Largest Estate In Hawaii

Description

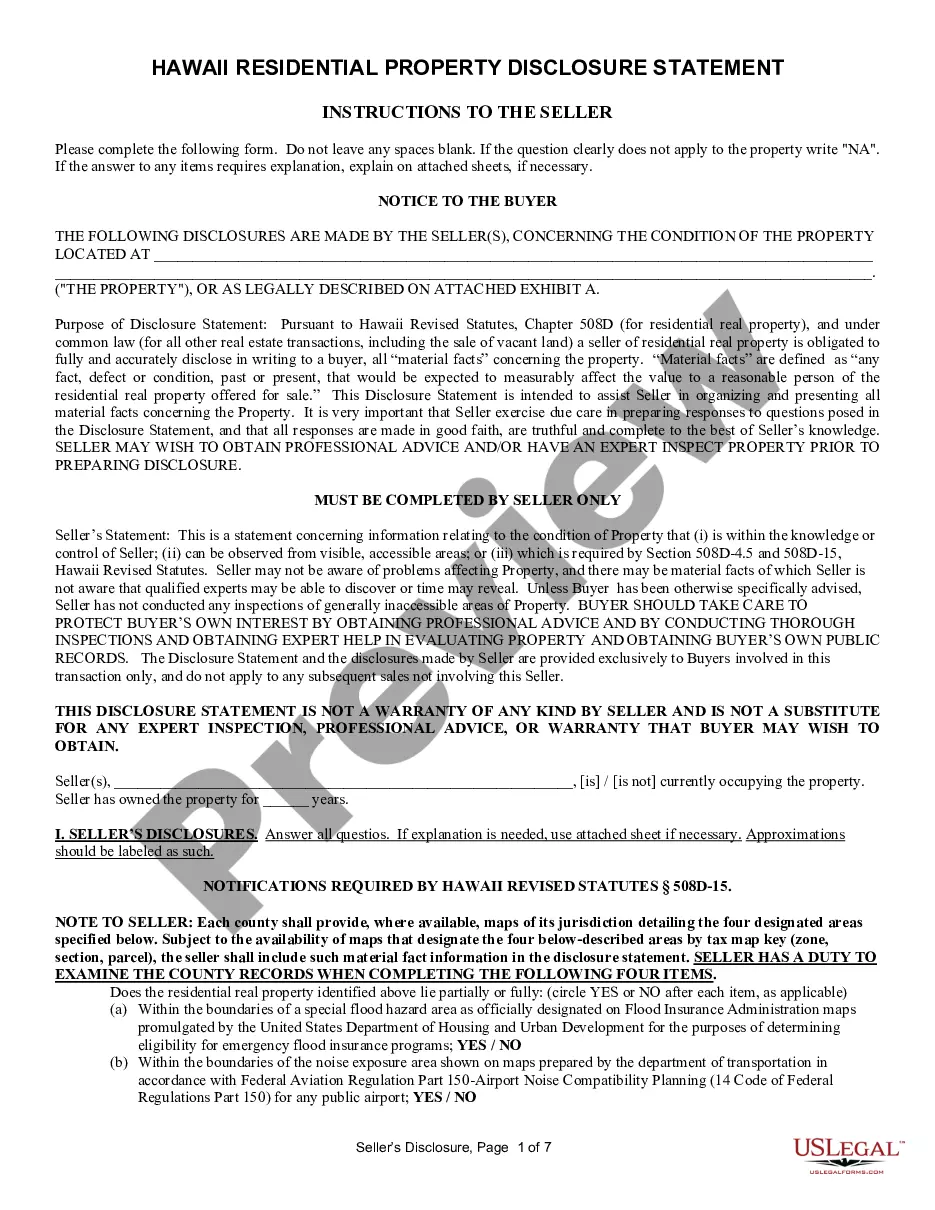

