Hawaii Deed Of Trust

Description

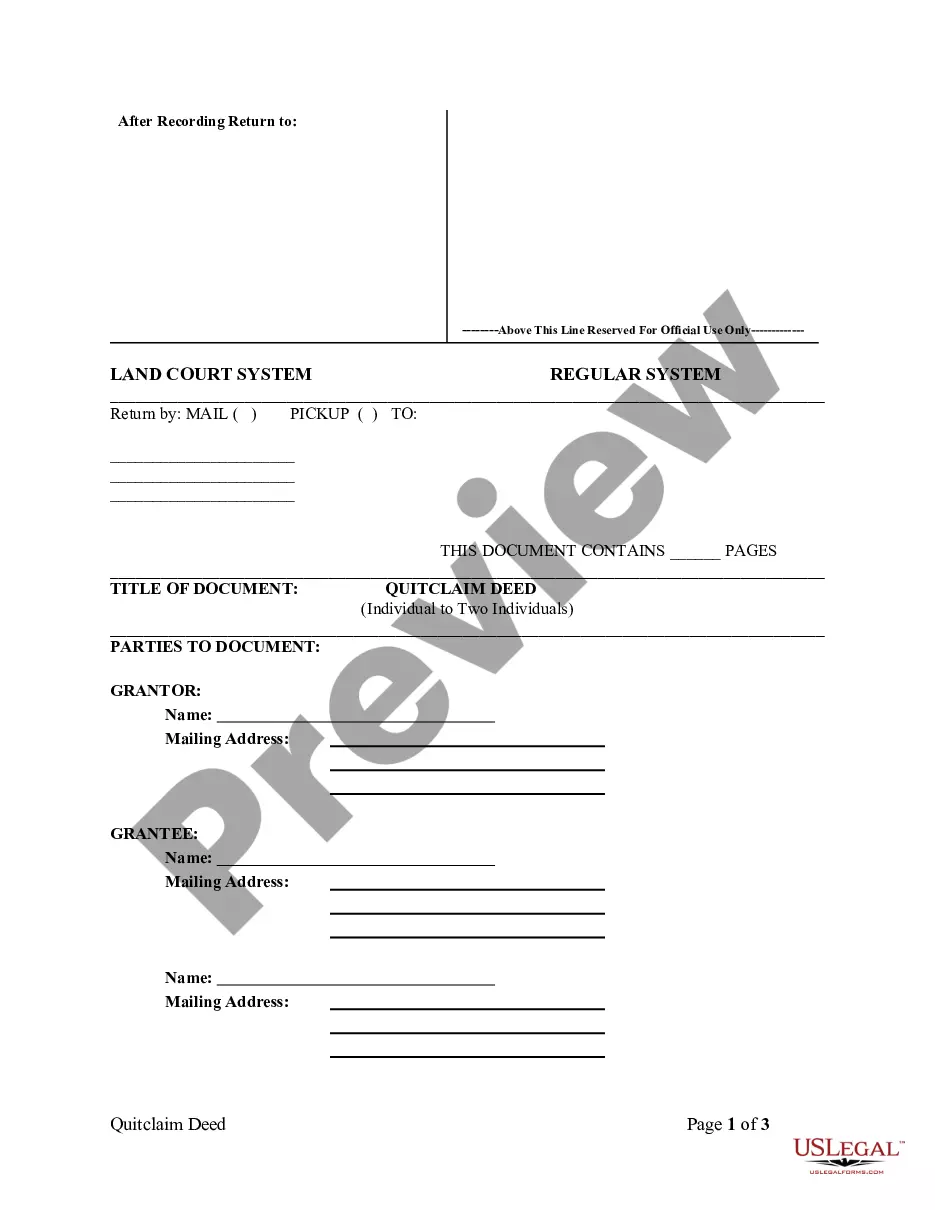

How to fill out Hawaii Quitclaim Deed From Individual To Two Individuals In Joint Tenancy?

Individuals typically link legal documents with complexity that can only be managed by an expert.

In some respect, this is accurate, as creating a Hawaii Deed Of Trust requires a thorough grasp of subject-specific requirements, encompassing state and county laws.

However, with US Legal Forms, everything has become simpler: pre-prepared legal templates for any personal and business situation tailored to state regulations are compiled in one online directory and are now accessible to everyone.

All templates in our collection are reusable: once acquired, they are kept in your profile. You can access them whenever necessary via the My documents section. Explore all advantages of utilizing the US Legal Forms platform. Register now!

- Examine the page content thoroughly to ensure it meets your criteria.

- Review the form description or inspect it using the Preview feature.

- Search for another template using the Search bar above if the previous one does not meet your requirements.

- Click Buy Now once you identify the correct Hawaii Deed Of Trust.

- Select a pricing plan that aligns with your needs and financial capability.

- Create an account or Log In to continue to the payment page.

