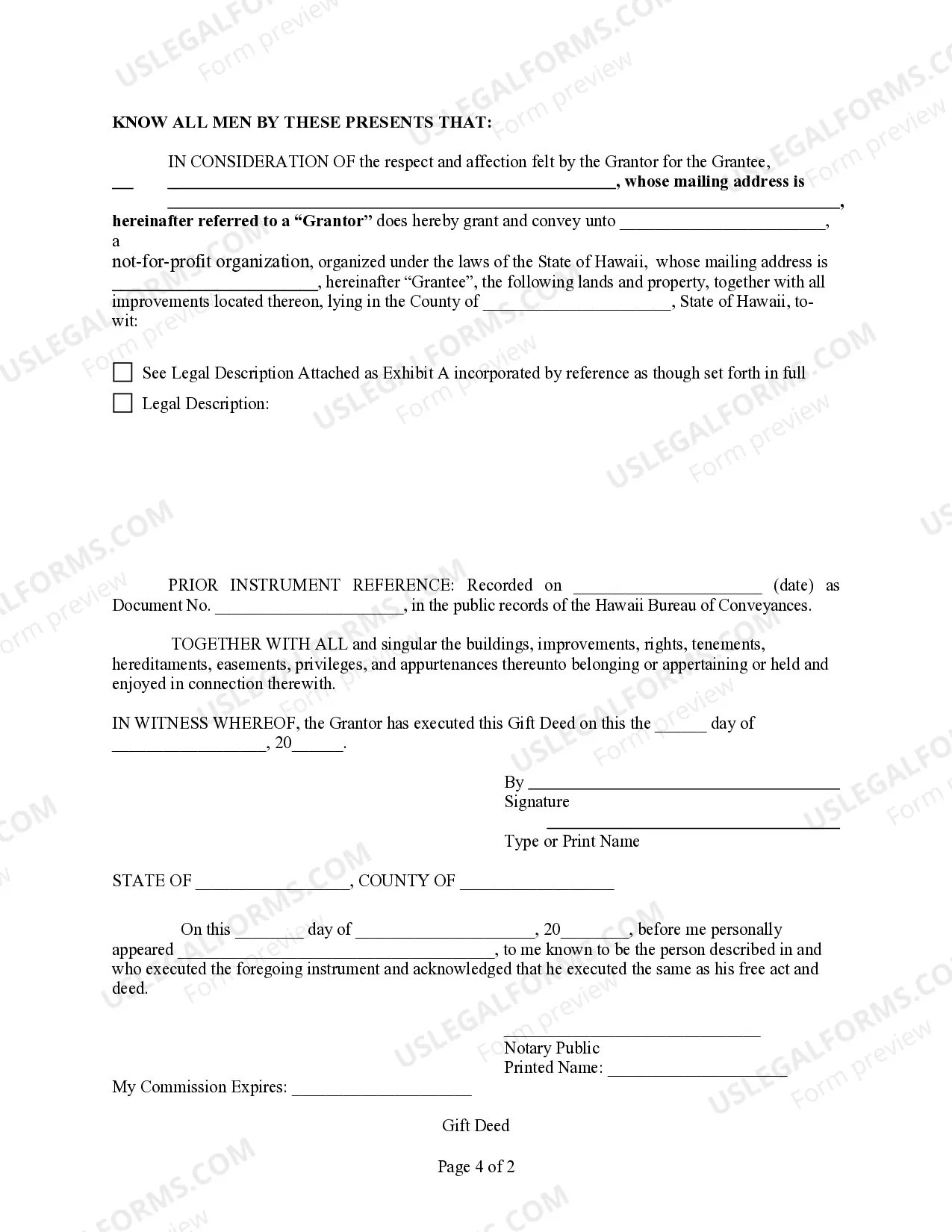

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated With A

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Start by accessing US Legal Forms and log into your account if you're a returning user. Verify your subscription status before proceeding.

- For first-time users, explore the library by checking the preview mode of available forms. Confirm that the selected template meets your needs and complies with Hawaii's specific requirements.

- If you find the initial form unsuitable, use the search feature to identify a more fitting document.

- Select your desired form by clicking the 'Buy Now' option and choose a subscription plan that works for you. Remember to create your account for full access.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Once your transaction is complete, download your form, and save it to your device. You can access it anytime through the 'My Forms' section.

In conclusion, US Legal Forms simplifies the legal documentation process in Hawaii unincorporated areas with its robust collection and expert assistance. Take the hassle out of legal paperwork by utilizing this comprehensive service today.

Explore the vast resources of US Legal Forms and ensure your documents are completed with confidence!

Form popularity

FAQ

Associations may need an EIN depending on their activities and structure. If your Hawaii unincorporated association is engaging in taxable activities or plans to open a bank account, then obtaining an EIN is often necessary. An EIN helps with tax reporting and simplifies financial transactions. Consulting with professionals can clarify whether your association should apply for an EIN.

Certain entities may face restrictions when applying for an EIN in Hawaii. Individuals who do not have a valid reason, such as starting a business or managing a tax-exempt entity, may not qualify. Additionally, non-residents without a legal presence in the U.S. also encounter barriers. Thus, it's crucial to ensure your association's purpose aligns with the requirements before applying.

To register a non-profit organization in Hawaii, begin by choosing a unique name that complies with state regulations. Next, you must file articles of incorporation with the state. Don’t forget to apply for tax-exempt status if applicable. For a smoother process, you can explore resources like UsLegalForms to guide you through the registration steps for your Hawaii unincorporated non-profit.

An unincorporated association in Hawaii can open a bank account, but specific requirements may exist. Most banks require a copy of the association's governing documents and an EIN if applicable. Having a bank account allows the association to manage funds effectively and conduct financial transactions securely. This is an essential step for forming a robust financial foundation for your Hawaii unincorporated association.

G 45 and G 49 forms refer to tax forms required by the state of Hawaii. The G 45 is a periodic general excise tax return, while G 49 is an annual return for business income tax. Understanding the distinction is vital for compliance and tax filings. If your Hawaii unincorporated association earns income, knowing which form to file can help you avoid penalties.

Yes, an unincorporated association can obtain an EIN in Hawaii. This identification number is useful for handling tax responsibilities and opening a bank account. Keep in mind that you will need to provide relevant information about the association during the application process. By having an EIN, your Hawaii unincorporated association can operate more effectively.

In many cases, you do not need an EIN for an unincorporated association in Hawaii unless the association meets specific criteria. If your association plans to hire employees or file certain tax forms, an EIN is necessary. Therefore, consider your association's activities when deciding whether to apply for one. It is wise to consult with a tax professional to understand your association's needs.

Hawaii includes only a few incorporated cities, with the majority of the land classified as unincorporated. There are significant urban centers such as Honolulu, but these incorporated areas differ from the unincorporated communities that make up much of the state. Understanding the balance between incorporated and Hawaii unincorporated regions can provide valuable insights into living in this beautiful state. You can visit uslegalforms for legal help regarding property and living arrangements.

The downsides of living in an unincorporated area often include a lack of local control and fewer public services. Residents might experience challenges in getting prompt responses to emergencies or accessing amenities. This can create a feeling of isolation from broader community resources. If you are considering moving to a Hawaii unincorporated location, weighing these aspects against your needs is crucial.

Living in an unincorporated area means you reside in a locality that lacks its own municipal government. As a resident, you rely on the state for governance and public services, which can lead to limited local representation. While some people appreciate the level of freedom this provides, it may also come with trade-offs regarding services and community involvement. Exploring Hawaii unincorporated living is essential for grasping these dynamics.