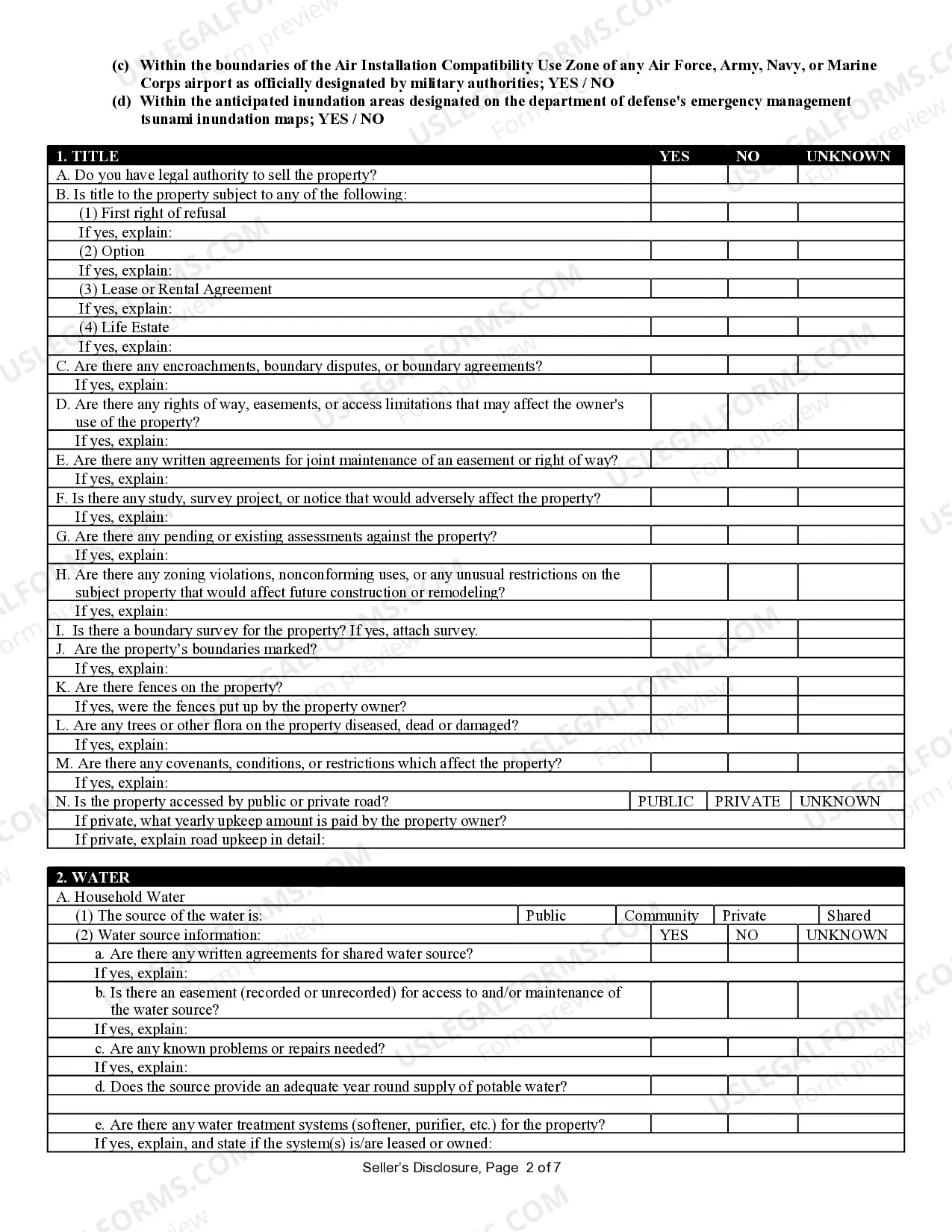

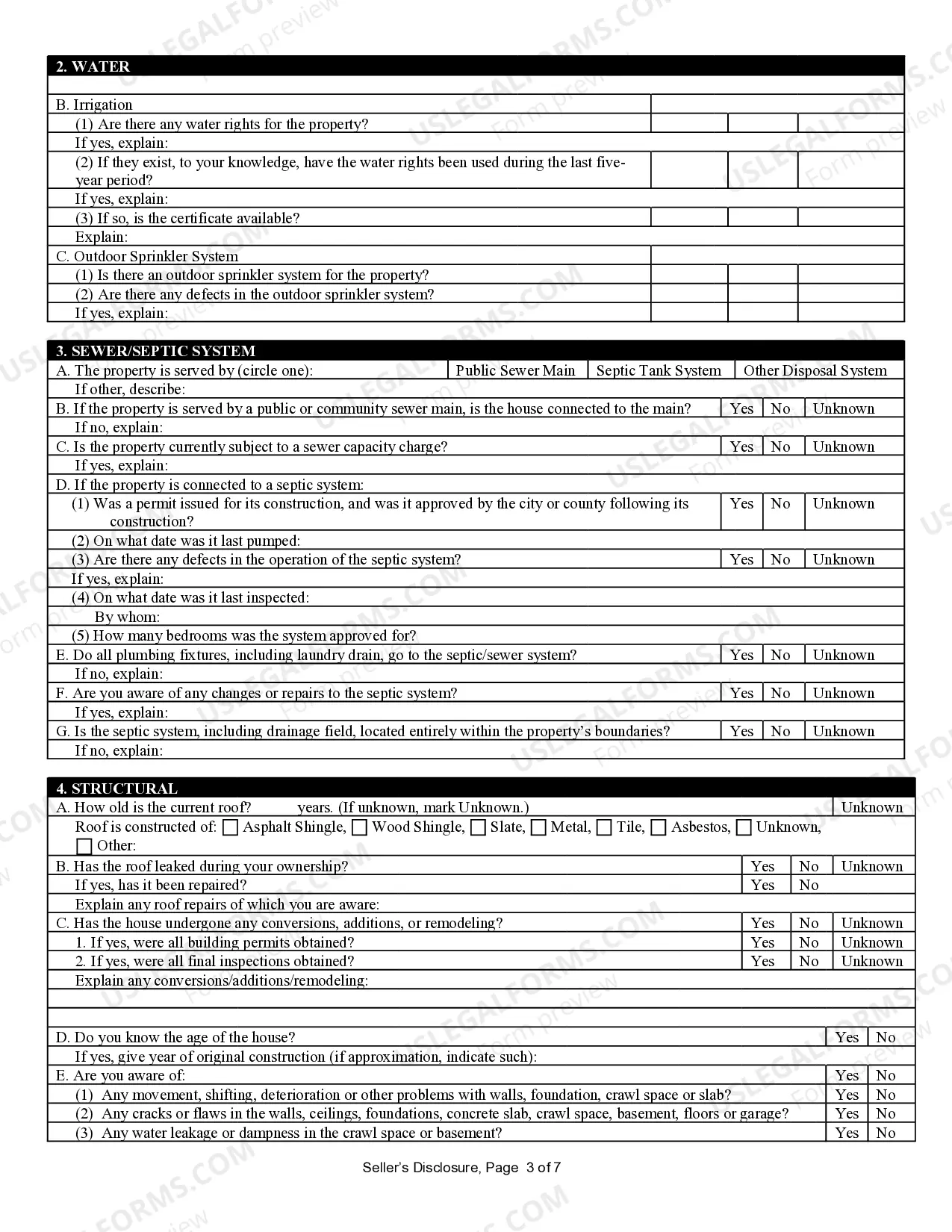

