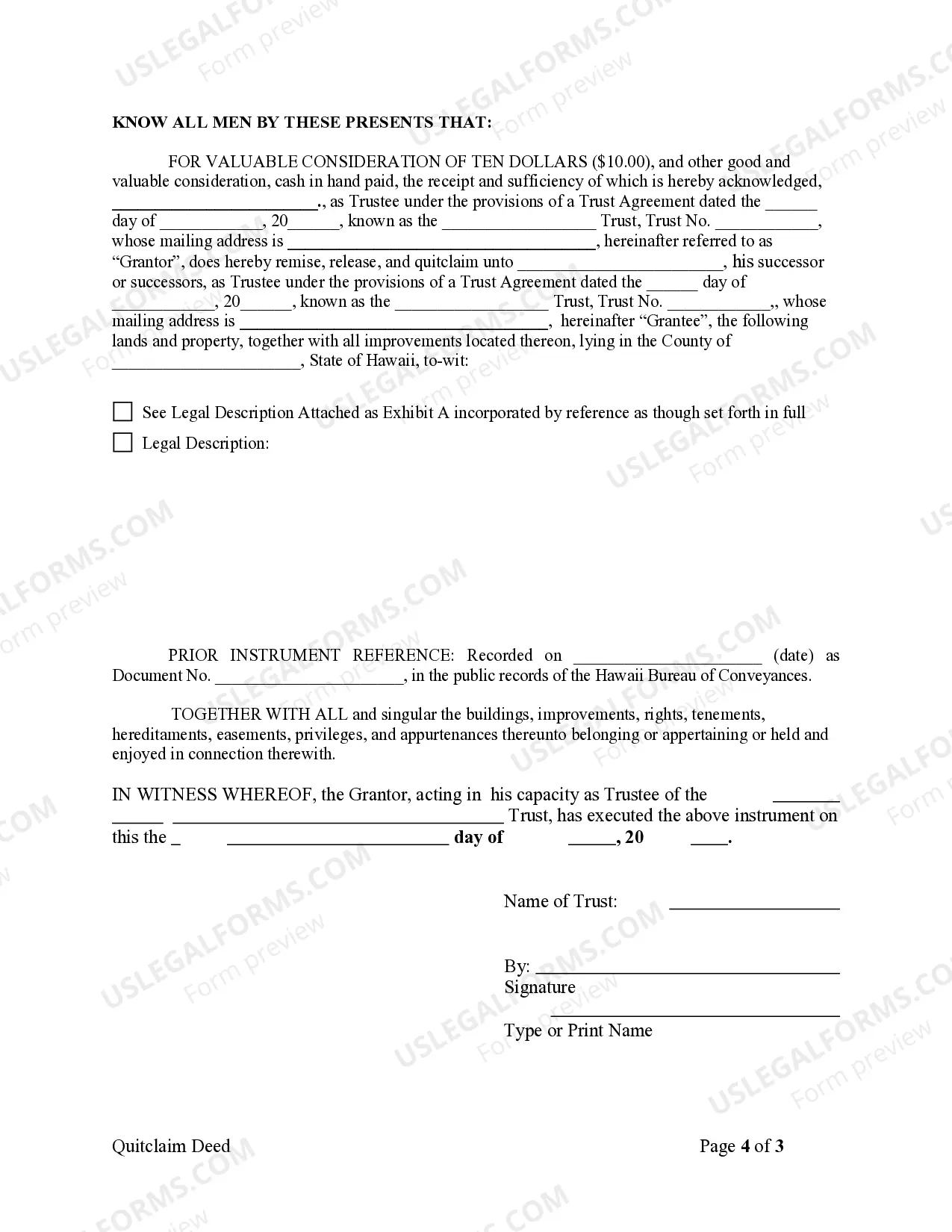

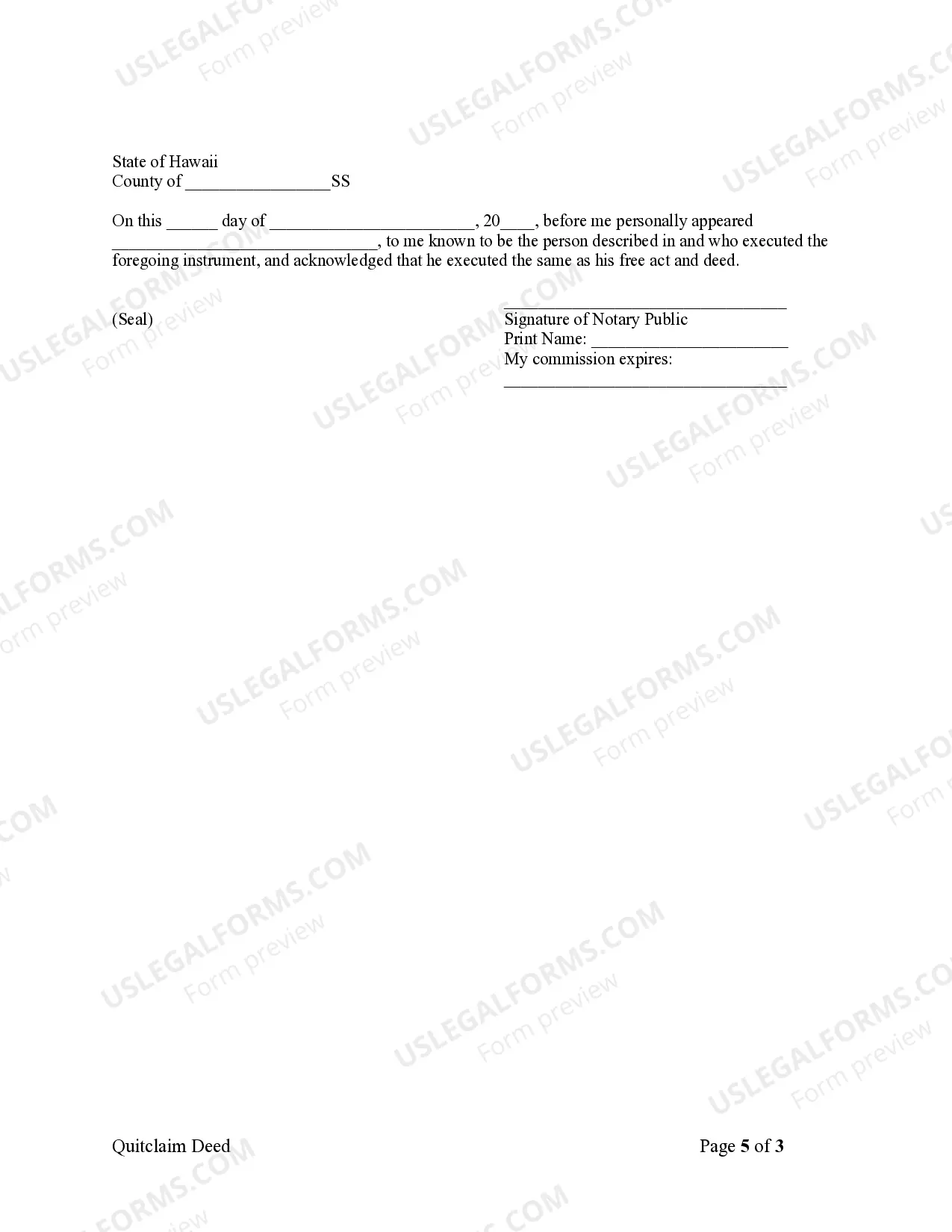

This form is a Quitclaim Deed where the grantor is a trust and the grantee is also a trust. Grantor conveys and quitclaims the described property to trustee of the grantee. This deed complies with all state statutory laws.

Quit Claim Deed Hawaii With Lien

Description

How to fill out Quit Claim Deed Hawaii With Lien?

Whether you handle paperwork frequently or occasionally need to submit a legal document, it is crucial to have a resource that provides all relevant and current samples.

The first step when using a Quit Claim Deed Hawaii With Lien is to verify that it is indeed the latest version, as this determines its submitter eligibility.

