Hawaii Provisions Withholding

Description

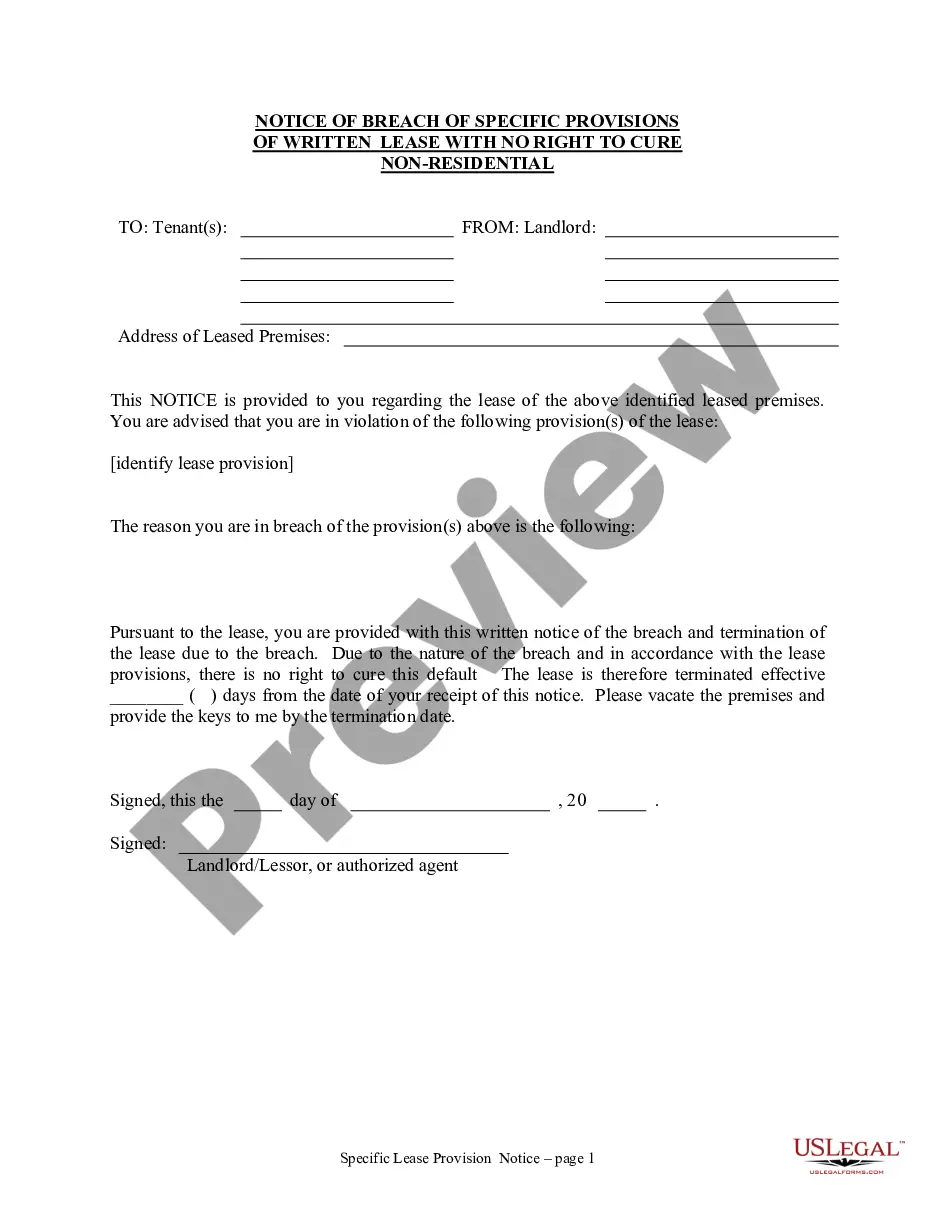

How to fill out Hawaii Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With No Right To Cure For Nonresidential Property From Landlord To Tenant?

- Begin by logging into your US Legal Forms account if you're a returning user. Ensure your subscription is active.

- For new users, begin by browsing the extensive online library of over 85,000 legal forms. Carefully review the preview and descriptions to select the appropriate document that follows local laws.

- Should you need a different form, utilize the search function to find alternatives that meet your requirements.

- Once you've identified the correct document, click 'Buy Now' and select your desired subscription plan. You must create an account to access the forms.

- Complete your purchase using your credit card or PayPal for secure payment.

- Finally, download the chosen form to your device and find it conveniently within the 'My Forms' section of your profile for future access.

By utilizing US Legal Forms, individuals and attorneys can easily execute crucial legal documents, benefiting from a comprehensive library and expert support for form completion.

Don't hesitate—visit US Legal Forms today to streamline your document acquisition and stay compliant with Hawaii provisions withholding requirements.

Form popularity

FAQ

To fill out a withholding allowance form, start by writing your name, address, and filing status. Next, provide the number of allowances you intend to claim based on your financial situation and dependents. Understanding Hawaii provisions withholding can improve your filing accuracy, ensuring you withhold the appropriate amount of tax.

You can submit tax withholding by providing your employer with the completed withholding form, such as the HW 4 for Hawaii. Employers will then calculate the amount to withhold from your paycheck based on the declared allowances. Following Hawaii provisions withholding guidelines can help you maintain proper tax withholdings throughout the year.

Yes, you can file your Hawaii state tax online. The state provides a user-friendly platform where you can submit your forms electronically, saving time and effort. Utilizing online resources ensures you adhere to Hawaii provisions withholding and other tax filing requirements seamlessly.

Filling out the Indiana WH-4 form involves providing your personal information like name and address, just like in Hawaii provisions withholding forms. Determine your filing status and allowances. While this form differs from Hawaii, understanding withholding practices in your state is crucial for accurate tax management.

Yes, Hawaii is a mandatory withholding state. Employers are required to withhold state income tax from their employees' wages according to established Hawaii provisions withholding rates. If you earn wages in Hawaii, your employer must follow these regulations, making it essential to complete your withholding forms correctly.

To accurately fill out your W4, begin by reviewing personal information, such as your name and address. Specify your filing status and decide the number of allowances based on your financial situation. Properly applying Hawaii provisions withholding principles ensures you withhold the right amount of tax throughout the year.

Filling out form HW 4 requires attention to detail. Begin with your personal details at the top of the form, then select your filing status and specify the number of allowances. Utilizing Hawaii provisions withholding rules can guide you in accurately completing this form to match your tax obligations and reduce under-withholding.

To fill out the Hawaii HW 4 form, start by entering your personal information, including your name and address. Next, indicate your filing status and complete the withholding allowance section based on the number of allowances you plan to claim. Remember, Hawaii provisions withholding guidelines can help you maximize your allowance claims while ensuring compliance with state tax regulations.

To enter the amount of additional withholding, you will specify an extra amount you want withheld from each paycheck on your withholding form. This is especially important if you anticipate owing additional taxes or if your financial situation changes during the year. Make sure to calculate the appropriate amount and report it accurately to ensure Hawaii provisions withholding reflects your needs. For further assistance, uslegalforms can provide clear templates and guidelines.

Filling out a withholding exemption involves completing the appropriate IRS form along with any state-specific forms, such as those for Hawaii provisions withholding. Be sure to provide accurate information regarding your filing status and the number of exemptions you are claiming. Our platform, uslegalforms, offers helpful resources and guides to assist you in filling out these forms correctly, reducing errors and ensuring compliance.