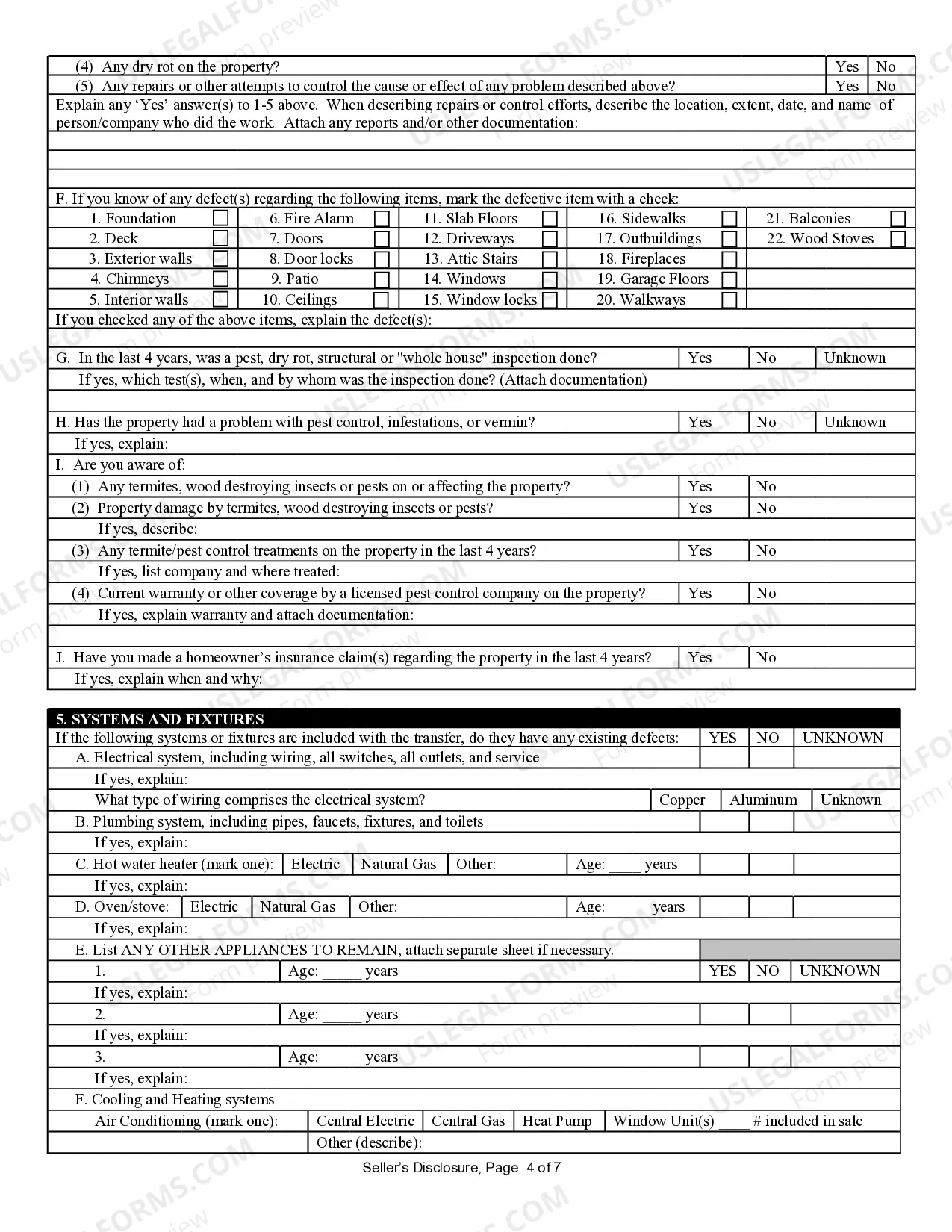

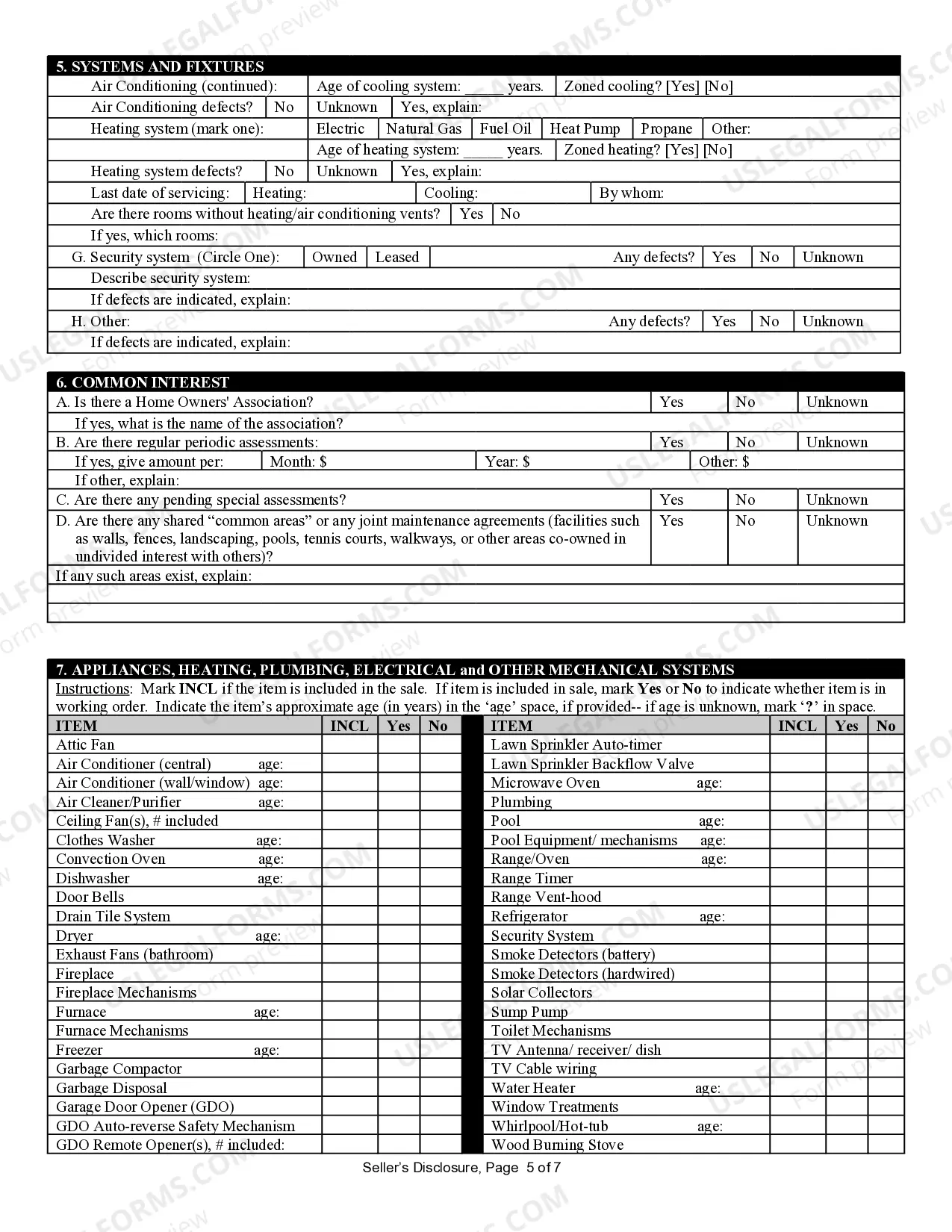

