Short Form Trust Agreement Hawaii For First Time

Description

How to fill out Hawaii Certificate Of Trust Existence And Authority By Individual?

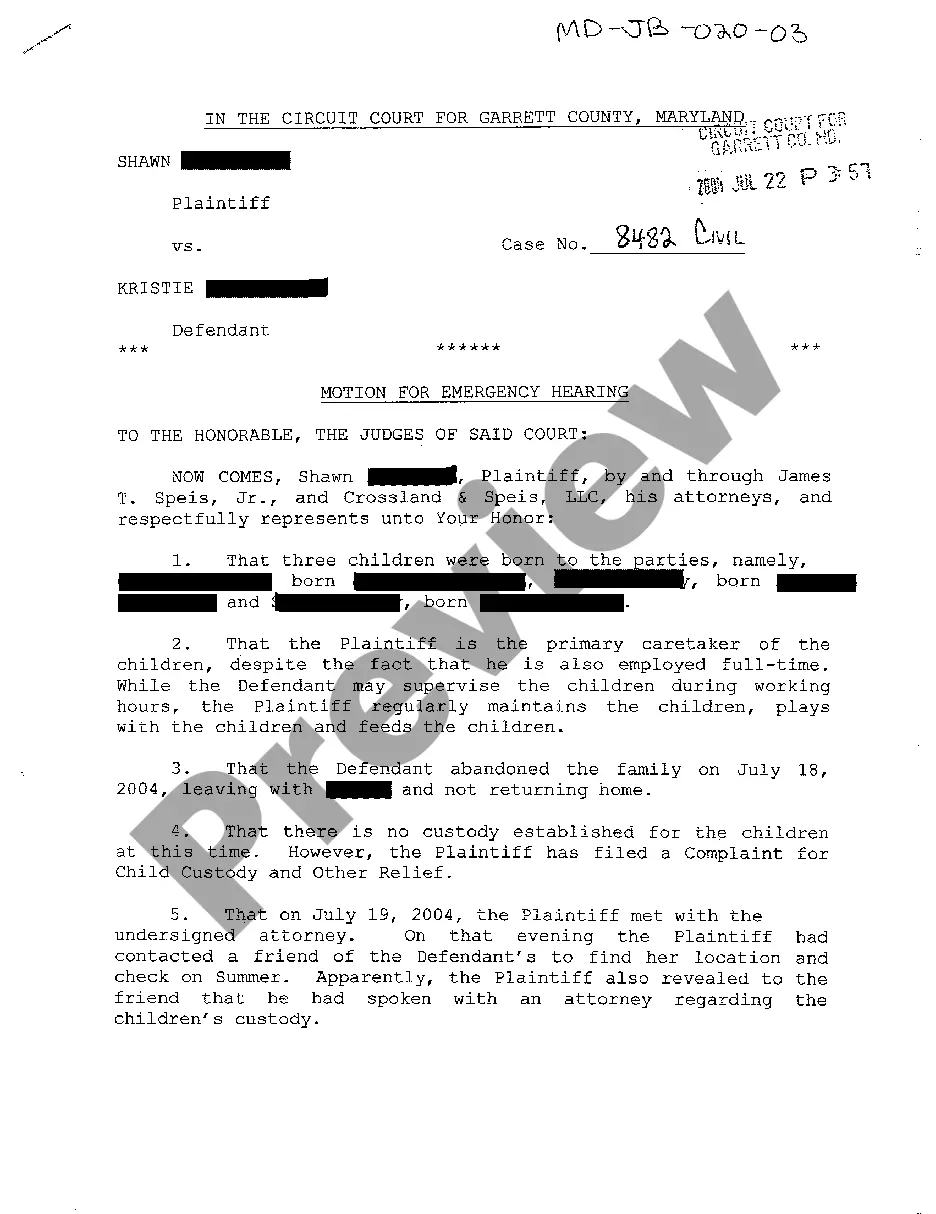

Whether for business purposes or for individual affairs, everyone has to manage legal situations sooner or later in their life. Filling out legal documents requires careful attention, starting with choosing the appropriate form sample. For example, when you choose a wrong version of the Short Form Trust Agreement Hawaii For First Time, it will be rejected once you submit it. It is therefore crucial to get a trustworthy source of legal files like US Legal Forms.

If you need to obtain a Short Form Trust Agreement Hawaii For First Time sample, follow these easy steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s information to make sure it suits your case, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect document, get back to the search function to find the Short Form Trust Agreement Hawaii For First Time sample you require.

- Download the file when it matches your needs.

- If you have a US Legal Forms profile, simply click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Pick the proper pricing option.

- Complete the profile registration form.

- Select your payment method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Short Form Trust Agreement Hawaii For First Time.

- Once it is saved, you can fill out the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time looking for the appropriate template across the internet. Take advantage of the library’s easy navigation to find the appropriate form for any situation.