If you wish to streamline your quest for the most recent document samples, look for them on US Legal Forms.

To obtain a form without an account, adhere to these procedures: Use the search feature to locate the form you need. View the Quit Claim Deed Hawaii With Lien preview and outline to confirm it is the exact form you are looking for. After double-checking the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Utilize your credit card or PayPal details to complete the transaction. Select the document format for download and confirm your choice. Put an end to confusion in managing legal documents. All your templates will be organized and authenticated through an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes nearly every sample you may seek.

- Locate the templates you require, evaluate their relevance immediately, and learn more about their application.

- With US Legal Forms, you will have access to over 85,000 form templates across various domains.

- Find the Quit Claim Deed Hawaii With Lien examples in just a few clicks and save them at any time in your account.

- A US Legal Forms account allows you to access all the samples you require with added convenience and reduced hassle.

- Simply click Log In in the header of the site and navigate to the My documents section where all the forms you need will be available, eliminating the time spent on searching for the appropriate template or verifying its authenticity.

Form popularity

FAQ

Yes, you can quit claim a house that has a lien; however, it is essential to understand that the lien stays attached to the property. This means the new owner will assume responsibility for any existing liens after the transfer. It is advisable to resolve any liens before proceeding with a quit claim deed to avoid complications. For guidance on managing property transfers with liens, U.S. Legal Forms provides valuable resources on quit claim deed Hawaii with lien.

To obtain a copy of your quit claim deed in Hawaii, visit the office of the Bureau of Conveyances or access their online portal. You will need to provide your property's information, such as its address or tax parcel number. This process helps ensure you have the necessary documentation if your deed involves a lien. For additional assistance, consider using U.S. Legal Forms to access resources tailored to quit claim deed Hawaii with lien.

To add your spouse to a property deed in South Carolina, you can use a Quit Claim Deed, which allows you to transfer ownership without needing a traditional sale. You'll need to fill out the deed with both spouses' names and any lien details. Once completed, the deed must be signed and notarized, then recorded with the county clerk. Utilizing a platform like USLegalForms can simplify the process, guiding you through each step effectively.

To fill out a Quit Claim Deed to add someone to a home title in Hawaii, first, include the full name of the current property owner and the individual being added. Next, provide a clear legal description of the property, along with the grantee's information. It's important to ensure the document explicitly states any lien on the property. After completing the deed, both parties should sign it in front of a notary public.

To find out if there is a lien on a property in Hawaii, you can perform a lien search through the Bureau of Conveyances. This process involves reviewing public records related to the property. Knowing if there are any existing liens is crucial, especially if you are planning to use a quitclaim deed for transfer, as it can significantly impact your ownership rights.

Transferring a title in Hawaii generally involves completing a quitclaim deed that effectively conveys the title from the current owner to the new owner. After executing the deed, you must file it with the local Bureau of Conveyances for official recognition. Be sure to check for any current liens on the property to avoid future disputes or complications in the transfer.

The time it takes for a deed to be recorded in Hawaii typically ranges from a few days to several weeks. After submitting the quitclaim deed to the Bureau of Conveyances, the processing time can vary based on current workload and filing volume. Ensure that your deed is properly completed and includes necessary details, especially if liens are involved, for a smoother recording process.

To transfer ownership of a property in Hawaii, you can use a quitclaim deed, which is a straightforward option. This deed must be signed by the current owner and then recorded with the Bureau of Conveyances. It is vital to ensure that there are no liens hindering the transfer, so conducting a lien search beforehand can save you future complications.

Yes, Hawaii does impose a property transfer tax on real estate transactions. This tax applies when a property is transferred using various methods, including quitclaim deeds. Understanding this tax liability can help you prepare financially for the transfer process, particularly if you’re dealing with properties that may have liens associated with them.

Individuals in situations like divorce or estate transfers benefit the most from quitclaim deeds. These deeds facilitate a straightforward transfer of property without extensive costs or formalities. Additionally, if a property owner wishes to transfer property to a family member, a quitclaim deed simplifies the process, but awareness of any liens is crucial for the recipient.