Hawaii Unincorporated Application For The Future

Description

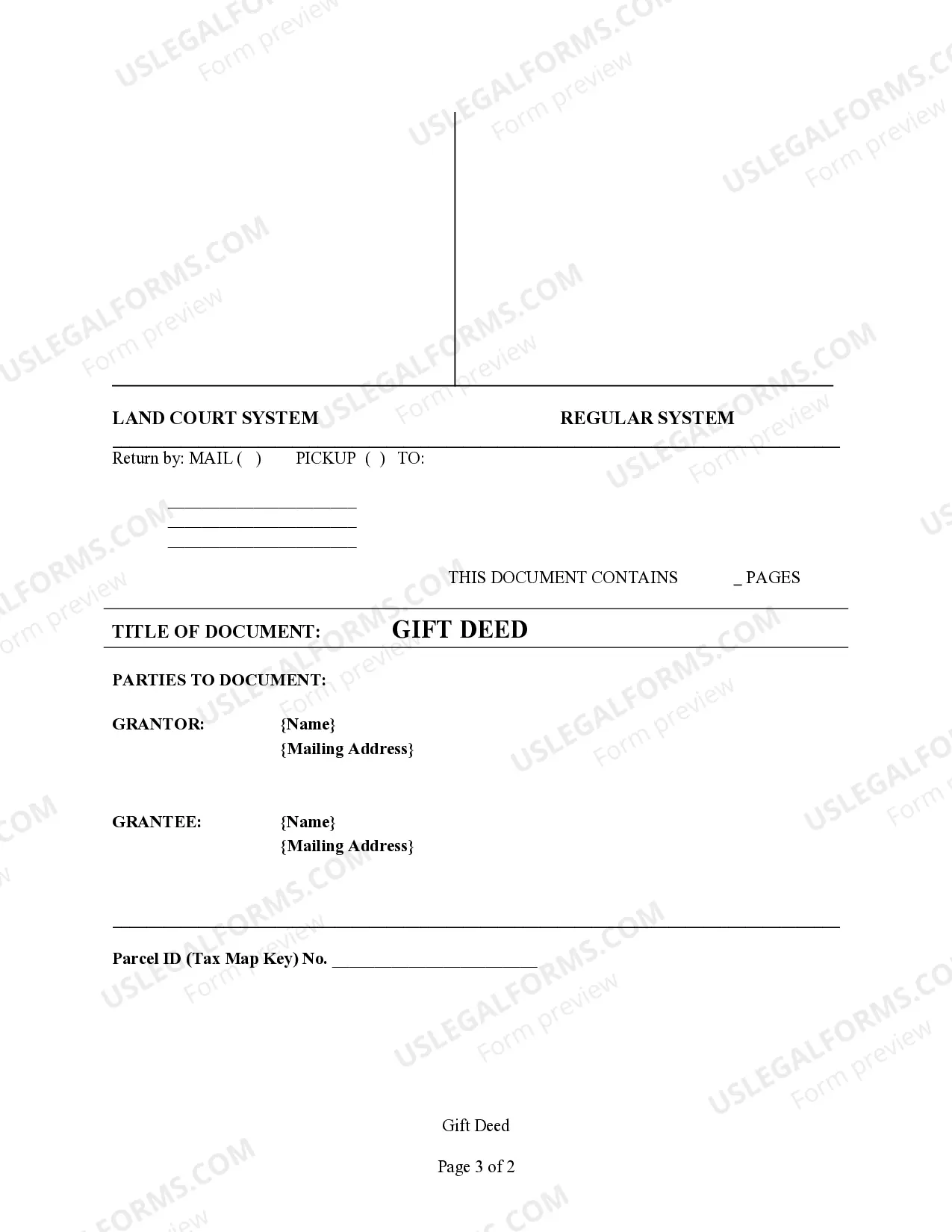

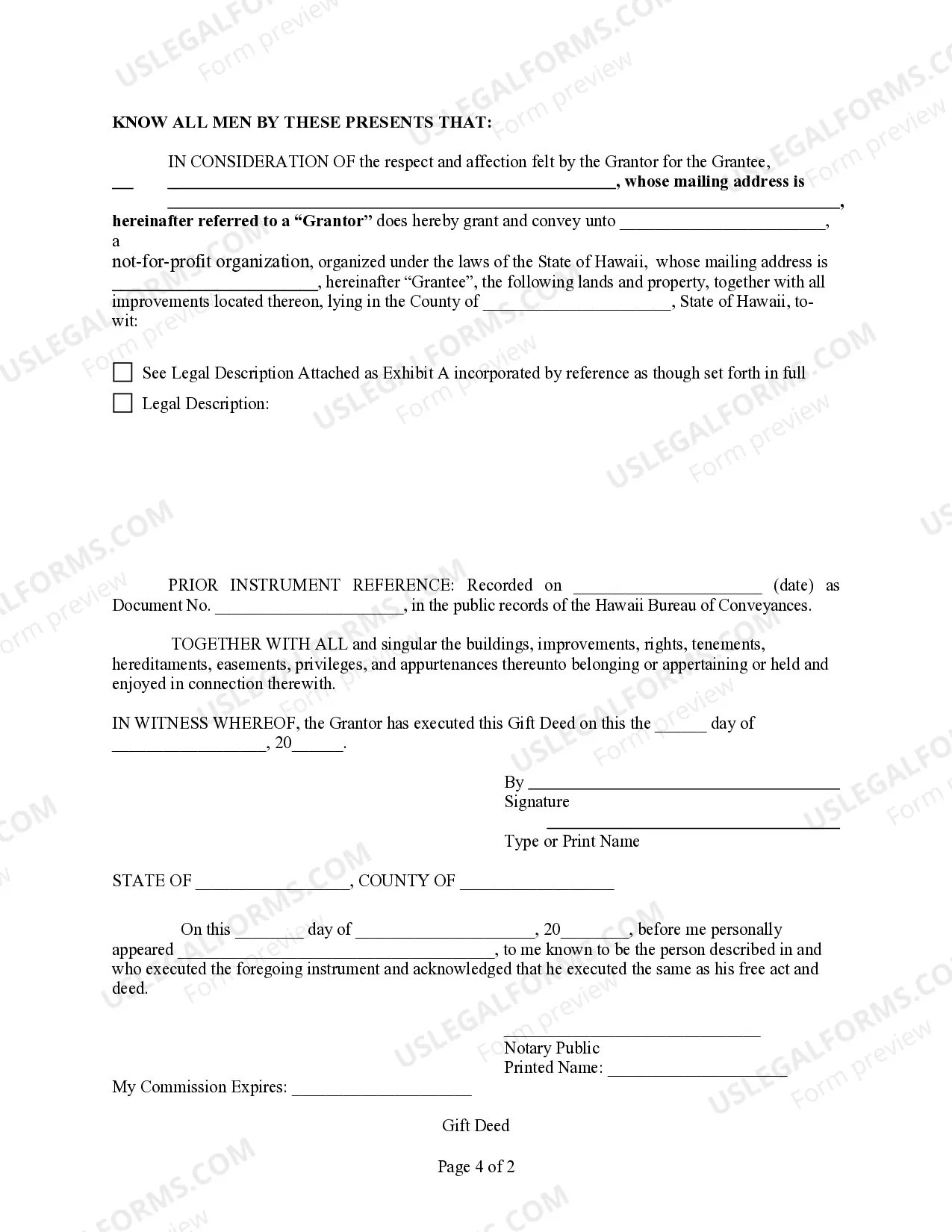

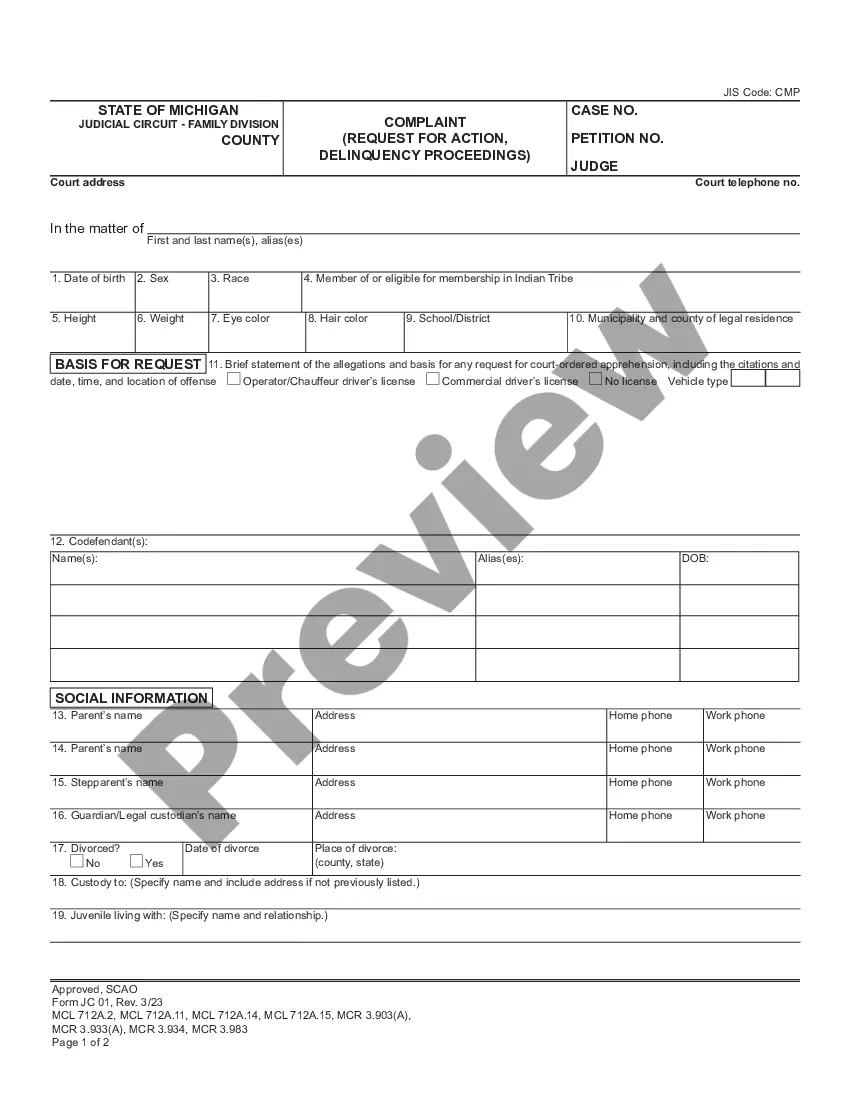

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is current to avoid interruptions.

- Explore the Preview mode and form description to confirm the selected template suits your requirements and meets local jurisdiction rules.

- Utilize the Search feature if necessary, to identify a different template if the current one does not align with your needs.

- Select the Buy Now option to proceed with your preferred subscription plan. An account registration is required to access the full library.

- Complete your purchase by entering your payment details. Options include credit/debit card or PayPal.

- Download the form directly to your device, making it easy to fill out later. You can also revisit it anytime via the My Forms section in your profile.

The process is seamless and designed to save you time while ensuring your legal documents are accurate and compliant.

Don't delay your legal needs; visit US Legal Forms today to take advantage of our vast resources and expert assistance.

Form popularity

FAQ

Yes, Hawaii is categorized as an unincorporated state, which means certain federal laws apply differently than in incorporated states. This status can affect various legal and tax obligations for residents and businesses alike. Understanding this aspect is crucial for compliance and decision-making. The Hawaii unincorporated application for the future can offer insights into how this affects you.

