Hawaii Ceará

Description

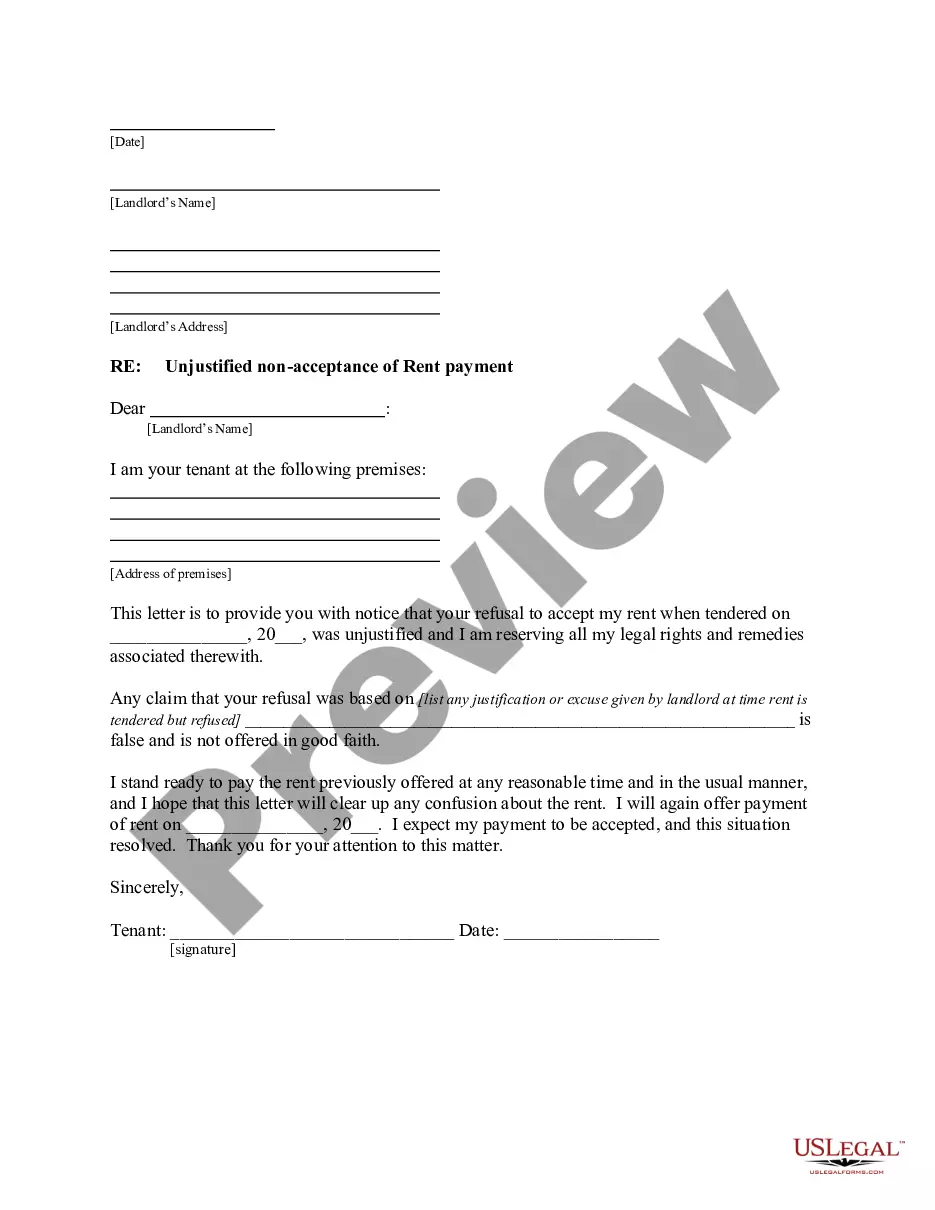

How to fill out Hawaii Letter From Tenant To Landlord Containing Notice To Cease Unjustified Nonacceptance Of Rent?

- If you're an existing user, log in to your account and verify your subscription status. If your subscription has expired, renew it according to your chosen plan.

- For new users, start by browsing the extensive form collection. Review the preview mode and descriptions to find a template that meets your legal requirements.

- Should you need a different form, utilize the Search tab to locate the right document that fits your local jurisdiction.

- Once satisfied with your selection, click the Buy Now button to choose the appropriate subscription plan that suits your needs.

- Proceed to checkout by entering your payment information; credit card or PayPal options are available for your convenience.

- After your purchase is complete, download the form to your device. You can always access it later through the My Forms section.

Using US Legal Forms ensures you have access to a robust collection of over 85,000 fillable legal forms, allowing flexibility and ease in document creation. Plus, with premium support available, you can confidently complete your legal forms knowing they meet all requirements.

Take control of your legal needs today and experience the convenience of US Legal Forms. Start your journey now!

Form popularity

FAQ

Yes, a Hawaii tax return can be filed electronically through approved e-filing services. Utilizing electronic filing can expedite the processing of your tax return and may result in quicker refunds. Ensure you have all necessary documents ready, as this will streamline the e-filing experience. If you are unsure how to proceed, platforms like US Legal Forms provide helpful tools and templates tailored to Hawaii's regulations.

To file an annual report in Hawaii, you must provide basic information about your business, such as the entity name, registration number, and details of your leadership team. Additionally, you may need to update your business address or other relevant information. Make sure to check specific filing dates to avoid any penalties. For thorough assistance in preparing your report, US Legal Forms can guide you through the necessary requirements.

To file an amended Hawaii state tax return, you will need to complete Form N-101A, also known as the Application for Refund. It is important to provide all necessary documentation, explaining the changes you are making. Ensure the revised information is accurate, as this will help expedite the review process. If you need guidance, US Legal Forms offers resources to assist with filling out the right forms clearly.

You can mail your Hawaii state tax forms to the Department of Taxation. Make sure to send them to the correct address based on your specific situation. Check the Hawaii Department of Taxation website for details about different forms, as there are separate addresses for individual and corporate tax filings. If you have any further questions, consider using US Legal Forms to ensure you have the correct documents.