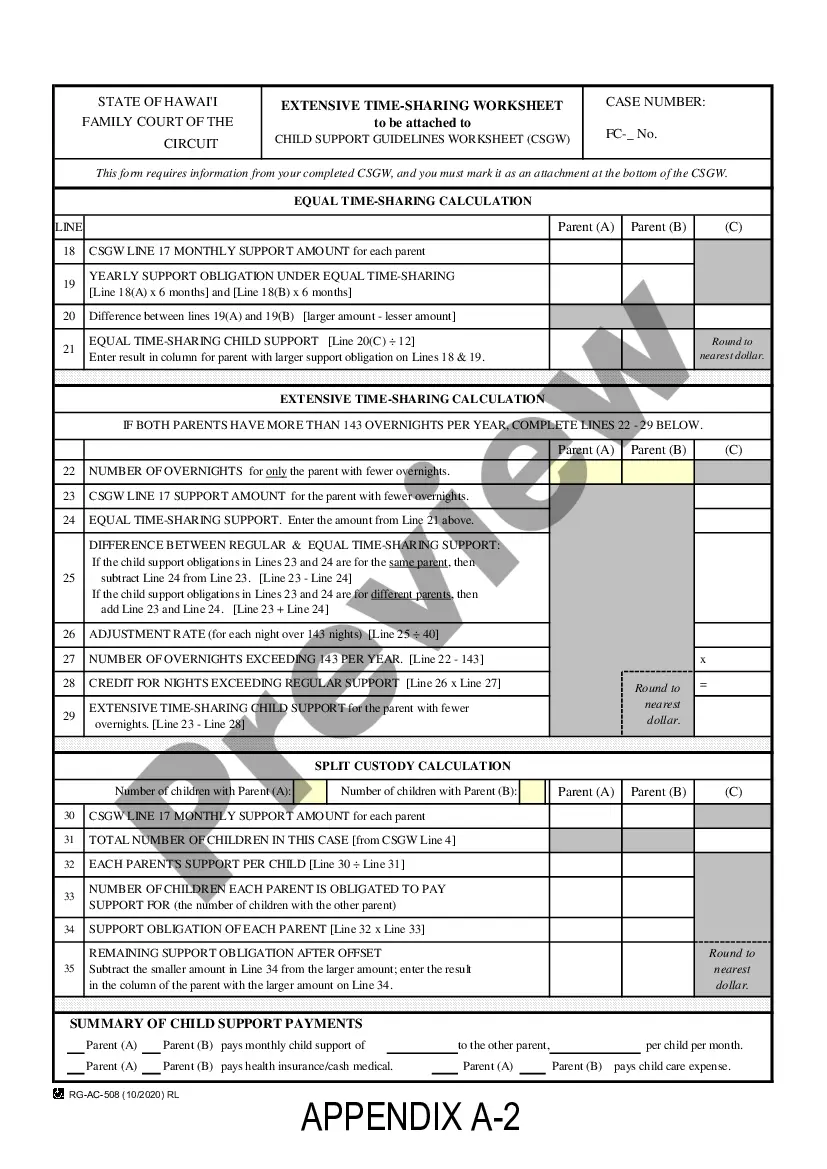

Hawaii child support is based on the number of overnight visits. Hawaii uses overnights or where the children sleep as the basis for figuring shared custody timeshare percentages in its child support formula. Besides income, overnight totals are a key part of the Hawaii child support formula.