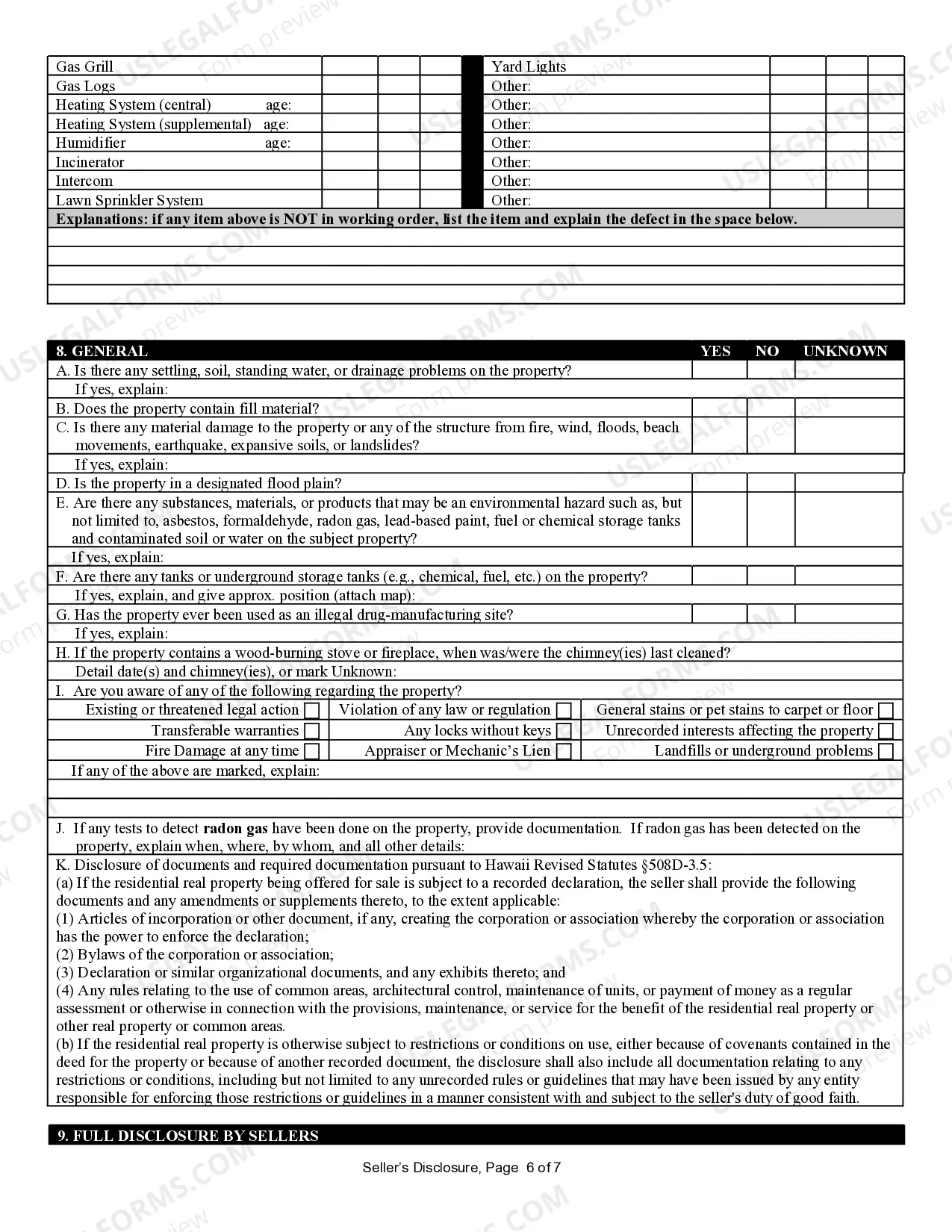