- Complete your payment via PayPal or with your credit card.

- Choose the format for your document and click Download.

- Print your file or upload it to an online editor for easier completion.

Form popularity

FAQ

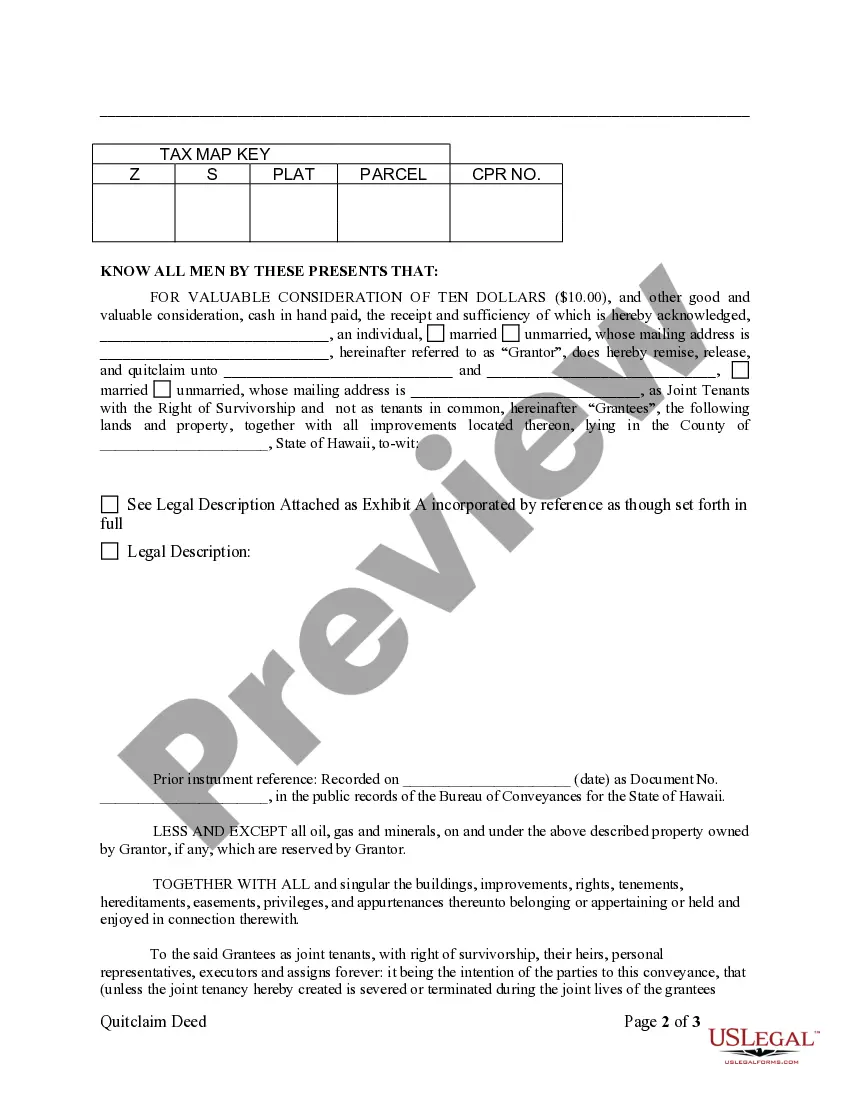

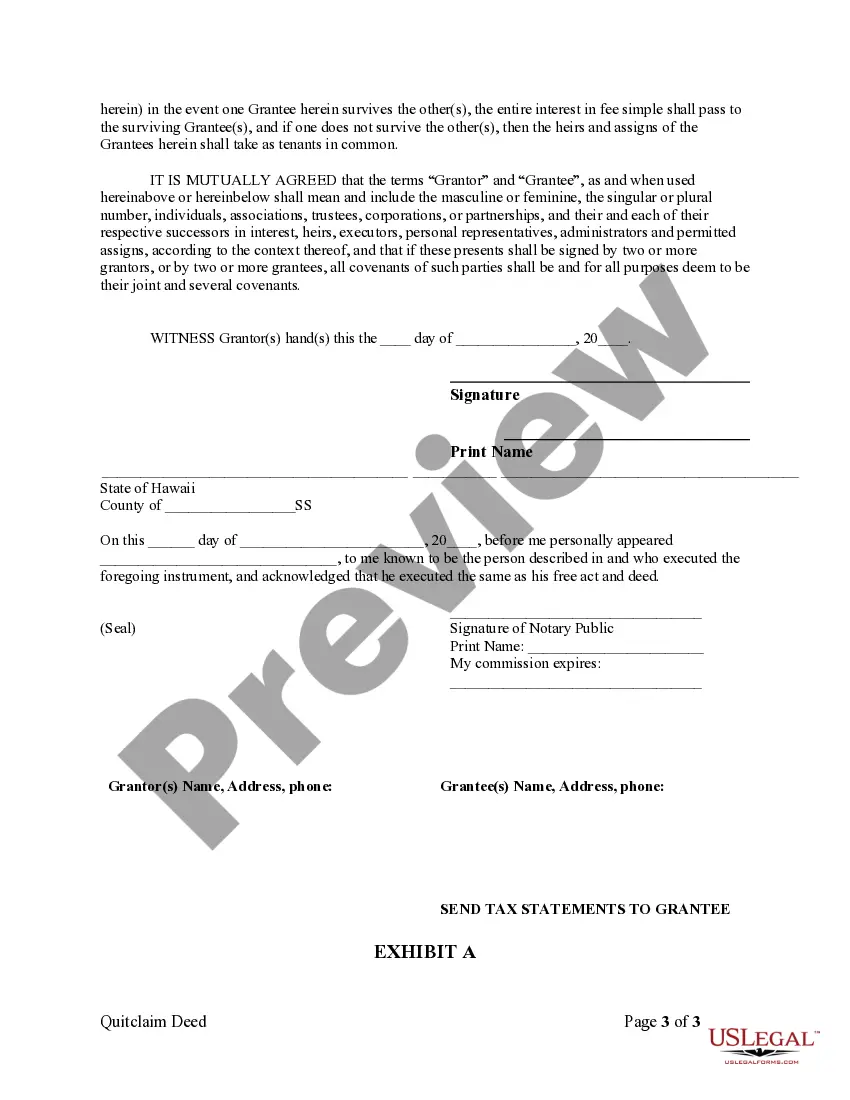

Transferring a title in Hawaii involves filing a deed with the Bureau of Conveyances. This document must be properly completed and signed in the presence of a notary. To simplify this process, consider using US Legal Forms, where you can find detailed instructions and templates specifically for a Hawaii deed of trust, ensuring all steps are securely followed.

The most effective way to transfer ownership in Hawaii is through a legal document like a deed. Whether you are using a warranty deed or a quitclaim deed, ensure that you meet the requirements set by local laws. US Legal Forms provides templates and guidance that can streamline the process of creating a Hawaii deed of trust, making ownership transfer simpler and more secure.

To obtain a copy of your deed in Hawaii, you should visit the Bureau of Conveyances in your local county. You can request a certified copy by providing specific details about the property, such as the address and the names of the owners. Additionally, consider using resources like US Legal Forms, which can guide you through the process and provide the necessary forms for requesting a Hawaii deed of trust.

To record a deed in Hawaii, you must complete the deed document, ensuring it is notarized and includes all necessary details. After that, submit it to the local Bureau of Conveyances for official recording. Recording your deed secures your property rights and makes your ownership information publicly accessible. For assistance in preparing and submitting your deed, uSlegalforms offers a variety of resources to help you navigate the recording process.

To obtain the deed to your house in Hawaii, you can request a copy from the Bureau of Conveyances. Alternatively, if you know your property's Tax Map Key (TMK) number, you can find the deed information online. If you require assistance with the process, the uSlegalforms platform offers resources that guide you in retrieving and understanding your property deed.

