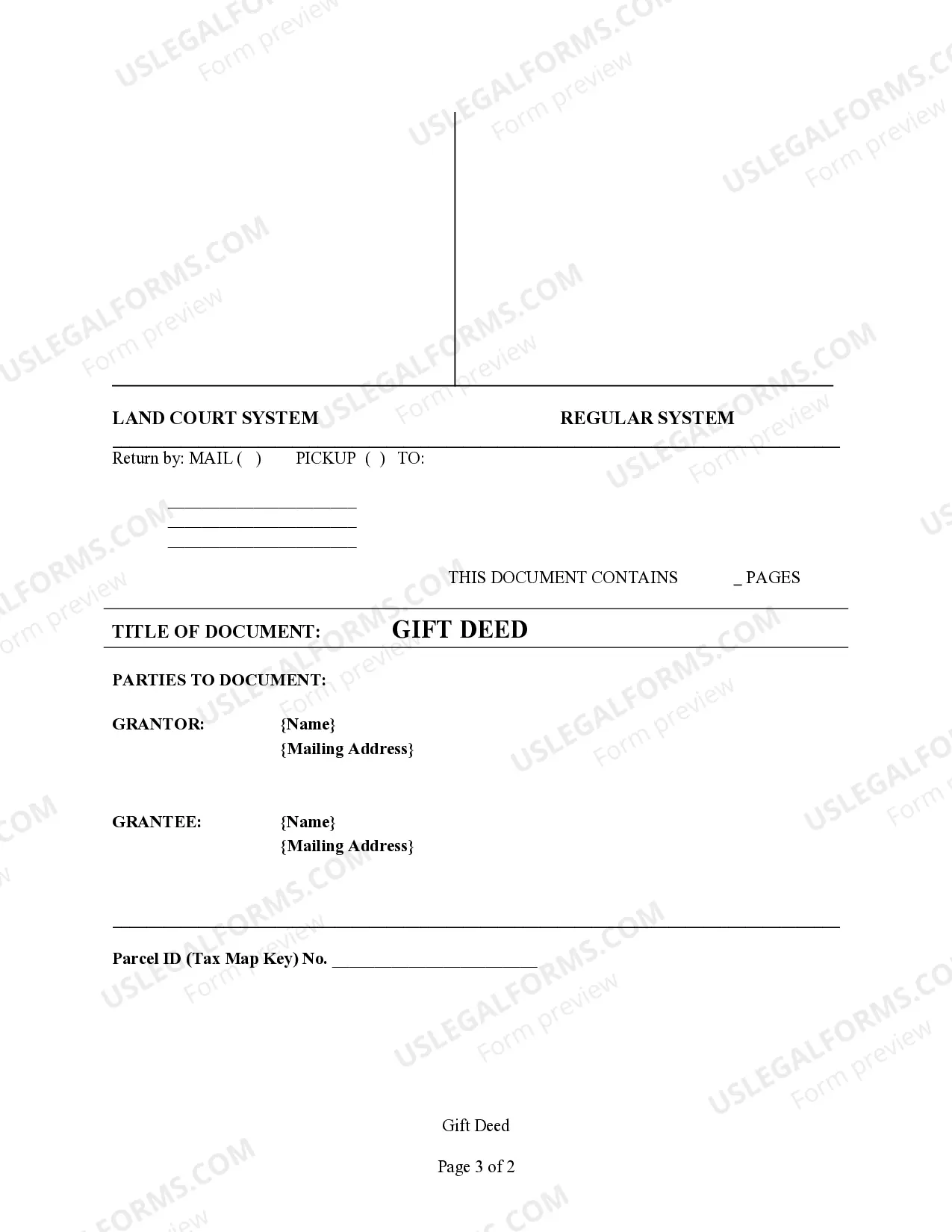

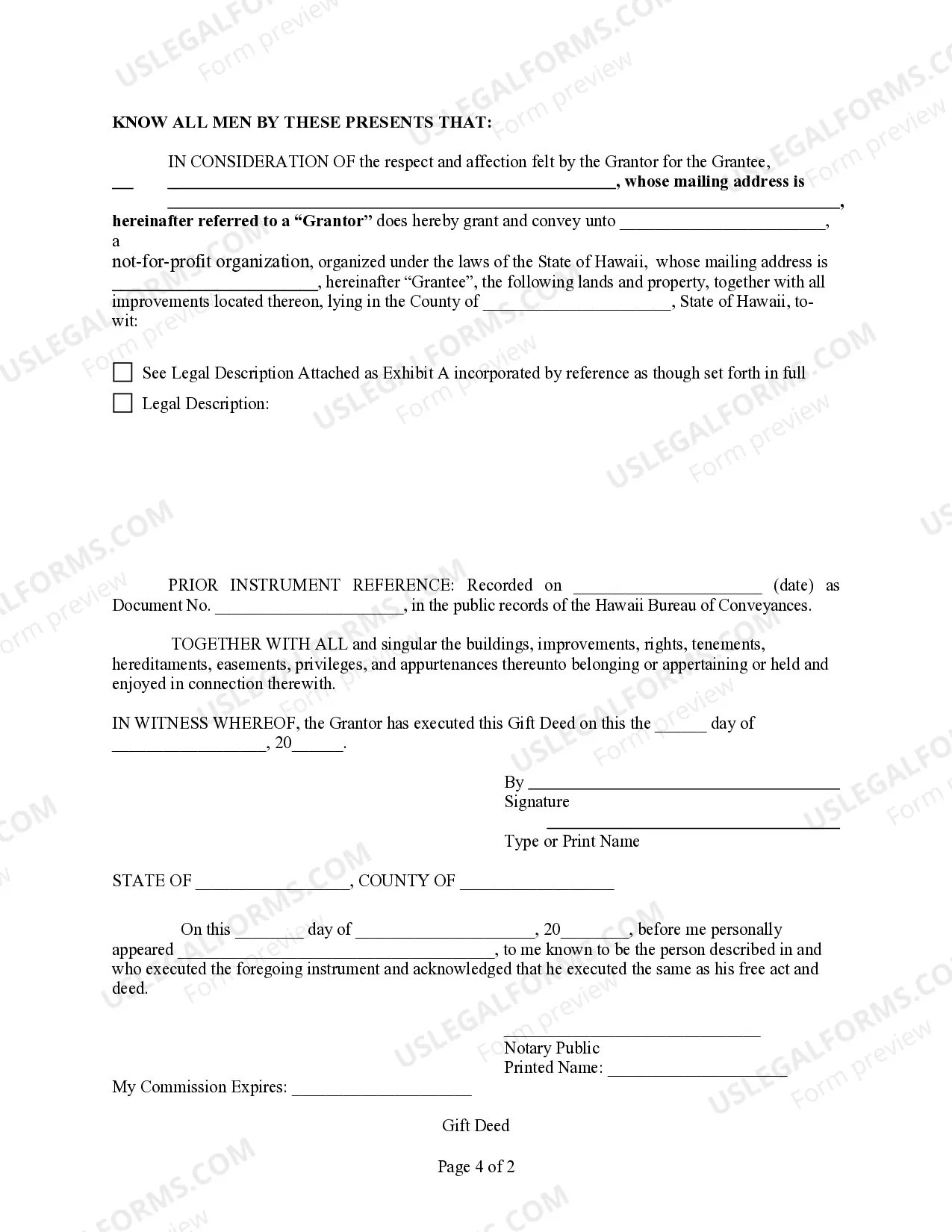

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated Printable For Business Case

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Log into your US Legal Forms account if you're an existing user to access your downloads. Confirm that your subscription is active; if not, renew it as per your payment plan.

- For first-time users, start by browsing the extensive form library. Use the Preview mode to assess the form description and confirm it meets your business requirements.

- If you find the form you need, but require additional templates, utilize the Search feature to locate alternatives that may better suit your needs.