Form popularity

FAQ

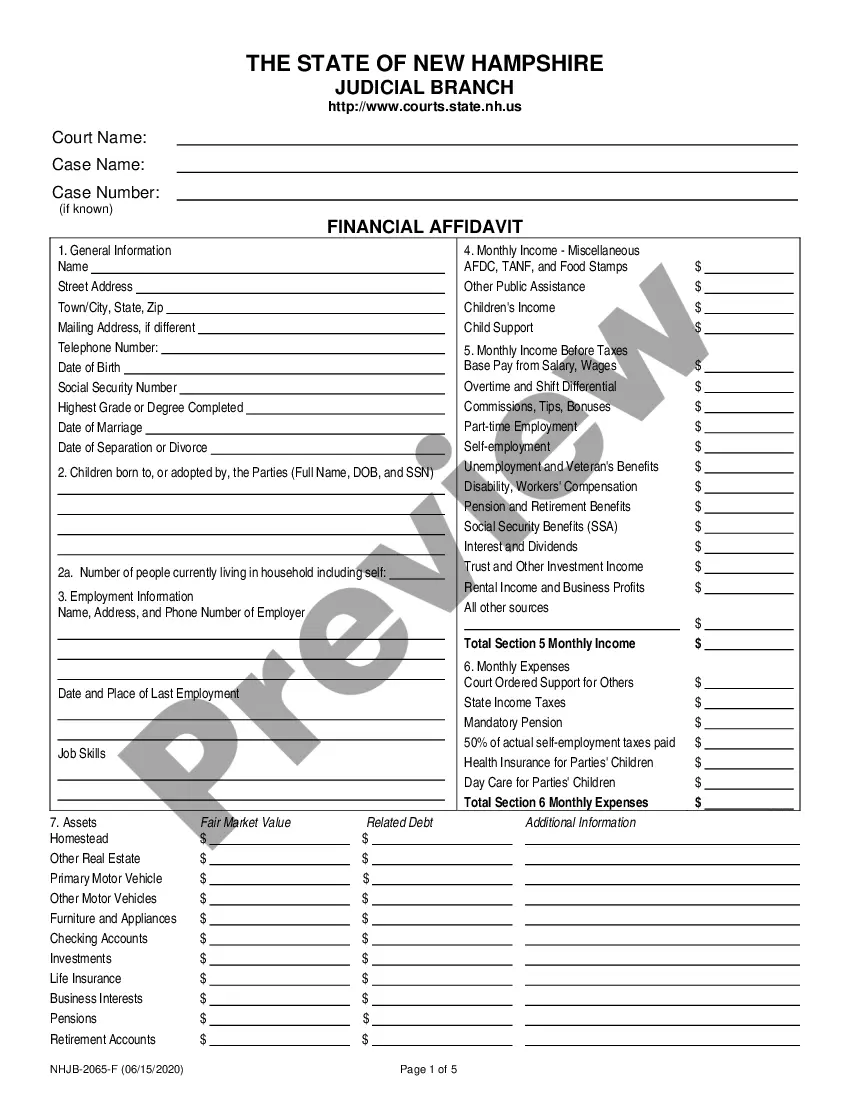

The cost of setting up a trust in Hawaii varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

