Hawaii Together Agreement For Change

Description

How to fill out Hawaii Non-Marital Cohabitation Living Together Agreement?

- Visit the US Legal Forms website and log into your account if you are an existing user. Ensure your subscription is active.

- For first-time users, explore the extensive library. Use the Preview mode to examine the form and ensure it aligns with your local jurisdiction requirements.

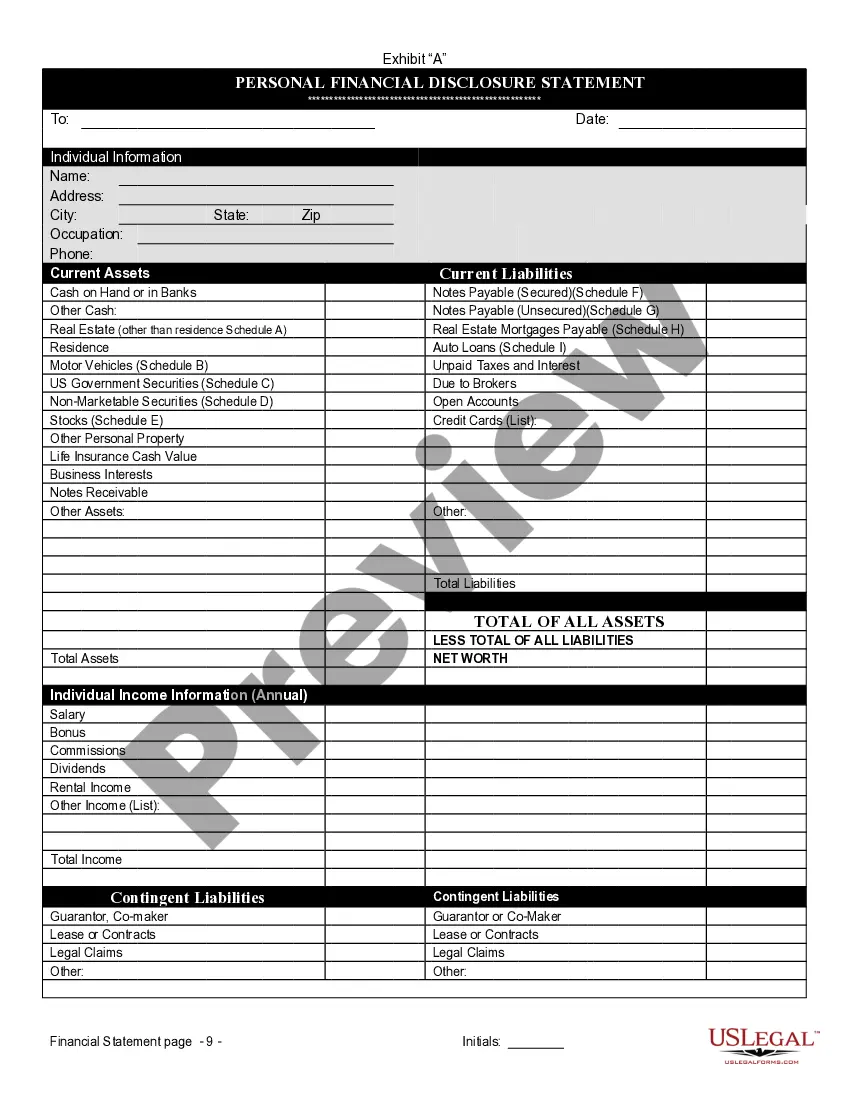

- If you need a different form, utilize the search feature to find the correct template.

- Select and click on the 'Buy Now' option to choose your preferred subscription plan. Registration is required to access the resources.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Once the transaction is successful, download the form to your device. You can also find it under the 'My Forms' section in your profile for future reference.

With US Legal Forms, you benefit from a robust collection of over 85,000 fillable legal forms designed for ease of use. This extensive library empowers you to complete legal documents efficiently and accurately.

Take control of your legal needs today. Start your journey with US Legal Forms and access the 'Hawaii together agreement for change' now!

Form popularity

FAQ

Changing a property title in Hawaii requires you to complete a deed and submit it to the Bureau of Conveyances. You must also ensure that all parties involved agree to the transfer, and it is wise to keep documents organized. Utilizing the Hawaii together agreement for change can facilitate this process and ensure legal compliance. To navigate this effectively, consider turning to Uslegalforms for the necessary forms and expert advice.

To obtain a legal separation in Hawaii, you will need to file a petition with the family court. This process involves submitting necessary forms that outline your situation, including finances and child custody arrangements. For assistance, you may consider the Hawaii together agreement for change, which helps streamline this arrangement. Using platforms like Uslegalforms can simplify the process by providing templates and guidance tailored to your needs.