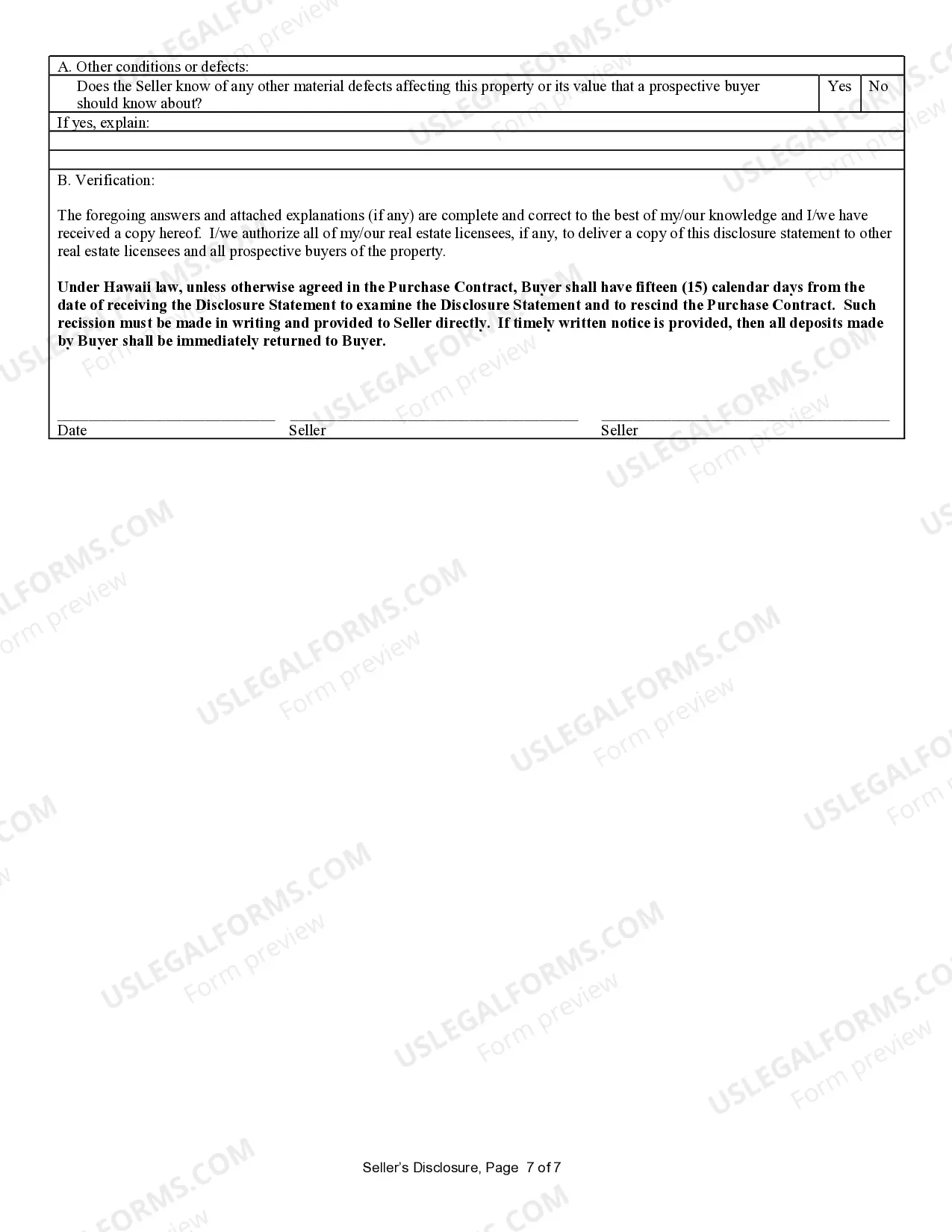

How to fill out Hawaii Residential Real Estate