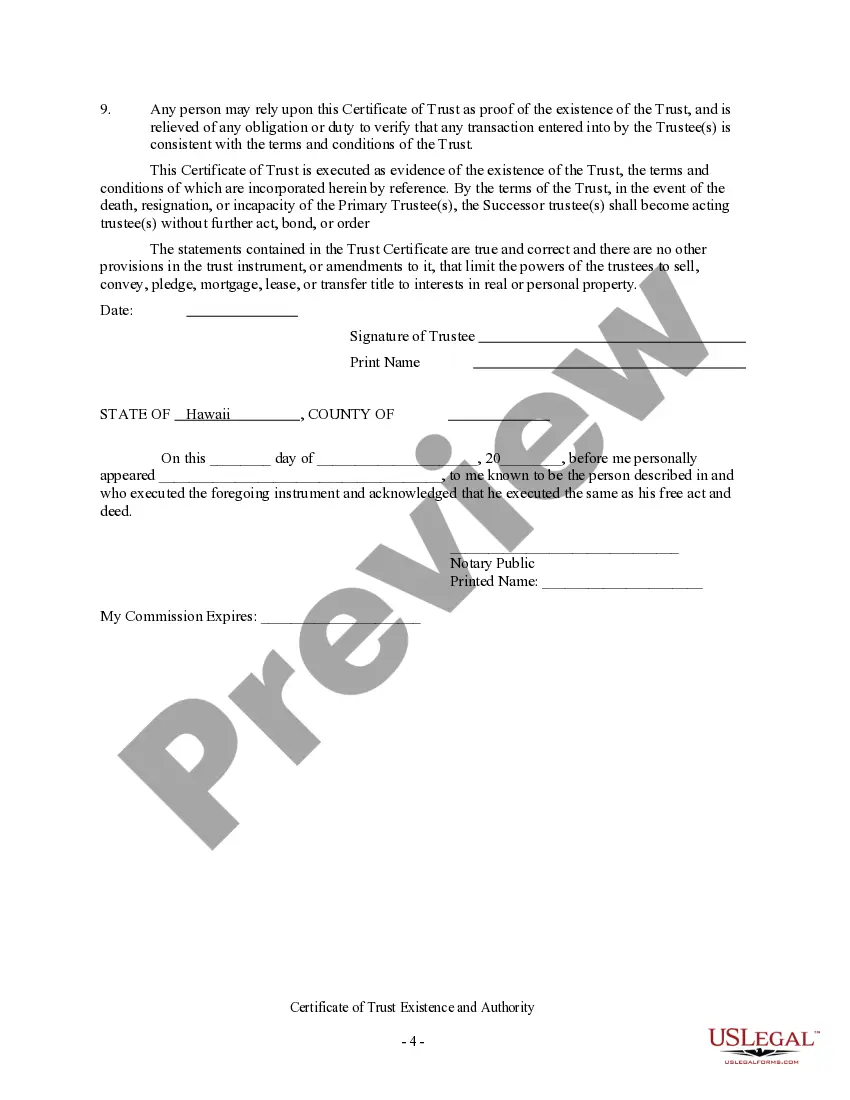

To set up a trust you need to have a trust document prepared with all of your details and specifications. You sign the document before a notary public. Finally, you transfer ownership of assets from your name to that of the trust. Living trusts can be an excellent tool to create control and privacy over family wealth.

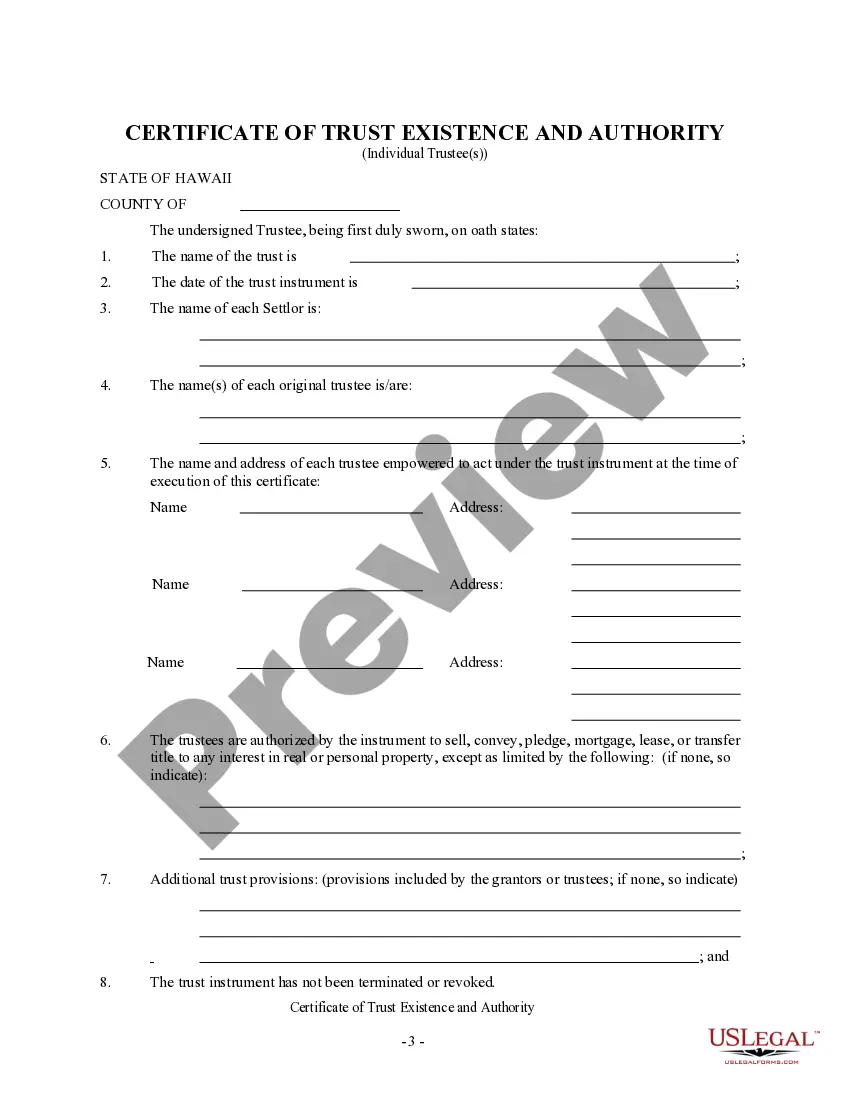

The Short Form Trust, also called a Trust Certificate, contains only the most pertinent information in your Long Form Trust. It is used to prove to institutions, such as banks and investment firms, that you are the trustee of your trust and the powers and duties you have as trustee.

To register a trust, a person shall file with the clerk of the court in the judicial circuit in which the trust has its administrative situs a Trust Registration Statement that complies with the requirements of Rule 4 and contains the name of the trust, the date the trust was created, the name and address of the ...

A will must be probated and become public record. A trust needs no court approval and is effective on its own. The beneficiaries, assets, and terms of the trust never become public record.