Hawaii tax form N-11 is intended for full-year residents to report their income and calculate taxes owed. It requires detailed information on your various income sources and deductions. Filing this form promptly helps ensure compliance and can expedite tax refunds. The Hawaii unincorporated application for the future can provide guidance through each step of the N-11 process.

Line 11 on Hawaii tax forms typically refers to the total adjusted gross income. This figure is essential as it determines your overall tax liability. Ensuring that this line is filled out correctly is crucial for an accurate tax assessment. For clarity on what to include, consult the Hawaii unincorporated application for the future.

Part-year residents of Hawaii should file Form N-15. This form accommodates individuals who have resided in Hawaii for only part of the year, allowing them to report income accurately based on their residency status. Accuracy in this filing can help prevent unnecessary tax issues. For seamless assistance, you can refer to the Hawaii unincorporated application for the future.

Hawaii Form N-11 is the state’s individual income tax return form for residents. It is used to report your income, deductions, and calculate your tax liability. Completing this form accurately is crucial for avoiding penalties. The Hawaii unincorporated application for the future offers resources that simplify the process of filling out Form N-11.

Certain organizations and activities may be exempt from Hawaii's general excise tax. This includes charitable organizations, certain government agencies, and some specific sales or services. Understanding these exemptions is important for compliance and optimal tax planning. Utilize the Hawaii unincorporated application for the future to explore available exemptions that may apply to your situation.

If you earned income in Hawaii but do not live there, you must file a Hawaii nonresident return. This includes individuals who work in Hawaii but have a permanent residence elsewhere. Filing ensures compliance with tax obligations and could potentially lead to refunds for any withheld taxes. The Hawaii unincorporated application for the future can guide you in completing this process efficiently.

Yes, Hawaii is a non-community property state. This designation means that marital assets are distributed based on what the court deems fair rather than splitting everything 50/50. By utilizing the Hawaii unincorporated application for the future, individuals can gain clarity on how to manage their assets effectively during divorce proceedings.

Non-community property states allow for marital property to be divided based on principles of equitable distribution rather than automatic equal division. In these states, courts consider various factors, such as each spouse's contributions, needs, and the duration of the marriage. The Hawaii unincorporated application for the future can be a helpful resource for understanding these distinctions and facilitating property division planning.

No, Hawaii is not classified as a community property state. Instead, it operates under the principle of equitable distribution for marital property. This means that during a divorce, the court will decide how to divide property fairly based on individual circumstances. Utilizing the Hawaii unincorporated application for the future can assist in navigating these complexities.