Sales Disclosure Statement?

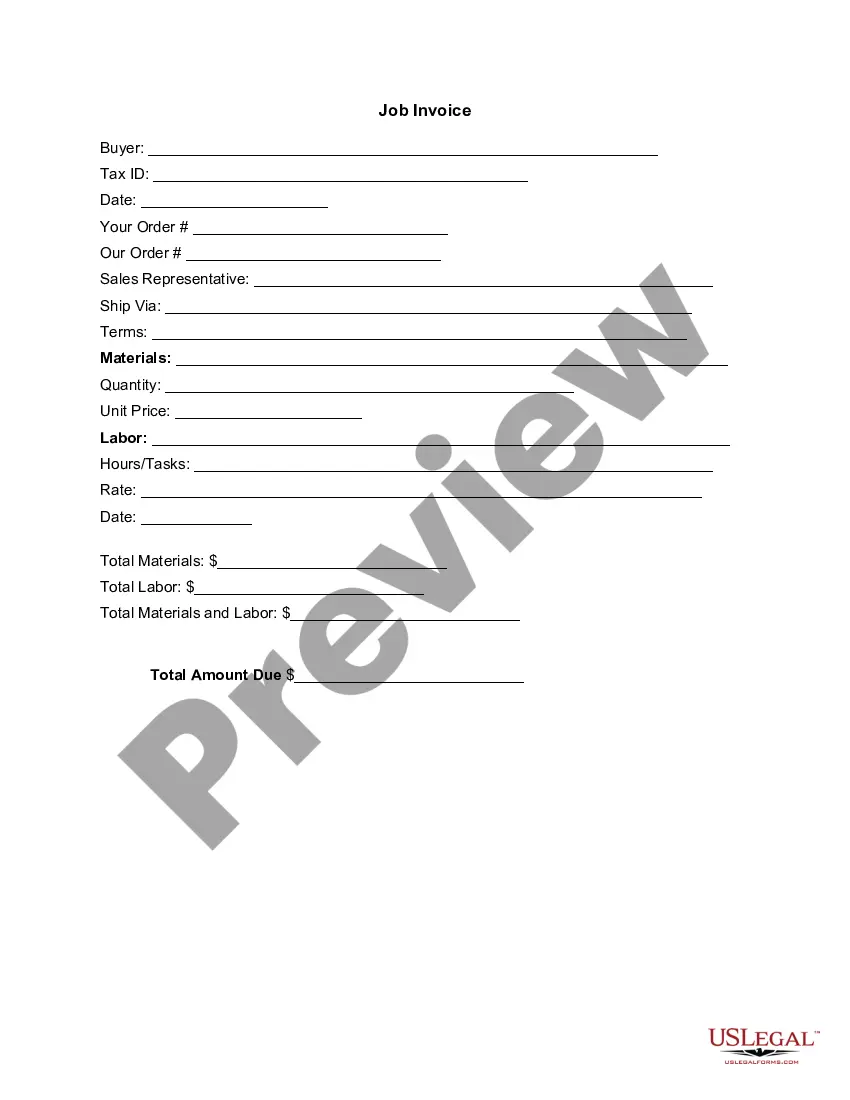

Managing legal paperwork and processes can be a tedious addition to your routine.