Transferring ownership of a property in Hawaii generally requires preparing a deed, such as a warranty deed or a quitclaim deed. Once you have the deed ready, you will need to sign it in front of a notary and then submit it for recording at your local Bureau of Conveyances. This ensures that the change in ownership is made public and formally recognized. Utilizing tools from uSlegalforms can ensure your deed is correctly prepared for a seamless transfer.

To record a trust in Hawaii, you need to prepare the appropriate documents that outline the trust's terms and beneficiaries. Once completed, you can submit your trust documents to the Bureau of Conveyances in the state of Hawaii. Ensuring all paperwork is accurate and properly formatted will facilitate a smoother recording process. Using platforms like uSlegalforms can simplify the preparation of your trust documents.

In Hawaii, the process of recording a deed typically takes a few days to a couple of weeks. The speed can vary based on the specific county's workload. Once recorded, the deed of trust becomes a public document, ensuring your ownership is officially recognized. For more efficient processing, consider using the uSlegalforms platform, which provides guidance in preparing and submitting your documents.

In Hawaii, a trust operates by having a grantor transfer assets to a trustee who manages those assets for the benefit of the beneficiaries. Trusts can provide clear instructions on how and when the assets should be distributed. This structured approach can help avoid probate and ensure privacy regarding your affairs. If you're interested in setting up a trust, including a Hawaii deed of trust, consider using resources from US Legal Forms to streamline the process.

While a trust offers many benefits, it also has some disadvantages. Establishing a trust in Hawaii can involve significant legal fees and ongoing administrative costs. Additionally, there may be limitations on how assets can be accessed or distributed, which could impact your financial flexibility. It's important to weigh these factors carefully when considering a Hawaii deed of trust as part of your estate planning.