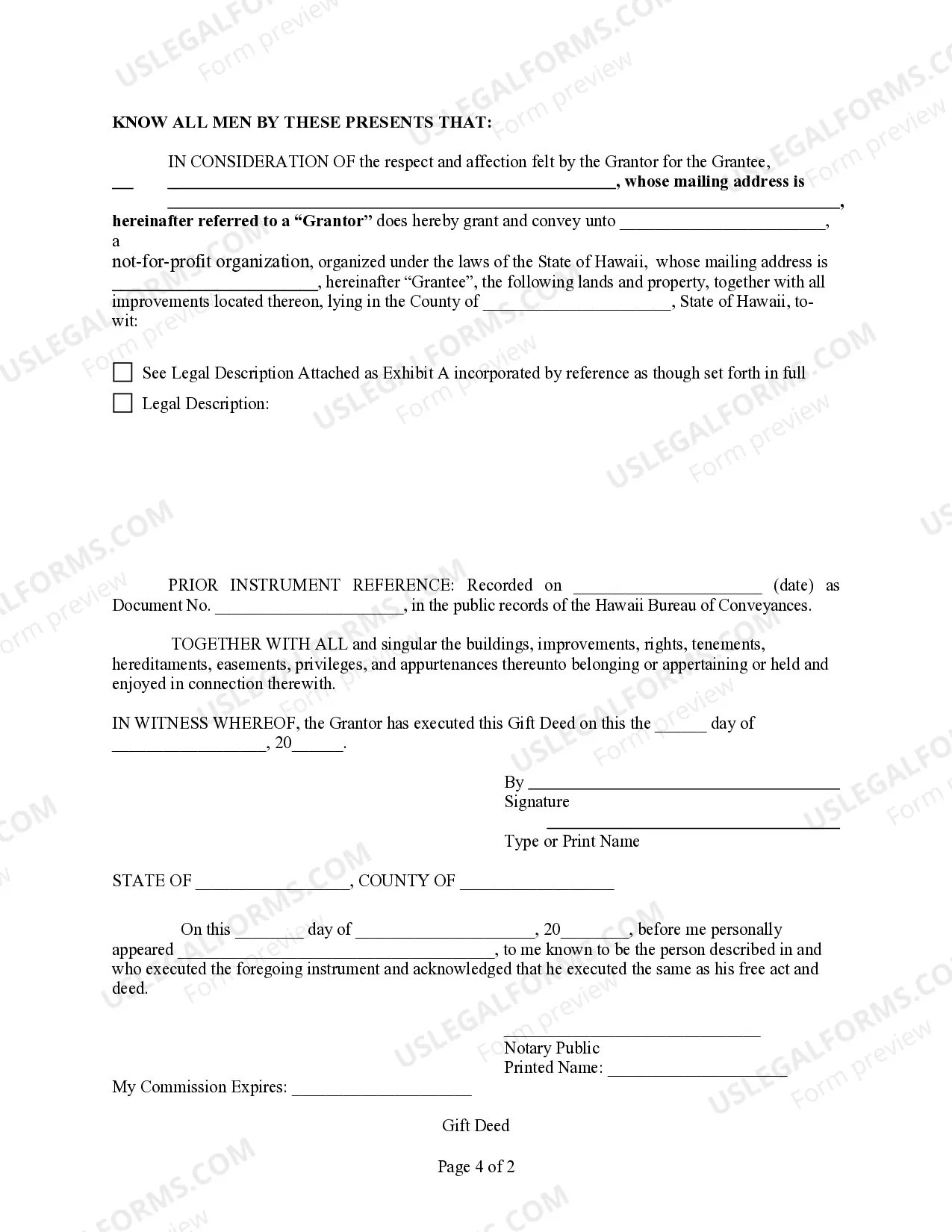

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated Printable With Address

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Log in to your US Legal Forms account if you have one, and verify your subscription status is active.

- If you're a new user, begin by browsing the extensive library to find the Hawaii unincorporated form that fits your needs.

- Preview the selected form to ensure it meets your local jurisdiction requirements. If necessary, use the search function to find an alternative.

- Choose your subscription plan and proceed to the purchase step by clicking 'Buy Now.'

- Enter your payment information through credit card or PayPal to complete the subscription process.

- Download the completed form to your device, and you can also access it later in your profile under 'My Forms.'

In conclusion, US Legal Forms is the go-to solution for individuals and legal practitioners looking for a reliable source of legal documents. With a vast library and expert assistance, you can ensure your documents are accurate and conform to legal standards.

Start your journey with US Legal Forms today and make your legal documentation process simple and efficient!

Form popularity

FAQ

In Hawaii, LLCs are generally taxed as pass-through entities unless they elect to be treated as corporations. This means profits and losses pass through to the owners, who report them on their personal tax returns. An important factor to consider is that Hawaii imposes an income tax on LLCs at both state and local levels. If you seek assistance in navigating taxes, consider a Hawaii unincorporated printable with address to keep your filings organized.

The typical timeframe to receive your LLC in Hawaii can vary, but it generally takes about 7 to 10 business days for processing. To expedite the process, consider filing online, which can speed up approval times. Having all required documents prepared in advance, including your Hawaii unincorporated printable with address, helps ensure a smooth process. Patience is key as you await your official formation documents.

Filing an annual report for your LLC in Hawaii is a straightforward process. You can complete it online through the Hawaii Department of Commerce and Consumer Affairs website or by using a Hawaii unincorporated printable with address form. Make sure to include your business details and any necessary information. This report is essential for maintaining good standing for your LLC.

When writing a check to the Hawaii state tax collector, ensure it is made out to the 'Hawaii State Tax Collector.' Include your taxpayer identification number in the memo section to provide clear identification. Using a Hawaii unincorporated printable with address can help you keep track of the necessary details. Always confirm the latest payment instructions from the Hawaii Department of Taxation.

Filing the Hawaii G-49, which is the annual withholding tax reconciliation form, can be done electronically or via paper submission. Make sure to enter all required details accurately for a smooth filing experience. A Hawaii unincorporated printable with address can be a practical tool for ensuring you have everything in order. For detailed guidance, check out the resources available through USLegalForms.

You should mail your Hawaii N-15 form to the Department of Taxation for processing. Similar to other tax documents, ensure that you are using the correct address for your specific filing situation. Keeping a Hawaii unincorporated printable with address can simplify this process for you. Always confirm the current mailing details on the official tax department website.

The mailing address for your Hawaii state tax return varies based on your filing method and whether you are making a payment. It is crucial to use the correct address to avoid delays. With a Hawaii unincorporated printable with address, you can verify the exact location for submission. Always check the Hawaii Department of Taxation website for the latest and accurate mailing details.

You need to mail your Hawaii state tax return to the Department of Taxation for processing. The specific address will depend on whether you are enclosing payment or not. By utilizing a Hawaii unincorporated printable with address, you can easily find the correct information. This helps ensure that your tax return reaches the right place quickly and efficiently.

To mail your 1040 form in Hawaii, you should send it to the address specified for federal tax returns. Generally, this involves sending it to the appropriate IRS processing center. Make sure to include a Hawaii unincorporated printable with address for your records. It's always wise to double-check the latest mailing addresses on the IRS website.

Yes, you can file your Hawaii tax return electronically. The state provides an online filing option which is convenient and secure. Utilizing this method ensures that your Hawaii unincorporated printable with address is submitted accurately and on time. It's a great way to streamline your tax process.