Largest Estate In Hawaii and similar forms often necessitate that you search for them and navigate the steps to fill them out correctly.

As a result, whether you are handling fiscal, legal, or personal issues, utilizing a thorough and user-friendly online directory of forms at your disposal will be very beneficial.

US Legal Forms is the ultimate online platform for legal templates, featuring over 85,000 state-specific forms and various resources to assist you in completing your paperwork with ease.

Is this your initial experience using US Legal Forms? Register and create an account in just a few moments and you’ll have access to the form directory and Largest Estate In Hawaii. Then, adhere to the instructions below to fill out your form: Make sure you have identified the correct form using the Preview option and reviewing the form description. Choose Buy Now when ready, and select the subscription plan that fits your needs. Click Download then complete, eSign, and print the form. US Legal Forms has 25 years of experience aiding clients in managing their legal documents. Locate the form you seek today and streamline any procedure seamlessly.

- Browse the directory of relevant documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Safeguard your document management processes with a premium service that enables you to assemble any form within minutes without extra or concealed fees.

- Simply Log In to your account, locate Largest Estate In Hawaii and acquire it immediately in the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

The largest private landowner in Hawaii is the Parker Ranch, which spans thousands of acres on the Big Island. This historic ranch has a rich legacy and plays a significant role in Hawaii's agricultural landscape. If you are exploring opportunities on the largest estate in Hawaii, the Parker Ranch is an important entity to consider for potential land acquisition or partnership. This insight can guide you in navigating the unique real estate market in Hawaii.

In Hawaii, a homesite within a larger piece of property is often referred to as a 'house lot' or 'homesite.' This designation allows for the development of residential structures while preserving the surrounding land. If you are considering properties on the largest estate in Hawaii, understanding these terms is essential. It ensures you can make informed decisions regarding land use and potential development.

In Hawaii, there is no specific age at which you stop paying property taxes. However, certain exemptions, such as the Homeowner Exemption, can reduce your tax burden if you meet specific criteria. For those owning large properties, like the largest estate in Hawaii, exploring these exemptions can lead to significant savings.

Hawaii's estate tax exemption is set at $5.49 million as of 2023, meaning estates valued below this threshold are not subject to estate tax. For those managing large estates, such as the largest estate in Hawaii, understanding this exemption is vital for effective estate planning. Consulting with a legal expert can help ensure you maximize your benefits.

Yes, capital gains are taxable in Hawaii, and the rates depend on your income level. This tax applies to profits made from selling properties, including high-value ones like the largest estate in Hawaii. It's crucial to plan your sale carefully and consult a tax advisor to minimize your tax burden.

To avoid capital gains tax in Hawaii, consider strategies like holding onto the property for more than a year, which may qualify for favorable tax rates. Additionally, utilizing deductions and considering a 1031 exchange can be effective. For more tailored advice, platforms like US Legal Forms can help you navigate the process and ensure compliance with local laws.

Hawaii imposes a mansion tax on properties that sell for $1 million or more. If you're considering purchasing the largest estate in Hawaii, be mindful of this tax, as it can significantly impact your overall investment. Understanding the mansion tax will help you budget effectively and avoid surprises during your transaction.

One straightforward method to avoid capital gains tax is to use a 1031 exchange, which allows you to defer taxes by reinvesting in similar properties. This strategy can be particularly beneficial when dealing with valuable properties like the largest estate in Hawaii. Always seek advice from a tax expert to navigate the process effectively.

In Hawaii, capital gains tax on real estate can range from 0% to 7.25%, depending on your income bracket. If you sell a property, such as the largest estate in Hawaii, you may need to account for these taxes. It's essential to consult a tax professional to understand your specific situation and ensure you comply with state regulations.

To qualify for certain land benefits in Hawaii, you typically need to be at least 50% Hawaiian. This requirement stems from the state's laws aimed at preserving native Hawaiian land and culture. However, for specific programs or estate transactions, the criteria can vary. If you're interested in the largest estate in Hawaii, understanding these nuances is essential, and resources like US Legal Forms can guide you through the process.