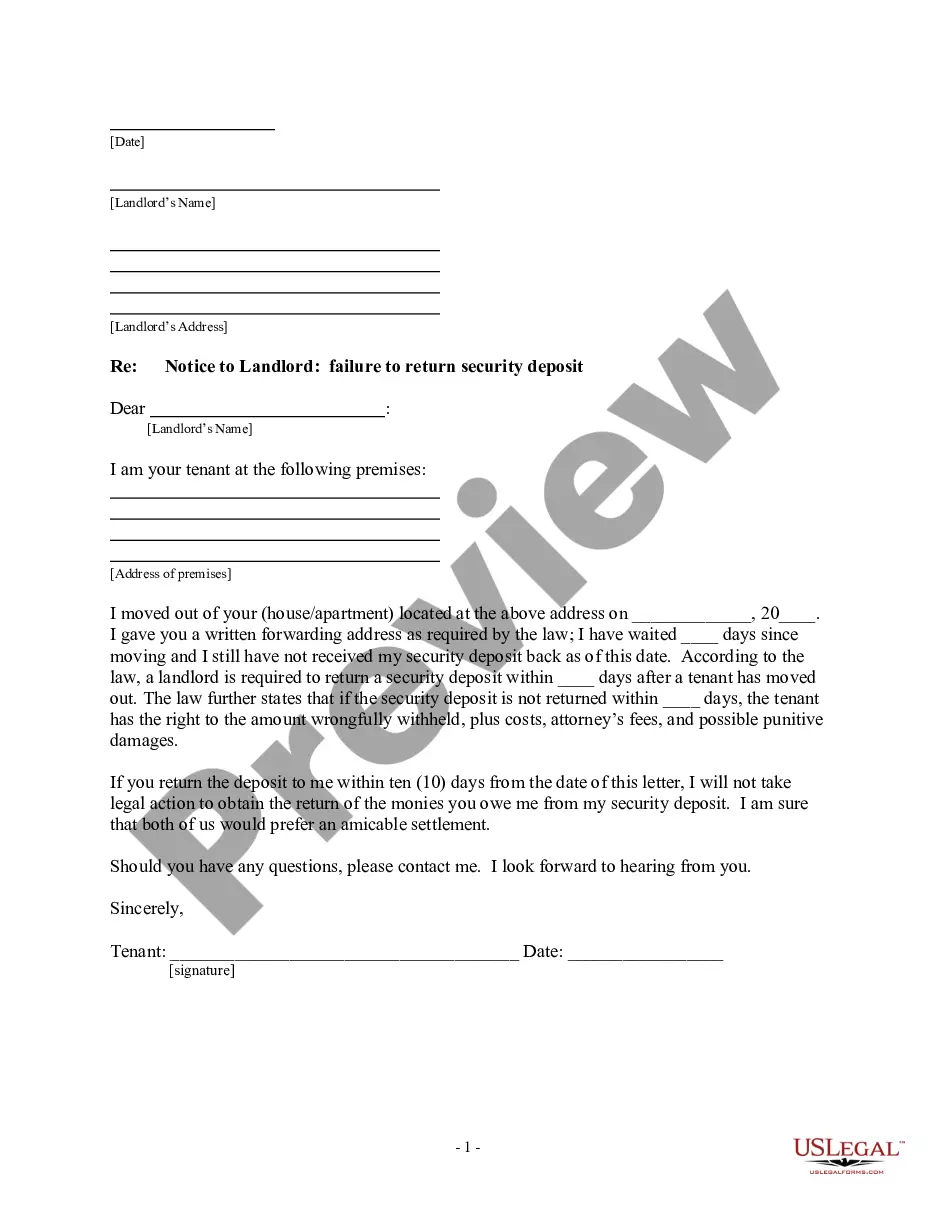

This is a sample letter from a Tenant to the Landlord. This letter serves as Notice to the Landlord that he/she must return the Tenant's security deposit immediately or risk legal actions.

Security Deposit Hawaii For Credit Card

Description

How to fill out Security Deposit Hawaii For Credit Card?

What is the most dependable service to obtain the Security Deposit Hawaii For Credit Card and other current iterations of legal documents? US Legal Forms is the answer!

It's the finest collection of legal forms for any application. Each template is properly drafted and verified for adherence to federal and local laws.

Form compliance review. Before you acquire any template, ensure it aligns with your use case specifications and your state or county’s regulations. Review the form details and use the Preview if accessible.

- They are categorized by region and state of application, making it simple to locate the one you need.

- Experienced users of the website only have to Log In to the platform, verify their subscription status, and click the Download button next to the Security Deposit Hawaii For Credit Card to obtain it.

- Once saved, the template stays accessible for additional use in the My documents section of your profile.

- If you don’t have an account with our database, here’s what you need to do to obtain one.

Form popularity

FAQ

A deposit on a credit card, particularly for secured cards, means that you commit funds that act as collateral. This helps the lender secure their risk while granting you a credit limit. Knowing this can help you make informed decisions, especially when evaluating the security deposit in Hawaii for credit cards.

Not all credit cards require a deposit; however, secured credit cards specifically do. This deposit serves as a backup for the lender and is important for individuals looking to improve their credit profile. If you're considering options, be sure to explore various secured credit card offers, especially those with security deposits in Hawaii.

When you see '200' associated with a credit card, it usually refers to the amount of your security deposit or your credit limit. In the case of secured credit cards, this means you can spend up to $200. This structure is particularly relevant when exploring the implications of security deposits in Hawaii for credit cards.

A $200 deposit on a credit card signifies that this amount is held as security for your account. This deposit will likely be your credit limit, allowing you to spend up to that amount. Understanding this concept is crucial, especially when dealing with a security deposit in Hawaii for credit cards.

The $200 deposit serves as a safety net for the credit card issuer. If you fail to make payments, the issuer can use the deposit to cover the outstanding balance. It’s a common requirement for those looking to establish or rebuild credit, especially when dealing with security deposits in Hawaii for credit cards.

Yes, secured credit cards require a security deposit. This deposit acts as collateral, and it protects the credit issuer in case you default on payments. The deposit is often equal to your credit limit, making it important to understand how this works when considering a security deposit in Hawaii for credit cards.

For a $200 secured credit card, it’s recommended to spend around 30% of your credit limit, which amounts to about $60. This approach helps build your credit score by demonstrating responsible usage without overextending yourself. Remember, managing your spending wisely also reflects positively on your credit practice, especially concerning the security deposit in Hawaii for credit cards.

In Hawaii, the security deposit law stipulates that landlords can collect a security deposit up to one month's rent for unfurnished properties and no more than two months for furnished ones. This law also outlines the return process and conditions that may apply. Familiarizing yourself with the security deposit hawaii for credit card laws is crucial for maintaining compliance as both a tenant and a landlord.

The 30 day rental law in Hawaii requires landlords to return security deposits within this time frame after a tenant vacates the property. If there are deductions, landlords must provide an itemized list, justifying those charges. Understanding this law helps tenants ensure they receive their rightful security deposit, reflecting the security deposit hawaii for credit card standards.

In Hawaii, landlords may deduct amounts from a security deposit for unpaid rent, damages beyond normal wear, or cleaning costs necessary to restore the property. It's essential to be aware of the specific deductions allowed under the security deposit hawaii for credit card provisions. Landlords are obligated to provide an itemized statement for any deductions made.