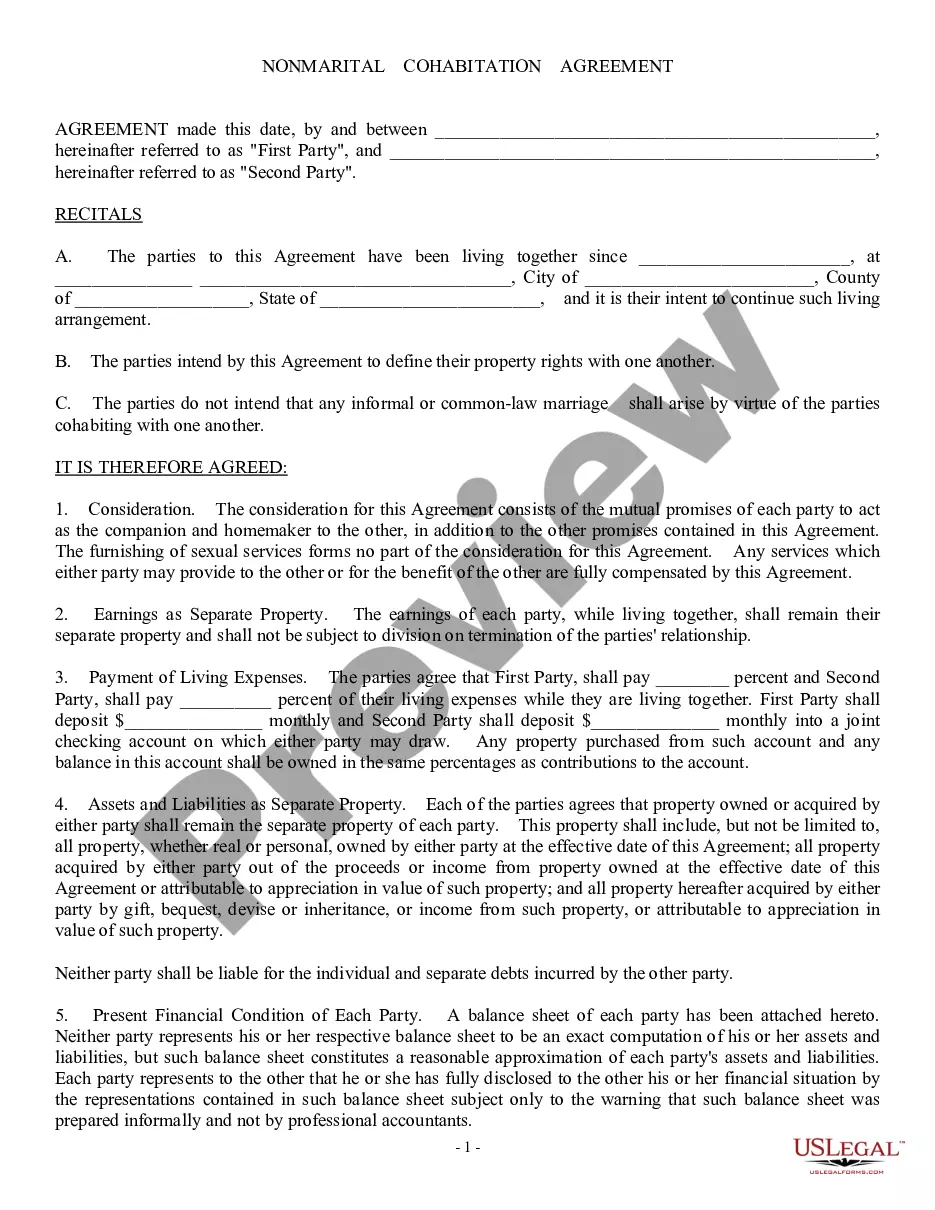

Hawaii does not have specific laws regulating cohabitation for unmarried couples. The state recognizes and allows couples to live together freely. Implementing a together agreement for change can fortify your partnership by addressing issues such as financial management and property rights. This agreement can serve as a necessary foundation for any couple living together in Hawaii.

As of now, there are no states in the United States where it is illegal for unmarried couples to live together. In Hawaii, cohabitation is not only legal but also common. Nevertheless, some couples may benefit from a together agreement for change to outline their living arrangements and responsibilities. This ensures clarity and can help prevent conflicts down the road.

An unmarried couple can absolutely live together in Hawaii without any legal restrictions. Cohabitation is common and accepted. However, to ensure a smooth living arrangement, a together agreement for change can outline key details, such as financial contributions and property ownership. This can lead to a more harmonious cohabitation experience.

In general, unmarried couples are not automatically responsible for each other's debt in Hawaii. Each person is liable for their own financial obligations unless they jointly incurred the debt. Establishing a together agreement for change can clarify financial responsibilities and can help prevent misunderstandings in the future. This agreement can serve as a helpful resource if any debt-related issues arise.

Yes, it is legal for unmarried couples to live together in Hawaii. The state recognizes cohabitation without imposing laws that restrict it. However, having a together agreement for change can offer clarity on financial and property matters, ensuring both parties understand their rights and responsibilities. It's a proactive step to take.

If you split up as an unmarried couple, you generally do not have the same legal protections as married couples. In Hawaii, a together agreement for change can help outline property division and responsibilities during a breakup. Without such an agreement, disputes over shared property or assets can become complicated. It is wise to consult legal resources to ensure your interests are protected.

The conveyance tax in Hawaii is usually the obligation of the seller in a real estate transaction. When dealing with a Hawaii together agreement for change, it's vital to understand this tax and its impact on the sale. This tax helps fund various state programs and services. Ensure that you address this responsibility in your closing statements to avoid complications.

The transient accommodations tax (TAT) is typically the responsibility of accommodations providers, such as hotels and vacation rentals. If you are entering a Hawaii together agreement for change, ensure that you understand this tax. It is your obligation to collect the TAT from guests and remit it to the state. Compliance with tax regulations is crucial for successful management of your properties.