- Once you've selected the appropriate document, click on the Purchase button to choose your ideal subscription plan and create an account to unlock the full library.

- Complete your purchase by entering your payment information, including credit card details or PayPal.

- Lastly, download your form. Save it on your device for immediate use and access it anytime from the My Forms section of your user profile.

By following these straightforward steps, you can effortlessly acquire your legal document without hassle. US Legal Forms stands out with its extensive library of over 85,000 fillable forms and direct access to premium experts who are ready to assist you, ensuring your documents are both accurate and legally sound.

Start today by exploring the US Legal Forms website to fulfill your business documentation needs effectively!

Form popularity

FAQ

To apply for a Hawaii general excise tax license, you need to complete an application form and submit it to the Department of Taxation. This process can be done online or by mail, and you should have your business information readily available. Having the right forms in order helps expedite your application process. For easy access to necessary documentation, check out the Hawaii unincorporated printable for business case options on USLegalForms.

The processing time for a business license in Hawaii can vary, but it typically ranges from a few days to several weeks. Factors that influence this timeline include the type of business you are operating and the completeness of your application. It's beneficial to prepare thoroughly to avoid delays. For efficient application processes, consider utilizing resources like the Hawaii unincorporated printable for business case provided by USLegalForms.

Yes, if your business has employees or operates as a corporation or partnership, you need to obtain an Employer Identification Number (EIN). This unique identifier is essential for tax purposes, hiring employees, and conducting various business activities. By securing an EIN, you facilitate smoother operation of your business in Hawaii. For further assistance, explore the Hawaii unincorporated printable for business case options available through USLegalForms.

The G 45 is a tax return used to report Hawaii general excise tax for business activities, while the G 49 is for annual reconciliation of general excise and use taxes. The G 45 is filed periodically, usually monthly or quarterly, depending on your business activity level. Understanding these forms is crucial to maintaining proper tax compliance and can be simplified with a Hawaii unincorporated printable for business case document from USLegalForms.

Individuals who earn income in Hawaii but are residents of another state must file a Hawaii nonresident return. This includes anyone who receives income from Hawaii sources, such as wages or rental income. By filing the return, you can ensure compliance with Hawaii tax regulations and potentially claim refunds. For detailed guidance and Hawaii unincorporated printable for business case templates, consider using USLegalForms.

To incorporate in Hawaii, you must file Articles of Incorporation with the Department of Commerce and Consumer Affairs. Ensure your chosen business name is unique and adheres to state guidelines. Utilizing a Hawaii unincorporated printable for your business case will further simplify the process by providing necessary templates and information. After incorporating, consider obtaining any required business licenses to operate legally.

Yes, most businesses in Hawaii require a general business license, which you can obtain through the state. The specific requirements can vary based on your business type and location, so it’s essential to check with local authorities. Additionally, a Hawaii unincorporated printable for your business case provides a checklist of requirements, ensuring you don’t miss any crucial steps. Therefore, conducting thorough research and gathering proper documentation is critical.

The process of obtaining an LLC in Hawaii usually takes about 5 to 10 business days if you file online. However, if you opt for paper filing, it may take longer due to processing times. Using a Hawaii unincorporated printable for your business case can help expedite your preparation and submission of necessary documents. Thus, ensuring you meet all requirements will speed up the entire process.

To set up an LLC in Hawaii, you must first choose a unique name for your business that complies with state regulations. Next, file your Articles of Organization with the Hawaii Department of Commerce and Consumer Affairs, which you can do online for convenience. Additionally, consider obtaining a Hawaii unincorporated printable for your business case, as it helps streamline the documentation process. Finally, create an operating agreement to outline the management structure of your LLC.

The BB1 form in Hawaii is a business registration application that allows organizations to obtain a general excise tax license. This registration is crucial for all businesses to legally operate in the state. Completing this form correctly helps ensure compliance with state regulations. For further assistance and guidance, you can review a Hawaii unincorporated printable for business case available on US Legal Forms.